Explore how Integrated FP&A empowers organizations to achieve analytical excellence through synchronised planning, driver-based models and...

While FP&A continues to evolve, many organisations still face significant barriers to adopting modern practices. According to the 2024 FP&A Trends Survey, 52% of teams rely on spreadsheets, 45% of FP&A time is spent on data reconciliation, and only 9% have implemented driver-based planning. These figures underscore persistent inefficiencies that hinder agility and limit the strategic impact of FP&A functions.

Leading organisations are addressing these challenges through structured transformation initiatives — strengthening analytics, deepening business partnerships, and leveraging modern technologies. But how does this transformation take shape in real-world settings?

On March 26th, the FP&A trends webinar brought together senior practitioners and thought leaders to explore the Four Layers of Modern FP&A Transformation, a practical framework designed to elevate FP&A's organisational value and strategic contribution.

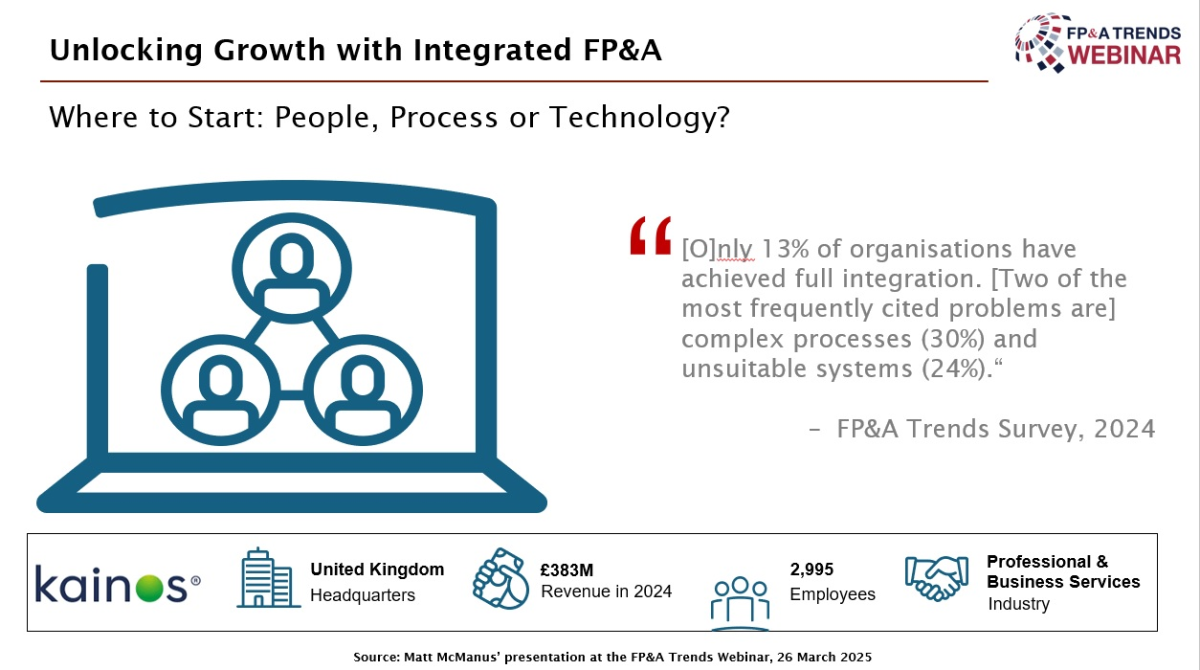

Unlocking Growth with Integrated FP&A

Matt McManus, the services CFO at Kainos, shared insights from his company, which operates in over 20 countries and has close to 3,000 employees and annual revenues of over £350 million.

They operate three core divisions:

- Digital Services is the original and still largest division.

- Services based on a leading cloud-based enterprise management platform.

- Proprietary Products – complementary products supporting the ecosystem.

From an FP&A perspective, the services divisions account for over 80% of our revenue and operate on a project-delivery P&L model, while the products division follows a Saas-based subscription model. Running these two different business models across 20 countries adds some complexity.

The Starting Point

Matt McManus mentioned: “Our true FP&A transformation began in 2019, but the groundwork stretches back further. Kainos was a private company for over 30 years until our 2015 IPO on the London Stock Exchange. At the time of our listing, we had about 700 employees and £60 million in revenue”.

The following years brought rapid growth across divisions and geographies. However, as they scaled, it became clear that existing systems and processes, largely unchanged since their earlier, smaller days, would not sustain them long-term.

At that time, their operational ecosystem looked like this:

- An on-premise financial ledger

- Planning in Excel

- HR data

- CRM data is spread across Salesforce and other systems

- Project data in Kimble (now Kantata)

This disjointed setup made it challenging to plan effectively, even at a steady state. Add in rapid growth and global expansion, and they had a recipe for inefficiency, slow decision-making, and inconsistent data trust.

Taking Action: A Phased Integration

Transformation began by selecting a cloud-based platform as the foundation, followed by a phased rollout:

- 2014: HR

- 2017: Finance

- 2020: Planning

- 2021: Professional Services Automation (PSA)

Today, these four key systems are fully integrated, allowing seamless interaction across the business operations and enabling smooth onboarding of acquired companies.

Next, a centralised reporting framework was introduced with a unified P&L format across all divisions, enhanced with relevant KPIs for deeper performance insights.

Also, a targeted suite of dashboards was created for defined user personas, whether delivery managers or operations leads.

Tools supporting executive presentations and operational analysis were also deployed.

This structure ensures that the right insights reach the right people at the right time. Most importantly, we no longer see planning as just a finance function — it is a collaborative process that helps facilitate across the business.

Results: What Was Gained

- Stronger business partnering: FP&A teams spend significantly more time adding value alongside business leaders.

- Less time on variance reporting: Native data consolidation removed time-consuming tasks.

Improved agility: The company responds faster when exploring “what-if” scenarios, helping the business proactively manage risk.

Figure 1

The Big Takeaway

Integrated FP&A provides a vital foundation for commercial awareness and strategic decision-making. The process is evolutionary rather than revolutionary, but once the changes begin to embed, the results are both tangible and transformative.

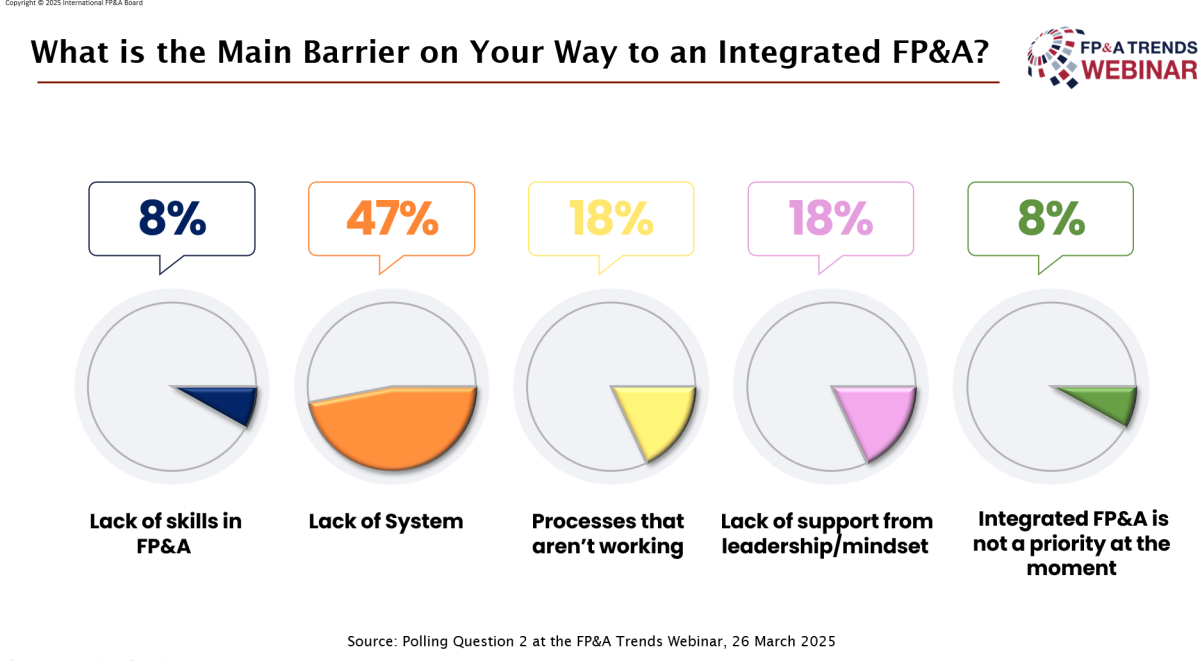

Our First Polling Question Sought Insight into the Main Barriers to Achieving Integrated FP&A.

47% of respondents identified a lack of a system as the most significant challenge. It is followed by ineffective processes, limited support from leadership, or a misaligned mindset, each cited by 18% of participants. Meanwhile, 8% of respondents pointed to a lack of FP&A skills, and another 8% indicated that integrated FP&A is simply not a current priority.

Figure 2

While all these factors are interconnected, the dominance of system limitations is telling. Building a strong business case to demonstrate the value of integrated FP&A and securing stakeholder engagement is often the key to unlocking investment in the right systems and removing wider barriers, noted Matt.

FP&A Efficiency Through Driver-Based Strategies at Expo Logistics

Dave Tranter, Head of Central Finance at Expo Logistics UK & Ireland, shared a powerful case study on transforming Financial Planning and Analysis (FP&A) through driver-based strategies. Drawing on two decades of experience across multiple finance roles within the company, Tranter offered an insider's perspective on how his team has shifted the focus from manual processes to strategic business partnering.

The Problem: Too Much Time on Admin, Too Little on Strategy

Tranter highlighted a widespread issue in finance. Up to 84% is spent on administrative tasks such as data entry and manual reporting, leaving only 16% for high-value activities like business partnering and strategic decision-making. Recognising this imbalance, Tranter led a project aimed at reversing the tide.

The Solution: Driver-Based, KPI-Led Planning

Expo Logistics moved to a driver-based planning approach to unlock value and reallocate time. While traditionally, budget forecasts relied on large Excel models detailing every cost line, Tranter's team transitioned to KPI-driven forecasting, rooted in operational data.

For instance, instead of building forecasts from scratch, the team now begins by asking strategic questions:

- How many pallets are forecasted?

- How many vehicles are needed?

- Will they be owned, leased, electric, or diesel-powered?

- How many drivers are required based on shifts?

By inputting this non-financial data, the system automatically generates detailed, accurate P&Ls. This approach has reduced forecasting time by four to five times and minimised human error.

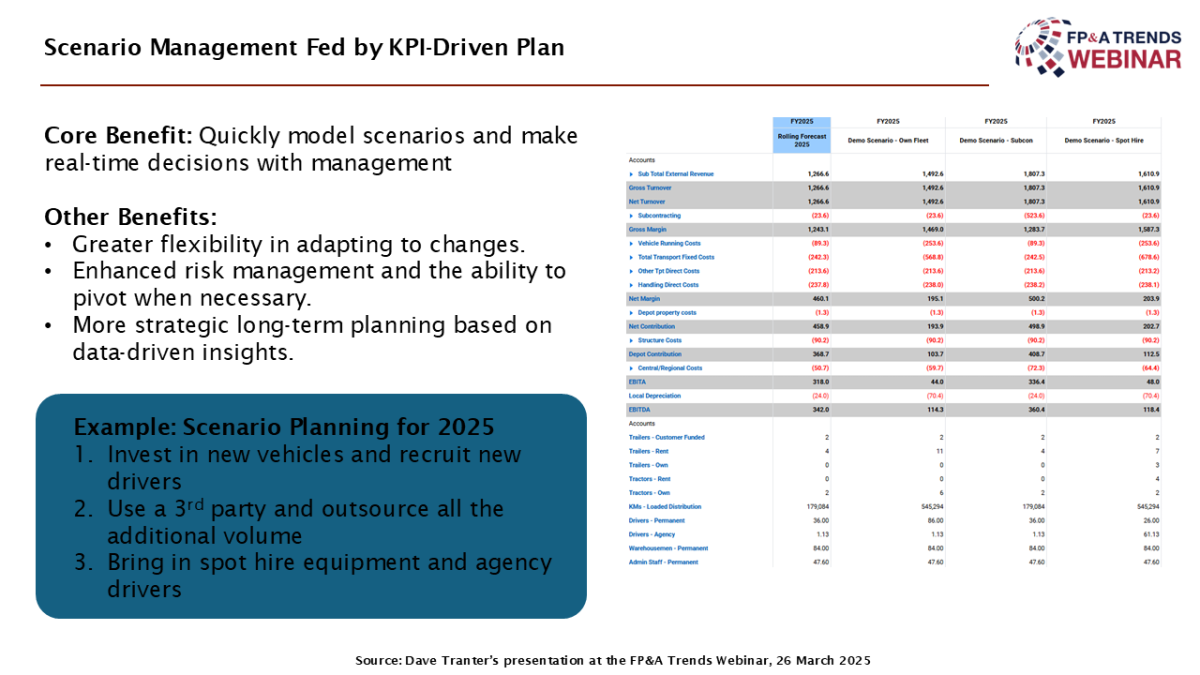

Real-Time Scenario Planning

With this new system, Expo Logistics can also perform scenario planning in real-time. Tranter shared an example where a site faced a potential 40% volume increase. Within minutes, his team produced three P&L scenarios:

- Invest in new vehicles and hire drivers

- Outsource to a third party

- Spot hire vehicles for flexible demand

This capability enables real-time decision-making at the board level, something previously unachievable due to time constraints.

Fast, Impactful Decision-Making

Another use case included modelling the impact of upcoming National Insurance changes within minutes, showcasing the system's agility and responsiveness to external factors.

Figure 3

Tranter closed with a challenge to finance professionals:

How can you start unlocking that 84%? - By embracing tools that automate admin-heavy tasks, finance teams can shift focus to strategic initiatives, deepen business partnerships, and deliver real value to their organisations.

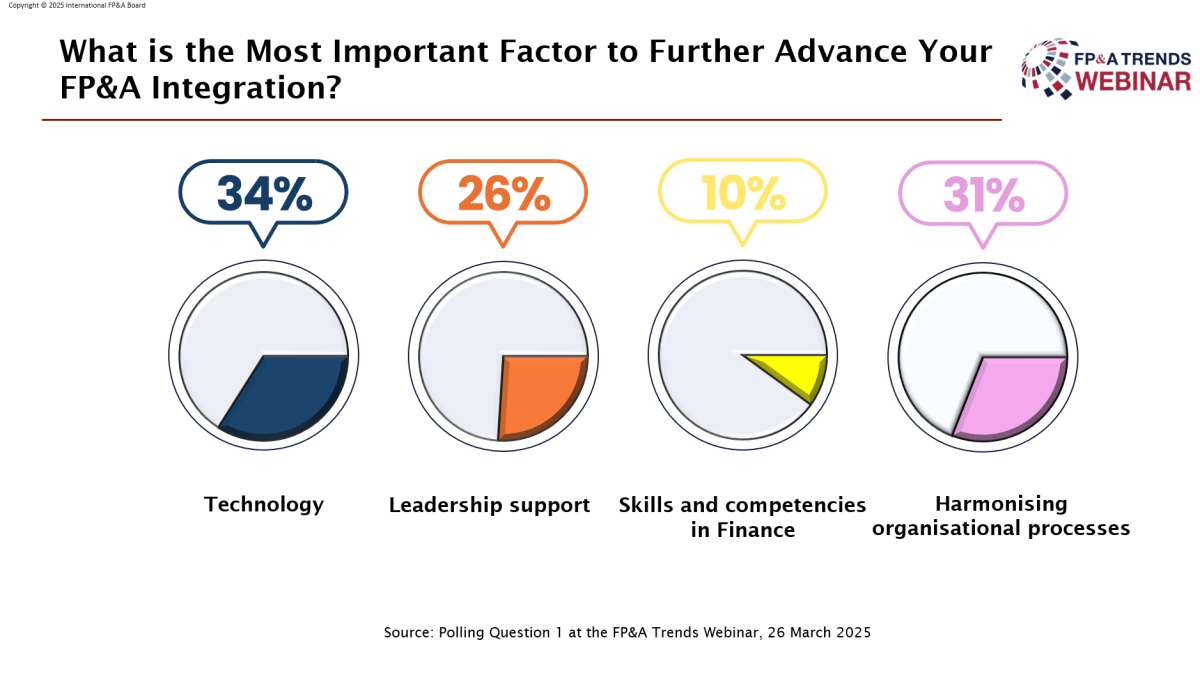

The Second Poll Asked Respondents to Identify the Most Important Factor in Advancing FP&A Integration.

34% of participants selected technology as the leading choice. Close behind, 31% highlighted the need to harmonise organisational processes. Leadership support was chosen by 26% of respondents, while only 10% pointed to skills and competencies in finance as the key factor.

These results suggest that while talent remains important, technological enablement and process alignment are seen as the primary drivers of FP&A integration.

Figure 4

The Power of AI in Integrated Planning

Kelsey Vaughan, Product Marketing Manager at Workday, shared her insights on the evolving landscape of Finance Planning and Analysis (FP&A), highlighting how Artificial Intelligence (AI) is transforming the function and what businesses can do to stay ahead.

Technology as a Catalyst, Not a Barrier

Kelsey began by acknowledging a common struggle revealed in audience polls: many finance professionals view technology as a barrier to integrated planning. Drawing from her experience in finance, she emphasised how she once relied on Excel for budgeting and forecasting — tools that were never purpose-built for today's complex, fast-paced business needs.

Now, she helps organisations embrace AI-driven planning tools that streamline processes, save time, and unlock strategic value. Her message was clear: while AI can seem intimidating, it is, in fact, an enabler, redefining how FP&A teams operate.

Two Faces of AI: Machine Learning and Generative AI

Kelsey explained the two key types of AI reshaping FP&A:

Machine Learning (ML): ML analyses historical and non-financial data to identify patterns and trends. It enhances forecasting accuracy, detects data anomalies, and automates variance analysis. For instance, integrating historical sales data with weather patterns can deliver highly accurate predictive forecasts.

Generative AI: Often associated with tools like ChatGPT, generative AI revolutionises how professionals interact with technology. Features like conversational planning and intelligent reporting allow users to ask natural-language questions such as "Which products are generating the most revenue this month?” — and receive immediate insights.

Real-World Value: Efficiency, Agility, and Performance

To illustrate AI's value, Kelsey broke it down into three key areas:

- Efficiency: AI dramatically reduces the time spent on manual tasks. One UK organisation switched from Excel to the Adaptive Planning tool and reduced its forecast cycle by four weeks — a 66% improvement. The time saved even allowed them to hire a new business partner to focus on high-value work.

- Agility: With AI, businesses can make faster, smarter decisions. Kelsey shared the example of a U.S. company that combined historical data with weather information to predict customer demand better and adjust staffing levels in real time.

- Performance: AI enables organisations to scale insights quickly. A large telecom provider is now using AI to forecast subscriber growth across markets, making data-driven decisions about future investments.

Overcoming the Barriers to AI Adoption

Despite the clear benefits, Kelsey acknowledged several barriers organisations face:

Resistance to Change: Fear of job loss or shifting responsibilities can slow adoption. However, she emphasised that AI is not replacing people — it is transforming their roles.

Legacy Systems: Outdated platforms like Excel weren't designed for today's AI-driven planning demands. Migrating to modern, cloud-based solutions is essential.

Ethical Concerns: Trust in AI-generated outputs is still a hurdle. Transparency in how data is used and how algorithms function is crucial.

Skills Gaps: AI isn't taking jobs — it is creating new ones. Upskilling and hiring for evolving roles is key to success.

Data Quality: AI is only as good as the data it uses. Organisations must invest in cleaning and structuring their data to realise AI's benefits fully.

To support successful AI adoption, Kelsey recommended a practical strategy:

- Define Business Needs: Take a human-centric approach and understand what your people need from the technology.

- Evaluate FP&A Skills: Upskill existing staff and ensure new hires can work alongside modern tools.

- Prepare Your Data: Clean, structured data is the foundation of effective AI use.

- Choose the Right Partner: Select vendors with proven track records, strong roadmaps, and a clear AI vision.

Kelsey closed with three powerful reminders:

- Start Where You Are: AI is evolving rapidly, but every organisation can find a starting point.

- Innovation is the Future: AI will change how FP&A operates — embrace it as an opportunity.

- Preparation is Power: Investing in data quality and team readiness today sets the stage for long-term success.

Her final message: “Be curious. Ask questions. Start conversations within your team. The future of finance is not just about numbers — it is about navigating change with confidence and clarity”.

Final Conclusions

Matt emphasised that while integrating FP&A can be challenging, pursuing full integration across systems, processes, and people is proven by Kainos' experience.

Dave highlighted the importance of understanding where your FP&A function stands in terms of operational versus value-added activities (the 16/84% ratio) and using that insight to drive improvement and enhance the team's impact.

Kelsey concluded that no matter where an organisation is on its technology maturity journey, it is crucial to stay curious, ask questions, and prepare thoughtfully for the future, especially with AI.

We would like to take this opportunity to thank Workday for sponsoring the meeting and our panellists for their incredible insights and presentations.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.