What could Beyond Budgeting mean for your enterprise — and what benefits are available if you...

Transformation and new ways of working – the buzzwords that you hear a lot these days applied to business or IT functions. Are these concepts also suitable for finance, and especially finance in a stock-listed large corporation?

Transformation and new ways of working – the buzzwords that you hear a lot these days applied to business or IT functions. Are these concepts also suitable for finance, and especially finance in a stock-listed large corporation?

At Roche, we have a bold vision to deliver more medical advances of fewer costs to society. With this vision in mind, we started a transformation journey in finance in 2018 that helped to change the way finance works with business. This article will describe this transformation and also outline the main success factors.

A step towards adding more value to the business

In early 2018 Roche still followed a very traditional planning approach, multi-layered budget cycles, where one cycle was an iteration of the previous cycle. An average finance employee would spend about 8-10 months of the year in various parts of the planning cycle.

Despite this slow, and non-satisfactory process, it came as a shock to most of us, when in early 2018, our Pharma CFO announced that we would step away from two large elements of the planning events. Also, the annual business plan event for the countries would be significantly reduced in the effort. The CFO shared his excitement that we now would have time to spend with activities that are more value-adding to the business. Most of us did not understand what he referred to with more value-adding activities. Finance was doing the planning. How could this not be value-adding?

However, the colleagues in the Swedish affiliate understood this was an opportunity to radically transform how they work, not only within finance but also with their business partners. They asked the Pharma CFO for permission to experiment with a beyond budget approach, and after receiving the go-ahead, they shared the idea with the affiliate leadership team and got the green light as well.

Asking new questions: a change in the decision-making process

The finance team wanted the business to consider opportunities they could leverage instead of defending budgets. The guiding principle had to be both local and global strategies but, most of all, our customer needs.

In the past, decision-making in the teams, not only in Sweden, was driven by the question: ”Do I have a budget for this?”. My Swedish colleagues wanted the teams to instead focus on relevance for our customers, the patients instead.

Those principles would then be embedded in the main assumptions, which helped to develop a high-level forecast for the affiliate. Following this approach, we moved from an annual big planning event to targeted adjustments for selected products, whenever key assumptions changed.

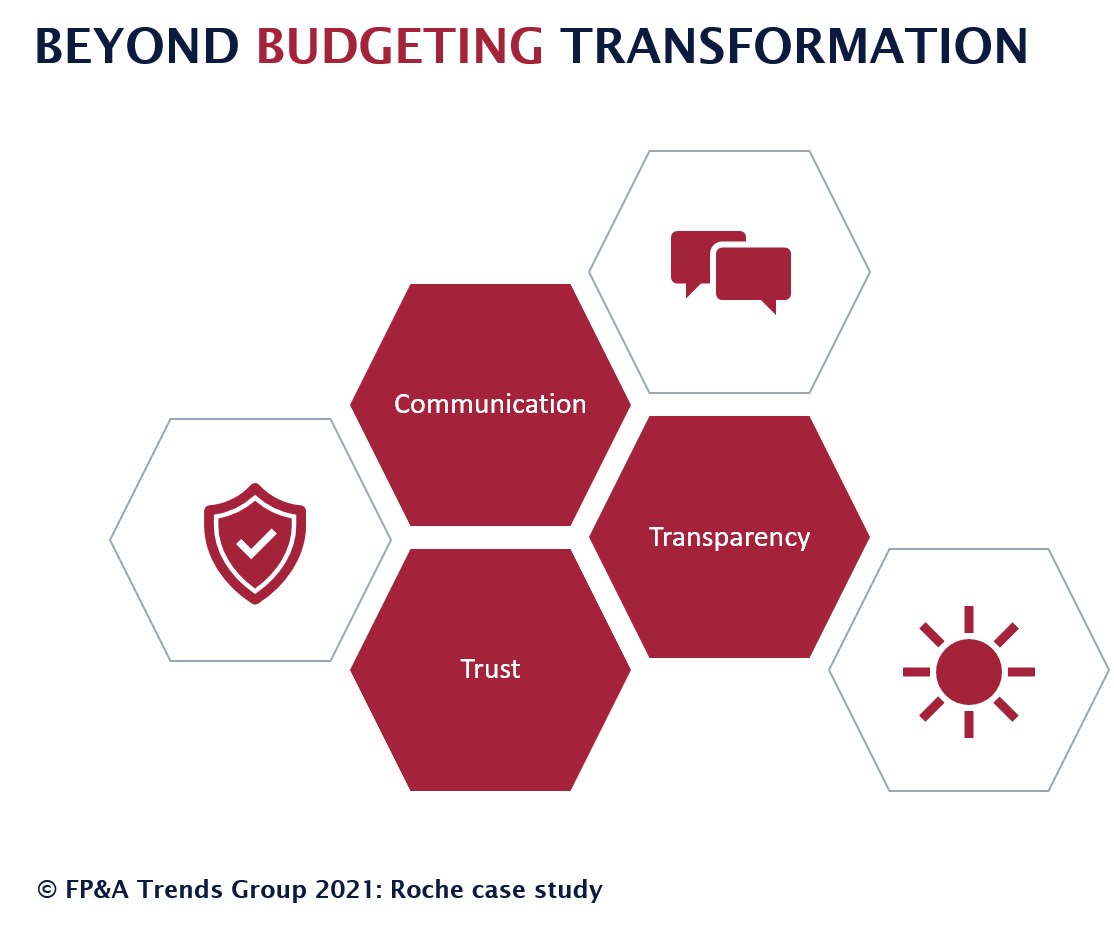

A move towards beyond budgeting: three important components

There is no one-size-fits-all solution to move from traditional budgeting to a beyond budgeting approach. Still, there are a few elements that need to be in place to enable success, and I’ll explain how the Swedish team approached those elements:

- Clear communication

- Transparency

- Trust

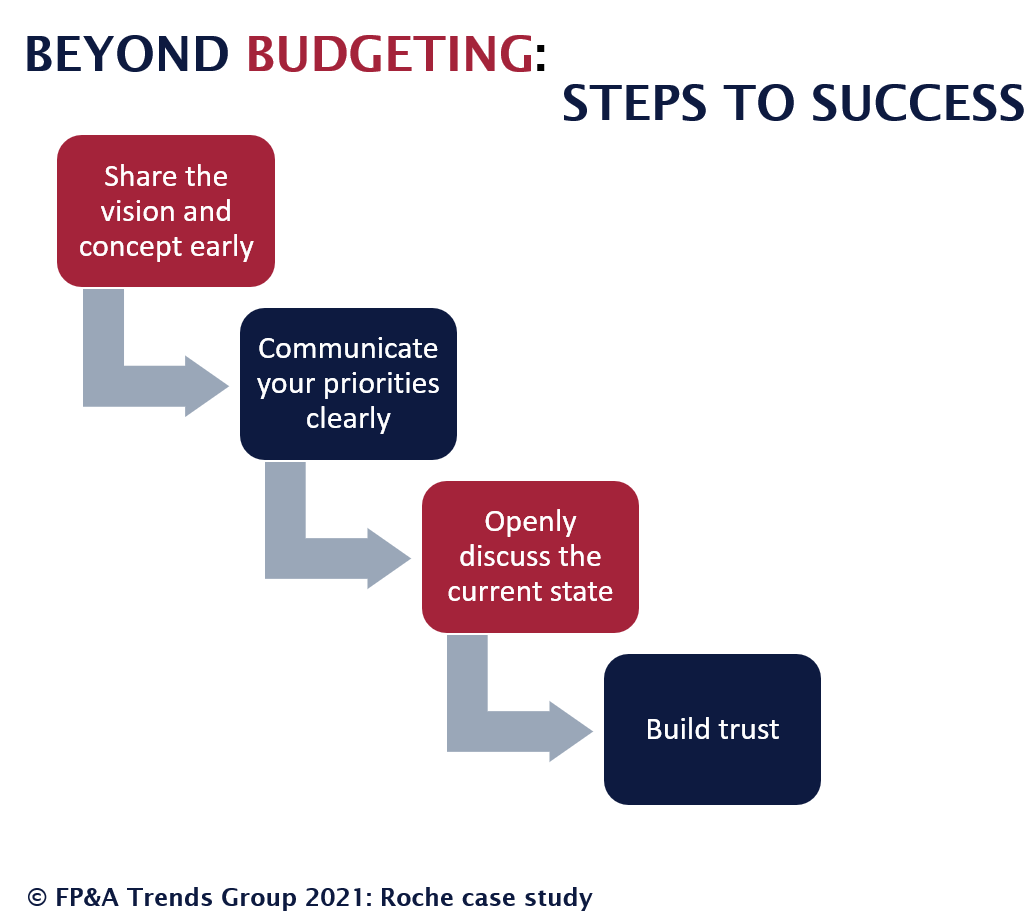

The team started early with clear communication with the teams and the senior stakeholders in Sweden. They shared the vision and the concept and made sure to confirm that there would be no secret budgets in the background either. It was essential to involve key stakeholders early to understand their perspectives and to help everyone see the opportunity of a new approach.

The next step was creating transparency on priorities. In a traditional management approach, with senior leaders making decisions and assigning budgets, there is no need to share priorities transparently with the entire organisation. The budgets that had been assigned are reflecting priorities already. In a world, where teams are empowered to take decisions on spending, everyone needs to be aware of both the company's long-term strategy and mid-term priorities.

In Roche, both priorities are transparent nowadays. The annual managers meeting, where the long-term ambitions are being discussed, has been held more or less completely broadcast in the last two years. Previously the opening slides would be available, but the rest was a secret to those attending.

In Roche Sweden, we discuss the mid-term priorities openly, and develop the measures together with employees, and they are transparently shared with all employees and teams. Both enable teams to take the company priorities into consideration when deciding on new projects and activities.

Another element of transparency is transparency in the current state. Traditional finance spends a lot of effort in creating reports. A large part of today's report is developed in collaboration with the business teams. It’s a platform for teams to share their insights on the products they are working on. In addition, we’re looking at how the spending and resources align with our priorities. This enables teams to challenge each other and discuss how our resources align with our priorities openly, both in the teams and across the company.

Trust is the most important element in any new way of working, a new way of budgeting, or as in our case, beyond budgeting. All that I described above is only possible if there is trust in all management layers, trust that people are able to make the right decisions, based on the information they have. If there is no trust in place, it’s the beginning of failure, as then shadow processes, shadow budgeting and shadow budget reviews might start to take place, guided from within the business, and worst case, even without finance being aware.

To enable the trust to be in place, an open and transparent involvement from the key business stakeholders is of utmost importance. It is essential to understand their perspective and to help everyone see the opportunity of a new approach.

In summary

Today, nobody wants to go back to the traditional budgeting approach. It turned out not only Finance did spend a significant time of the year busy with planning, our business partners did too. Since the implementation of the beyond budget approach, teams now have much more time to spend with our customers, understanding their needs and, with that being in a much better place to add value to our customers.

Over time this change in working sparked an even larger transformation, where the Swedish affiliate has moved away from many management layers, to align the organisational setup with the empowerment that the teams are living.

So, what does this teach us?

First of all, transformation is not a buzzword only for business functions, it is possible in all parts of the organisation. To be successful, it must have a clear purpose and clearly defined success factors to work on. It might even happen that a change in finance sparks the transformation of an organisation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.