The purpose of an income statement is to describe the delivery of products or the provision...

Introduction

Introduction

The purpose of a statement of cash flows is to describe how businesses receive and spend money. This purpose is seen as an end result of financial planning but this purpose can be seen as a starting point of financial planning. As a starting point of financial planning, people should think about how to accumulate wealth from the receipt and disbursement of cash.

The Foundation

- Operating Activities describe the relationships that businesses have with customers, employees, and vendors.

- Investing Activities describe the purchase and sale of long-term assets.

- Financing Activities describe the act of raising money from long-term debt and stockholders’ equity.

Operating Activities

The statement of cash flows describes operating activities through two methods, the indirect method and the direct method. The indirect method starts with net income, continues with adjustments to net income, and finishes with changes in current assets and current liabilities. The direct method indicates cash receipts from customers, cash disbursements from suppliers, cash disbursements for selling and administrative expenses, cash disbursements for interest, and cash disbursements for income taxes.

This article will focus on the direct method.

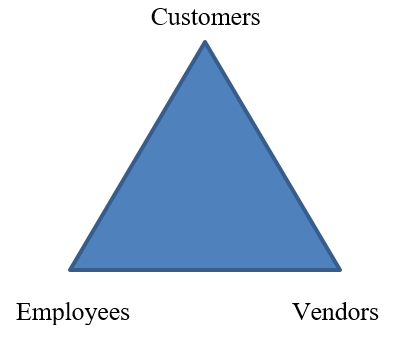

Thinking about how to accumulate wealth from operating activities begins with a visualization:

I call this visualization “The Value Triangle.”

Being at the top of the triangle means businesses must provide value to customers. In order for businesses to provide value to customers, businesses must have a base and that’s why employees and vendors, the entities that affect the value customers see, are at the base of the triangle.

What this triangle illustrates is the connection that a business has with its customers, employees, and vendors. Employees and vendors must connect with customers in order for customers to pay for what they receive in a timely manner. Customers must connect with employees and vendors in order for employees and vendors to receive payments for what they give in a timely manner. Any disconnection in this triangle causes a disconnection in cash flows which hinders the ability of a business to accumulate wealth from operating activities so how can a business minimize the threat of disconnection? The answer is to establish quality in what not only customers receive but also customers and employees give.

During the first decade of the 21st-century mortgage-backed securities (MBS) were the rage of financial institutions. A simple description of these securities is they are an accumulation of mortgages issued by commercial banks so the underlying value of these securities were the cash flows from the mortgages (loans) issued to homeowners. The values of MBS led to good times among many financial institutions until one problem arose: homeowners were defaulting on their mortgages. This problem created other problems which caused the worst financial situation since the Great Depression and caused the bankruptcy of Lehman Brothers which to this day is the largest corporate bankruptcy in United States history. So what this story has to do with conducting relationships with stakeholders, i.e. operating activities?

The answer is the quality of the value propositions within businesses. Businesses having value propositions like accessibility, competence, courtesy, durability, and timeliness that customers demand to serve as a basis for accumulating wealth from operating activities. The ability of businesses to fulfill these propositions through the combination of employees and vendors will determine the quality of these propositions. So the financial planning process must incorporate thoughts on how to fulfill and satisfy value propositions that accumulate wealth from operating activities. We must remember however that using a statement of cash flows for financial planning is not limited to operating activities, using a statement of cash flows for financial planning is necessary for investing and financing activities.

Investing Activities

The statement of cash flows describes investing activities by indicating the purchase and sale of

- Investments

- Land

- Buildings

- Equipment

- Intellectual Property

What should be minimized when thinking about how to accumulate wealth from investing activities? The answer is to minimize thinking about the tax effects from the purchase and sale of long-term assets. Why should thinking about the tax effects from the purchase and sale of long-term assets be minimized?

The answer is the following equation: GDP = C + I + G

This formula is how Gross Domestic Product (GDP) is calculated where C is consumer spending, G is government expenditures, and I is business investment; this article will focus on business investment. The Internal Revenue Code (IRC) is loaded with incentives for businesses to purchase and sell long-term assets but these incentives have nothing to do with the accumulation of wealth from investing activities, these incentives have everything to do with the increase in GDP. Think about it: incentives to purchase long-term assets increase business investment which increases GDP. A business does not exist to increase GDP, a business exists to improve the well-being of its stakeholders. As a result, thinking about how to accumulate wealth from investing activities must incorporate thoughts on how long-term assets will support the relationships that a business has with its customers, employees, and vendors.

One of the tasks in investing activities, the purchase of long-term assets, does not come from nowhere. The purchase of long-term assets comes in large part from monies raised through long-term debt and/or stockholders’ equity. As a result, using the statement of cash flows for financial planning includes the third part of this statement which is financing activities.

Financing Activities

The statement of cash flows describes financing activities by indicating transactions like

- Borrowing money

- Repaying debt

- Issuing stock

- Paying dividends

Financing activities, raising money, is about supply and demand. Lenders and investors supply money while businesses demand money; businesses supply income while lenders and investors demand income. So when thinking about accumulating from financing activities people within businesses need to think about how their businesses will supply income.

Supplying income is based on how money is raised.

Monies raised by borrowing consists of three transactions: borrowing money, repaying what is borrowed, and paying for the cost of borrowing which is interest. Repaying what is borrowed requires thinking about the future because long-term debt will be settled in a period of time greater than one year. We know a lot of events can occur within one year however many more events can occur over many years and thinking about how to accumulate wealth from borrowed money must incorporate what can go wrong, most notably the availability of cash to repay principal and pay interest. So when people decide to borrow they must think about what will be acquired in the form of long-term assets and how these assets will generate cash flows in a manner that cash inflows from customers will exceed cash outflows to employees and vendors. As a result, thinking about accumulating wealth from raising money by borrowing must be tied to investing and operating activities.

Monies raised by issuing stock focuses on the type of stock issued. Monies raised by issuing preferred stock focuses on the dividends promised to stockholders while monies raised by issuing common stock focuses on the appreciation expected by stockholders. Dividends promised to preferred stockholders, like paying for the cost of borrowing, must incorporate thinking about cash inflows from customers that exceed cash outflows to employees and vendors. Appreciation expected from common stockholders must incorporate thinking about the value propositions that customers see, employees and vendors provide, and long-term assets deliver. Like thinking about how to accumulate wealth from raising money by borrowing thinking about raising money by issuing stock requires a link to the investing and operating activities within businesses.

Conclusion

The Statement of Cash Flows is the youngest of the three primary financial statements – income statement, balance sheet, and statement of cash flows – but its youth should not diminish its importance. Its importance is due to its ultimate purpose which is the validation of a business’s value proposition. Since the validation of a business’s value proposition is vital to the existence of a business it is critical for people inside a business to think about how to accumulate wealth based on the format of a statement of cash flows.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.