In 1992 a professor named Robert Kaplan and a consultant named David Norton created a measurement...

The purpose of an income statement is to describe the delivery of products or the provision of services. This purpose is seen as an end result of Financial Planning but this purpose can be seen as a starting point of Financial Planning. As a starting point of Financial Planning people should think about how to accumulate wealth from the delivery of products or the provision of services.

The purpose of an income statement is to describe the delivery of products or the provision of services. This purpose is seen as an end result of Financial Planning but this purpose can be seen as a starting point of Financial Planning. As a starting point of Financial Planning people should think about how to accumulate wealth from the delivery of products or the provision of services.

Revenues

The first element on an income statement is revenues. Why are revenues the first element? Revenues are the first element because they represent rewards. Rewards are what businesses receive from delivering products or providing services. As a result, Financial Planning should start with what businesses want to receive.

On an income statement, people will see revenues presented in the form of financial numbers. Financial numbers will be prices for products or rates for services. Even though financial numbers appear on an income statement they are not the only form of data that affects revenues. Non-financial numbers like quantities or time affect what appears on an income statement as revenues however Financial Planning needs to go deeper in the thinking process. How Financial Planning can go deeper is by focusing on a third type of data, words.

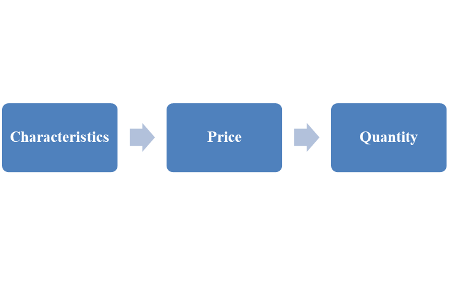

In regard to revenues, words are the characteristics of what is being sold; examples of characteristics are accessibility, competence, courtesy, durability, and innovation. Before revenues can appear on an income Financial Planning needs to address the characteristics of what is being sold. Why? The reason is simple: the characteristics of what is being sold affect the two factors that determine the amount of revenues that appear on an income statement, price and quantity. Let’s look at this premise in greater detail.

A company wants to earn revenues by delivering products. The products will contain a price that the company wants to charge but this price has to be accepted by customers. Customers will accept the price by the quantities they purchase but accepting the price by the quantities purchased is based on desire. Customers will desire products like smartphones that make information more accessible, customers will desire products like automobiles that make repairs few and far between, and customers will desire products like food that make personal health better. What will satisfy these desires is the characteristics that these and other products possess.

As a result Financial Planning should start the process of thinking about accumulating wealth from revenues by identifying characteristics that stand out in the marketplace. After identifying these characteristics Financial Planning can go to the next step and that’s determining the price for these characteristics. After determining the price for these characteristics Financial Planning can finish the thinking process by determining the quantity of the products the company can sell. What this process establishes is an organized approach to communicating the revenues that appear on an income statement:

Earning rewards from revenues does not come from nowhere, earning rewards from revenues comes from effort. An income statement recognizes this fact by communicating effort. The effort that is communicated on an income statement through the following expenses: cost of goods sold plus selling and administrative expenses.

Cost of Goods Sold

The second element on an income statement is cost of goods sold. Why is cost of goods sold the second element? Cost of goods sold is the second element because it is the largest expense for companies that deliver products. Cost of goods sold represents the effort in creating what is being sold. For manufacturers creating what is being sold focuses on the conversion of raw materials into finished goods while for retailers creating is what is being sold focuses on the acquisition of products.

Thinking about how to accumulate wealth from cost of goods sold is comparable to thinking about how to accumulate wealth from revenues. Thinking about how to accumulate wealth from cost of goods sold starts with the costs incurred to manufacture or purchase products. Thinking about how to accumulate wealth from cost of goods sold continues with the number of products that can be sold. Thinking about how to accumulate wealth from cost of goods sold finishes with the characteristics of what is being manufactured or purchased. Characteristics that a business wants to create must correspond to the characteristics that customers want to receive in order to accumulate an amount of wealth that is necessary for a business to not only maintain but also enhance its existence.

Let’s look at this comparability further.

A business engaged in selling products, whether it is a retailer or a manufacturer, creates satisfaction. For a retailer satisfaction comes from the products it purchases from suppliers. For a manufacturer satisfaction comes from the materials it purchases from suppliers and its use of labor and overhead to convert these materials into products. How can a retailer or manufacturer create satisfaction? Here are some tips:

- Educate buyers on the expectations customers want from what they purchase.

- Conduct relationships with suppliers that can fulfill customer expectations.

- Educate labor on the expectations customers want from what they purchase.

- Acquire overhead that corresponds with the expectations of customers.

- Establish processes that can respond to changes in customer expectations.

The effort to create products or services is not the only type of effort that a business must think about in its Financial Planning. An income statement contains another type of expenses that encompasses effort. This effort appears on an income statement as selling and administrative expenses.

Selling and Administrative Expenses

The third element on an income statement is selling and administrative expenses. Why are selling and administrative expenses the third element? Selling and administrative expenses are the third element because they are an extension of the effort in delivering products or providing services. A business cannot deliver products or provide services until they are created however recognition of these tasks is needed. How a business creates recognition is through the effort that comprises selling and administrative expenses.

Selling expenses represent the effort in promoting the products that are delivered or the services that are provided. Promoting what is being delivered or provided requires thought because a disconnection between promotion and creation will hinder the ability of a business to accumulate wealth. So when thinking about the promotion of what is being sold here are some questions that should be asked:

- Are distribution centers located in areas accessible to customers?

- Are carriers in sync with the characteristics that customers expect?

- Are salespeople engaged with their customers?

- Should products be promoted by showing customers how products are created?

- How should we spread the word on the benefits of what we sell?

Administrative expenses represent the effort in supporting the products that are delivered or the services that are provided. Supporting what is being delivered or provided requires thought because this task enhances the existence of a business. So when thinking about the support of what is being sold here are some questions that should be asked:

- Is the accounting function focused on information related to creation and promotion?

- Is the executive function focused on leadership in creation and promotion?

- Is the human resources function focused on talent that can create and promote?

- Is the legal function focused on regulations that protect creation and promotion?

- Is the technology function focused on equipment that enhances creation and promotion?

Conclusion

The ability of a business to earn income is due to the ability of a business to satisfy customer expectations from creating, promoting, and supporting what it sells. Creating, promoting, and supporting are actions that should be thought about before acted upon. How a business can think before acting on delivering products or providing services is through the structure of an income statement.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.