xP&A is more than an attempt to ‘fix’ the planning process. It is a complete transformation...

We held the 6th Chicago FP&A Face-to-Face Board on the 11th of October, 2022, and this meeting was dedicated to the emerging and developing concept of Extended Planning and Analysis (xP&A). Indeed, professionals and FP&A practitioners attended the second after the pandemic Board to delve into the questions and challenges caused by implementing this multi-dimensional approach. That meeting welcomed its members with a cooperative atmosphere, lively forward-thinking discussion, and, most importantly, provided many valuable insights from leaders of the industry.

The Agenda of the Meeting

Figure 1

Larysa Melnychuk facilitated this meeting, and everything started with a discussion of the fast-paced evolution of FP&A. Attendees agreed that Financial Planning must also be agile and react quickly to changing circumstances to better respond to the rapidly developing business world. That is why outdated approaches and traditional methods in FP&A do not work anymore, and changing them should be perceived as an opportunity. Participants got acquainted with the agenda stating the necessity of moving towards Extended Planning and Analysis (xP&A).

Other subjects on the meeting plan included:

- implementation of xP&A,

- a practical case study on the transformation of traditional FP&A processes to Business Planning and Analysis (BP&A),

- and assessing your itinerary to xP&A with the help of the FP&A Trends Maturity Model.

The International FP&A Board embodied thought leadership and focused on the critical moments of different journeys to Extended Planning and Analysis (xP&A).

What is xP&A, and Why Do Organisations Need It?

Extended Planning and Analysis (xP&A) presuppose harmonising all processes in your organisation. Implementing this approach will require finding a perfect balance between your top-down and bottom-up processes and creating a single, integrated process instead of multiple disjointed ones. Acquiring the right mindset to remain agile may take some time, and xP&A can help you mitigate the uncertainty and embrace tangible benefits like collaborative planning and running on-demand scenarios.

However, many organisations are still stuck on their journey to Extended Planning and Analysis, so this meeting helped senior FP&A practitioners figure out the methods of overcoming obstacles. If you are interested in more practical cases, you are welcome to learn more about this concept from our website.

What Should You Do To Set Up xP&A in Your Organisation?

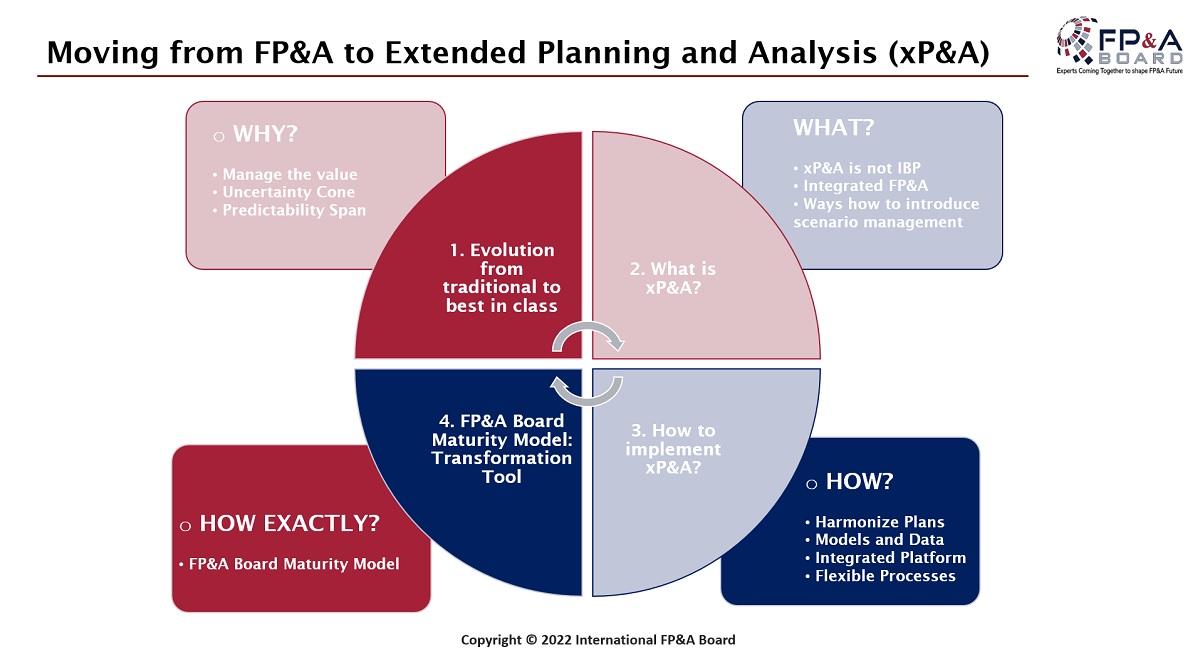

Figure 2

Larysa Melnychuk, the facilitator at the meeting and the CEO of FP&A Trends Group, shared her vision on shifting to xP&A. Before considering a move towards Extended Planning and Analysis, you should find the answers to four questions: why, what, how, and how exactly?

The discussion was centred around these questions. Senior finance practitioners were glad to share their points of view regarding the subject matter. Larysa Melnychuk also mentioned the six consequent steps to transform your FP&A journey into a successful one. The essentials include the following:

- identifying data and key drivers;

- creating a harmonised driver-based model;

- reassessing your financial view;

- moving towards connected and collaborative processes within an organisation;

- creating a structure in your company that allows all units to become business partners,

- and, finally, transforming your business into an integrated platform where technology connects people, models, and processes.

How To Move from FP&A to BP&A?

Figure 3: Delving into the Case Study During the Chicago FP&A Board

One of our speakers delivered a presentation on transforming FP&A into Business Planning and Analysis (BP&A). He outlined why this approach is more holistic than the traditional methods they have used previously. As a result, the company has grown from creating its budgets in Excel. Most of its processes are automated, so the FP&A team has more time for strategic and operational planning. The evolution will not take place overnight, so you must develop a positive attitude to change and be patient.

FP&A Trends Survey 2022 Shows That Companies Will Use More AI/ML Tech

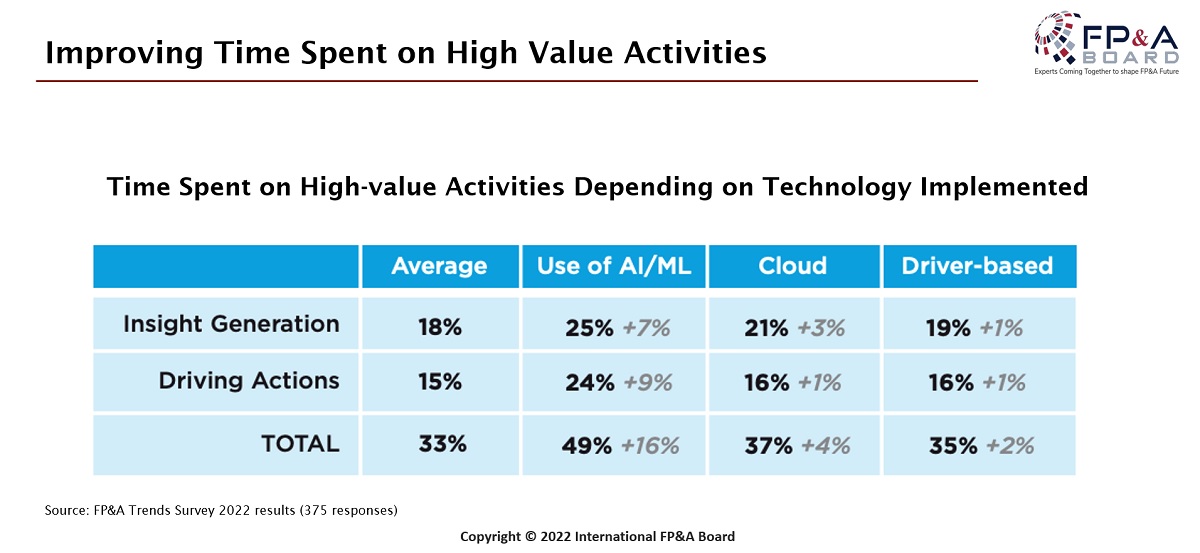

After this presentation, Larysa Melnychuk addressed the audience and focused their attention on key takeaways from the FP&A Trends Survey. This paper analyses the positive dynamics of implementing Artificial Intelligence or Machine Learning (AI/ML) in business processes and the specifics of driver-based planning.

Figure 4

Group Work

Figure 5: Group Work During the Chicago FP&A Board (October 2022)

Then the attendees were split into three groups, and group work began. After a lovely chat on the most vital issues, participants shared their findings on Data and Models, Systems and Processes, and People and Culture aspects. The most valuable insights voiced during the meeting include the following:

- Senior FP&A practitioners agreed that Extended Planning and Analysis is not new. However, it is not widely used;

- Creating harmonised processes and aligning all types of business plans is the most challenging venture on the transformation journey;

- Most finance professionals are looking forward to more efficient tools than Microsoft Excel, which can be insufficient in a changing business environment;

- Implementing more sophisticated technology like Artificial Intelligence and Machine Learning (AI/ML) may require several additional steps, but it will ease organisational processes.

Conclusion

The journey to Extended Planning and Analysis requires the proper attitude to changes, time, and efforts from the C-Suite leaders and the whole team, which needs the motivation to be ahead of the game. This transformation will not happen at once, and your travel may take several years; however, the game is worth the candles.

We thank SAP, Robert Half and IWG for sponsoring this event.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.