The vast majority of companies still rely on traditional organisational designs characterised by hierarchical structures, and...

As was famously proclaimed by Pericles, the powerful politician of ancient Greece: “The key is not to predict the future but to prepare for it.”

As was famously proclaimed by Pericles, the powerful politician of ancient Greece: “The key is not to predict the future but to prepare for it.”

In an ever-changing environment, dynamic and data-driven Scenario Planning is of critical importance. That means moving from traditional methods to an agile FP&A process, which can help organisations to navigate successfully through uncertainty. At the FP&A Trends Webinar, the panel of three high-profile speakers discussed the transition to agile FP&A, examining a particularly insightful case study.

What is Agile FP&A?

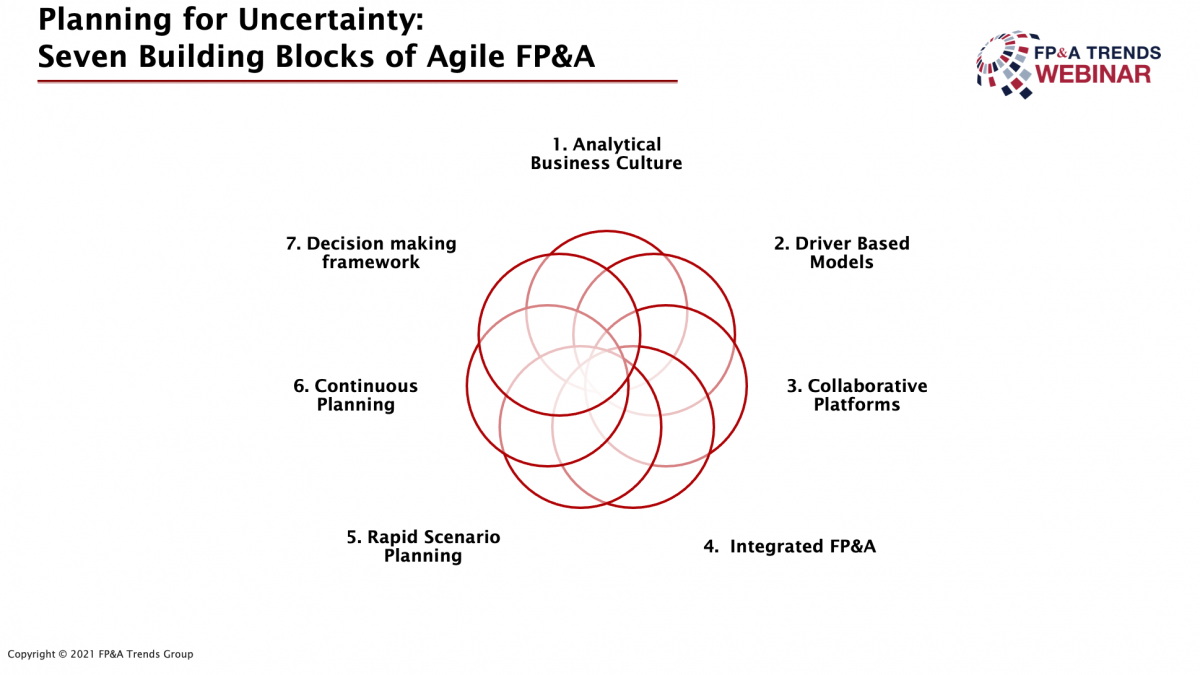

The first presentation was given by discussion facilitator Larysa Melnychuk, MD at FP&A Trends Group. Larysa emphasised that agile FP&A allows organisations to adapt quickly to market changes. It also enables them to manage and maintain their shareholder value using seven key building blocks: Analytical Business Culture, Driver Based Model, Collaborative Platform, Integrated FP&A, Rapid Scenario Planning, Continuous Planning, and Decision-Making Framework (Figure 1).

Figure 1

Business Trends, and Agile FP&A as a Connector Across the Enterprise

Following Larysa, attendees heard from Philip Galvan, Senior Manager at EY. Philip began by reviewing some emerging business trends from an ROI perspective:

Pivoting from extended transformation programs to focused outputs that rapidly deliver value

Fit-for-purpose planning across all levels of the enterprise, aligned to a connected strategy

Analysis capability to quickly model business scenarios and understand key performance drivers

Continuous improvement mindset across the enterprise to adapt to changing situations

Example: In an organisation, you may be dealing with certain dependencies i.e. source systems, change management, different types of adaptability, however that doesn't mean you shouldn't start a program. So pivoting from large, complex, multi-year transformations to delivering value as fast as possible. But as you deliver that value, make sure you have a connected strategy with a continuous improvement mindset.

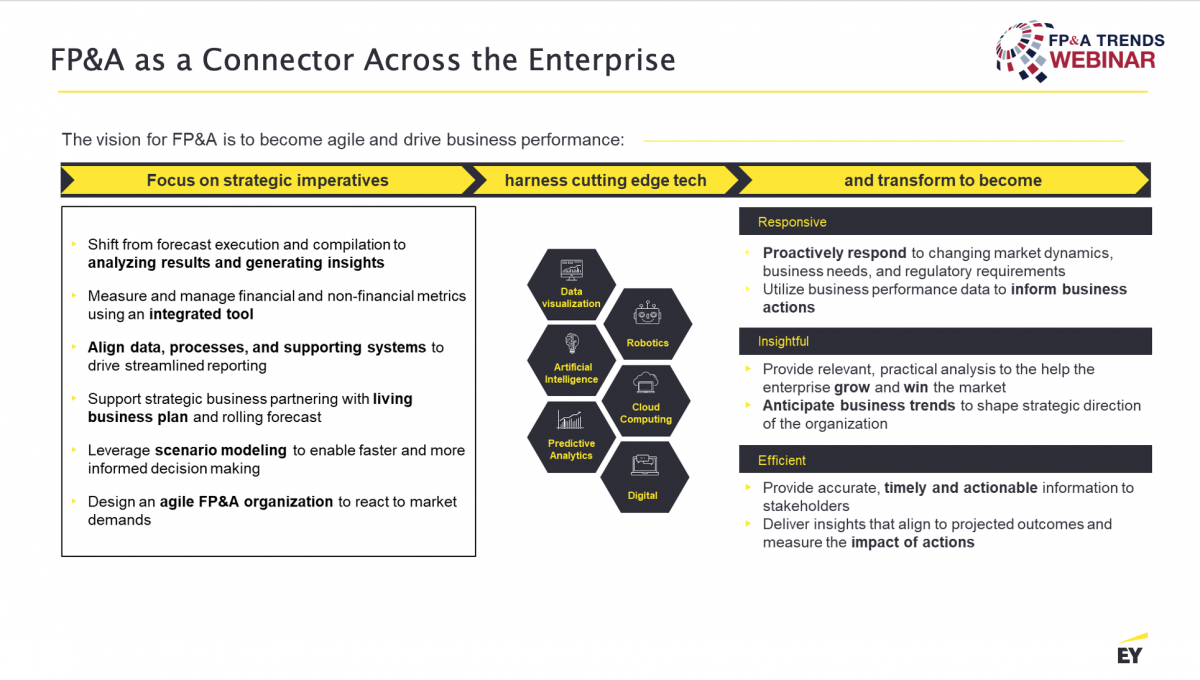

Philip described a three-step process for agile, performance-driving FP&A ( Figure 2):

Focus on Strategic Imperative: FP&A can impact the value derived from analysis and insights, and organisations should structure themselves to deliver those insights. FP&A should also align data, processes and supporting systems to drive streamline reporting.

Harness cutting-edge tech: e.g. robotics, Predictive Analytics, ML and AI.

Transform to become responsive, insightful and efficient

Figure 2

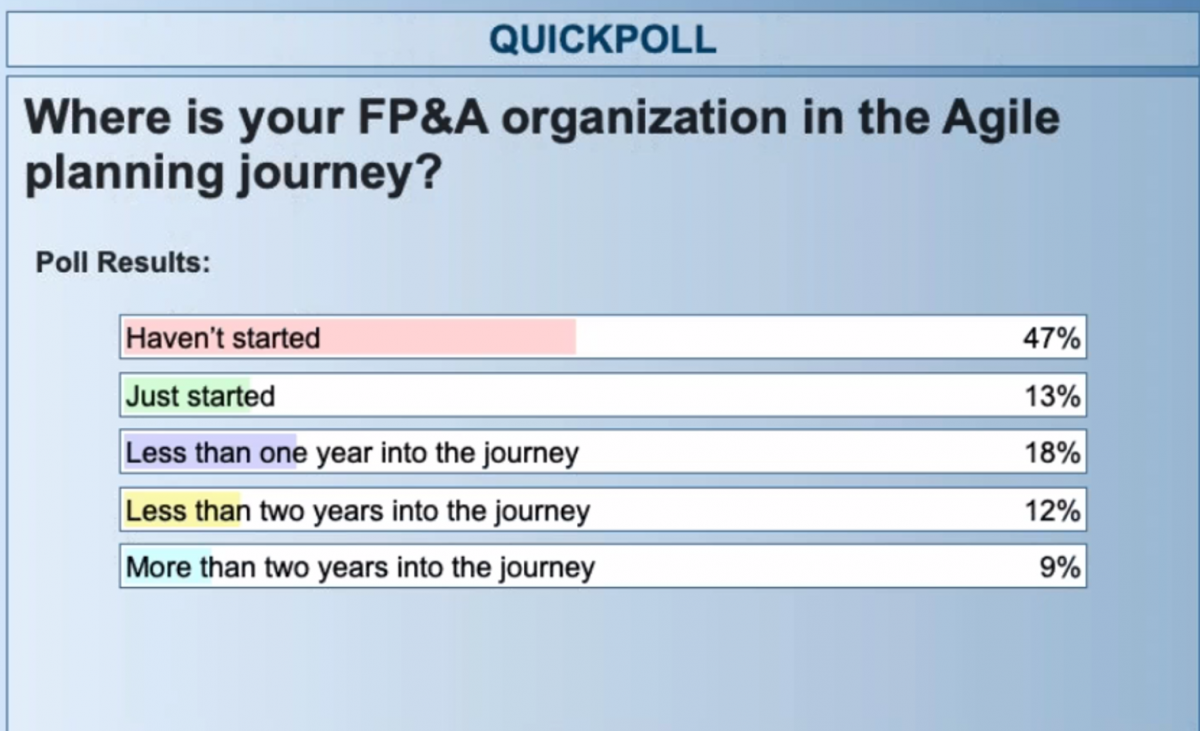

To receive audience feedback, a poll was conducted, asking attendees: “Where is your FP&A organisation in the agile planning journey?” The majority answered that they ‘haven’t started’, which is in line with the market benchmark. (Figure 3).

Figure 3

Applied Materials: a Case Study of Agile Finance Transformation

After the poll, the webinar turned to Junaid Ahmed, Corporate Vice President, Finance, at Applied Materials. Junaid began by introducing his organisation, an iconic semiconductor company that helped establish Silicon Valley. With 50 years of innovation, they have 21.6B revenue and over 26,000 employees across 19 countries.

Applied Materials set up agile finance to achieve three strategic goals:

Enhance finance scalability and effectiveness in support of the company’s growth objective

Improve employees’ work-life-balance and career fulfilment

Enable greater business agility through a digital way of working

The company achieved these goals by targeting key transformation levers. They upskilled the finance function on Automation, Data & Analytics, and speed and quality of Decision Support. While they did not seek to become IT professionals, with whom they were partnered, finance professionals needed higher levels of digital proficiency. The process is certainly about extensive automation, but it is also about process effectiveness. The processor needs to deliver real-time business performance and the decision-making that the enterprise needs.

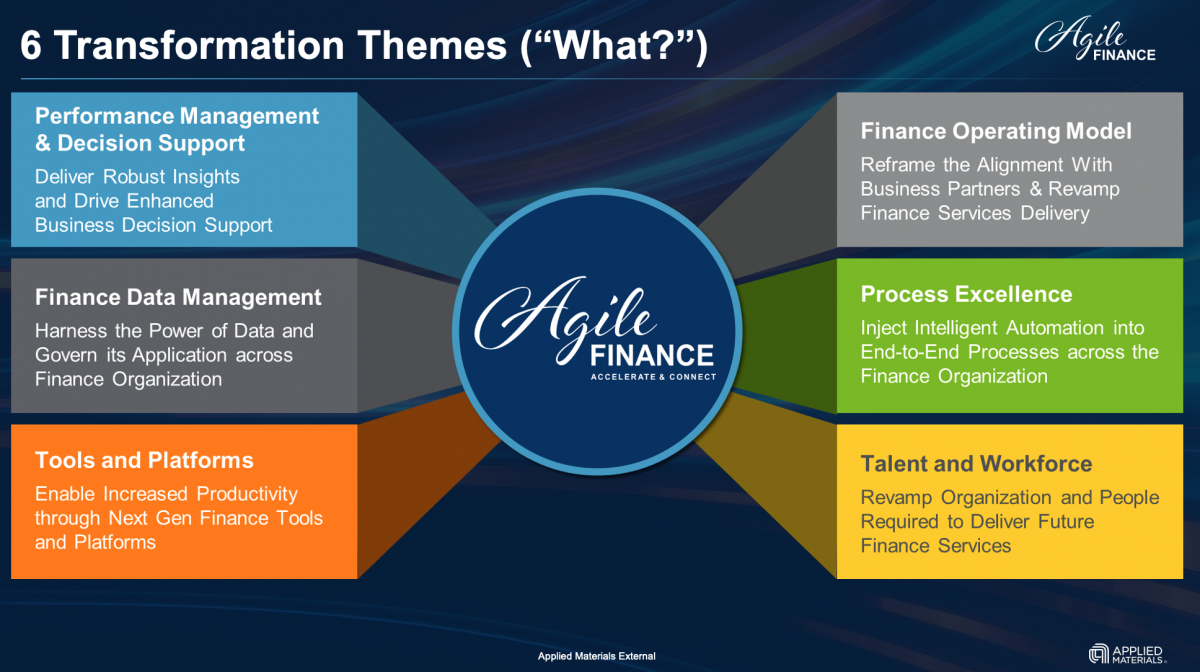

The above levers ensured holistic thinking across the organisation. But Applied Materials also set up a Six Transformation Themes framework to guarantee end-to-end thinking, and to upskill finance to become the trusted business advisors. (Figure 4)

Figure 4

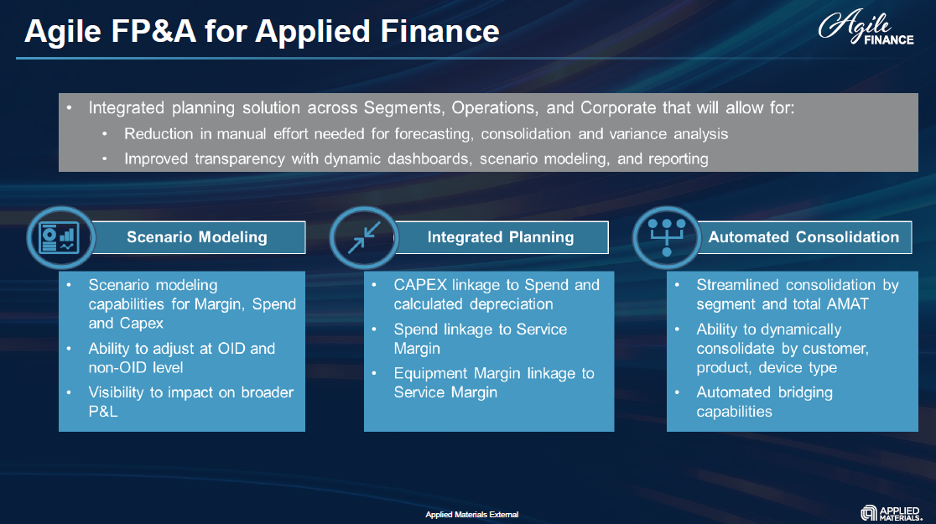

Next, Junaid provided three pillars for Agile FP&A for Applied Finance (Figure 5):

Scenario Modelling: Scenario modelling capabilities for Margin, Spent, and Capex and visibility to impact on border

Integrated Planning: Reduce manual efforts needed for forecasting, consolidation and variance analysis, and promote a self-service reporting model.

Automated Consolidated: Dynamically consolidated by customer, product or device type.

Figure 5

The key takeaways from the Applied Materials case study:

Institutional Support: this is essential to ensure strategy/priorities alignment

Communication: make the “why” about both organisation and individuals

Key Teams: Cross-functional, project leads and data quality

Training: ensuring all users attend training enables accelerated adoption

Steady state operations: establish COE and associated new business processes

Time to value: speed of execution enables mindshare and value capture

Junaid told the audience: “As a company, we were able to implement the entire new portfolio of digital applications for finance that we established in 18 months. Now, since this summer, it's been all about change management, training, adoption, and getting our business processes around this new digital infrastructure to steady state. And we're very much on target to hit the first 2022 goals, which is very, very exciting indeed.”

Conclusion

The future competitiveness of real-time business relies on more accurate forecast planning and analysis. Not only is this important in the short term, it is also critical to the decisions upon which long-term digital transformation will be based. Organisations that struggled the most were those relying on traditional principles for financial planning and analysis. It was the companies that were most reluctant to embrace new technology, new business models, and digitisation of their organisation. Now is the time for FP&A to become more agile.

We would like to thank our global sponsors and partners Anaplan for their great support. We also thank our participants and, of course, our amazing panel. We are very grateful that you have shared your practical experience with us.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.