As more and more enterprises endeavor to move from a centralized, command and control structure to...

What could Beyond Budgeting mean for your enterprise — and what benefits are available if you move past traditional command-and-control approaches to finance? With the right technology, companies will be better equipped to operate in a more agile way and achieve their financial goals.

What could Beyond Budgeting mean for your enterprise — and what benefits are available if you move past traditional command-and-control approaches to finance? With the right technology, companies will be better equipped to operate in a more agile way and achieve their financial goals.

Today, there's huge interest in the concept of Beyond Budgeting — for understandable reasons. The ritual of budget negotiation and iterations can swallow up vast amounts of valuable time for finance professionals. Before long, detailed plans can feel inflexible and become irrelevant to everyone. They can be overtaken by events quickly, such as the Covid pandemic, market volatility, or changes within a company. So the idea of scrapping the budgeting process for something else can feel seductive and seem necessary.

Just recently I took part in a webinar for the Digital FP&A Board where over 400 financial professionals were asked: "Where is your company in terms of Beyond Budgeting?" What's intriguing is that 29% said they had already started their Beyond Budgeting journey and another 41% were thinking about it.

I believe that abandoning budgeting completely is tricky, even dangerous. This is because enterprises need some sort of control and ways to answer those fundamental financial questions, such as "How are we doing?" and "Where are we succeeding or failing?"

The best way to embrace Beyond Budgeting is to transform how we operate. We need to make the financial planning process easier, quicker, and better. And we also want new insights and tools that will enable us to react quickly. With the right financial planning and analysis (FP&A) platform, all of this is possible.

So let's think about where the Beyond Budgeting journey should take us.

Where to start?

Before beginning any budgeting process, it's essential to keep your strategic goals in mind. That means anchoring everything you do in your corporate vision, your goals, and the very reason your company exists. From here, you can establish individual objectives and key performance indicators (KPIs) as well as value drivers — and start reporting on them.

At Unit4, we're prioritizing cloud growth and we've determined two KPIs associated with that goal to help us. As a result, we can measure our performance using these as reference points and returning to them whenever we create a budget. This approach keeps us on track.

When you look at your company's overview in an FP&A system, you should be able to see a wide range of strategic goals and related KPIs. To fully understand your situation and outlook, you'll also want software that supports fully integrated financial planning. This is because you need critical data in all areas, gleaned from across your organization.

Unfortunately, I've often seen examples of where enterprises stop at profit and loss — missing important areas such as cash flow. I think this has changed for many companies over the past 18 months because of the pandemic. But this only underlines the need of having the full financial picture, readily accessible in one place. Otherwise, you might miss something that's critical to your future.

Driving up efficiency

The Digital FP&A Board webinar I mentioned earlier also posed another question to its finance audience: "How do you currently use modern technology in your organization?" Not surprisingly, 58% said their tech was used primarily as a driver of efficiency.

This is critical because when enterprises move towards Beyond Budgeting, they can take efficiency to the next level using artificial intelligence (AI) and machine learning with advanced FP&A software.

Efficiency gains happen in several ways.

For those organizations with defined value drivers, any data entered will automatically be calculated across other components within the plan, reducing the amount of manual input needed and therefore the likelihood of errors.

Other efficiency gains occur where all planners are collaborating in one system and using a workflow structure. In this instance, the finance department has full visibility of how the company is performing, even down to sub-plan level e.g. where are we in the process of sales planning?

Three user groups who can benefit from an FP&A system

The first user group to profit from an FP&A system are the planners. If the organization already uses AI the planners will find their planning forms pre-filled with suggested values by AI. They then only need to check and if necessary, adjust the values. And if the organization uses value drivers then users will only need to upload relatively few data entries to generate their planning figures. Of course features like splashing from all levels will also ensure that the data entry process is as efficient as possible.

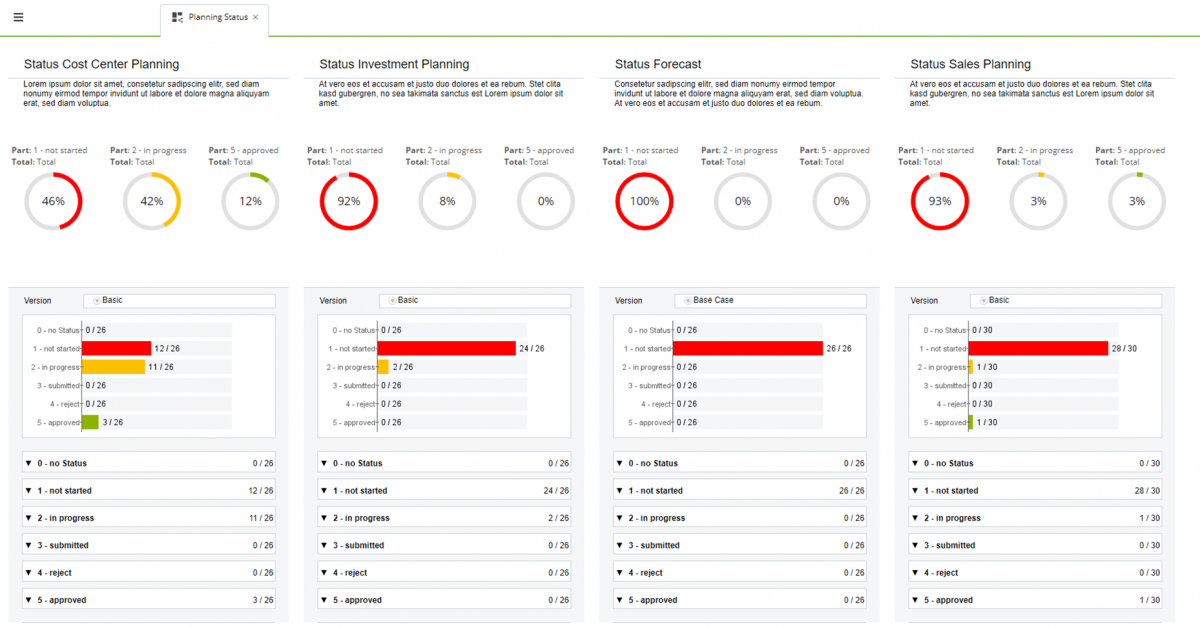

The second group to benefit substantially from using an FP&A system is the finance department who controls the planning and forecasting process. The finance department will have full transparency of where the organization is in relation to the planning process for each sub-plan (cost center, investments, revenue planning, etc.) The following screenshot is an example of such an overview.

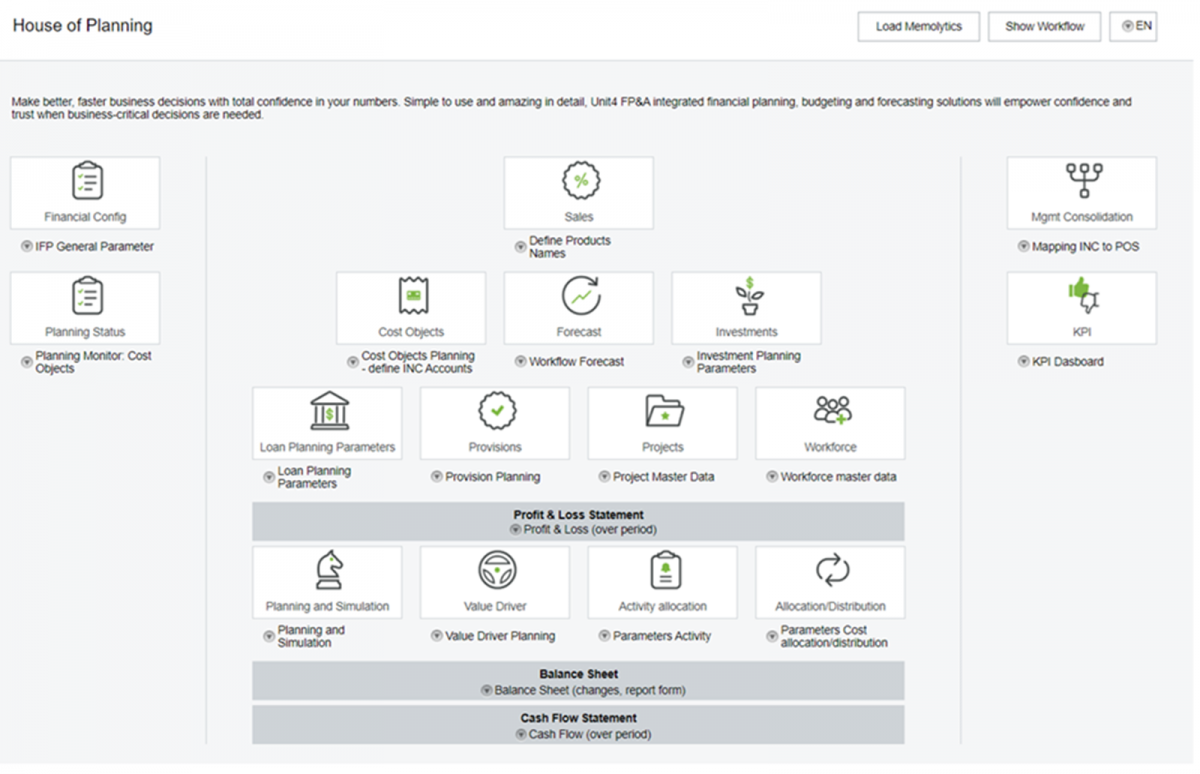

Finally, the storytellers or influencers have a huge benefit by having just one single point of truth. All the forecasts and budgeting data will be immediately available in their reports from which they can start with the analysis and report preparation. This House of Planning image below illustrates the integration of Profit & Loss, Balance Sheet, and Cash Flow with the sub-plans.

The role of storytelling

Of course, AI and algorithms do amazing things, but they only take you so far. People need context and interpretation. And here's where a Beyond-Budgeting-capable FP&A platform can help again. It should let you add commentary alongside each data point, forecast, performance comparison, and scenario simulation.

With this storytelling capability, you won't simply identify whether outcomes are good or bad, you'll be able to add insight and explain the underlying reasons to your colleagues.

This storytelling role is becoming increasingly important for financial analysts. FP&A teams will need to dig deep and find the 'how' and 'why' behind the numbers. But this will help audiences hugely. Instead of presenting hefty tables and oceans of figures, you can provide your colleagues with easily digestible key points. That's a significant win when you move Beyond Budgeting.

A world of constant forecasting

With all your financial data in one place and an FP&A platform working effectively, Beyond Budgeting starts to become a tangible reality, rather than a vague concept. You can examine your finances from the top-down or the bottom-up. It's easy to compare data sets in seconds without scrambling for spreadsheets. Alternatively, you can drive straight into the detail, certain of its accuracy, and see where it takes you.

With Beyond Budgeting, you can enter a world of constant forecasting. Essentially, this is where you have a finger on the pulse of your organization and its financial performance.

At last, there's no rigid stop-start budgeting process that leaves everyone feeling drained and where your plans quickly pass their sell-by date. Instead, entry forms stay open — and the data insights keep coming. You just decide where the reporting cut-off should be at any moment. From there, you can guide your decision-making using the latest data, quickly and easily.

Budgeting hasn't gone away — but it's changing, almost beyond recognition. And that's great news for everyone.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.