In his latest video, CFO of Hub Terminals at A.P. Moller-Maersk, Joao Almeida, shares his recipe...

Mark Cuban, the billionaire investor and minority owner of the Dallas Mavericks, once said that business is the ultimate sport, as it is a constant competition that takes place 24/7, 365 days a year. In sports, winning is determined by scoring more points than the competition. However, unlike sports, winning in business is not always as clear-cut because there is no scoreboard or defined time for the game. This article examines the role of FP&A in helping businesses win by measuring financial data and explores what should be measured when the score may not be clear.

The Importance of Capital Allocation and Its Influence on What We Measure

The importance of capital allocation became clear to me many years ago when I struggled to explain my purpose as a financial advisor. I came across a book called "The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success" by William Thorndike. This book resonated with me because it explained that successful CEOs need to excel in two areas:

- running their operations efficiently

- and effectively deploying the cash generated by those operations.

There are three main choices for deploying capital:

- investing in existing operations,

- acquiring other businesses,

- and managing capital structure by issuing dividends, paying down debt, or repurchasing stock.

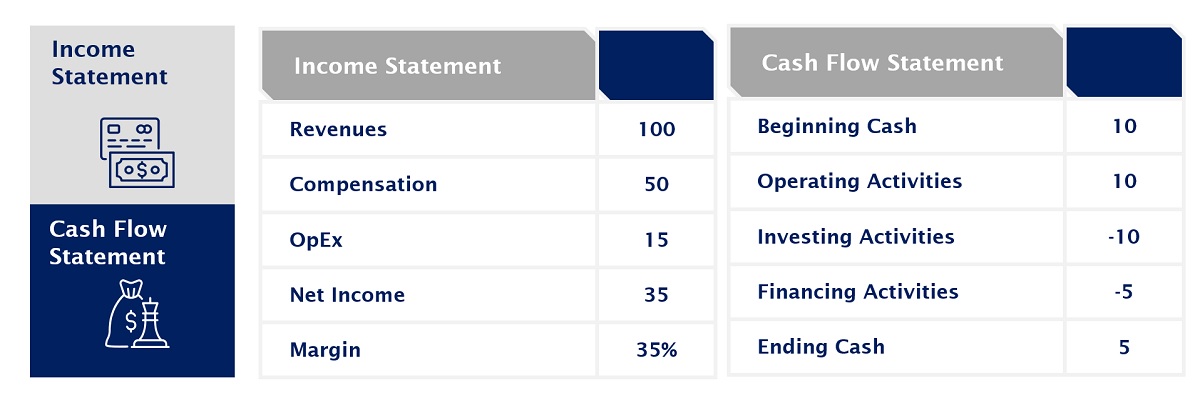

While the traditional profit and loss (P&L) statements are frequently used for measurement and analysis, they do not provide a comprehensive view of resource allocation. To gain more insight into the different performances between mergers and acquisitions and existing operations, we need to look at P&Ls separately. Additionally, evaluating decisions in the context of cash flow statements, such as operating, investing, and financing activities, can provide a better understanding of how cash is being used. Measuring returns on investment (ROI) from the uses of cash and performing valuations of assets can also help us evaluate the effectiveness of resource allocation. Understanding the decisions management is trying to make, and their influence on capital allocation is critical to the success of the business.

Figure 1

How Measurement Changes with Context

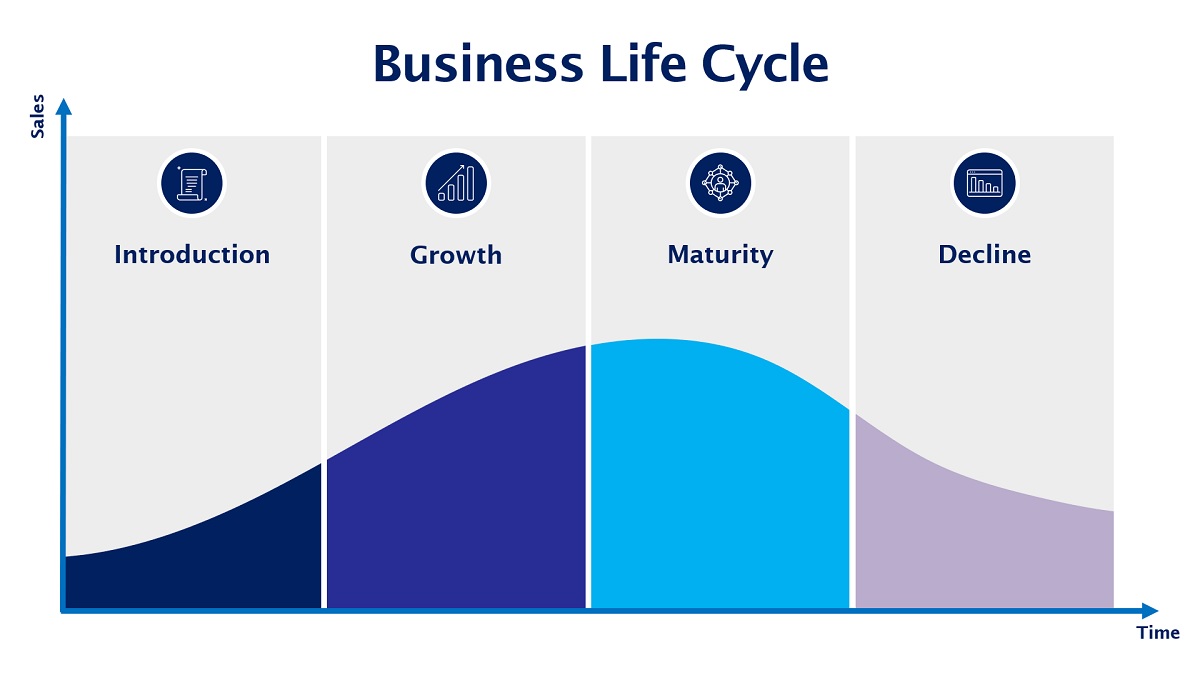

In sports, the context of the game is crucial. Factors such as weather conditions, including rain, snow, or wind, can impact the game plan and potentially the outcome. Similarly, in business, adjusting to external conditions is important. We like to compare the weather conditions in sports to the different phases of the business life cycle. It consists of introduction, growth, maturity, and decline phases. Each requires different strategies. It is essential to be aware of the current stage and adapt accordingly.

Figure 2

Tug of War between Growth and Maturity

One interesting aspect of these conditions is the tug-of-war between the growth and the maturity phases and its impact on decision-making and what we measure. The growth phase is exciting as it comes with rapid expansion and an expanding customer base, while the maturity phase offers stability, a solid customer base, and consistent revenue generation. In this paradigm, the growth phase is about measuring innovation and providing a better customer experience, while the maturity phase is about profitability and financial returns.

The ability to strategically toggle back to growth from maturity is key to sustained success, as it is crucial to avoid the decline phase. For example, Blockbuster Video once dominated the video rental business but focused too much on profit over innovation. As a result, they missed the emergence of Netflix, which evolved the industry by introducing mail-order DVDs and later transitioning to online streaming. Similarly, Nokia, a dominant player in the cell phone market before the iPhone, had engineers who proposed an App Store before Apple did. However, Nokia's management hesitated to explore this idea as it could disrupt their highly profitable business model. Ultimately, Apple unleashed the App Store first on the iPhone, which led to the disruption of Nokia's business model and its subsequent decline.

As FP&A professionals, we have to understand if the financial data we provide helps management balance this tug-of-war between profitability and innovation.

Conclusions

Many people mistakenly believe that the role of an FP&A professional is limited to analysing spreadsheets. However, true financial leadership goes beyond that. It involves the ability to analyse numbers from different perspectives and present information in a way that drives better decision-making. Our ultimate purpose is to ensure better capital resource allocation, which is crucial for the organisation to remain in the growth phase and achieve long-term success.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.