As more and more enterprises endeavor to move from a centralized, command and control structure to more agile and decentralized business units, the biggest constraint felt by many is the way financial control is exercised via traditional budgeting and budgetary control. At the Digital Pan Asian FP&A Board, the panel of four high-profile speakers discussed the challenges, learnings and benefits of moving from traditional to better and beyond budgeting.

As more and more enterprises endeavor to move from a centralized, command and control structure to more agile and decentralized business units, the biggest constraint felt by many is the way financial control is exercised via traditional budgeting and budgetary control. At the Digital Pan Asian FP&A Board, the panel of four high-profile speakers discussed the challenges, learnings and benefits of moving from traditional to better and beyond budgeting.

The article starts with an introduction to the beyond budgeting concept, lists practical aspects learnt from Roche Australia’s experience and explains how technology can be leveraged in this process.

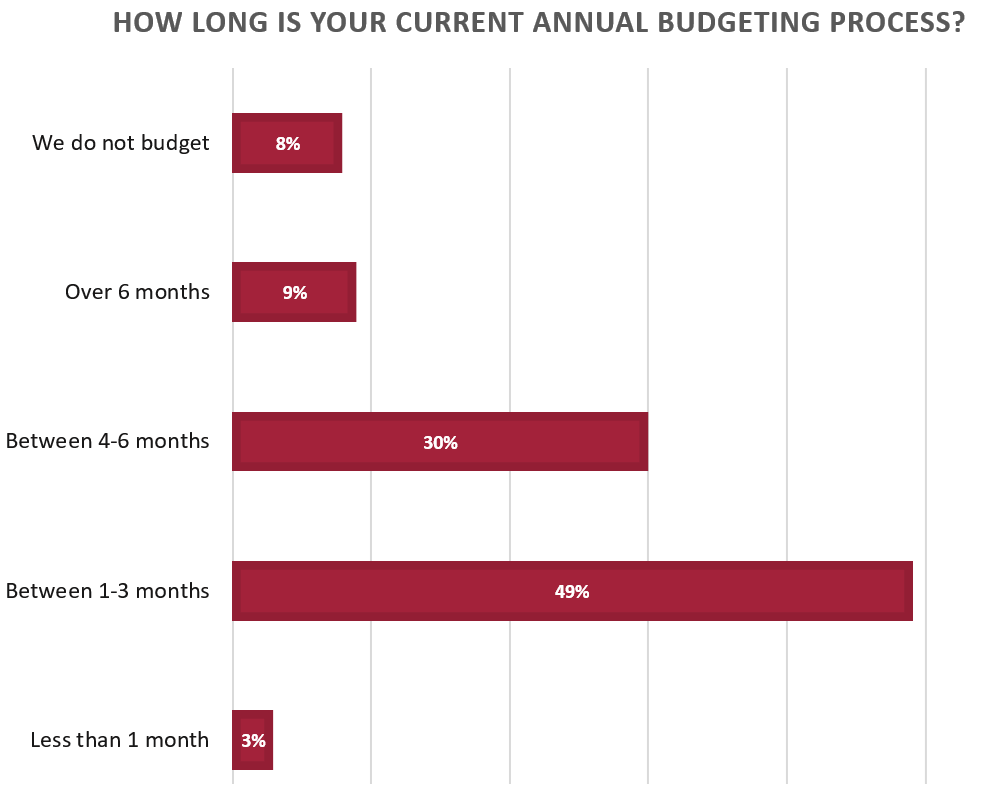

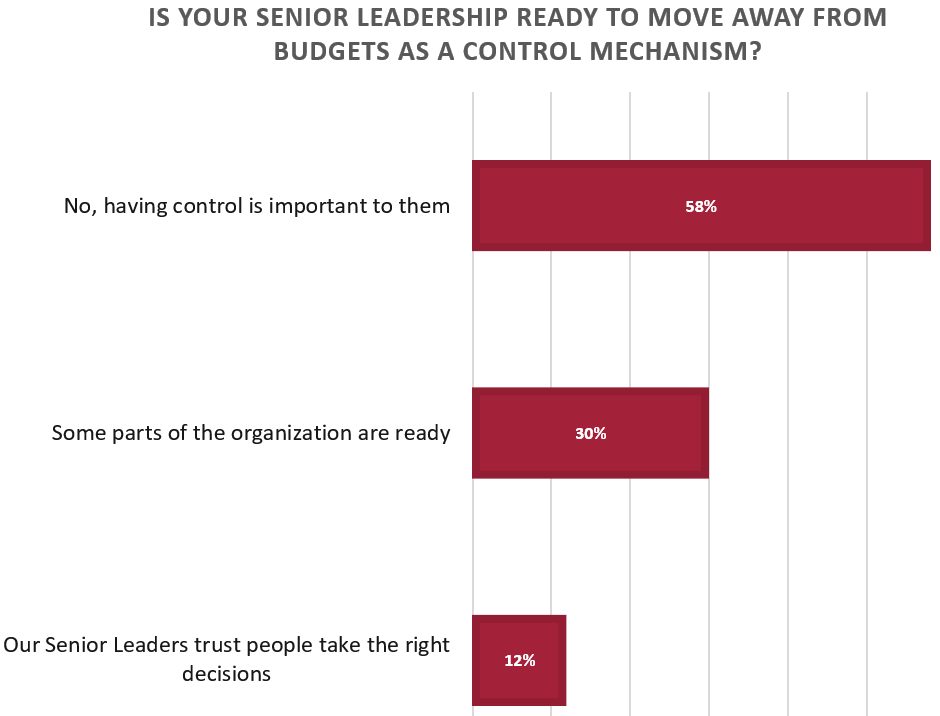

Fig 1. Results of the webinar poll #1 (among participants)

Why is traditional budgeting becoming irrelevant?

Rikard Olsson, Managing Director at Beyond Budgeting Roundtable, explained how the current traditional budgetary control system was devised in an era that was far different from the times we currently live in.

The traditional budget system used by most companies today was founded almost a century ago. The basis of this system was that there is a center of power with the top leadership and then based on their intelligence, targets are decided once a year, then these are broken down by the lowest level of control points and then monitored for adherence. Variance analysis plays a crucial role in the analysis and every month/quarter variances by factory, product, business units etc. were done by controllers vis-à-vis the budget and the rewards and recognition would flow in sync with this.

However, with the business and competitive landscape changing rapidly, the old way of working is being found very restrictive. Despite doing a good job vs the fixed budget, companies were not being successful at the end of the year due to the changes around it. It further creates a silo mentality of “spend or lose”, local optimums vs global benefits, sub-optimal allocation of resources and an extremely slow response to changes as everything is stuck when finance stops an investment as it is not budgeted.

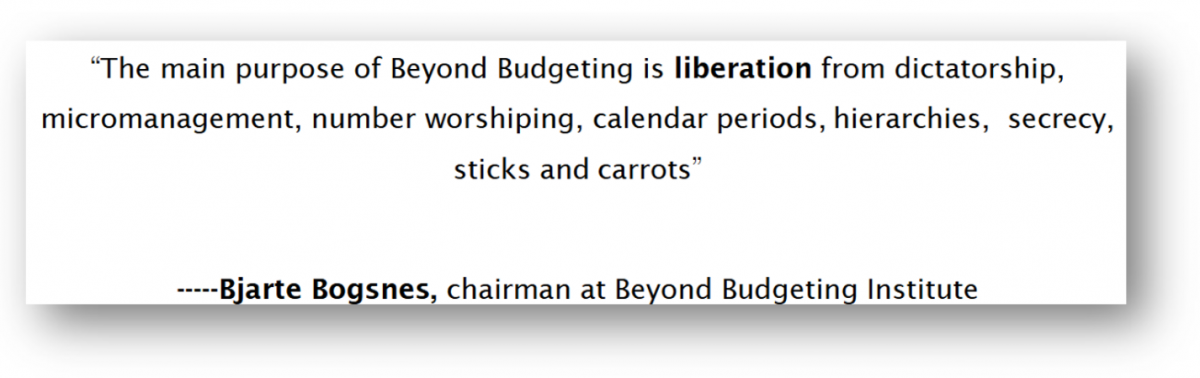

The below table shows the basic principle of “Beyond Budgeting”. For finance, the right side is the more relevant aspect to focus upon.

A few prerequisites of beyond budgeting that need to be taken care of are as follows

Dependence on an annual (or calendar based) budget cycle should be avoided. This provides managers with flexible forecasting cycles instead that are aligned with new events in your industry to cover the specific new opportunities/risks that have arisen.

Fixed targets should be abandoned. The targets have to keep moving in sync with the latest changes in the landscape. This ensures that the targets are realistic and relevant.

The planning and forecasting cycles should be de-politicized. People should be encouraged to come up with their ideas and involvement at different levels is set by the company strategy.

Resource allocations should not be based on the once-a-year budget assumptions. They need to be dynamic and flexible to move between products and geographies depending on the changing circumstances.

Performance evaluation should be based on holistic achievements of targets and not based on full or over achievement of an independent unit. Rewards should be against relative performance by competition and not based on fixed targets.

There needs to be a clear movement from variance analysis to trend analysis. Currently, the focus shifts to business acumen from a pure financial acumen as finance is required to understand the drivers of the business and how they interact with each other.

Fig 2. Results of the webinar poll #2 (among participants)

Beyond budgeting: Experiences and lessons from Roche Pharmaceuticals, Australia

Adri de Vleeschauwer, Chapter Lead - Business Advisory at Roche, and Stefan Plattner, Finance Director and Community Lead Future at Roche, spoke about their personal experiences while implementing beyond budgeting at Roche Australia. To succeed, this initiative had to start top-down with strong leadership support. In Roche, they had a clear 10-year vision of what they wanted to do and everything was subordinated to achieve this.

They achieved this through some specific steps

No bottoms up budgeting meant no hoarding of budgets by cost center managers who were accustomed to getting their budgets slashed if they didn’t spend (hockey stick spend in Q4 as witnessed by many companies).

All employees were encouraged to let go of their narrow mindset and do the cap of “enterprise management”. They needed to ask themselves how their decision would affect the whole enterprise rather than just their division or geography.

The company changed the targets from individual and country-level ones to a single global target. The rewards were also shifted from an individual level to team levels to foster collaboration. This required a major mindset shift. Roche had to deal with the resistance that arose from the uncertainty and unfamiliarity. Increasing volume of communication was done by leadership to buy the people into the new model.

There was a shift from a strict “need to know” basis to a more open data visibility to employees. This helped teams evaluate themselves and their performance and contribution to the global goals.

The company educated its employees. If there is no budget, this does not mean a blank cheque book.

Roche actively uses the 3C concept to drive alignment

Context for the decisions to be made

Conditions which are making the decisions and actions necessary

Commitment from the team to achieve the joint goals

They managed to achieve the following:

190 days of company time saved; 2,700 slides eradicated

More transparency and visibility to the employees on spends and investments

Higher ROI on investments due to better focus

Faster cycles of forecasting meant better agility to make required course corrections

Avoiding hockey stick spend at year-end, sandbagging of sales targets

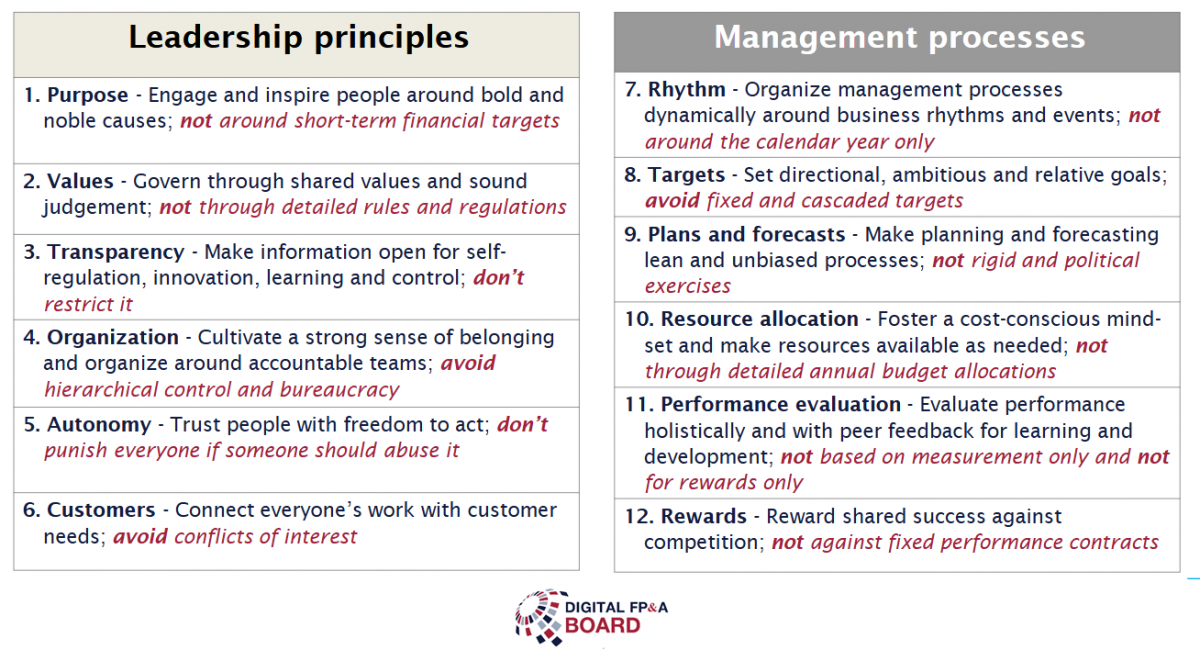

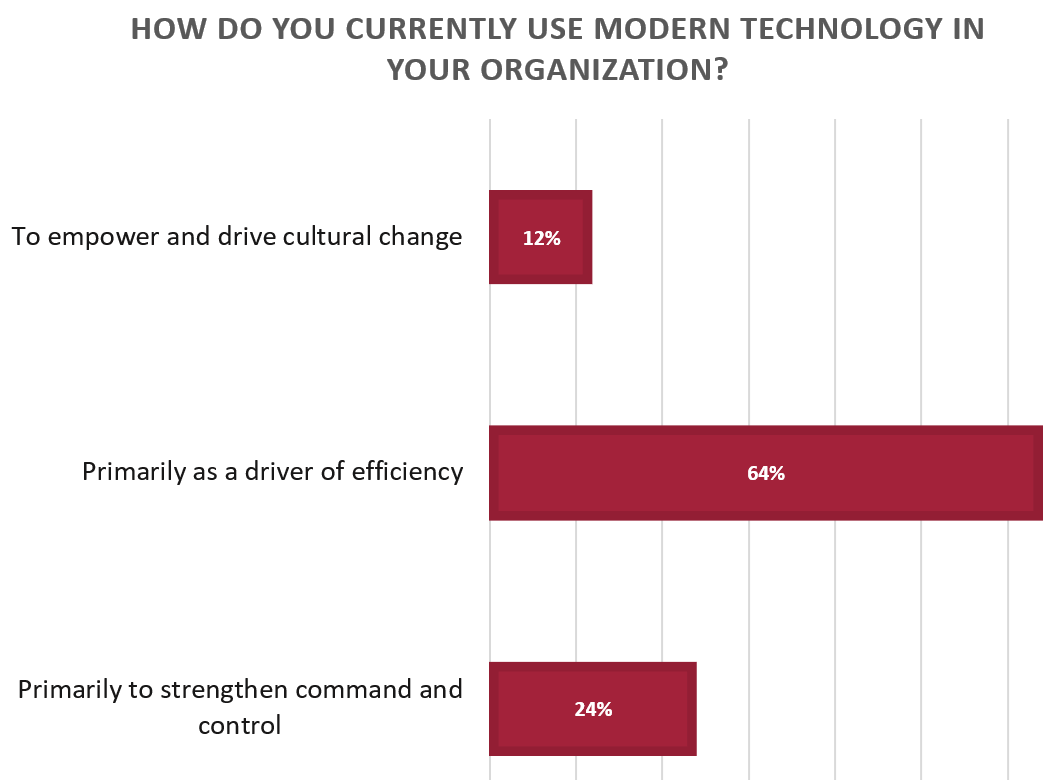

Fig 3. Results of the webinar poll #3 (among participants)

On role of technology

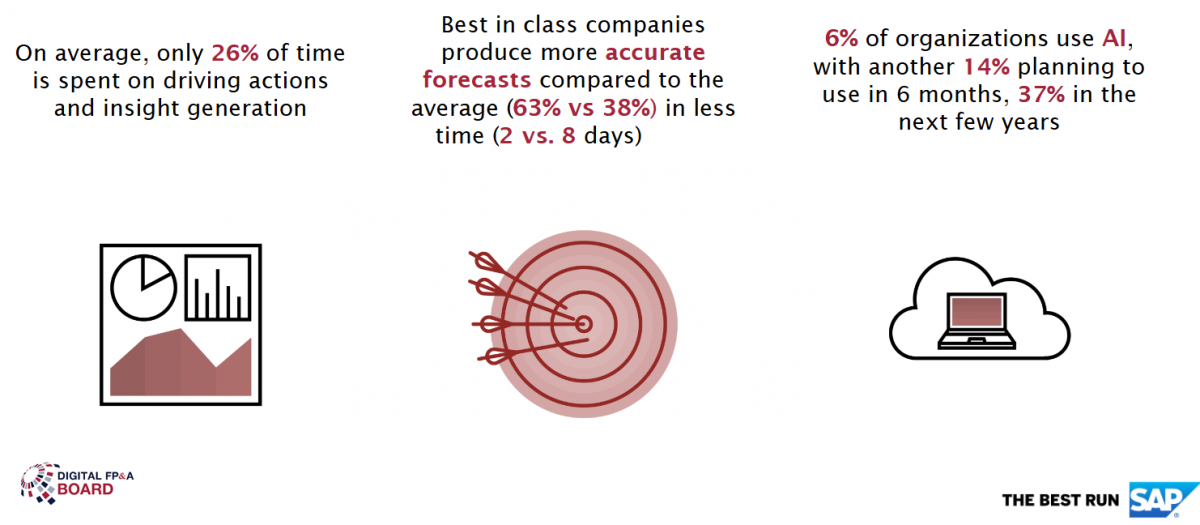

Pras Chatterjee, Senior Director at SAP, shared some interesting numbers (see the slide above). He explained how cloud-based planning can help to move to the new era of financial planning. While today most of the companies use excel for analysis, traditional tools have several shortfalls. For example, companies struggle with using them as a collaborative tool that multiple users can use at the same time across the globe.

Modern technologies are enterprise-ready which means that they are ready to be used without the need to have a full-time data scientist on the roles. The information provided by the modern tool would provide predictive planning insights and valuable insights readily, simulate future outcomes and prepare the presentation in a very appealing visualization.

Implementing such tools would help finance to move from the back of the boat to the front of the boat where finance manages by looking at future trends rather than the past variances. In a nutshell, it will help teams to make faster and more confident decisions.

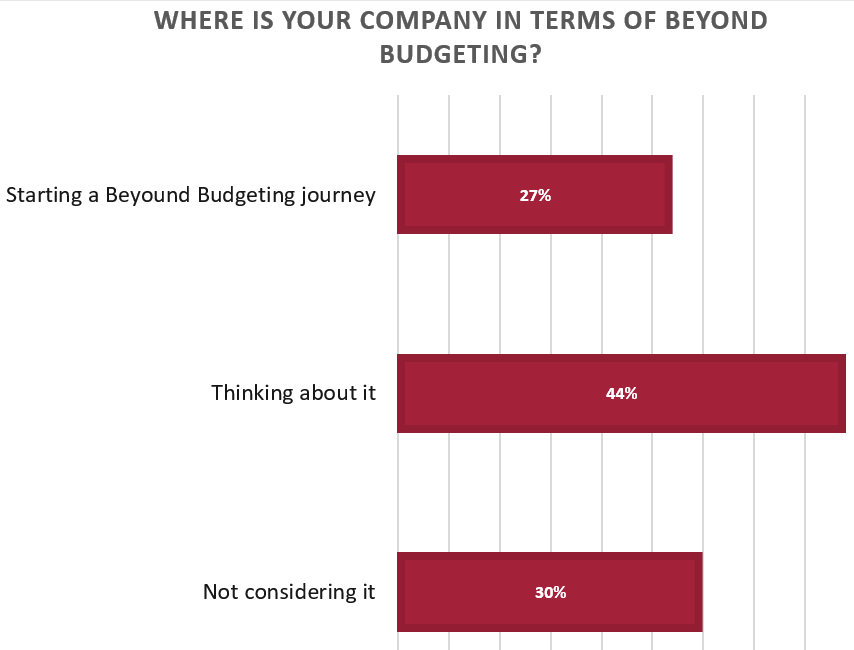

Fig 4. Results of the webinar poll #4 (among participants)

In Conclusion

Any transformation has three critical components:

People and their mindset

Processes

Technology

It is critical that we approach the transformation in a holistic manner that addresses all three aspects of the transformation. Remember that the full exercise is a continuous journey and not a one-stop. The most important step is the first step on the journey by letting go of the uncertainty of not having a budget. Today most companies have their FP&A team spending way more time on planning than on analysis. It is time to reconsider this.

We would like to thank our global sponsor SAP for great support with this Digital FP&A Board.

The full recording of the session is available here.