Many organisations still struggle with data quality and timeliness, with 35% citing these issues as the...

The Traditional Organisation Paradigm Is Dead; Long Live the Agile Organisation

The traditional organisation is like a machine. Instructions come from the top, then they are cascaded down through the bureaucratic structures, and eventually, everyone falls in line. These organisations are highly structured and designed this way to maximise the efficiency and productivity of their workforce.

Such organisations are slow to react to constantly changing environments. They need to adapt their strategies more frequently than ever before. While the majority have attempted to redesign their organisations, only 23% of these attempts are successful1. This is reflected by the fact that a mere 20% of organisations in the S&P500 in 1994 are still around today.

In addition to the uncertain macroeconomic environment, traditional organisations face even more pressures due to the fast-paced emergence of disruptive technologies and the increasing pace of digital transformations, which democratise information and allow for greater collaboration.

Over the last decade, a new view on the organisation has emerged. It perceives an organisation as a living organism in a state of entropy. If you push one area of the organisation, the rest reacts to counteract the change. However, if channelled correctly, the entire organisation can work together to move in a new direction.

More recently, this view has evolved into the concept of an ‘agile’ organisation2. This is one guided by a common ‘north star’ with a common purpose and vision. They can sense and seize opportunities. Such organisations have flat structures with empowered cross-functional teams and accountable roles. They learn fast and make rapid decisions. All of this is supported by enabling technologies.

What Is One Measure that Indicates How Agile an Organisation Is?

How fast is your planning cycle? I feel that the planning cycle speed is the ultimate indicator showing that:

- the organisation is hungry for information,

- the organisation is demanding what-if scenarios,

- the finance/FP&A team are also flexible.

What Is Agile FP&A?

Agile FP&A has become a buzzword. It feels like another software vendor is constructing their FP&A products, and they sound ready to solve the problems. In isolation, they won’t. Mainly because we do not think about the context of what an agile organisation actually is. This is further clouded by the fact that no one really knows what they mean by agile FP&A. I feel that the term ‘agile planning’ has emerged independently of the ‘Agile Organisation’. However, there can be a lot of synergies. Being able to analyse current trends and deliver rapid iterations of plans is a crucial capability for an agile organisation.

During a recent London FP&A Board meeting in September 2024, we discussed the concept of agile FP&A. We defined it as a set of activities that allow an organisation to adapt when the market shifts whilst maintaining financial stability and shareholder value. Digging deeper means that FP&A needs to deliver insights and be able to prepare scenarios in near-real-time. This will allow the organisation to understand the current position and make fast decisions. In short, we have to adapt to new external conditions and rapidly deliver insights and reforecasts/plans.

What Are the Foundations of Achieving Agile FP&A?

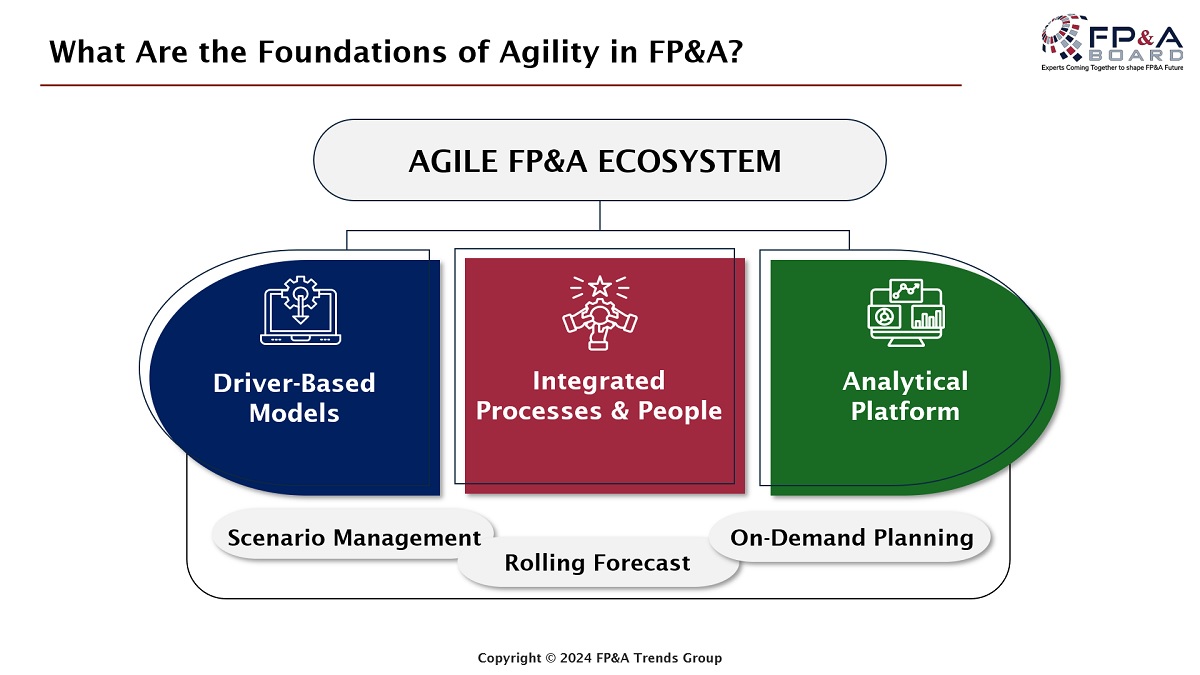

We discussed the concept of an Agile FP&A Ecosystem. This is the big picture of what we need in place.

Figure 1: The Agile FP&A Ecosystem

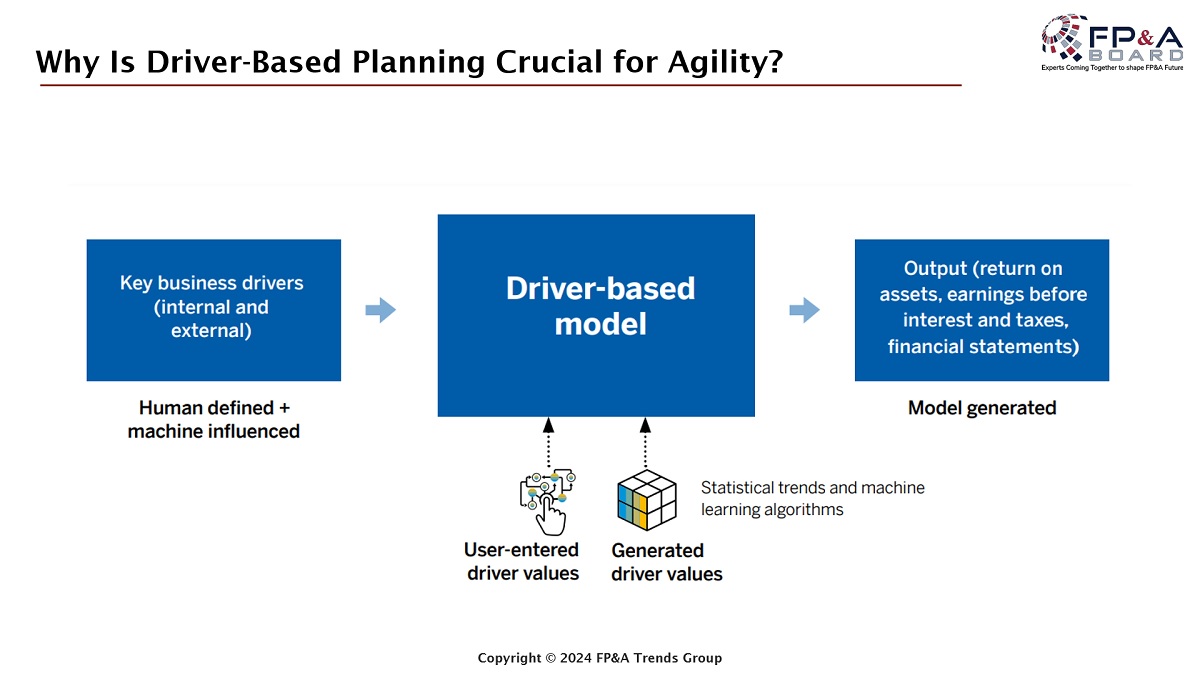

Driver-based models are critical for agility. You really can’t deliver multiple iterations if most of your forecasts are manually created. You need to know 20% of drivers that impact 80% of your performance. You need to understand how these drivers change when the market changes.

Figure 2: Driver-based Models

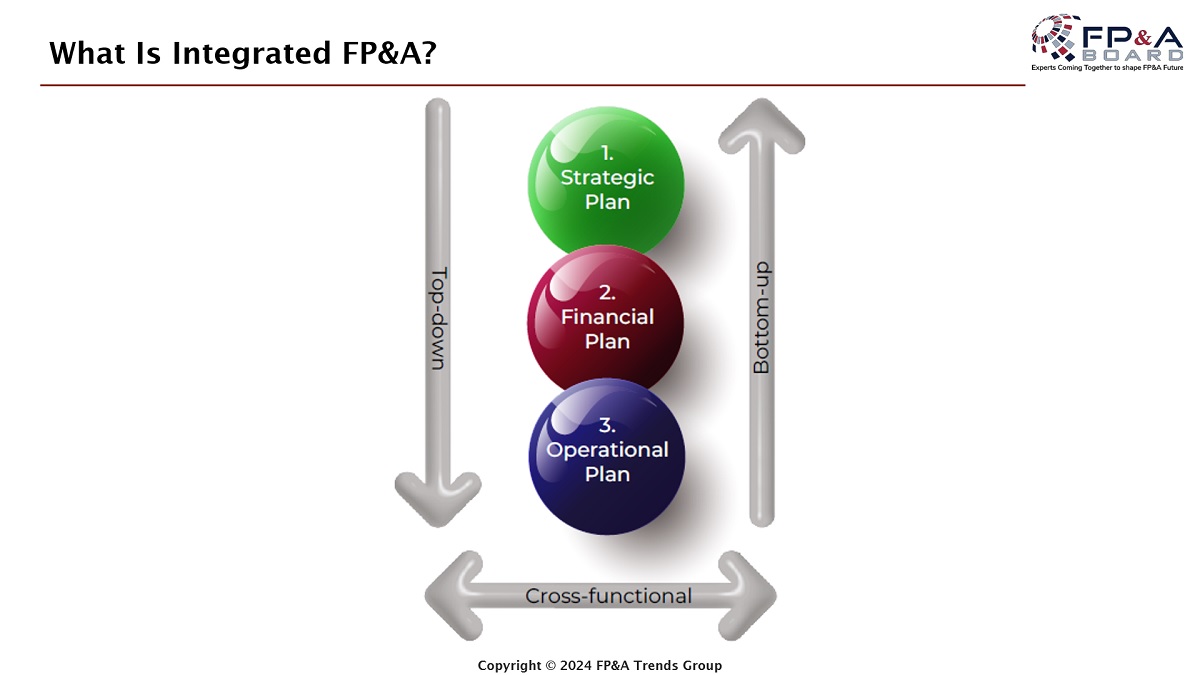

Your FP&A processes need to be joined up across the entire organisation. For example, your S&OP activities need to be linked to financial planning models. For more information, address my points on Integrated Processes and People in a separate insights paper called “Seven Pillars for Integrated FP&A Excellence.”

Figure 3: Integrated FP&A

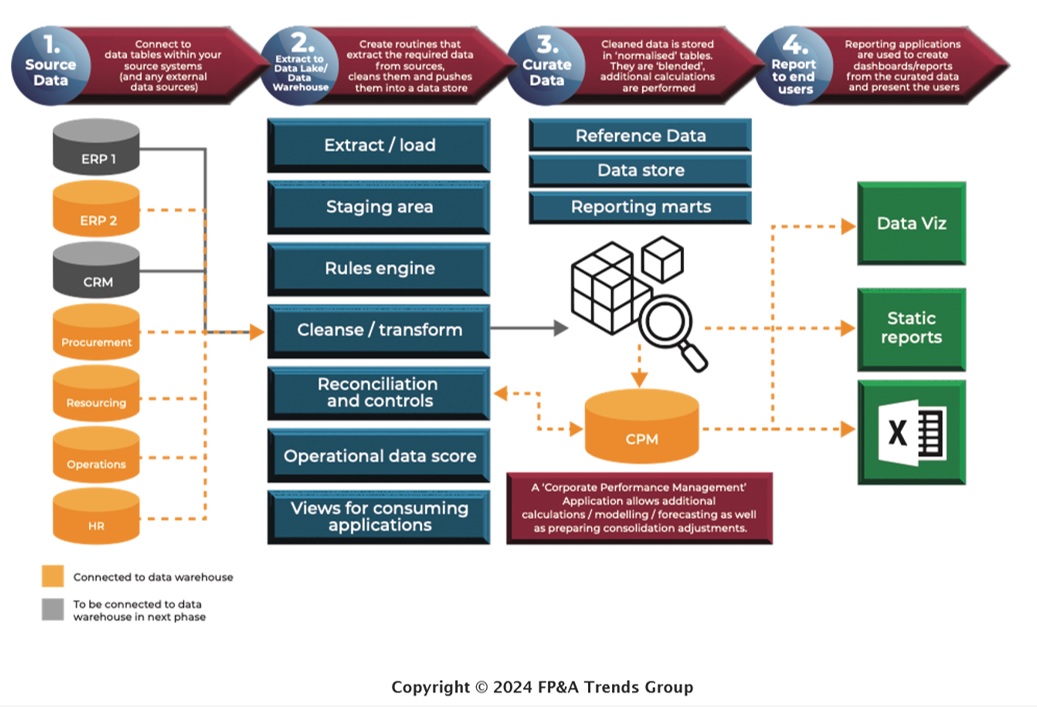

Lastly, you need the analytics technology to do this. I do not mean Excel by technology. Excel will hold you back. You need to connect your models directly to the source. It should be an automated process.

Figure 4: Example of FP&A Data Architecture

Is Agile FP&A Achievable?

Looking at the 2024 FP&A Trends Survey results3, it feels that most organisations are a long way off. Nearly two-thirds of FP&A time is spent on data curation activities. Only 9% of respondents from our survey said they have full driver-based models in place. That means many organisations will not be able to perform flexible planning, even if the entire finance department works through the night.

On the technology side, spreadsheets predominate in 52% of organisations, while a mere 18% use Cloud Planning platforms.

What About Data?

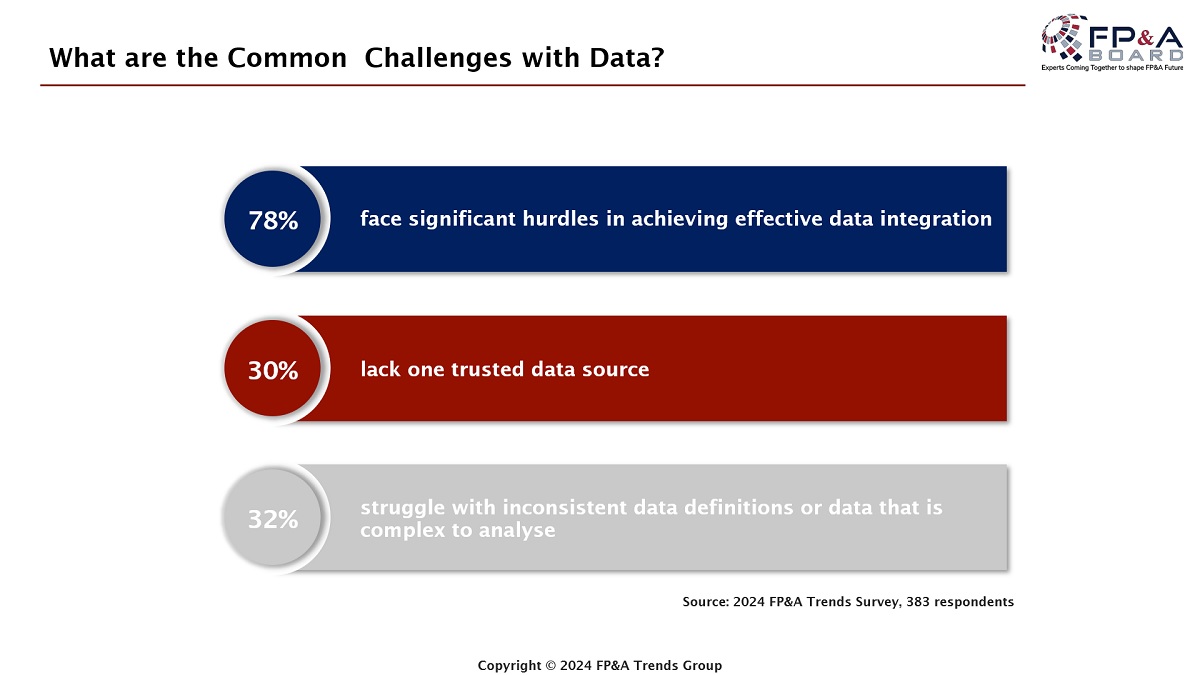

Yes, we spent a lot of time discussing data issues. This is one of the biggest barriers. You cannot generate insights if your data is not clean, and you cannot generate fast insights and rapid planning iterations if your data ecosystem is not integrated.

Figure 5: FP&A Common Data Challenges

The good news is that data management is a well-trodden path, and there are several strategies and methodologies to solve these challenges. I have discussed some of these approaches in another Insights Paper called “Mastering Data in FP&A.”

Are the Blockers Much Deeper than Models, Processes and Data?

These numbers are unsurprising but staggering. To me, this points towards a mindset and culture issue within these organisations. The tools and methodologies have been in place for a long time. There is plenty of knowledge and know-how out there. Technology is not a barrier either. It is becoming simpler to implement and even simpler to use due to rapid developments. Why have they not been deployed? What is preventing organisations from adopting what is already available? I know that some leaders are scarred by past experiences of failure. However, this mindset will not drive you towards a prosperous future.

What About FP&A in an Agile Organisation?

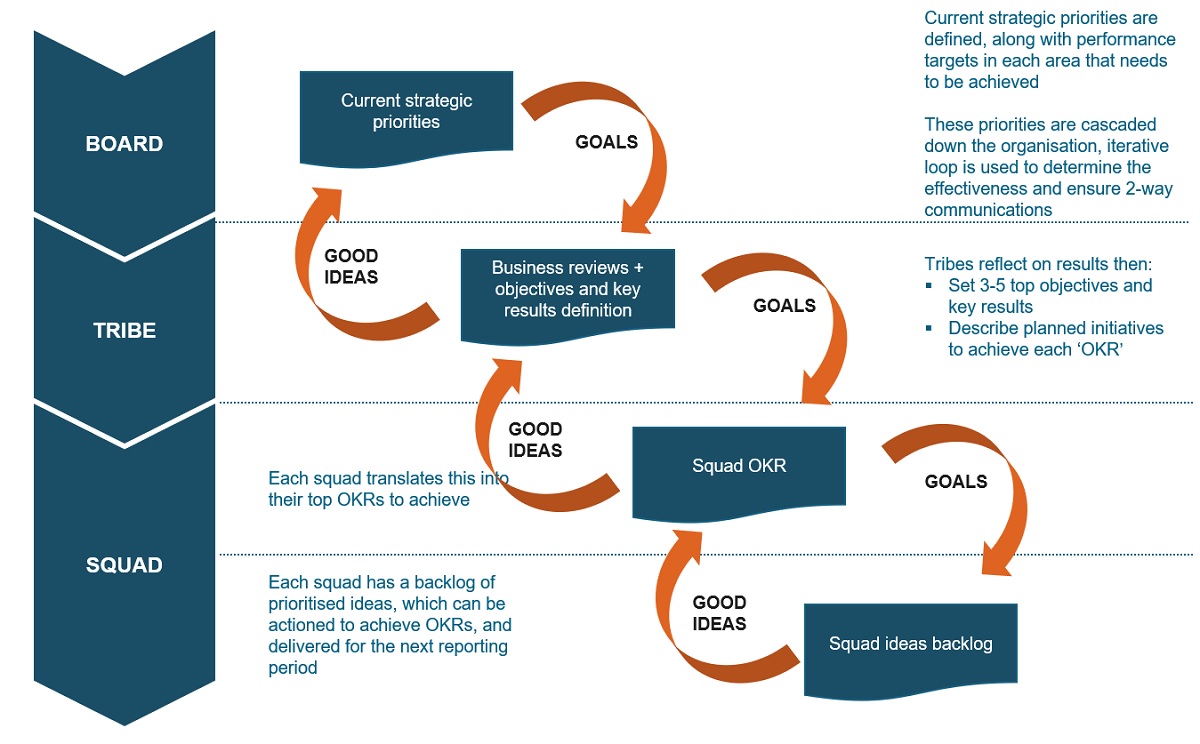

The organisational drumbeats in an agile organisation are very different to a traditional one. There is a continual flow of information across all levels of the enterprise. The leadership will typically have a quarterly review process. They will be able to review their current business state and make any course-correction decisions. These are then turned into priority actions for the next quarter, which, in turn, is translated into Objectives and Key Results (OKR). Cross-functional teams are mobilised to action plans to achieve the OKR before the next quarterly review.

Figure 6: Agile Organisation Drumbeat

Many agile companies organise their work into tribes, comprising functions and departments, and squads, which are cross-functional teams brought together for specific activities. It is a different way of working compared to a traditional organisation, which tends to be much more siloed.

The delivery of fast FP&A insights across all organisational levels is crucial for this model to work. FP&A also needs to track performance and replan on the fly.

The Challenges of Agile FP&A in a Traditional Organisation

Let’s assume you have achieved agile FP&A. It is perfect within an agile organisation. However, let’s consider how effective it would be in a traditional organisation. You might be able to generate insights rapidly, but are decision-makers data literate enough to make sense of it? Does the organisation have the right structure to be able to act on your insights? Are decision-makers used to the concept of learning from insights and making rapid decisions?

If the answer to any of the above questions is no, then your FP&A team will not reach its full potential. Nevertheless, from a glass-half-full perspective, you will at least have an effective team with an efficient process.

Conclusion

Yes, agile FP&A is something we aspire to. It is more than just another professional buzzword. It requires the delivery of insights at speed and greater depth. It requires the ability to replan instantly. It will allow you to support agile organisations, which can learn fast and make rapid decisions to respond to the environment. However, FP&A is only part of the story. We need to ensure that we have the right culture and mindsets and adopt new working practices to maximise our potential.

References:

- Aronowitz, Steven, Aaron De Smet, and Deirdre McGinty. “Getting Reorganization Redesign Right.” McKinsey Quarterly, June 2015. https://www.mckinsey.com

- McKinsey & Company. “The Five Trademarks of Agile Organizations.” Accessed November 29, 2024. https://www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/the-five-trademarks-of-agile-organizations

- FP&A Trends Group. 2024 FP&A Trends Group Survey: Empowering Decisions with Data – How FP&A Supports Organisations. Accessed November 29, 2024. https://fpa-trends.com/fp-research/fpa-trends-survey-2024-empowering-decisions-data-how-fpa-supports-organisations

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.