For organisations looking to get the most out of their Driver based planning and Rolling Forecasting...

Managing a successful FP&A (Finance) department requires balancing the right blend of People, Processes and Technology. Of course, this construct is nothing new, we’ve all heard this many times before.

However, when it comes to running your organization’s FP&A function, establishing the optimal mix of these three critical elements is surprisingly less obvious than one would think.

Why Technology is Very Telling

Normally, addressing technology first is a terrible idea. That’s because technology is never the driving factor. In fact, leading with technology is like trying to suggest an answer without really knowing the underlying problem. In leadership, we are often told to suspend judgement until we have all the facts. So, jumping to solution mode too quickly, especially on your most important infrastructure, can be very costly down the track.

Yet, surprisingly a lot can be learned by studying a company’s “current state” or existing technical footprint because it has a lot to say about how you currently address the people and processes

Does your FP&A function value process over people? Is the reverse true (people over process)? Or is the organization able to balance both efficiently and effectively?

When Planning is About PROCESS OVER PEOPLE

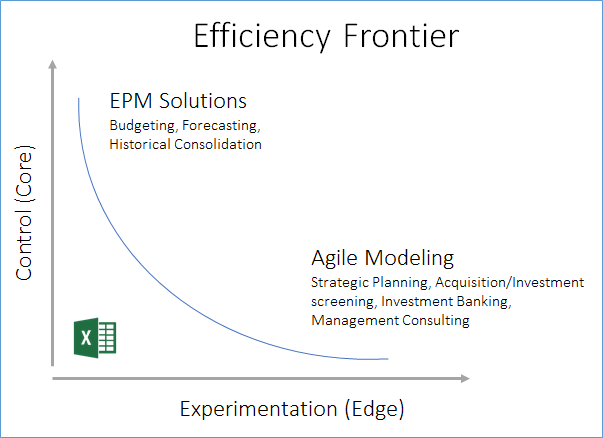

Tactical planning (Budgeting and Forecasting) is a highly process driven activity. Let’s face it, putting together the Annual Budget and reforecasting it throughout the year is an exercise in Process Management (time to get your calendar out and block out whole chunks of it).

As FP&A professionals, we would all like to spend more time analyzing the data and helping make better and more insightful decisions with less time spent in the process. However, when it comes to tactical planning, the reality is we’re often up to our eyeballs in process managment (hence the need for purpose-built technology).

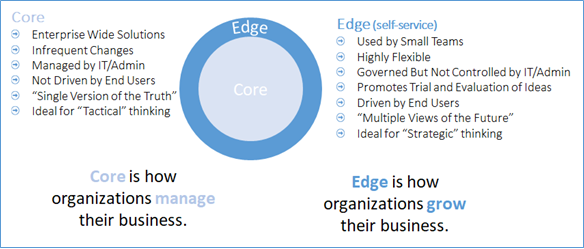

So, in order to handle a heavy dose of process-driven planning, we leverage technology known as Enterprise Performance Management Suites (EPM/CPM). These solutions are great for collecting and validating data across the entire Enterprise with the goal of streamlining a “single version of the truth” (SVOT) across the entire organization.

Often times, what makes these tools so powerful is their centralized or “Core” architecture. In short, Core architecture involves using a centralized database (on-premises or in the cloud) to store large amounts of data so that information can be leveraged by others throughout the organization.

Naturally, deciding who has access to view and enter data is a key concern that is addressed by a heavy dose of both access controls and pre-defined workflow rules (a key feature set of any EPM solution).

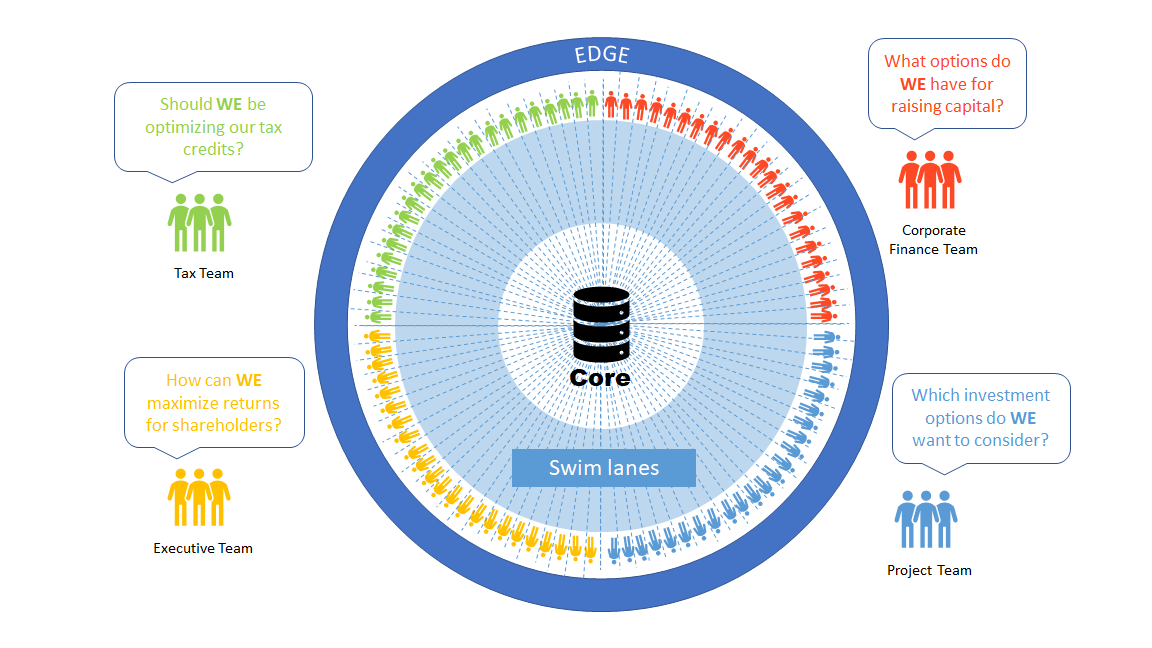

The outcome is a solution with robust yet rigid swim lanes which is ideal for centralized control, collection and coordination of data across the entire organization.

Key buzzwords for Core architecture are often phrases such as “Connected Planning”, “Budgeting and Forecasting”, “Single Version of the Truth” or “Enterprise Planning”.

When Planning is About PEOPLE OVER PROCESS

Of course, not all financial planning and forecasting is process driven. What happens when you are looking to shape the future direction of the business and need to evaluate alternative investments and strategies that are new to the organization? New divisions or products that don’t exist in the current “Core” architecture.

Strategic Planning, Investment/Acquisition Screening and other forms of Corporate Development (growth initiatives) are optimized when people drive the process (not the other way around).

Under this approach, literally anyone can initiate a plan (financial model) and invite or share it with others when the time is right. Once shared, users are free to suggest their own perspectives on that plan in terms of the assumption needing to change or even amending the logic. This is the optimal approach for team-based planning (business partnering), where the individuals involved are treated as peers and as a result work together to influence each other and facilitate real discussion and debate around financial alternatives that are more fluid and dynamic in nature.

This form of agile planning is optimized under a technical architecture referred to as “Edge” architecture.

Edge architecture is great for experimentation of alternatives where, much of what is being evaluated has a very short shelf-life and is either thrown away or proven invalid by other peers. As a result, there is little desire to centralize that data for enterprise consumption. Only the ideas/plans that make the most sense and prove to be valuable make their way to the Core, everything else is considered “noise” from the perspective of the enterprise and either remains or dies at the Edge.

Unlike, Core architecture that leverages a centralized database, Edge architecture typically leverages a distributed database architecture. Distributed databases are a collection of one or more databases that operate independently of one another, but exchange messages between each other in a network relationship.

This approach enables individuals to evaluate their own alternative scenarios and model configurations while relying on the system to capture and sync the “messages” occurring on the edge network. The result is an agile approach to modeling that facilitates the proper discussion and debate of alternatives required to form consensus.

Integrated Business Planning

Integrated Business Planning should not be about prioritizing People and Process. Rather it should be about optimizing the harmony of both Tactical Planning (process over people) and Strategic/Agile Planning (people over process).

Dispelling the Myths

A common myth about adopting a dual architecture approach to Integrated Business Planning is that it somehow creates an integration (mapping) challenge. Yet the reality is that over time, the integration points remain pretty constant. This is because the Edge architecture only requires aggregate data from the Core architecture (data that rarely changes). In return, only the consensus scenario(s) are passed back down keeping the integration points rather compact and consistent over time.

The real “Strategy Gap” occurs when organizations try to address “Edge” questions using “Core” solutions or vice versa.

For sure, data mapping and metadata alignment can be improved if vendors adopted shared APIs, common languages or other collaborative approaches, but this should not be a reason to hold off on adopting a dual Core and Edge toolset.

The Role of Excel

So where does Excel play a role in Core and Edge? Well, it’s important to realize that when we talk about Core and Edge we are referring to database architecture. Excel on its own is not database. But of course, it can be linked to a backend database. We see this in BI with tools like PowerPivot, PowerQuery and PowerBI. In addition, Most Core (EPM) vendors also have add-ins to Excel. Some vendors even require users to use Excel as the frontend.

However, what we don’t see right now is a proliferation of edge modeling tools that enable teams to uncover alternative strategies by constantly screening for alternative strategies that can be thoroughly discussed and debated without creating a myriad of version control related issues. So as familiar and flexible as Excel is, this remains to be a problem without proper edge architecture in place.

Conclusion

In the future FP&A teams will demand this flexible dual architecture as new generations of employees enter the workforce requiring more connectivity and integration of all systems through the use of open API technology.

The next generation already use APIs on a daily basis to login to various apps using their Facebook login for example and will expect to see similar connectivity within the Finance architecture.

Furthermore, this new wave of employees embrace working as a team on engagements that are built with agile frameworks. This is the future of financial modeling with greater collaboration and real time results driven modeling and analytics capabilities

Be forewarned, an organization’s inability to balance Core and Edge architecture is likely to be a key factor in determining whether an organization will attract and retain the best talent.

From a company standpoint, if you are not adopting cutting “edge” solutions that make employee’s jobs easier and expecting them to swim in a sea of spreadsheets we think they will reconsider taking those roles.

From an employee standpoint, if you are about to enter a large organization within the FP&A team be sure to ask the question on their Core and Edge architecture or strategy. We certainly would be.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.