What could Beyond Budgeting mean for your enterprise — and what benefits are available if you...

How long are your company’s budgets valid? Are they out of date after one, two or three months? In today's unpredictable times, the year has hardly begun before many companies suffer from useless, antiquated budget data.

How long are your company’s budgets valid? Are they out of date after one, two or three months? In today's unpredictable times, the year has hardly begun before many companies suffer from useless, antiquated budget data.

The environment of organisations is becoming increasingly demanding due to megatrends such as digitalisation, globalisation and mobility. We are said to live in a VUCA world, which stands for Volatility, Uncertainty, Complexity and Ambiguity. The corona pandemic has catalysed the need for organisations to cope with unforeseen events as the uncertain becomes the norm. We have entered the age of uncertainty.

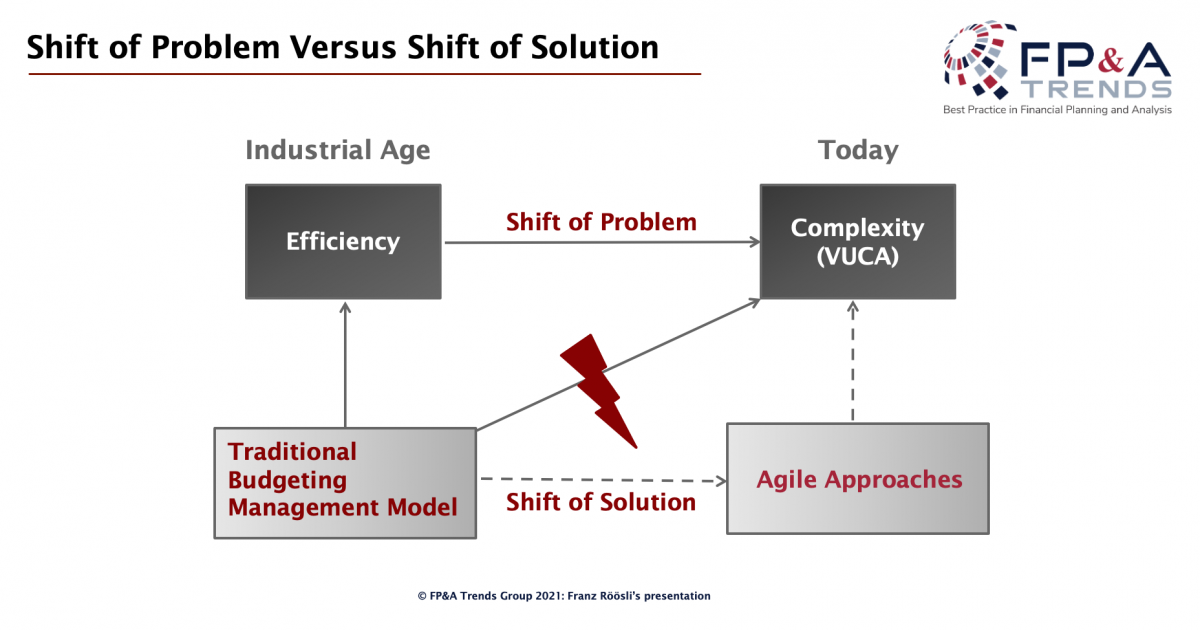

Problem shift needs solution shift

The vast majority of companies still rely on traditional organisational designs characterised by hierarchical structures and steering with budgets. But these designs are outdated, severely limiting a company's ability to act and respond in today’s fast-changing environments.

How can organisations operate viably in this age of uncertainty? The answer: moving to Beyond Budgeting as an agile approach. The following chart shows the problem shift with the necessary solution shift.(Figure1)

Figure 1

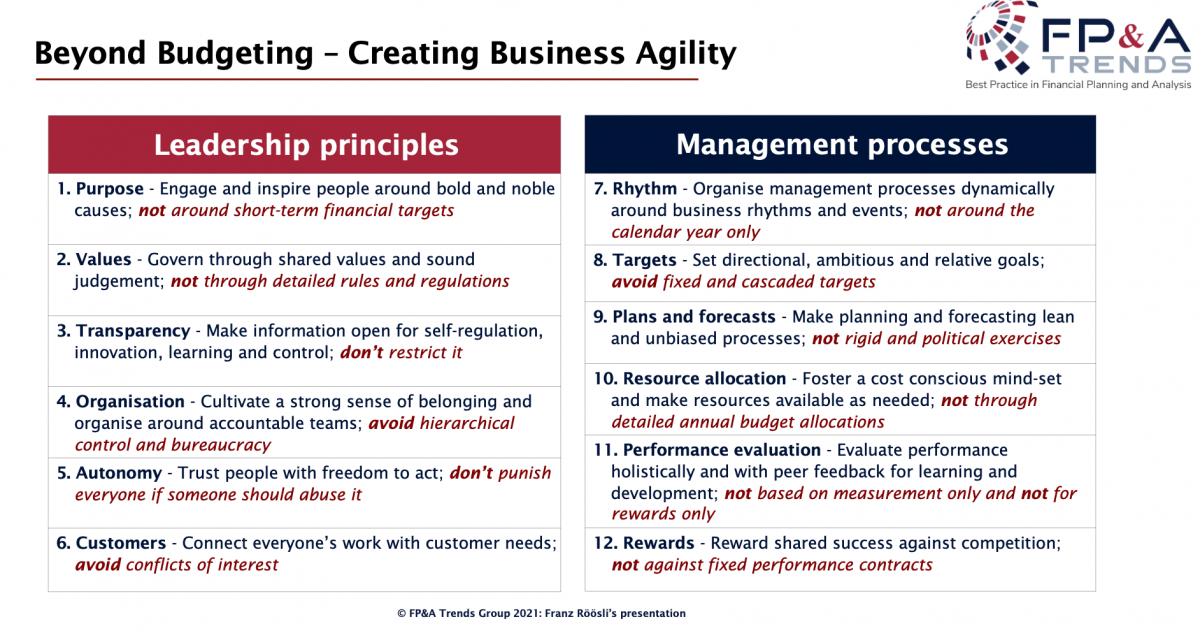

Beyond Budgeting has often been regarded as a financial concept comparable with methods like Better Budgeting. But this view is narrow and misleading. Beyond Budgeting is, in fact, a holistic organisational design. At its core lies an agile approach based on self-organisation. Beyond Budgeting comprises two interlinked, coherent key dimensions: decentralised leadership and adaptive management processes, each comprising six principles. (Figure 2)

Figure 2

As a holistic approach, Beyond Budgeting consistently offers an alternative to the inherently rigid and bureaucratic budget-based management processes (also called budgetary control). Without tackling these processes, a sustainable transformation to an agile organisation is unrealistic.

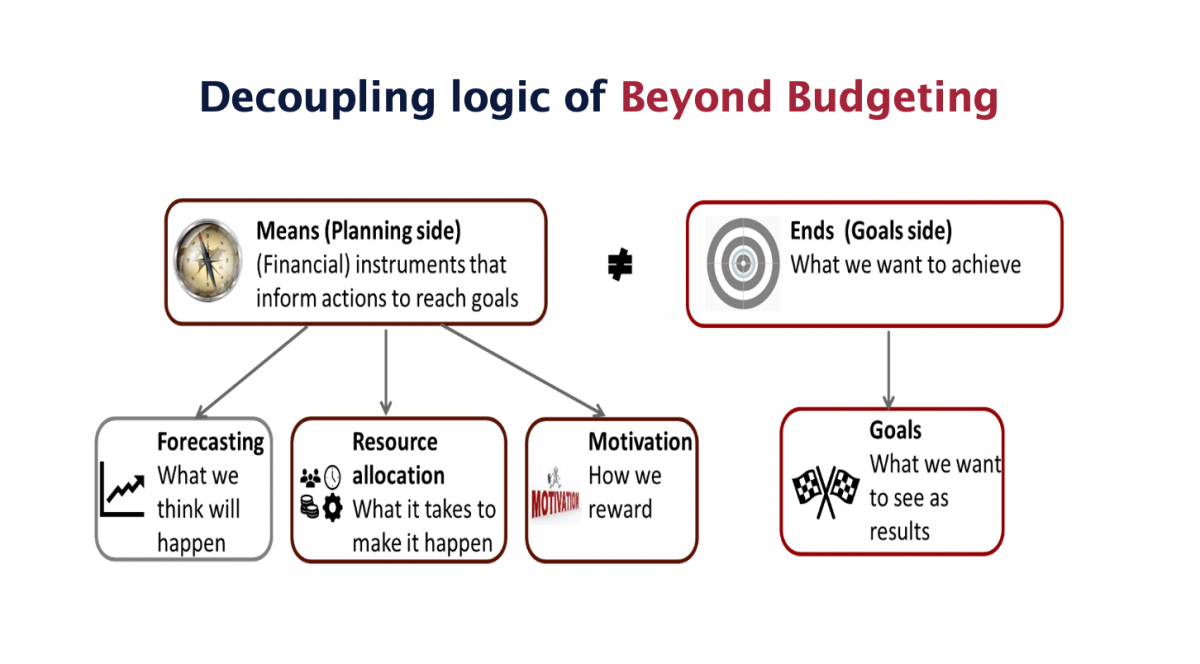

Budget-based management processes: a perversion of means and ends

In almost every organisation, a budget represents (financial) planning data and (financial) goal data at the same time. Budgets, therefore, have a dual nature, addressing both means (planning) and ends (goals) simultaneously. This is the overarching design problem of budgetary control: planning figures become goal figures – a phenomenon called displacement of goals. What is at stake here, then, is a perversion of means and ends. To make matters even worse, the means side of budgets involves several different planning functions, such as forecasting, resource allocation, and reference for the incentive plan (i.e. motivation). Hence, this multiple coupling of different things into one number further exacerbates the dysfunctionalities of the displacement of goals. It commonly leads to absurd and time-consuming negotiation games; demotivating alibi exercises, wasting resources to be on the safe side; transferring revenues to other closing periods, and number crunching to maximise incentivised bonuses.

It is sometimes thought that such budgets support control. But these dysfunctionalities demonstrate that they only produce the illusion of control.

Beyond Budgeting as a way forward

So how do we achieve real control and overcome the dysfunctionalities of budget-based management processes? Beyond Budgeting addresses the problems on two levels:

- It abandons the displacement of goals, as it separates planning (means) and goals (ends).

- On the means side, it distinguishes between different planning functions, such as resource allocation, forecasting and motivation.

The following chart shows Beyond Budgeting’s decoupling logic. (Figure 3)

Figure 3

Let’s see how this decoupling works, starting with the goal side.

Goal setting

Beyond Budgeting advocates a new approach towards financial goals, which should be set according to today's VUCA dynamics. One organisation that has got this right is Svenska Handelsbanken. For the Swedish bank, the ultimate financial goal is a sustainably higher return on equity compared to the competitor average. This means that the goal is relative and self-adjusting, changing according to the dynamics of the environment. In other words, the goal is decoupled from the plan. Since Svenska Handelsbanken introduced this objective in the early 1970s, the company has been operating successfully and is now a leader in the markets in which it operates.

Now let’s see how things work on the planning side. How does Beyond Budgeting implement the three planning instruments shown in the figure above?

Forecasting

In business environments, a common misconception is that a forecast is a prophecy: a prediction of exactly what will happen. When rolling forecast concepts are used, the new forecast data, therefore, become binding expectations, which themselves become a control standard. Essentially, what this means is that the forecasts have mistakenly been changed into goals. We, therefore, see the same perversion of means and ends with forecasts as we saw with budgets. That undermines the essential intent of forecasting completely: to generate forward-looking thinking and act in dynamic times.

A forecast aims to provide an unbiased assessment of future reality. The results of a forecast include the effects of assumptions on the external environment and the consequences of previously made decisions. If a forecast shows that the targeted aim is in danger or that new chances have arisen, decisions on additional possible actions must be made. These decisions must then be integrated instantly into the forecasting cycle, resulting in a new forecast. Due to new insights and actions to be initialised, the present forecast can change in the next forecasting cycle. One forecasting cycle follows another, continuously integrating the newest insights and actions.

Resource allocation

In a Beyond Budgeting context, resource allocation is no longer rigidly fixed for a year by a given budget figure. Instead, resources are dynamically allocated to business needs, according to continually updated and unbiased forecasting information. For example, a business unit of a pharmaceutical company works with a cost ceiling, and managers dynamically require resources based on campaigns. Throughout the year, decisions are made with full transparency about resources by a team of people that represents the whole business unit. The resource allocation process, therefore, avoids silo thinking and suboptimisation.

Motivation

Budgets are an essential part of the motivation instrument. But in the Beyond Budgeting model, individual incentives are not used to encourage motivation. Beyond Budgeting assumes that employees are intrinsically motivated and do not have to be led with carrots and sticks. W.L. Gore, an inventor of the world-famous Gore-Tex, utilises a profit-sharing system instead of a budget-based incentive plan. Like Svenska Handelsbanken, W.L. Gore has a relative, self-adjusting financial top goal. If this target is achieved, all employees receive a share of the profit. Motivation doesn’t come from individual incentivisation but rather from everyone’s participation in the success.

Impact of Beyond Budgeting for successful FP&A work

What does all this mean for FP&A professionals working with Beyond Budgeting? To succeed, professionals must…

- … implement agile planning processes

- … produce new sets of financial reports, with the increased focus on visualisation

- … combine financial acumen with business acumen

- … use new techniques for evaluating performance

- … get increasingly involved in processes related to rewards

- … collaborate more and more with other central functions

Conquering these six challenges leads to a more interesting and interactive FP&A job profile, much closer to the business units and to other central functions like HR or IT.

Implementing Beyond Budgeting amounts to nothing less than an upgrade of the relevance of this profession. It is an opportunity for FP&A professionals to play an active role in contributing to the viability of their organisations. In this dawning age of uncertainty, agile organisations have a competitive advantage.

Invitation

This article is intended to encourage you to think critically about goal setting, forecasting, resource allocation, and motivation in terms of Beyond Budgeting, and equally critically about the current management processes in your organisation. In this way, you will be able to make an informed assessment of the best course of action in the interest of your organisation's viability.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.