In this article, the author examines the FP&A's role in helping businesses win by measuring financial...

Capital planning is such an ancient topic. It is not like Artificial Intelligence (AI)/Machine Learning (ML) and other buzzwords that can instantly attract the attention of modern finance professionals. Some people may even think, ‘Hey, I know it all, as there are a ton of textbook articles about it’.

I am sure that we all have heard or read the phrase, “The only thing that does not change is change itself.” This is true whether we refer to a building, a person, a concept, or capital planning.

This brings us to the question of how the capital planning process has changed over time.

The Evolution of Capital Planning

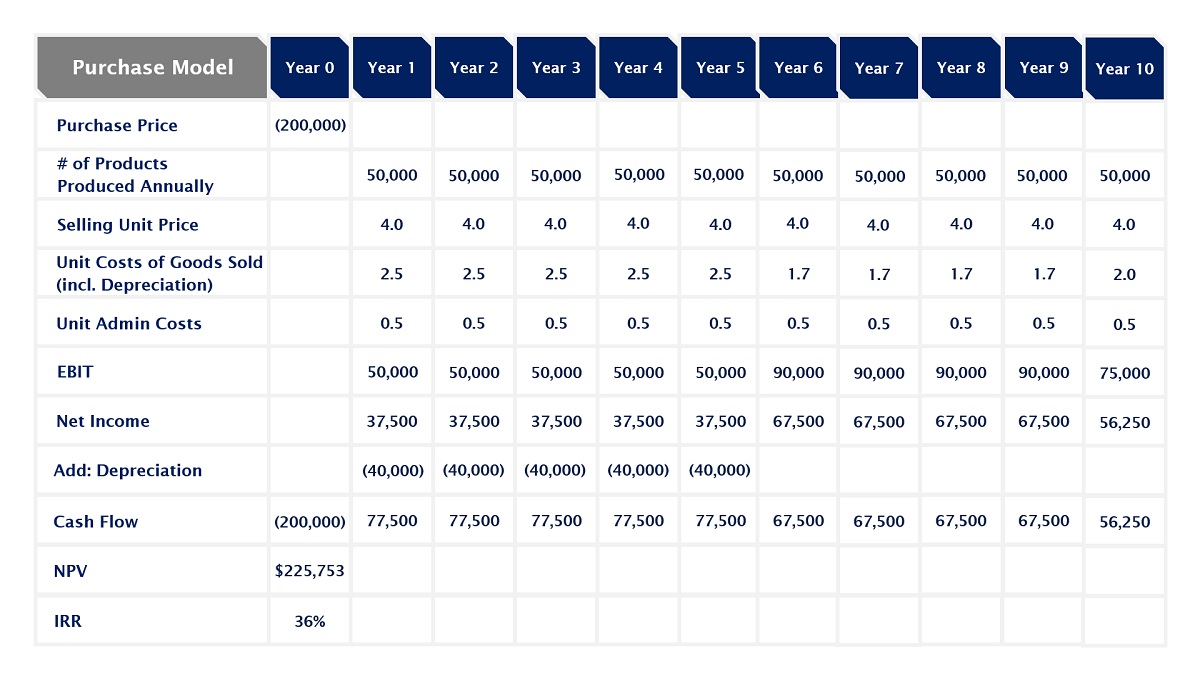

In the old days, when we talked about capital planning, we typically referred to investment in a piece of equipment. Mergers and Acquisitions (M&A) were uncommon then. The very beginning of the analysis typically relates to how many products the equipment will produce daily or yearly and how much net cash it will generate. We could easily find out whether it is a good decision or not by utilising the Net Present Value (NPV) and Internal Rate of Return (IRR) (see Table 1).

Table 1

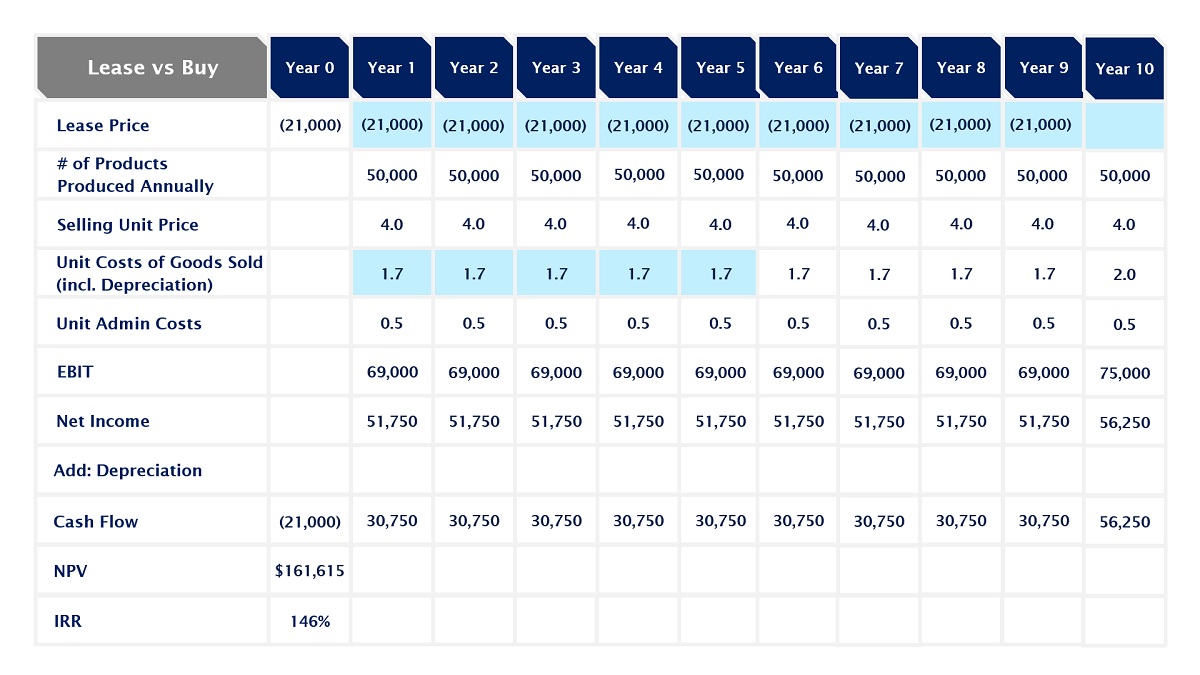

When rental and leasing emerged as a service business model, some companies realised they didn’t necessarily need to buy equipment, which often required paying cash upfront. Instead, they can actually lease the equipment to avoid paying a large amount of money before they reap any profits from a purchase, especially if they have cash constraints. It naturally introduced the “Lease vs. Buy” capital planning concept. Many companies started to perform “Lease vs. Buy” analyses. Indeed, interest rates play a big role here. When a leasing company borrows cash at a low rate and purchases the equipment, they could lease it out to smaller companies with cash constraints or organisations with higher borrowing rates and profit from the interest rate gap. It shows how a leasing company can be profitable.

In return, it helps companies with higher borrowing rates or cash constraints gain access to production equipment. Both business models can be beneficial under the two different capital planning models. Table 2, combined with Table 1, represents the “Lease vs. Buy” analysis. However, the leasing model generates a lower NPV. At the same time, the IRR is higher, which means the leasing model requires less capital, i.e. a lower denominator on the return of capital analysis. The lease model’s NPV is less than that of the purchase model, but it still has a very attractive NPV value. That is why it is a feasible capital investment to choose. Of course, the lease model can be more complicated if it involves the lease accounting method or if you have the right to purchase the equipment at the end of the lease term. These factors need to be considered when you choose the lease model.

Table 2

Is AI/ML a Game-Changer?

Now, let’s jump ahead to the AI/ML age. How do we evaluate the investment in AI/ML in the new era? Typically, when a company decides to invest in an AI program, they already have an existing operation that can be enhanced with AI. Let’s assume that’s the case for this discussion.

The early development of AI can be very costly. It involves hundreds if not thousands of software engineers and capital investment in machinery, computers and facilities during the research and development stage. Still, it is hard to forecast the return as this is a new concept, and we don’t have historical or industry data to rely on. The finance team really needs to work closely with the business operation teams and ask provoking questions to understand the market landscape before investing capital into new technology. Start with the following questions to put some numbers around a very contrasting concept:

- What’s the goal of an AI program? What do we offer?

- Who are our customers? What is the size of the customer base and the penetration rate?

- What is considered successful, and by when?

- If we work backwards, does the technical challenge pose a risk of delivering on time? If so, should we postpone the go-live timeline or hire more people to speed up the process?

You could develop a spending timeline based on the complexity of the AI program, understanding that you will need to adjust it as time goes by. Now, the business needs to understand the benefits they will receive after deploying the AI program. Questions around that could be as follows:

- Now we have the number of customers from the above discussions. Will customers be ready to pay more due to the added benefits from AI?

- Will leveraging the AI program help us generate new customers? Will those be customers whom we do not currently serve geographically or demographically?

- Or, will the upgraded program help us understand the current customers more so we can upsell more services/products? Do they need certain daily amenities? Do they need spare parts for their machines if we are serving industrial customers?

Some benefits and costs are more straightforward than others. When considering an investment in AI, we also need to think about the inherent costs and benefits. For instance, inherent costs if the AI program becomes obsolete. In the tech world, technology upgrades are a lot more frequent than in other industries. Let us consider two illustrative examples. Apple continues to stay ahead of the competition by constantly upgrading their smartphone models. Adversely, Tesla is slowing down because they are not pushing out new models fast enough, according to some analysts. We cannot use the 10-year cash flow model without considering technology upgrades or obsolete costs.

Inherent benefits can include other products or services that the AI program might be able to expand into and sell to the existing customer base. We have seen companies leveraging AI to learn about customer habits and push through adjacent services or products or even other suppliers’ products through their platform. There are no boundaries when it comes to the convenience of selling and buying. Think creatively.

When you have collected all the pieces from the above, you are ready to implement a 10-year NPV and IRR model.

Conclusions

The concept of capital planning remains the same, and its ultimate goal is to ensure that the investment generates attractive NPV and IRR. However, the business operation models we deal with have changed dramatically over time.

Nowadays, finance professionals have more advanced analytical tools at their disposal, but the business environment has also become more complex and global-scaled than the one we used to deal with. This requires finance professionals to evolve and adapt continuously.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.