As an FP&A professional, you deal with data. Your data travels a long way from its...

Introduction: The Role of Data in FP&A

Fundamentally, the ‘Value add’ a good FP&A team brings lies in its ability to steer organisations towards strategic objectives. Therefore, to achieve this, the FP&A team must possess key skills and competencies, which can be grouped into:

- Business Acumen

- Process Orientation

- Tech Savy

- Communication

The thread that ties all these categories together is Data.

Data is a broad topic, but in relation to FP&A, I always think of it this way:

Good Data gives organisations the ‘Eyes’ with which to “Look”. However, without skilled FP&A professionals, can an organisation truly ‘See’?

For an organisation, data is only as valuable as what you can do with it, how you interpret it and what decisions it can drive. Generally, FP&A is best situated to understand both the business needs from a data perspective and what data is available.

Data-Driven FP&A

As technology advances and working habits evolve towards greater flexibility and work-life balance, there is a significant emphasis on making information more action-oriented and timely. At the core of this transformation is a solid Data Strategy, built on the traditional pillars such as:

- Data Use Business Case (Senior Leadership & FP&A)

- Data Governance (People [including FP&A] & Process)

- Data Ownership / Stewards (People [including FP&A] & Process)

- Data Cleansing (People [Primarily Data Engineering instructed by FP&A] & Process)

- Data Consolidation (Data Engineering)

- Data Automation (Data Engineering, Technology & FP&A)

- Data Visualisation (FP&A in their corporate MI (Management Information) capacity)

These pillars have gained new urgency in the current environment of prolific data gathering, storing, and AI-driven data mining. However, the need for Good Data has always existed and is just becoming more formally recognised in most organisations today.

The Shift in Investment Sentiment

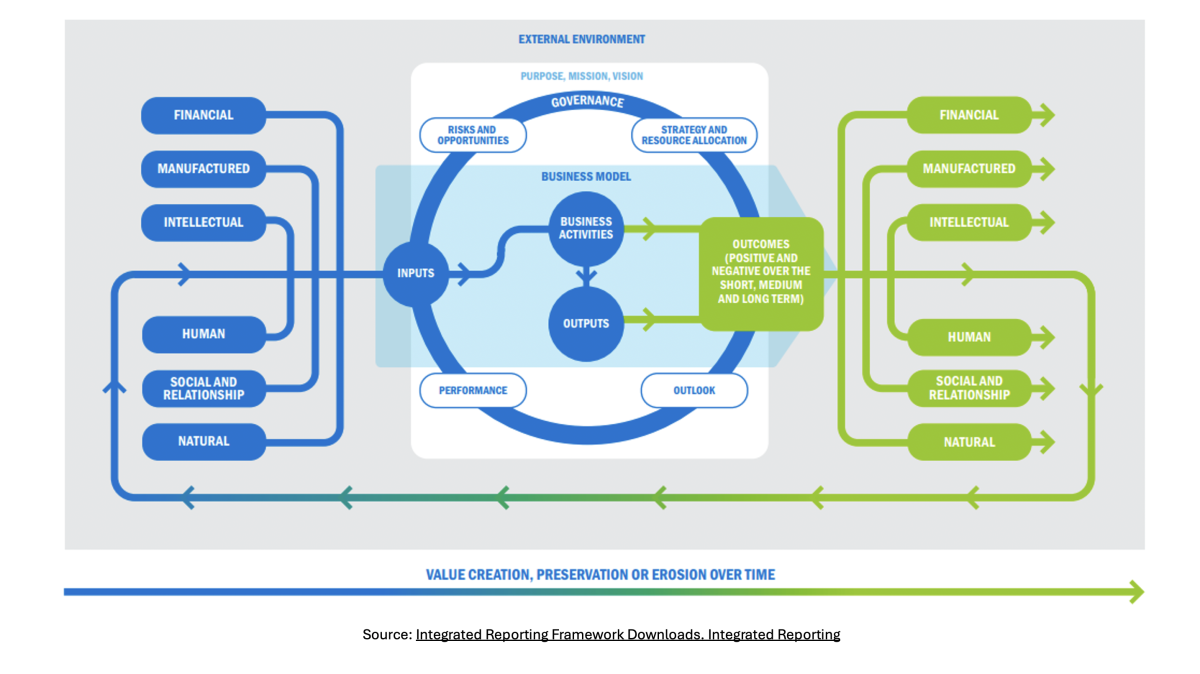

A shift in demand from Investors requiring Integrated Reporting and looking at organisationі holistically, as described by Donut Economics, is creating value in data. This, in turn, is making FP&A teams far more data-driven this article does not intend to explain these two concepts in detail, it is worth briefly introducing them to illustrate why FP&A teams are finding themselves in the centre of a web of data requirements.

The Integrated Reporting (IR) framework, first introduced in 2013 and later refined and incorporated as part of IFRS in 2021, combines financial and non-financial metrics — such as ESG factors — into a unified reporting approach. Since then, as investments become more closely tied to Carbon and ESG targets, the need for integrated performance reporting has increased significantly. Data is being used to paint a picture in which financials might only form the background. This is a change in mindset that is happening with the aid of technology.

Most organisations are beginning to realise that from a traditional perspective, there is no one central team that generally ‘Sees’ and monitors the business in an integrated way. This raises the question: which team is best placed to perform this function?

The resounding answer generally is FP&A in a corporate reporting capacity.

Figure 1. Integrated Reporting Framework

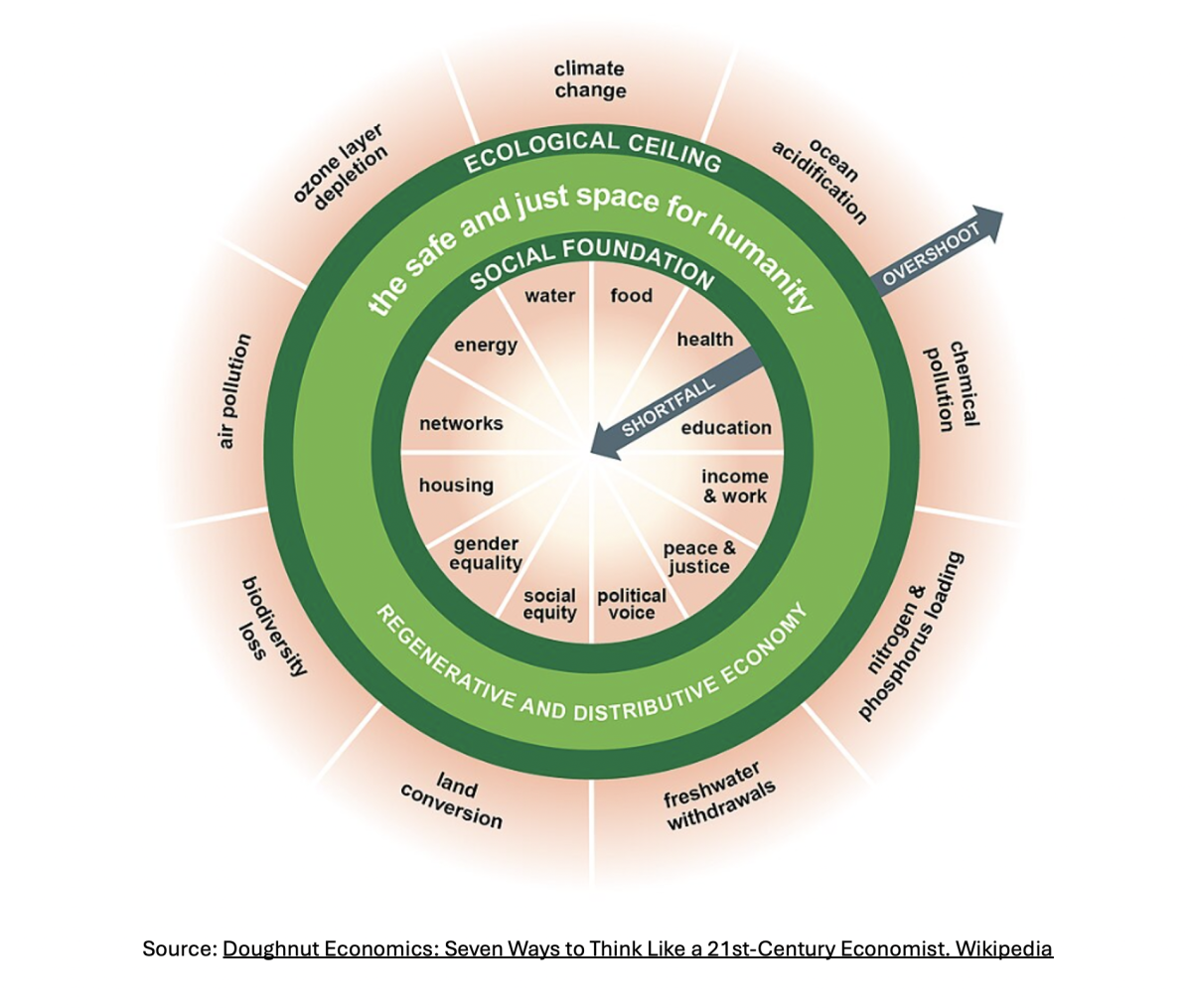

Over a similar time frame, introduced in 2012, Donut Economics has also become more closely linked with investor sentiment. The foundation of this economic school of thought is that human beings must thrive within the planetary boundaries in a sustainable way. Increasingly, FP&A teams are being asked to make these connections via the data they have access to and illustrate the impacts of operational actions on wider environmental aspects.

Figure 2. The Model of Doughnut Economics

While I don’t propose to explain the details of each of these models in this article, it is important to highlight two things:

- Traditional Financial reporting (P&Ls and Financial KPIs) is less prominent under these frameworks.

- The need to link financial information with multiple other data sources.

From an FP&A perspective, these models can be seen as an extension of the Kaplan & Norton Balanced Scorecard concept introduced back in 1992.

How FP&A Facilitates Better Data Gathering and Governing

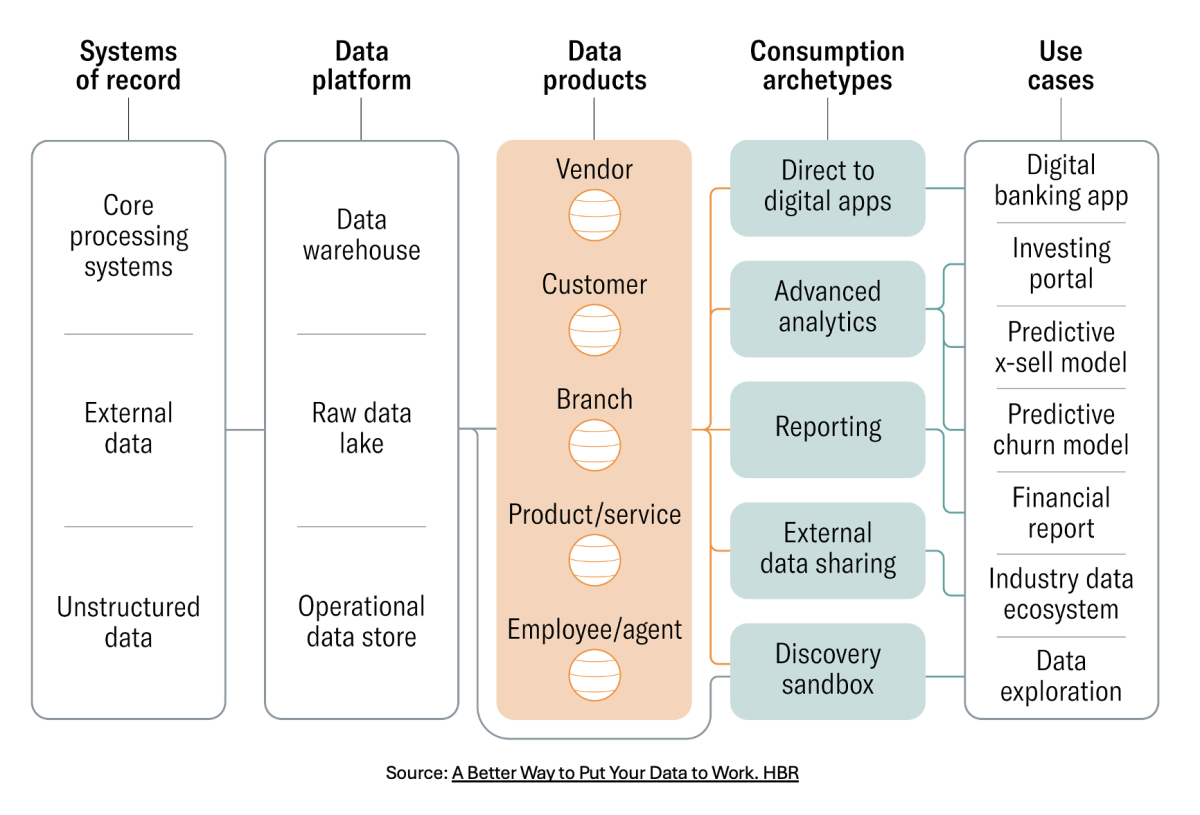

To improve data gathering and governance, there must be a shift in thinking of how data is perceived — from something used solely for specific functions to data as the end product (Asset).

Most organisations have teams responsible for maintaining/updating and keeping accurate system records. However, most of these teams see this as a requirement to keep their specific system working but not as a rich source of information that needs to ‘talk to’ other system information. The diagram below illustrates the general concept of how you can get more connectivity and governance across your data.

Figure 3. Data Product Approach

This interconnected approach enables better articulation of business outcomes by linking several data points. For example, sales data will indicate a rise or fall in sales in a particular product line in a certain region or a particular sale’s person’s territory. Now, if you could link into social media chatter to understand customer sentiment for that product in that specific location, you could begin to uncover whether it's actually a product design issue, a customer service problem or as a result of a competitor launching a strong new offering. The resulting business decision will be very different depending on which one of the factors is causing the change. It is important to note that correlation alone is not causality, and correlation shouldn’t be mistaken for causality.

FP&A leaders must always steer the business conversation with data to delve deeper into causality rather than just be satisfied with providing the numbers. Generally, the business teams have good ideas about what needs to be monitored, but they usually need the help of FP&A leaders to connect the dots.

Benefits of Integrated Data-Driven Reporting

But why is it only now that integrated operational reporting is becoming mainstream?

There is ample empirical evidence that organisations that adopt integrated data-driven reporting outperform those that do not, not only in profitability but across other areas such as employee retention, motivation, product innovation, social responsibility and, most recently, bank financing all benefit from better-integrated reporting.

From a traditional FP&A lens, integrated data insights also create better storytelling narratives. This is the fundamental pursuit of FP&A professionals. Can we make sense of the outcomes by identifying the drivers that can be controlled? Linked data allows savvy FP&A professionals to make connections to ‘true’ business drivers in ways that were not possible before. Technology and AI-driven algorithms are speeding up this process and allowing much larger data sets to be interrogated. However, you still need individuals to be able to ‘prompt’ the models.

The raft of regulatory changes in relation to mandatory disclosure around all forms of metrics & KPIs is also creating a mandatory requirement for CFOs to be fully aware of multiple non-financial performance stats, who in turn rely on FP&A teams to understand and monitor these.

Conclusion: The Future of Data-Driven FP&A

Data-driven organisations are beginning to recognise data as a valuable asset that needs to be used effectively to deliver a measurable Return on Investment (ROI) to the business. The FP&A teams are at the forefront of this transformation, acting as custodians of data connectivity and its business interpretation. Their role has evolved to include being the business experts on how the data can and should be used within the organisation.

This expanded role of FP&A, combined with multiple internal, regulatory and external demands on analytics, is driving FP&A teams to become more data-driven and data-savvy. This trend is being further accelerated by technological advances that enable the analysis of vast structured and unstructured code sets with much less reliance on complex coding. As a result, data-driven insights are becoming more accessible and used across the business.

This trend is a very exciting opportunity for FP&A teams to embrace change and take the lead in the data-driven era — an opportunity that should neither be discounted nor avoided.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.