Believe it or not, organizations do not collapse if they don’t have a plan or a budget! If a business is already established then two things will impact future results, irrespective of what is planned:

Believe it or not, organizations do not collapse if they don’t have a plan or a budget! If a business is already established then two things will impact future results, irrespective of what is planned:

Organic growth. The momentum of current activities will continue to generate costs and sales. The value of these is fairly easy to forecast in the immediate future but as time goes on the upper and lower limits of what this could be diverge.

External Influences. Similarly, external influences such as competitor actions, market perception, a cost of raw materials and a range of other events, most of which are uncontrollable, will also impact future results.

The purpose of planning is to change the status quo caused by organic growth and external influences. It does this by modeling the introduction of strategic initiatives that either stimulates a change in performance or help to mitigate the impact of an external event.

Planning Activities

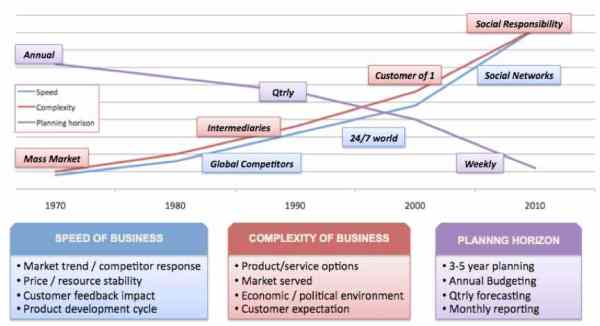

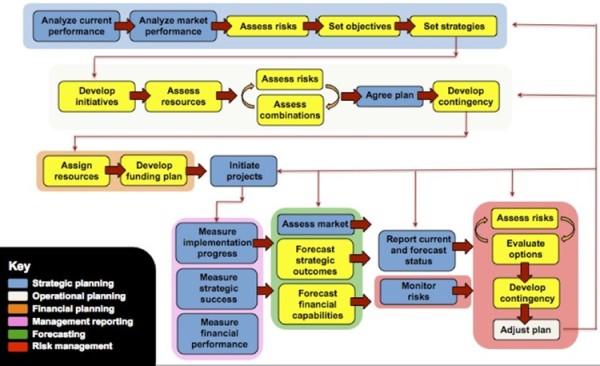

Planning is not a singular activity. If you look at all the activities involved in Performance Management, there are a number of inter-linked activities that are typically combined into the areas of strategic planning, operational/tactical planning, financial planning, management reporting, forecasting and risk management:

Out of the identified 26 activities, 15 are to do with planning. And because each of these has a different focus, then the content and the capability of planning models need to be different. However, these different models need to act as part of a single management system for managing corporate performance.

Types of Planning

Unless an organization has a single product in a single market, planning is relatively simple in that there is only one future to plan. But where there are multiple products / services in multiple markets, things are very different. For each product/service/market there could be one of four futures that need to be planned. These are referred by McKinsey as:

- Seeding. This involves a new business area that is being funded either through an acquisition or through an organic start-up investment. Here, there is typically no history to rely on, positive outcomes are likely to be long-term, and the risks being run are relatively high.

- Nurturing. This involves building up an existing business stream usually through the injection of additional resources. Positive outcomes will typically be shorter-term, the risks slightly lower and where there is a track record to build on.

- Pruning. This involves taking away resources from an existing business. This typically happens when a product/service is nearing the end of its life and the company is seeking to ‘milk’ profits. Outcomes will typically be positive, risks are low and there is probably a reliable forecast.

- Harvesting. This involves selling a business that no longer fits in with the organization’s aims. Outcomes will be short-term, risks are low and where costs are to be kept to a minimum.

The models for each planning type will probably need to be kept separate and may well have different rules to generate results. However, the results from each will need to be combined to give an overall organization view. To reduce risk and increase predictability, most organizations try to have a balanced portfolio of products/services and markets. In these cases, planning will consist of evaluating a range of options across all businesses to either mitigate a particular weakness or meet/exceed investor expectations.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.