In this article, the author is trying to capture a few areas that might need a...

What does Financial Planning and Analysis (FP&A) mean to you? More importantly, what does it mean to your key stakeholders within your business?

Perception is everything. While most organisations have an FP&A function, different individuals within the same organisation may often have contrary perceptions of what the FP&A team is responsible for and can help with.

It is a result of many decades of evolution of the FP&A function. Traditionally, FP&A is perceived as the middle reporting layer between transactional finance (Taxes, Accounting and Payments) and Senior Management/External Investors.

In this case, the FP&A function usually gets involved in and may even own Reporting, Business Partnering, Governance and Control and Data Architecture.

While the FP&A function has served this need well over the years, their grasp of the performance drivers and data generated by the business, fuelled by exponential technological developments, has grown enormously in the past decade. It caused the expansion of the sphere of control for FP&A, and then the term Extended Planning and Analysis (xP&A) was coined, which signified the growth of cross-functionality.

That said, there is confusion about the remit and how the FP&A/xP&A team adds value. Its ‘brand’ seems to be getting diluted, and the function seems to be experiencing many symptoms that often result in a total rebrand. Namely:

Internal and external perceptions are not aligned

While the finance team may see you as the custodian of financial reporting and performance evaluation, other functions may see you as the enabler for greater integrations between finance and their functions. It is more of a trusted advisor who needs to understand their own challenges as well.

The target audience is not well-defined and is constantly getting wider

FP&A is a core finance function, but it often spends more than 50% of their time with other departments. Their stakeholders range from line managers to key leadership/board members, and they are often the initial people you can contact if a new/complex business challenge needs to be understood.

The service mix has changed

Given the rapid changes being experienced in FP&A, CRM (Customer Relationship Management), ERP (Enterprise Resource Planning) and EPM (Enterprise Performance Management) tools, the quantity of what good FP&A Business Partners can support has grown exponentially. Their skills and knowledge base have changed, too. You can often find FP&A teams that are made up of finance people with a much larger technology bias than other finance functions.1

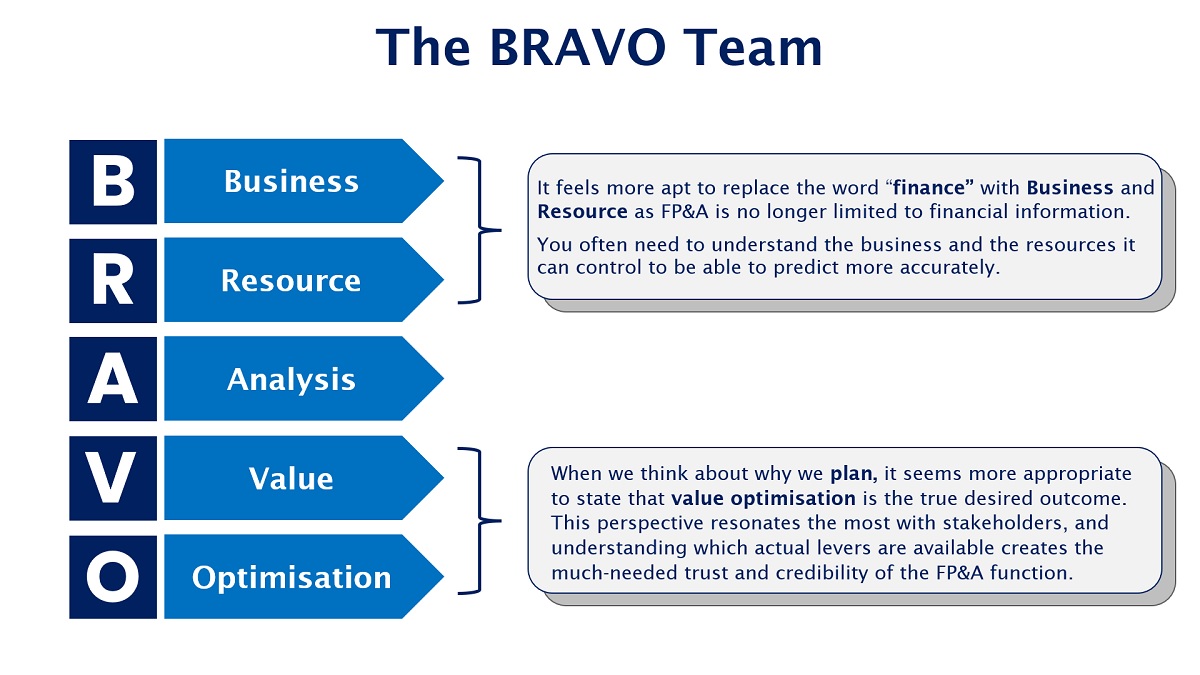

As we consider the value that FP&A truly brings to dynamic and flexible businesses today, it feels more fitting to rebrand FP&A as the BRAVO team.

Figure 1

Analysis forms the cornerstone of intelligent decision-making and should be performed at every stage, e.g.:

- Initially, when understanding the business and its resources,

- When devising a plan to optimising its value,

- When evaluating its performance against the planned outcomes,

- Thereafter, repeating this cycle periodically to achieve different outcomes.

FP&A leaders are required to be part of the BUSINESS planning and forecasting conversations and be able to question and guide progressive decisions. These conversations often become multi-faceted. For instance, a simple HR policy change to establish or extend paternity leave regulations will affect productivity, work patterns, morale, revenue and, eventually, profitability. Note that the consequences can be both positive and negative and thus need to be supported by robust data and analysis.

Thus, involving the FP&A leasers right at the start of these sorts of decisions enables them to:

- model possible Resource changes,

- Analyse various scenarios,

- communicate different Value propositions

- and then help the business make the Optimal decision.

Thus, as an acronym, BRAVO seems to cover the various functions these individuals can truly help with more appropriately.

Data becomes key for the xP&A/BRAVO team to truly perform these various activities, and thus, they usually champion good corporate data strategies. They understand the various linkages data needs to support and can help define how systems should be connected. Good data is about how you think about data and the organisational requirements for data usage.

While organisations are at different stages of the data maturity cycle, the amount of data being generated and stored within a company is growing daily. It puts additional pressure on the speed at which the FP&A teams need to evolve to support the business.

In the context of how a BRAVO team should think about data, it is vital to understand that data can and will be used for multiple purposes. That is why data needs to be categorised appropriately.

Conclusion

Given the wide-reaching nature of good FP&A teams and the reliance the entire business places on the insights this team brings, it seems that the scope we continue to refer to this team as just FP&A becomes too narrow. At some time, the word financial will become just one component of this team’s remit. Even the term xP&A still does not truly convey the value this team can bring. This team is integral to any company’s and/or project’s success. Hence, it would be better to describe them as the BRAVO team.

References:

1 – OAKLEY, Philip. When Is It Time to Rebrand? 10 Powerful Reasons You Should Take Action. salesfactory.com. https://www.salesfactory.com/blog/when-is-it-time-to-rebrand-10-powerful-reasons-you-should-take-action Accessed May 28, 2024.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.