In the period from 2001 to 2006, the Retail division of Swiss Post transformed itself from...

The business environment today requires fast and efficient adaptability. We are living in the information age after the industrial revolution. Budgets are one of the most critical components of Management Control Systems, and they are prone to various adaptations. Traditional Budgeting systems have been criticized many times by business managers and academicians. For the last 20 years, Better and Beyond Budgeting approaches are taking their place.

The business environment today requires fast and efficient adaptability. We are living in the information age after the industrial revolution. Budgets are one of the most critical components of Management Control Systems, and they are prone to various adaptations. Traditional Budgeting systems have been criticized many times by business managers and academicians. For the last 20 years, Better and Beyond Budgeting approaches are taking their place.

This article summarises the research conducted in Turkey’s top 500 industrial companies. The aim of the research was to test the criticisms towards Traditional Budgeting and to understand if Better and Beyond Budgeting approaches are desirable in the current environment.

Traditional Budgeting Definition

“Traditional budgeting is a method of preparation of the budget in which last year’s budget is taken as the base. Current year’s budget is prepared by making changes to previous year’s budget by adjusting the expenses based on the inflation rate, consumer demand, market situation, etc. Past year’s revenues and costs form an integral part of the current year’s budget. Only those items in traditional budgets need to be justified which are over and above the last year’s budget.” Source: eFinance management.

Better Budgeting and Mostly Used Systems

Better Budgeting should be considered a better version or upgrade of Traditional Budgeting. According to that, certain Better Budgeting systems should be implemented to fix some of the apparent problems encountered while using Traditional Budgets:

- Activity-Based Budgeting. Activity-Based Budgeting is an extension of Activity-Based Costing and Activity-Based Management theories. This theory is identified as a system that records, researches, and analyses activities that lead to costs for a business.

- Zero-Based Budgeting. Zero-Based Budgeting theory, a widespread technique in the 1970s, which dictates to build a new year’s budget from scratch, rather than taking last year’s actuals, forecasts or budget numbers as the base.

- Value-Based Management. The Value-Based Management system can be thought of as a supplementary system for Traditional Budgeting and requires creating value for shareholders over time with a formal and systematic approach.

- Profit Planning. Profit Planning is a set of actions to achieve a targeted profit level, rolling up to master budget. It does not abolish the budgeting or forecasting processes of a company.

Beyond Budgeting Definition

According to the Beyond Budgeting Round Table (BBRT), Beyond Budgeting means “beyond command-and-control toward a management model that is more empowered and adaptive. Beyond Budgeting is about rethinking how we manage organizations in a post-industrial world where innovative management models represent the only sustainable competitive advantage. It is also about releasing people from the burdens of stifling bureaucracy and suffocating control systems, trusting them with information and giving them time to think, reflect, share, learn and improve. Above all, it is about learning how to change from the many leaders who have built and managed ‘beyond budgeting’ organizations”. As defined earlier, Beyond Budgeting is the opposite of traditional and betterment approaches, and it has been invented to fulfill the need that traditional and betterment approach created.

Research Results

The majority of the companies’ management spends around 20% of their time on budgets, and most of the time, budgets are prepared within three months. These results are at acceptable levels considering global statistics.

What were the identified weaknesses?

Turkey’s top industrial companies’ financial planning managers/CFO’s do not think Traditional Budgets have any significant weaknesses pointed towards them. With a very tiny difference, managers think budgets are costly to prepare and takes a long time.

The research results confirmed a weakness that budgets increase vertical command and control. The strategic focus is denied by managers as a weakness. 88% of managers declared that they are linking budgets to company strategies and do not find budgets contradictory.

Table 1. Sample size of opinions about Traditional Budgeting weaknesses

Pearson’s correlation test resulted in one strong relation between budgets’ ‘gaming’ and guess-work clauses. It may be stated that if the budgets are prepared with guesses, this may be developing a suitable movement zone for bad intentions. A budget data provider, for example, a line manager, may provide unrealistic numbers to conceal a planned fraud.

Better Budgeting or Beyond Budgeting?

Better Budgeting results show that Turkish industrial companies are commonly using Better Budgeting techniques such as Activity-Based Budgeting and Zero-Based Budgeting. Almost three-quarters of Turkish industrial companies are already using Better Budgets. Beyond Budgeting is known only to 24% of managers. Research reveals that respondents do not wish to implement Beyond Budgeting; instead, they would prefer Better Budgeting, because abandoning budgets would cause problems for management.

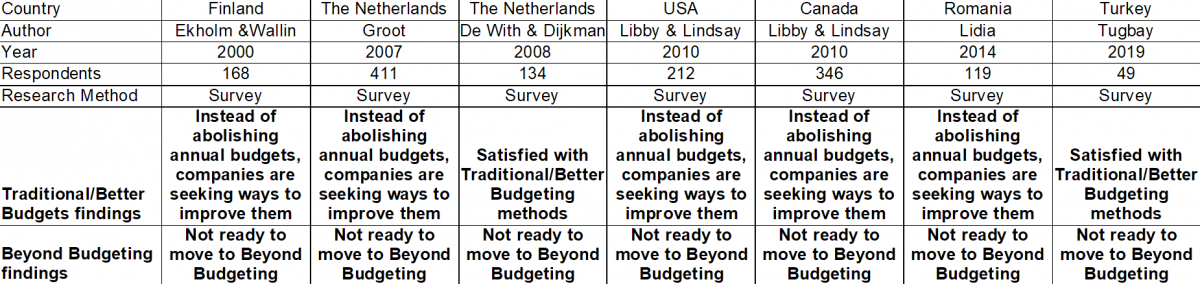

Table 2. Empirical findings of budgeting methods around the world

According to results, 83% of the participants declared that they are a part of a larger entity, and 26% of participants do not have the authority to adopt the budgeting process. They follow the instructions of global/regional headquarters of multinationals to contribute to final budgets.

75% of participants declared that they do not prepare budgets for stock market analysts, which is reinforcing the finding that most of the companies are a part of a larger entity, for that reason, they do not share local budgets with local analysts. However, research results reveal the fact that the companies aim to focus on Competitive Strategy and Business Process, while Organizational Capability is being ignored by the majority.

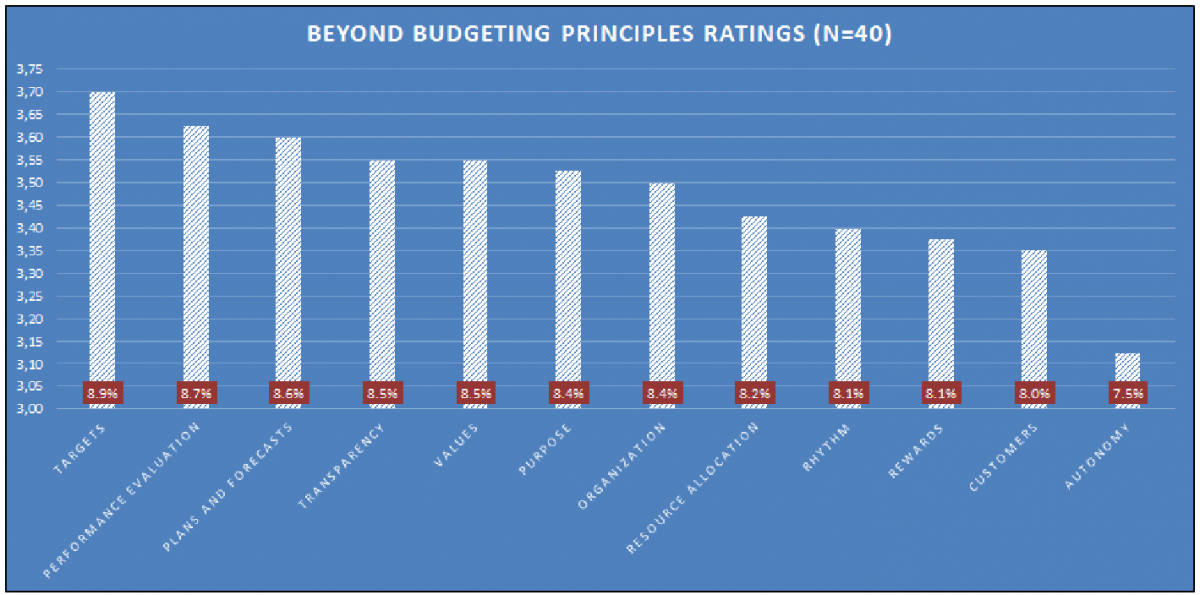

According to results, Beyond Budgeting principle – Autonomy, is the least implemented principle in Turkish industrial organizations. At the same time, participants strongly disagree that budgets make people under-valued and show the least amount of interest to Organizational Capability, consisting of human interactions. Please see below the list of all principles of Beyond Budgeting and average results of Likert 5 scale test:

Conclusion

The majority of Turkish industrial company financial planning managers believe that Traditional or Better Budgeting approaches are working for their companies very well. They do not see any significant weakness for Traditional Budgets. Executives think the majority of the criticisms are false. The motivation to use Beyond Budgeting is mostly related to competitive strategy and business processes.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.