Business Intelligence (BI) is finally starting to get the love it deserves. It is a transformational...

According to a recent Gartner survey on the CFO’s priorities for 2021, seven out of 10 board directors have accelerated their digital business initiatives. Organisations and their finance functions are now facing increasing pressure to deliver value, along with improved efficiency, speed, quality, and reliability. It’s no wonder that the latest Agile industry survey shows that Agile adoption is becoming more mainstream among non-IT groups like Finance, HR and Marketing. In DevOps teams, meanwhile, Agile adoption has risen from 37% in 2020, to 86% in 2021.

According to a recent Gartner survey on the CFO’s priorities for 2021, seven out of 10 board directors have accelerated their digital business initiatives. Organisations and their finance functions are now facing increasing pressure to deliver value, along with improved efficiency, speed, quality, and reliability. It’s no wonder that the latest Agile industry survey shows that Agile adoption is becoming more mainstream among non-IT groups like Finance, HR and Marketing. In DevOps teams, meanwhile, Agile adoption has risen from 37% in 2020, to 86% in 2021.

Whether it’s financial reports, management analysis or updates to financial processes and systems, Agile approaches are becoming more attractive for finance teams. When adopted successfully, organisations see improvements in quality, speed of delivery, and overall customer satisfaction.

Agile mindsets

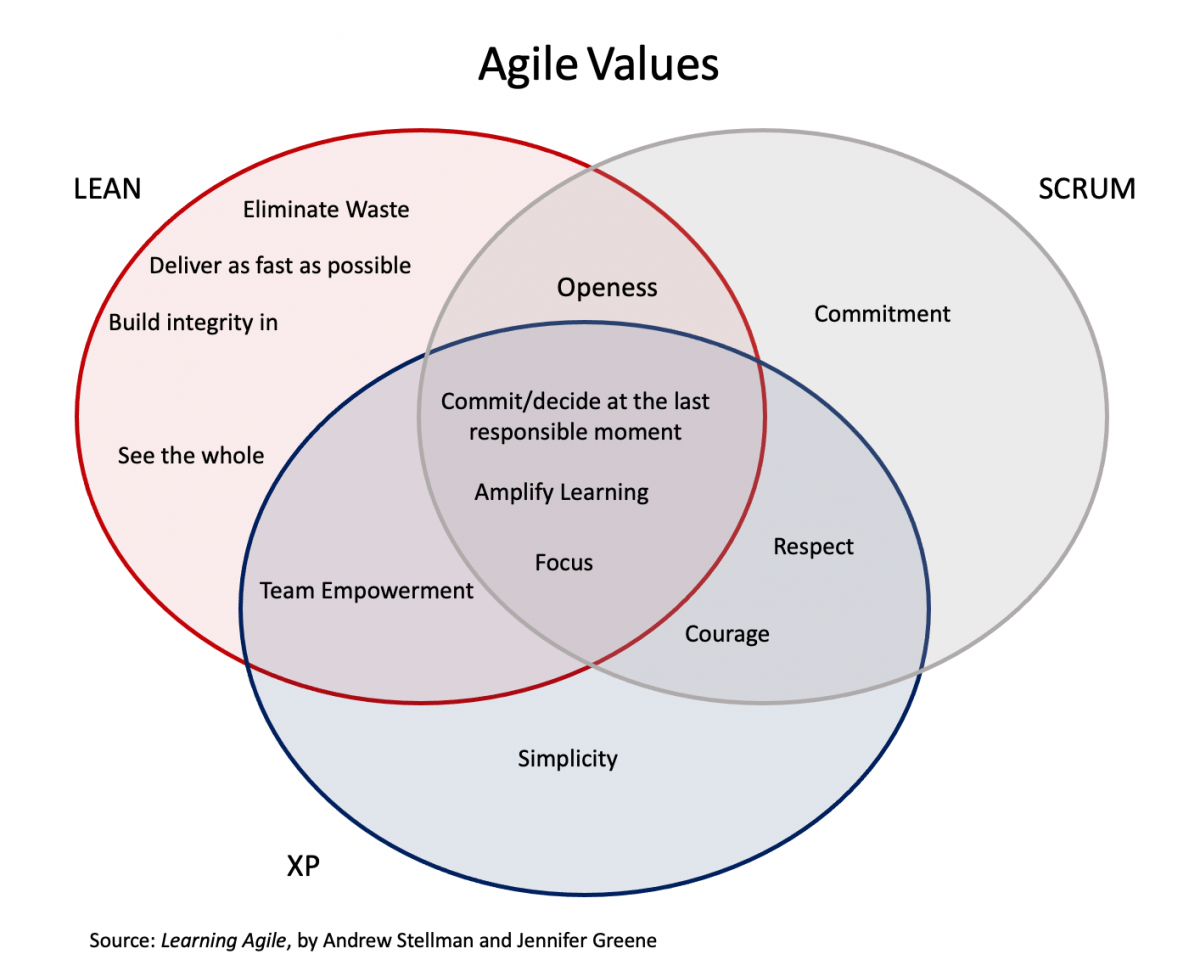

Agile techniques comprise multiple frameworks and methods, including Scrum, Lean, and Extreme Programming (XP). In fact, there are currently over 50 different Agile methodologies.

However, Agile involves much more than just a practice. Successful implementation requires adopting an entire mindset: the whole team must engage actively with Agile processes, rather than simply applying them by rote. Whilst good practice can move the team forward, the right mindset is crucial if the team is to embrace agility authentically. Success requires being Agile, rather than simply doing Agile.

Below is an example of how the three aforementioned Agile methods overlap in their values:

Figure 1

Being Agile versus simply doing Agile is about that mindset shift: embracing an empirical approach, rather than a predefined set of processes. Here are the fundamental principles of the Agile mindset:

1. Deliver value as early as possible

The two basic values we should take into consideration when delivering on a project are to either increase revenue or reduce cost. A project needs to justify its existence: why is it needed, and what value will be delivered? When considering value, it’s important to be customer-centric: value must start with the consumer’s needs. These needs should be carefully considered, because what might be paramount for the team might not be as necessary for the customer.

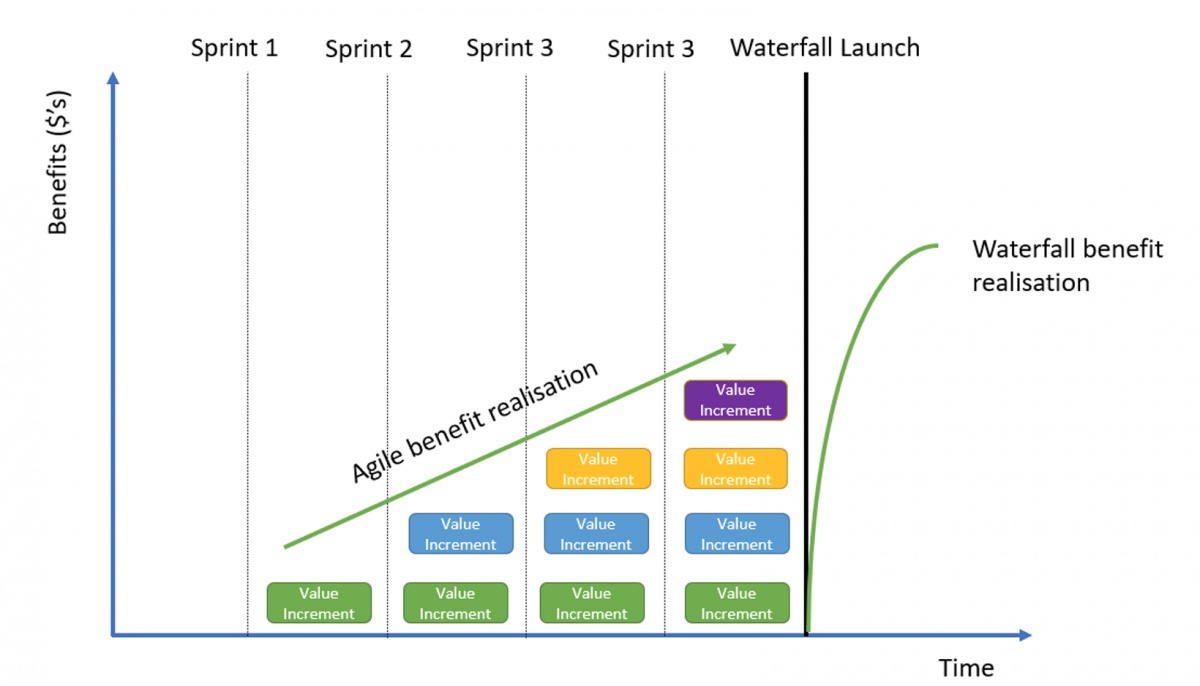

Agile works by breaking down a project into smaller delivery cycles. This way, value increments can be delivered as early as possible. Faster feedback loops can also be used to course-correct when needed. In Scrum, for example, the delivery cycle is typically divided into sprints, in which the units of value to the customer are grouped into increments. These units are identified by the Product Owner, who then prioritises the delivery of the highest value items first.

An Agile method, therefore, contrasts with a waterfall delivery approach, in which everything – including the benefits – is delivered at the end of the project (Figure 2).

Figure 2

2. Manage uncertainty

Agile addresses the fear of failure, and effectively manages risk. In an Agile approach, new requirements aren’t met with resistance. They’re expected and even embraced. The team must ‘fail fast’, though. It needs to have the flexibility to abandon an idea before it’s too late to course-correct or stop the project.

The longer a project continues without delivering value, the greater the risk, not to mention the greater the concern for the project sponsors. For this reason, the risk is considered as an ‘anti-value’ in Agile. If a risk cannot be addressed, then it decreases the likelihood of delivering value. An Agile approach prioritises risks, attacking them as soon as possible. If risks to value cannot be addressed effectively, then the project can be cancelled with minimal time and resources wasted.

Prototyping with mock-ups and wireframes is also a great way to de-risk key decisions. Small experiments are conducted to test a new initiative before all resources are allocated to it.

3. Trust your team

Agile success requires a servant leadership role. Team members need to be comfortable with speaking up when they need support, or when they want to brainstorm new ideas. Creating a safe space and an open environment encourages transparency and authenticity, as well as giving people the freedom to experiment and innovate.

The team need to be comfortable and empowered to make decisions and test ideas, as well as be open to admitting when an idea is failing. Effective solutions to complex problems require discovery and creativity. The best Agile teams comprise highly skilled individuals who are cross-functional and cross-trained. This requires an environment where people can both learn new concepts and collaborate cross-functionally on new ideas.

Without the right environment, having an Agile function in a traditional, hierarchal organisation will be like having a race car in a residential area – no matter how much you tune your vehicle, you will never be allowed to exceed the speed limit.

Why Agile transformations fail

The primary cause of failed Agile transformation is that most traditional organisations struggle with the answers Agile provides to the problems it addresses. Organisations may fail time and time again at Agile transformation. Typical reasons include culture, lack of executive buy-in, middle managers who feel threatened, and people who struggle with changing their work patterns.

As we have seen, Agile is all about mindset, and mindsets are some of the hardest things to change. People often have different ideas, with their unique sets of motivations and habits. Since a certain level of resistance to Agile transformation is expected, support from the top is critical if it is to be successful. Whether you are seeking a major scale transformation or looking to optimise your team through incremental improvements, you can take tangible and positive actions to move your finance function and business forward.

Summary

With any form of Agile adoption, it all comes down to being realistic about what can be applied. It’s also important not to be too dogmatic when trying to implement a particular Agile approach, as every business context is different. Agile teams will face friction when they interact with non-agile parts of the organisation. When an Agile organisation interacts with a traditional finance team, there may be conflict. The key is to explore, test, refine and take what works while ignoring the rest. Your Agile adoption may be small- or large-scale. As long as it moves the business forward, though, it will create a foundation for incremental advances over time. Successful Agile transformation becomes a platform for continuous improvement.

To quote Robin Sharma: “Think big. Start small. Begin now!”

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.