The Amsterdam FP&A Board met on Tuesday, 23 September 2025, to discuss “Agile FP&A: Turning Myths into Practice”. Senior FP&A leaders from companies such as Kraft Heinz, FedEx, Coty, Karl Lagerfeld, Reckitt, Equinix, ASML, AkzoNobel, Heineken and many others attended this event.

The event was hosted in the Robert Walters office within the WTC building, with a beautiful view across the city. This meeting was sponsored by OneStream Software in partnership with Robert Walters.

The agenda addressed the opportunities and challenges that companies are facing when it comes to agility within Financial Planning & Analysis (FP&A). Despite technological advancements, we still see significant gaps, and with the participants, we discussed strategies and techniques for achieving true FP&A agility.

What is Agile FP&A?

Over recent years, the FP&A community has been experiencing a paradigm shift from Traditional Financial Planning to Agile FP&A. So, what is Agile FP&A, and what is the key method or process for implementing it?

At the beginning of the event, this question was asked to the participants. It was a great way to fuel the discussion, where the following words were mentioned: clarity, scenarios, relevant, drivers, adaptive, pareto, focus, flexible, partnering, real-time, and modular.

Below is a concise definition that covers pretty much the group discussion.

Figure 1

Agile FP&A is a modern approach to financial planning that emphasises flexibility, speed, and collaboration – in contrast to traditional, rigid annual budgeting cycles. Think of it as moving from a static roadmap to a GPS that recalibrates in real-time.

Some key features of agile FP&A were discussed with the attendees:

Continuous planning: Instead of setting a fixed annual budget, agile FP&A involves rolling forecasts and frequent updates to reflect real-time business conditions.

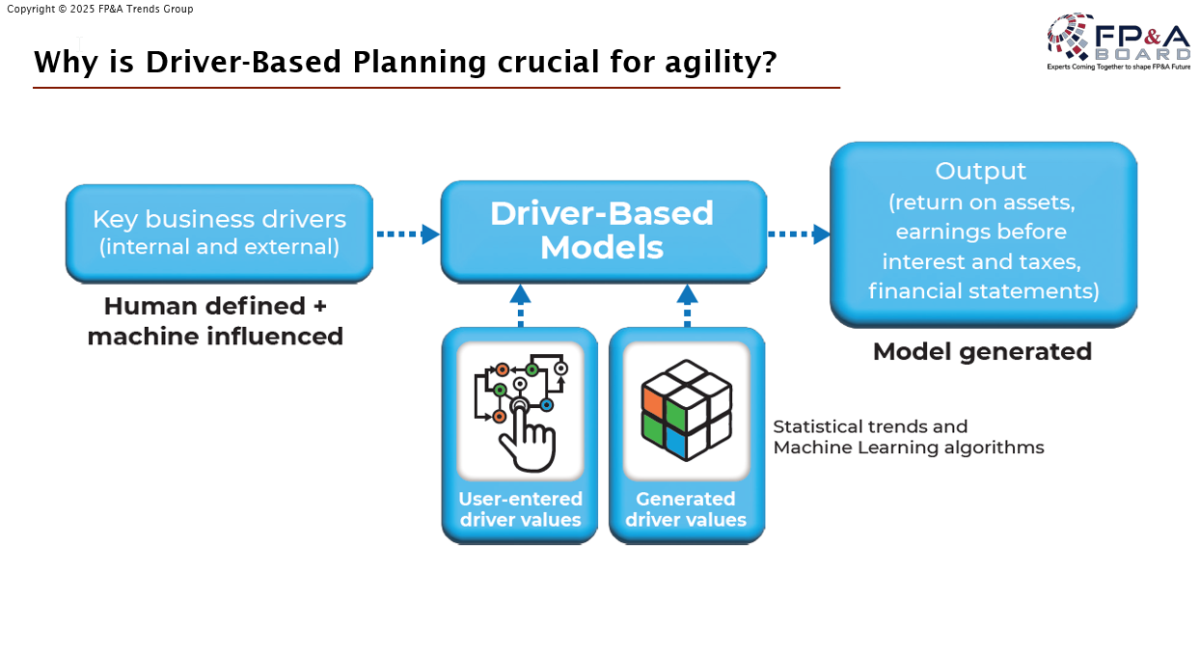

Driver-based modelling: Focuses on key business drivers rather than just top-line goals, allowing for more accurate and actionable planning.

Cross-functional collaboration: Finance teams work closely with business operations to align financial goals with strategic initiatives.

Rapid decision-making: Enables quicker responses to market changes, disruptions, or opportunities – especially critical for fast-moving industries.

Technology-enabled: Uses modern tools and automation (like RPA, Gen AI, and cloud-based platforms) to streamline data analysis and reporting.

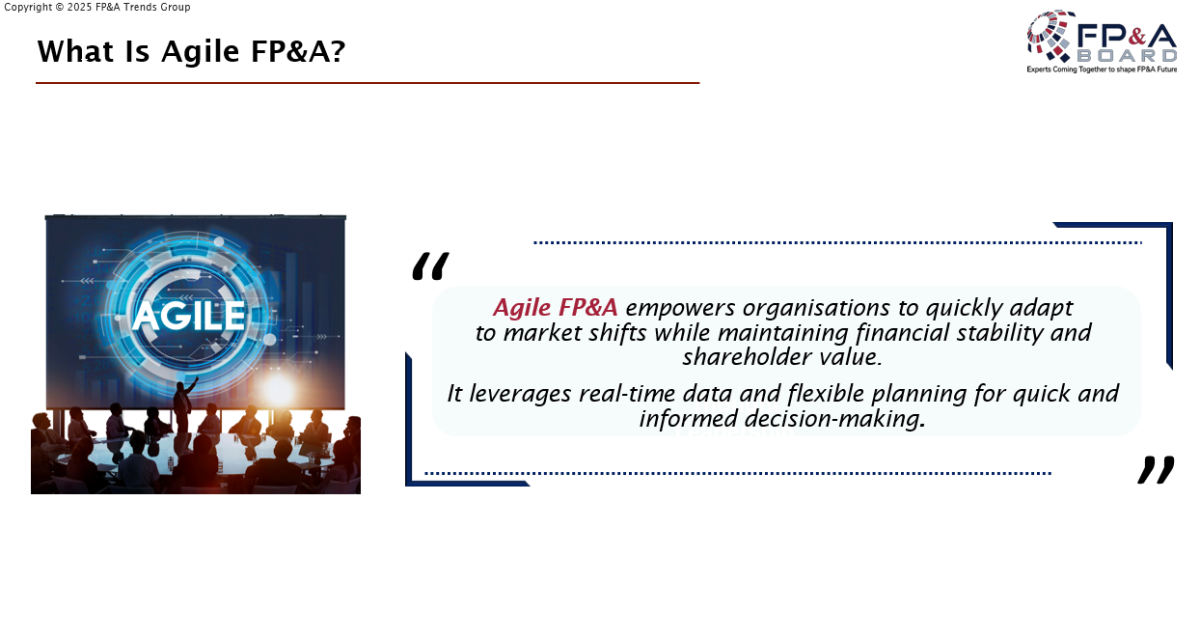

Why does it matter? Traditional planning methods are no longer effective or optimal. Our Predictability Span (PS) is shrinking, and only within that span can we plan in a traditional manner. Therefore, an evolved approach is required to handle uncertainty and multiple futures outside this span. See the diagram below of the “The Uncertainty Cone”, which is a powerful illustration.

“If there is one thing certain in business, it’s uncertainty” (Stephen Covey, American educator and author).

Figure 2

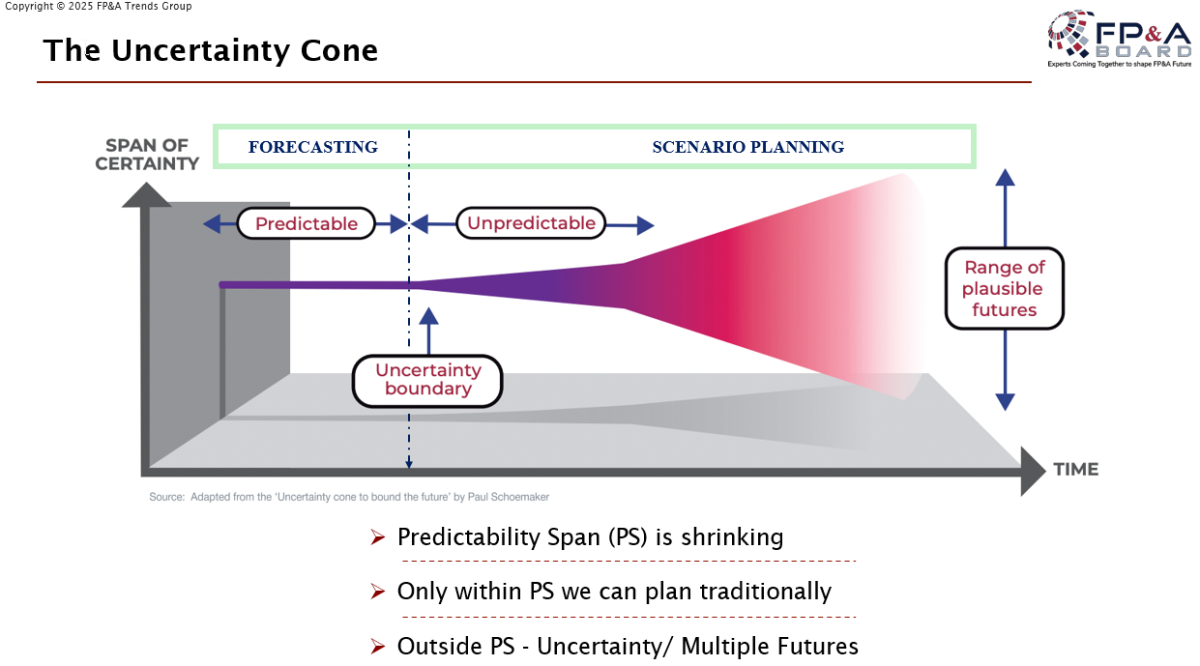

You don’t need a massive overhaul to begin. Start small and scale smart. You can start with a clear understanding of your business, reflected in driver-based scenario modelling, people & competencies, integrated value-adding processes, and gradually layer in technology. This is also reflected in the following “Agile FP&A Ecosystem” overview.

1. Pillar 1: Driver-Based Planning

Driver-based planning is an approach to strategic, financial, and operational planning that focuses on the key factors (drivers) that most directly influence business performance. Instead of forecasting every line item in detail, you identify and model the core inputs that truly move the needle.

FP&A professionals need to be extremely well aligned with the business requirements, go beyond financial figures to understand the relevant internal & external drivers behind the numbers, and be able to challenge the business.

These drivers are measurable elements that have a direct impact on the business. Some of the attendees also called them “leading” indicators, instead of “lagging” indicators, as they are predictive and not retrospective metrics. By linking drivers to business & financial outcomes, you can build dynamic models that adjust automatically when a driver changes.

Figure 3

Why use driver-based planning?

- Higher agility: Quickly update forecasts when assumptions shift (see figure 4)

- Adapt to uncertainty (e.g. economic shifts, competitive changes)

- Better alignment: Connect operational metrics to financial goals

- Improved accuracy: Focus on what truly matters, not noise

- Empower business leaders with timely insights

- Scenario planning: Easily test “what if” situations

- Reduce waste from outdated or misaligned budgets

Figure 4

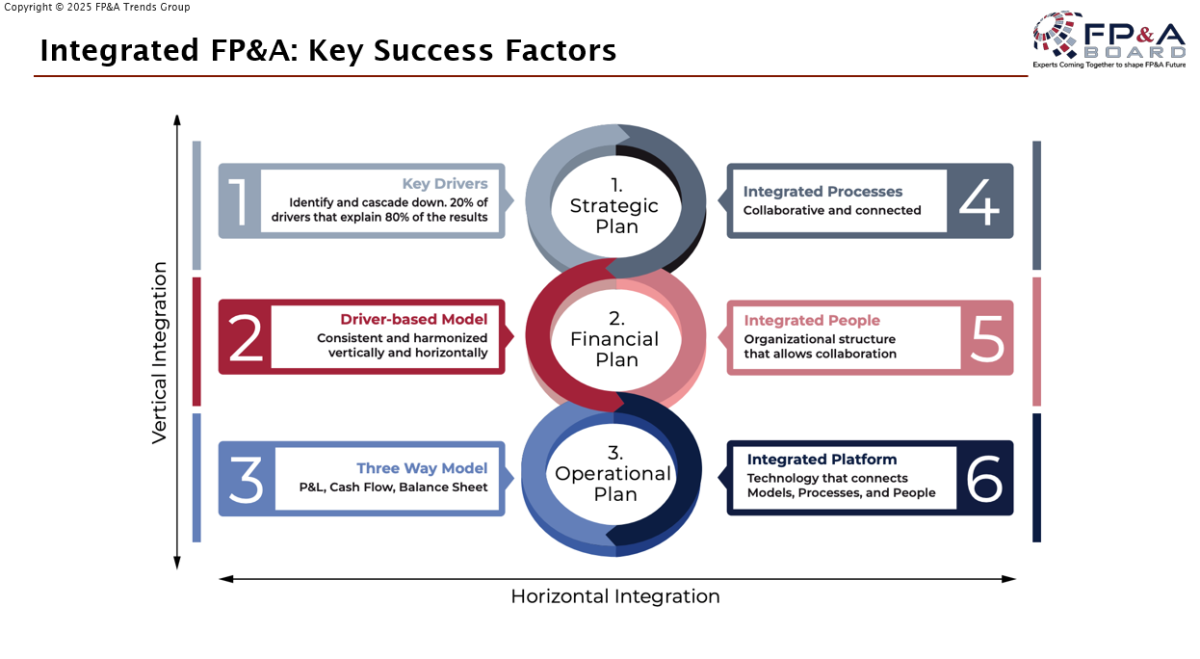

2. Pillar 2: Integrated Processes and People

The better the understanding of the business drivers, decision-making situations, and requirements, as addressed earlier, the better we know what is needed, from people, process, and technology. There should be a healthy balance between these enablers. Today, there is a strong focus on technology (e.g. Gen AI), and strangely enough, we don’t see much innovation in our processes and capabilities of our people.

With Integrated FP&A, including Integrated Processes and People, we refer to this balance, with cross-functional teams and streamlined workflows that enable faster, more adaptive financial planning. It utilises a single platform for continuous, data-driven decision-making, enabling collaboration across departments. It allows the organisation to be responsive to changes, well-aligned, and equipped to manage market volatility.

We also know that FP&A operates with strategic, financial, and operational planning for different purposes. However, these versions should work with the same business drivers. Together with people, processes, and technology, they are the key success factors to ensure FP&A integration, as illustrated in Figure 5 below.

Figure 5

3. Demonstration OneStream: “Sensible AI Agents for FP&A”

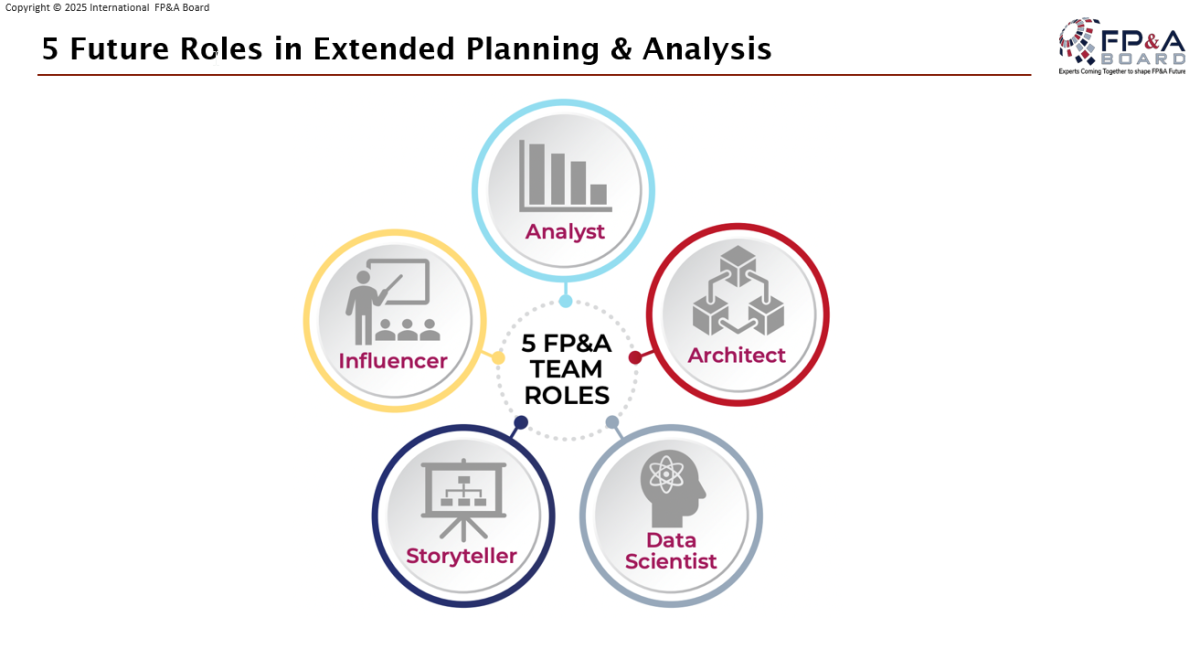

Of course, OneStream also understands the pressure FP&A teams face to steer the business, and they recognise the transformative power of digitisation and automation. FP&A leaders have new technologies (like Gen AI) available to boost productivity and improve decision-making. Automation of repetitive tasks will free up time and allow for a greater focus on value-added tasks, something technology can’t replace.

Embracing new technologies and combining them with other skills, beyond traditional finance, will set FP&A leaders apart. This means re- and upskilling of Finance and FP&A teams with hard and soft skills to unlock and develop the full “people potential”. The figure below shows an overview of our current roles in the FP&A domain.

Figure 6

In relation to this development, the participants discussed different visionary FP&A capabilities that eventually could lead to Autonomous Finance.

- Agentic AI: From automation to intelligent action

- Self-learning Forecasts: Always on, always improving

- Autonomous Scenario Management: From what-if to what-now

- Responsible AI: Built-in trust for Autonomous Finance

Autonomous Finance is a transformative approach to financial operations that leverages AI, Machine Learning, and intelligent automation to run finance processes with minimal human intervention. It goes far beyond traditional automation by enabling systems to learn, adapt, and make decisions in real-time.

The Account Director of OneStream Software, Pieter-Paul Presseisen, demonstrated Sensible AI Agents for FP&A, showing how “Intelligent Assistants” are already reshaping planning and decision-making (see the figure below).

This demonstration was truly inspiring and proved that the development of autonomous finance is going incredibly fast. There is even more reason to make sure that FP&A professionals are fully on top of these developments, as it is changing the job, which Florian Hofstee, Business Director Netherlands, also confirmed at Robert Walters.

4. Technology & Analytics

As discussed earlier, the development of Technology & Analytics within FP&A has accelerated dramatically in recent years, shifting the function from manual reporting to strategic, AI-powered decision-making. Here's a structured overview of how it's evolving:

- Traditional FP&A: Excel-based models, static reports, manual data consolidation

- Digital FP&A: Cloud-based planning tools, centralised data platforms, basic automation

- Intelligent FP&A: Advanced analytics, Machine Learning for forecasting, real-time dashboards

- Autonomous FP&A: AI agents simulate scenarios, generate insights, and trigger actions independently

We see that AI can play key roles within FP&A

- Productivity Enhancement: Smart data integration, report & narrative generation, budget seeding, AI-augmented meetings

- Insight Generation: AI-driven data exploration, virtual Finance assistants

- Decision Support and Simulation: ML forecasting, scenario simulation

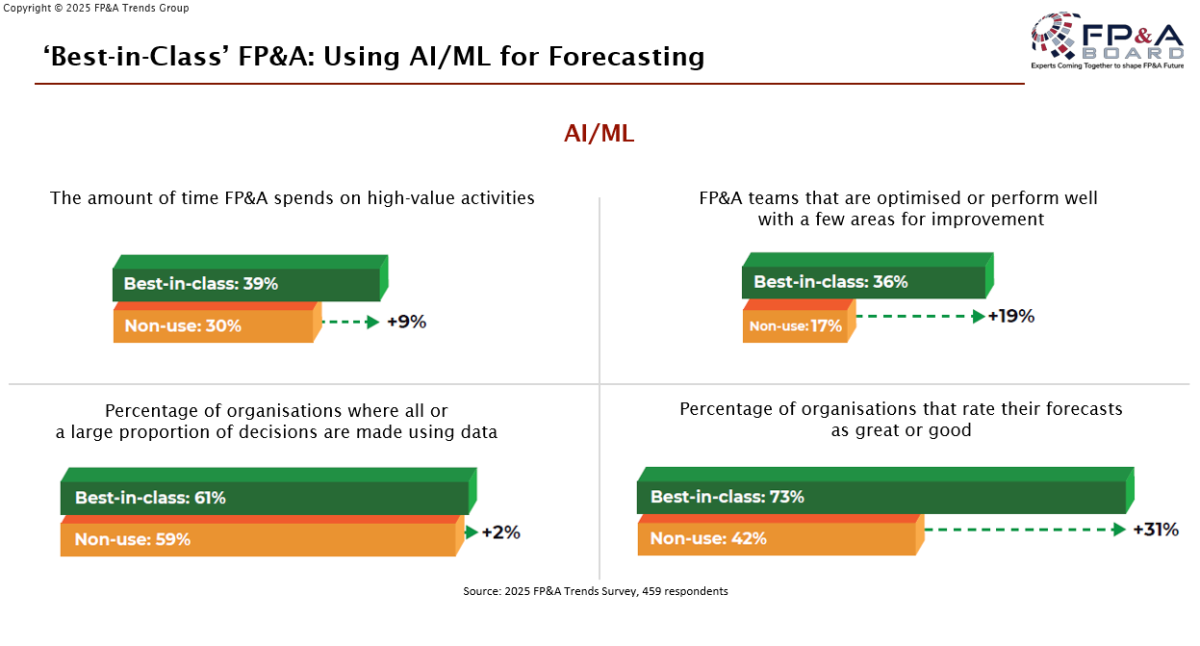

However, upon examining the adoption of these technological developments, such as cloud platforms and AI/ML for Forecasting, we see that there is still a long way to go. For example, refer to Figure 7 below, which displays the scores for the usage of AI/ML for Forecasting, as reported in the 2025 FP&A Trends Survey.

Figure 7

Group Work & Key Takeaways

The last item on the agenda was small group work. Three groups discussed practical steps for the implementation of Agile FP&A.

Group 1 agreed on the following practical steps for “Building a dynamic driver-based Model”

- Make sure the drivers can be linked to actions, analyse the past and evaluate.

- Set up a driver strategy and KPIs, and, together with the business, be open-minded and reflective.

- Identify 2/3 relevant drivers that define the outcome, uncover hidden drivers, and apply the Pareto principle.

Group 2 agreed on the following practical steps for “Designing value-adding processes”

- Define the business requirements related to the critical decision-making situations.

- Identify the required behaviours for your organisation, as FP&A can be done in many ways.

- Write down the process in a detailed way, as if it is a transactional process, and make clear who is doing what, when, and where.

Group 3 agreed on the following practical steps for “Implementing technology platforms”

- Identify databases & cubes, write down definitions, and leverage knowledge.

- Check what data correlates with AI outcomes.

- Apply a “stairway approach”, start small and continue.

The atmosphere during the whole evening was energising, with an open, constructive debate and a real willingness to explore and challenge old ways of working. Agile FP&A is no longer optional – it is the only way to keep FP&A relevant, as was concluded by the attendees and was also shown by the 2025 FP&A Trends Survey:

- Only 3% of organisations can run scenarios in real-time.

- Over 50% take more than five days to produce forecasts

- Just 31% of FP&A time is spent on high-value activities.

There is a clear need for change. However, implementing FP&A agility in your organisation is like rewiring the nervous system of your business – making it faster, smarter, and more responsive. It’s not a one-time project but a strategic transformation.