Agility has become an important initiative for many organisations as they struggle to cope with the...

The Need for a Strategic Approach

Under pressures from profitability, fluctuating demand and increasingly complex supply chains, businesses must sharpen their focus on cash flow management. For FP&A teams, this means not just surviving the volatility but actively driving financial agility through effective working capital strategies. Achieving financial sustainability today requires transforming global working capital approaches into solutions that are flexible and aligned with local market conditions. But what does this transformation look like in practice, and how can FP&A professionals play a pivotal role?

Practical Steps to Optimise Working Capital

Sustainable cash flow starts with aligning operational efforts to the right Key Performance Indicators (KPIs), ensuring finance and operations move together toward shared goals. To make these KPIs effective in the FP&A context:

1. Speak the Language of Operations

FP&A teams must translate financial metrics into actionable terms that resonate with procurement, sales and supply chain teams. While KPIs might appear as numerical targets to finance, they represent critical operational drivers for other departments.

Effective KPIs should be both understandable and achievable for those responsible for their execution. They must strike a balance between financial numbers and operational realities. For example:

- Payment Metrics: Instead of relying solely on Days Payable Outstanding (DPO), Weighted Average Payment Term (WAPT) can provide a more nuanced view, capturing variations across suppliers and mix of spend. WAPT reflects the average payment terms taken to settle payables, adjusted for the proportion of spend with each supplier.

- Inventory Metrics: Days Inventory Outstanding (DIO) is often used as a high-level metric. However, FP&A teams can enhance its relevance by estimating the impact of forecast accuracy improvement and seasonal buffer stock requirements.

- Receivables Metrics: Days Sales Outstanding (DSO) is a standard measure but layering in factors like overdue ageing buckets balances improvement and contract terms provides a deeper understanding of cash flow risks and opportunities.

2. Leverage KPIs to Drive Decisions

FP&A teams should ensure that KPIs are not just monitored but actively used to guide decision-making. By adopting these strategies, FP&A professionals can help businesses maintain financial agility. This alignment of working capital management with broader corporate objectives ensures profitability, even in uncertain times.

Once KPIs are optimised, the next step is to adapt these strategies for varying local conditions to ensure their effectiveness.

Adapting Global Strategies to Local Realities

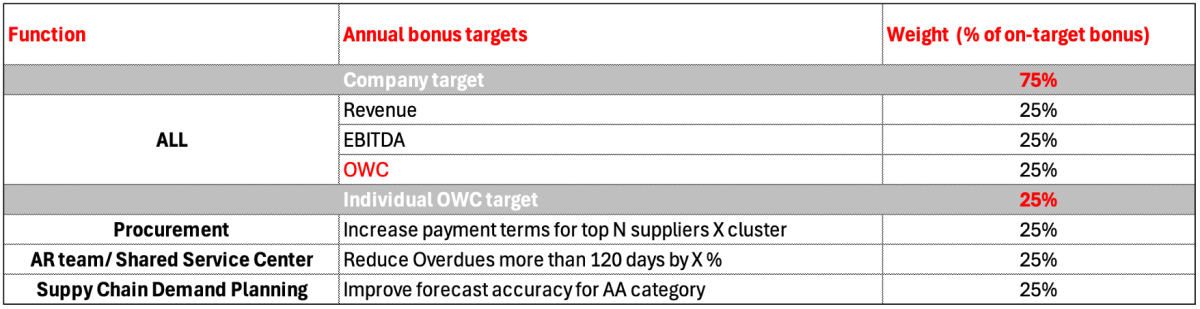

It’s tempting to apply a one-size-fits-all approach to working capital management, but the reality is far more complex when you forecast it. Local markets have unique dynamics that demand tailored solutions. Fragmented customer bases in some regions lead to longer payment cycles and stricter credit policies. Aligning capital planning with local operational conditions is crucial for maintaining agility. One highly effective approach is setting specific targets for different components of working capital at the country level and linking these to individual bonuses. This ensures that everyone, from procurement to finance, is aligned with the company’s cash generation goals. As shown in Picture 1, setting operational targets for working capital can significantly influence financial efficiency.

Figure 1: Setting Operational Targets for Sustainable Working Capital (example)

The structure of annual bonus targets can significantly impact financial efficiency. For example, 75% of the on-target bonus may focus on company performance, distributed equally among revenue, EBITDA and Operating Working Capital (OWC). The remaining 25% can link directly to individual functional objectives like Procurement, AR Team or Shared Service Center and Supply Chain Demand Planning, ensuring alignment across the company.

With tailored strategies in place, forecasting working capital becomes a vital next step to ensure these localised plans translate into actionable results.

Forecasting Working Capital

Turning strategy into actionable steps differentiates successful companies from those struggling to achieve their working capital goals. Below is a guide to refining working capital planning, focusing on practical and results-driven actions:

1. Clean Up Historical Data

Ensure that your cash flow analysis is not skewed by one-off events. Separate overdue accounts that are part of normal business operations from exceptional cases to create a more accurate view of receivables performance. When reviewing inventory data, account for seasonal stock buildups and procurement savings, which are often influenced by local business practices. Balancing forecast accuracy improvements with product availability targets will allow you to better understand year-over-year shifts in working capital.

2. Set Concrete Assumptions

Focus on high-value clients and specific receivable categories when setting assumptions to reduce overdue accounts and improve collection efforts. Adjust inventory levels to ensure product availability, while linking this to improvements in forecast accuracy for specific categories. For payables, categorise spending and develop assumptions based on supplier relationships and payment terms.

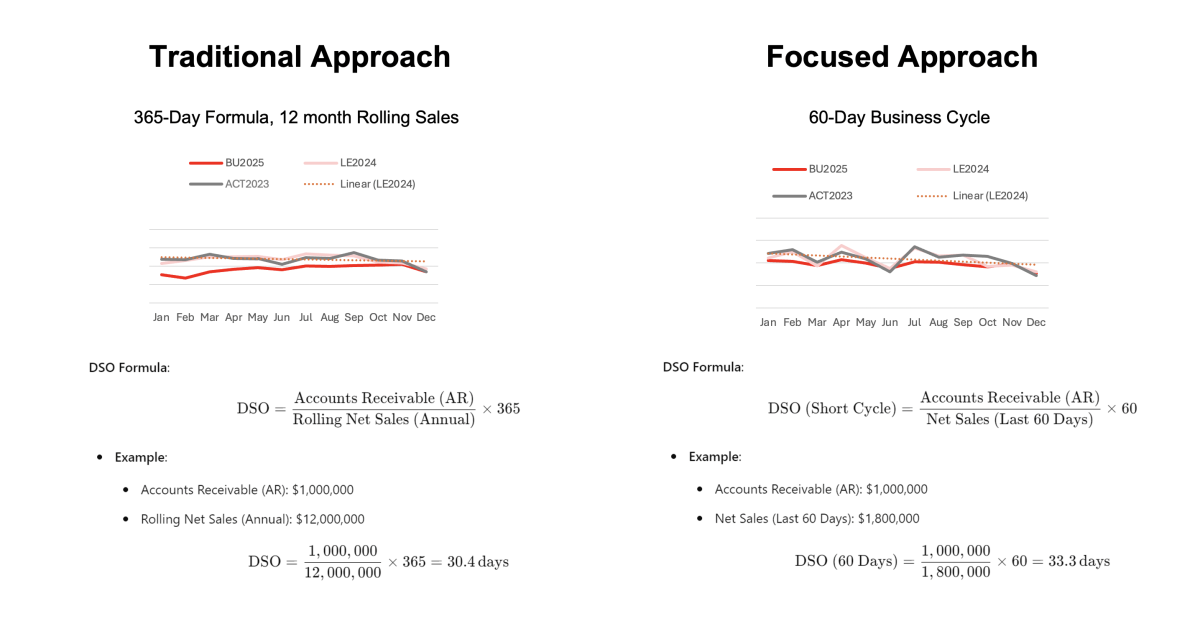

3. Align KPIs with Business Cycles

The KPIs you track should mirror the real-world business cycles. Instead of relying solely on a traditional 12-month rolling sales metric to calculate Days Sales Outstanding (DSO), use a more dynamic approach, such as a 2-month sales view, to better capture seasonal variations. Some businesses still use the “days KPI divided by 365” approach, but this can lead to delayed decisions. For instance, if a client has a $1 million overdue balance with a 30-day payment term, this might not be fully reflected in a DSO metric using a 365-day formula, leading to inaccurate assessments of cash flow and operational efficiency.

Figure 2: Aligning KPIs with the industry's operational cycle (example)

Using the 365-day formula, the Days Sales Outstanding (DSO) appears to align with the 30-day payment term. However, this approach averages performance over an entire year, potentially masking overdue trends or seasonal variations that require immediate action.

In contrast, using a 60-day snapshot reflects a slight delay beyond the 30-day payment term, highlighting overdue balances and current cash flow risks. This focused view provides a more accurate reflection of cash flow challenges and supports more immediate corrective actions.

Summary: Building a Cash-Focused Culture with FP&A at the Core

A cash-focused culture and the ability to adapt global strategies to local market realities are critical for effective working capital management. FP&A plays a pivotal role in making this happen by:

- Refining data to remove distortions,

- Setting clear and actionable assumptions that tie operational realities to financial outcomes,

- Aligning KPIs with operational cycles, ensuring financial metrics drive actionable insights,

- Integrating cash flow targets into incentive structures, like bonus plans, to embed accountability across the organisation.

By adopting these practical approaches, FP&A professionals can elevate working capital management, driving not just cash flow improvements but also the agility and resilience needed to sustain a competitive edge.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.