Why, when everyone hates it, do we still have traditional budgeting? My tentative answer to this would...

I would like to share my experience on my company’s journey towards a Better Budgeting process. I hope this will provide a starting point for fellow finance professionals to explore better ways to improve your own budget planning process.

I would like to share my experience on my company’s journey towards a Better Budgeting process. I hope this will provide a starting point for fellow finance professionals to explore better ways to improve your own budget planning process.

Traditional Budgeting

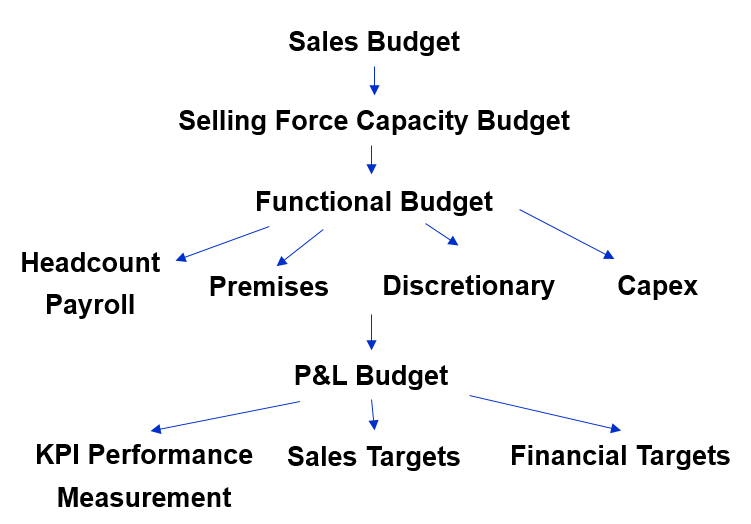

The traditional budgeting process in most companies follows an annual budgeting cycle. This usually starts off first with management deciding on a planned Sales Budget, following which the Functional OPEX and CAPEX Budgets are determined, both of which are then put together to derive the Profit & Loss Budget. This P&L Budget is finally established as a reference for performance targets fixed for the year ahead.

Pic 1. The Traditional Budget Process

The Challenge with Traditional Budgeting

- While the legacy approach to budgeting has some merits, it poses a challenge to modern-day requirements for corporate planning and management;

- While it is suitable for use in a stable business environment, it is not suitable to cope with the demands of a volatile business environment;

- The traditional method is focused heavily on an accounting approach for business planning, which may be mixed up by accounting treatments instead of focusing on business drivers;

- The method of preparations is often based on extrapolation of what has happened in the past e.g. run-rates;

- It fixes performance standards for the operating year without room for adjustments based on market conditions;

- Last, a rigid, fixed management process is often set in place to execute the Traditional Budget.

What We Need with a Better Budgeting Process

With constant changes in market conditions, what companies in a similar position need beyond Traditional Budgeting to make up for current process deficiencies are:

- A more decision-oriented process to facilitate a better budget process and outcome;

- A budget process based on a more forward-looking method of preparation based on key business drivers;

- A goal-setting approach which is self-adjusting and dynamic to suit changes in market environment and conditions;

- An adaptive, decentralised and agile management process;

- Last, an approach to enable a more dynamic and active reallocation of resources when assumptions and conditions change against the Base Budget.

Pic 2. Challenges with the Traditional Budget Process (left) vs. What we need beyond Traditional Budgeting (right)

Improving with a Continuous Budget Cycle Process

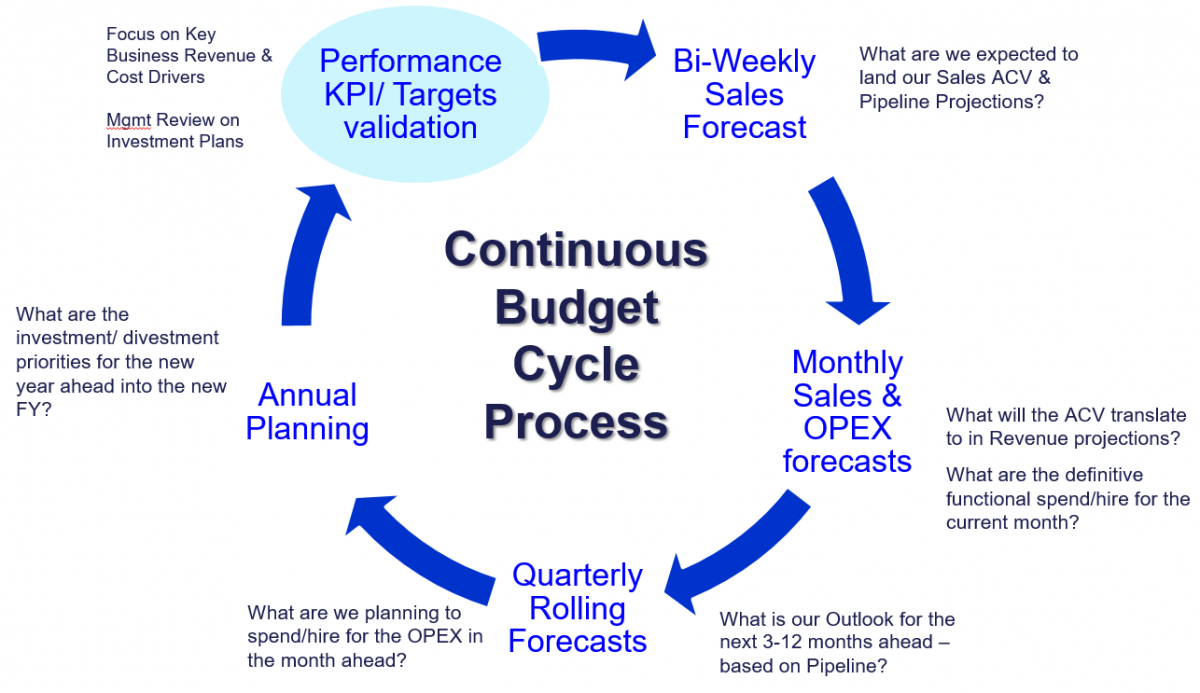

To achieve a better budgeting framework using a Continuous Budget Cycle approach, companies can consider going beyond the Traditional Budget by complementing it with more regular and frequent bi-weekly, monthly and quarterly forecasts and Rolling Forecasts projections which management uses to focus on key business revenue and cost driver discussions, and for management review on investment planning.

Pic 3. Continuous Budget Cycle Process

Positive Outcomes Achieved

When the above was implemented, the outcomes of a better budgeting process achieved are:

- Better agility in Target-setting performance KPIs/Targets for business owners, including rest of targets upon business change;

- More dynamic reallocation of investment resources with changing market conditions;

- A more accurate short-term and long-term financial forecasts for business planning;

- A stronger focus on key business drivers

Key Success Factors

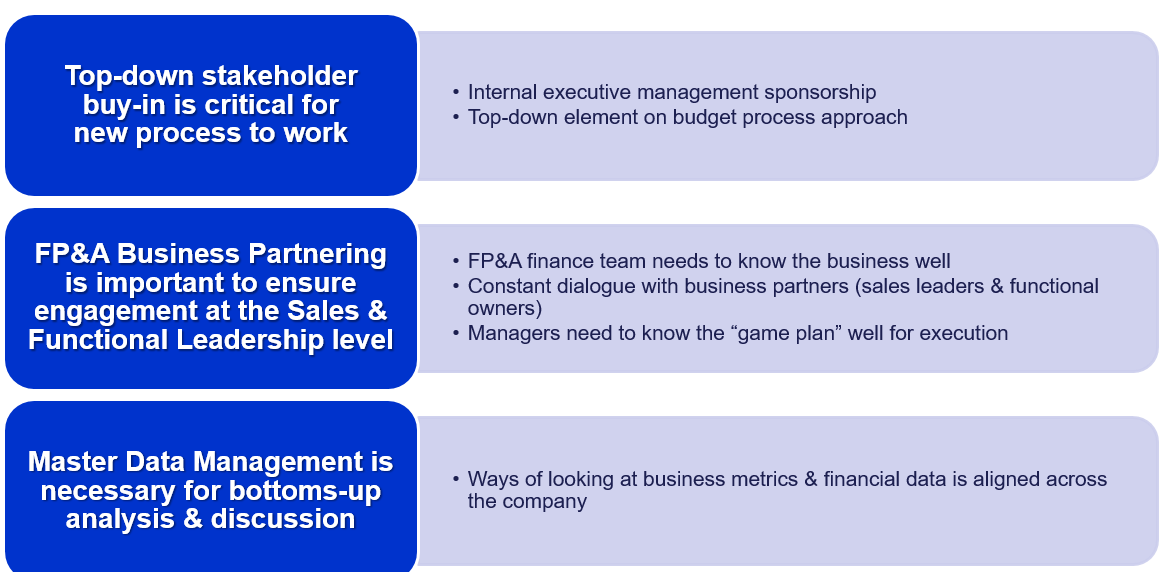

With a better approach to budgeting, success will not come automatically. In our experience implementing the initiatives, we found 3 main success factors:

- Top-down stakeholder buy-in is critical. Top-down executive management sponsorship is critical to ensure buy-in across all levels in the organisation;

- FP&A Business Partnering is important to ensure engagement at the Sales and Functional leadership level; FP&A finance members need to know the business well and have a constant dialogue with business owners to support and execute the plans;

- A consistent way of sorting, classifying and reporting business metrics and financial data is important. To do this, an organisation-wide Master Data Management approach is necessary for bottoms-up analysis and discussion

Pic 4. Some key success factors for a Better Budgeting approach

From Better Budgeting to Beyond Budgeting

Many companies may struggle to necessarily make an immediate change from the Traditional Budgeting approach to Beyond Budgeting. Change management aside, Annual Budgets are still required for Board and Shareholder approvals, as well as for minority interest’s considerations.

Our suggested approach is to take it incrementally with improvements to a better budgeting process and outcome first before considering elements of Beyond Budgeting such as Zero-Based Budgeting and Value-based management – shareholder returns.

The FP&A role as a business partner becomes even more critical into the future for leading finance and budgetary processes as well as to update more flexible tools, systems and processes needed to support financial modelling across sales and functional teams.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.