We held the 6th Chicago FP&A Face-to-Face Board on the 11th of October, 2022...

As a CFO, Here Is My Dream (Well, One of Them)…

We have a board meeting to discuss how we are performing vs strategic plans.

We can see that our revenue projections are lower than our strategic plan, and we need to find a way to close the gap so that we can achieve our financial targets. We look at how we can give the revenues a short-term boost. We agree on a marketing campaign, and from past data, we know exactly how much it will boost inbound enquiries by. Our analyst enters the campaign details into the FP&A application to create a new scenario, and voila, we know we can handle the additional capacity needed in the call centres. However, we need to bring in our flexible resources to cover peak time demand and lunchtime and tea times. We know the conversion rates to calculate the volume of additional sales, and we can source the additional inventory in time. We do need to do a bit more research on our logistics division to ensure they can handle the additional volumes and deliver to our customers, but the COO is on it and has sent a message to his team to review the feasibility and update the operational plans.

This is not a new dream. Planning across the entire organisation is not a new process. However, it continues to be a dream for a CFO, as it is hard to achieve.

Extended Planning & Analysis (xP&A) is about extending the planning processes beyond the finance function and across the entire organisation. How did this term come about? What are the practical steps to move from a distant dream into a reality?

I’ve Heard this Before

Yes. The concept of planning across the entire organisation is not new and even predates me. Indeed, many organisations were doing this soon after James O. McKinsey codified the concept of budgeting and budgetary control in the early part of the last century. It spawned a huge industry of Sales and Operations Planning (S&OP), which was critical to managing the supply chains effectively in an era where there were significant opportunities to improve cash flow / profitability by streamlining supply chain operations (e.g. through just-in-time inventory management). What we have struggled with is combining operations planning with the financial forecast and the strategic plan. In many organisations, these processes run entirely independently. To make things worse, the way these have been built up with layers of manually entered spreadsheets means that the processes are hard to change and integrate with each other.

Most CFOs and FP&A practitioners I speak to, are aware of the concept of Integrating FP&A, but not necessarily the term xP&A. They also tell me that they share my dream. Generally, they are smart enough to work out how to implement it. What they lack is the headspace, time and resources to start a project. Many have been burned by past failures, especially with previous generations of technology, which was hard to deploy and even harder to use.

How Do I Get to the Promised Land of xP&A?

Headspace is an underestimated part of deploying xP&A. Personally, I need this to create frameworks and structures before I start a project to implement. It helps me shape my thoughts around where the biggest problems are and, therefore, what I need to tackle first. It also gives me a checklist of what I need to deliver to consider it a successful implementation.

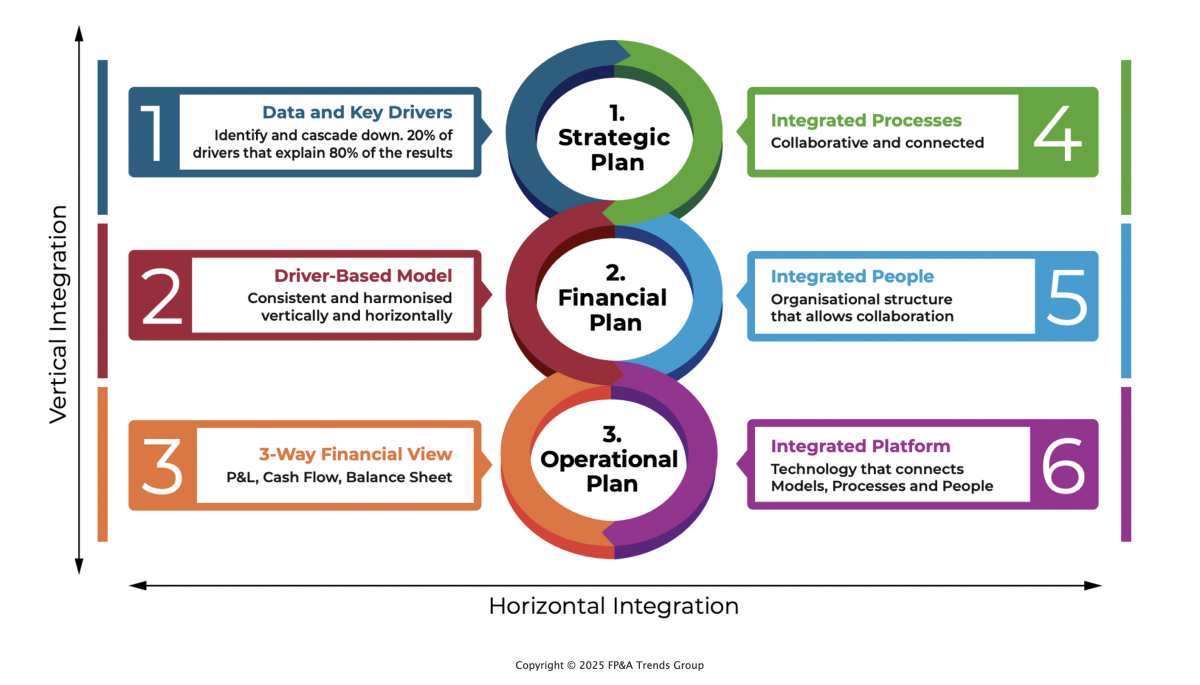

Thankfully, the good folks at the FP&A Trends Group have spent a lot of time studying this. They have developed a framework that neatly brings together all the things that must happen to achieve the dream of xP&A and bring a ‘One Plan, One Forecast’ mentality.

The first part links the strategic plan, the financial plan and the operational plan. When you update one, the others are updated at the same time through a single model. We refer to this as vertical integration.

Secondly, you need to integrate across the entire organisation. This is horizontal integration. You need to steer the entire organisation to work on the same integrated plan. When you set your strategic targets, the goals are cascaded down to each department to set a financial target. When you increase your marketing spend (or change the assumptions around the impact of marketing campaigns), your revenue numbers change in your financial plans. Accordingly, the models that show any gaps in the required capacity to deliver to your customers.

Figure 1. The Integrated FP&A Framework: Connecting Strategy, Operations and Finance

At the risk of showing my age… I have worked on both Hyperion, Carthesis and BPC/ Outlooksoft implementations, and the intention was always to deliver a system that could truly integrate the entire organisation’s planning processes onto a single platform. The intention was good, but the technology to build and implement was cumbersome. However, the bigger challenge was to change the way that a very diverse group of people across a diverse organisation wanted to work.

Within finance, we have always understood the importance of financial plans and know how to do this early in our careers. Our friends outside finance do not prioritise planning in the same way. Non-finance teams need a lot more training and education. They need to understand how critical planning is to organisational success, and they need to understand the importance of the role that they play. More importantly, we need to show them how it benefits their teams, both professionally and personally.

The technology problem was solved a long time ago. Modern FP&A platforms can handle #2, #3, and #6 with ease, speed and low cost. The latest architectures can handle more data than ever before. Cloud computing has forced an element of standardisation in the way we use applications while reducing the implementation effort and ongoing platform maintenance costs.

To solve #1, we are seeing a new breed of applications that use Machine Learning to uncover hidden drivers and variances. This won’t provide prescriptive guidance, but we can combine these insights with our ‘human intelligence’ to define the key drivers.

Practical Steps to Implement xP&A

1. Accept that you will not solve this with one implementation. Technology, data and modelling is a ‘complex problem', which can be solved with raw brain power. The people challenge is a ‘complicated problem’, which needs a more nuanced approach. An organisation, like a living organism, will maintain a state of entropy – if you change one part, something else will move to counteract this change. Instead, focus the first part of your journey on getting some basics right. Do you know your drivers? Do you have the right data? Do your models use the data and drivers to create the outputs that you need?

2. Start to harmonise your key processes. What are the processes that have the most impact on your planning process? For example, if headcount is your largest cost bucket, do all of your business functions have a common way of forecasting headcount costs across all of your departments?

3. Ensure that your finance team learns to work in cross-functional teams. In my opinion, this is a critical skill to develop as you scale your organisation, ensuring that the sum of parts is greater than its individual components. The business environment is more complex than it has ever been, and it is not possible for one individual or team to have expertise across the entire business spectrum. Working with a group of multidisciplinary experts ensures that you can leverage each other’s strengths.

4. Now, work on your people plan, and take a longer-term view on how to achieve change. How can you influence a group of people outside of finance, who do not necessarily want to change the way they work? How can you align them so that they are working together on the plan and, therefore, achieve horizontal integration? As a CFO, you are always building on your repertoire of influencing tactics. Do you use blunt force, or are you a follower of ‘Nudge Theory’? You need to judge what is the best for your organisation.

Conclusions

Yes, the concept of xP&A has been around for a long time. However, the technology barriers are much easier to overcome, and this distant dream is now within reach. To maximise the chances of achieving this dream, we need to start with small steps, focus on people and, more importantly, give yourself and your team time to think, plan and prioritise your approach before diving in.

This article was first published on the Wolters Kluwer website.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.