On October 22nd, 2020 the Global FP&A Trends group hosted another of its insightful webinars, putting...

![]() On 3 December, we had an interesting debate on why extended planning and analysis (xP&A) is playing an increasingly important role in finance. Senior finance professionals from Deutsche Bahn, Jedox and Microsoft shared their views on the subject.

On 3 December, we had an interesting debate on why extended planning and analysis (xP&A) is playing an increasingly important role in finance. Senior finance professionals from Deutsche Bahn, Jedox and Microsoft shared their views on the subject.

The panel of experts included:

Dr. Liran Edelist, President at Jedox, Inc.

Emre Gungoren, Group Finance Manager - Surface at Microsoft

Tanja Schlesinger, VP Business Intelligence OneSource at Deutsche Bahn Regio AG, Frankfurt FP&A Board member, AI/ML FP&A Committee member

This article is based on the insights from the webinar and speakers' presentations.

What is xP&A?

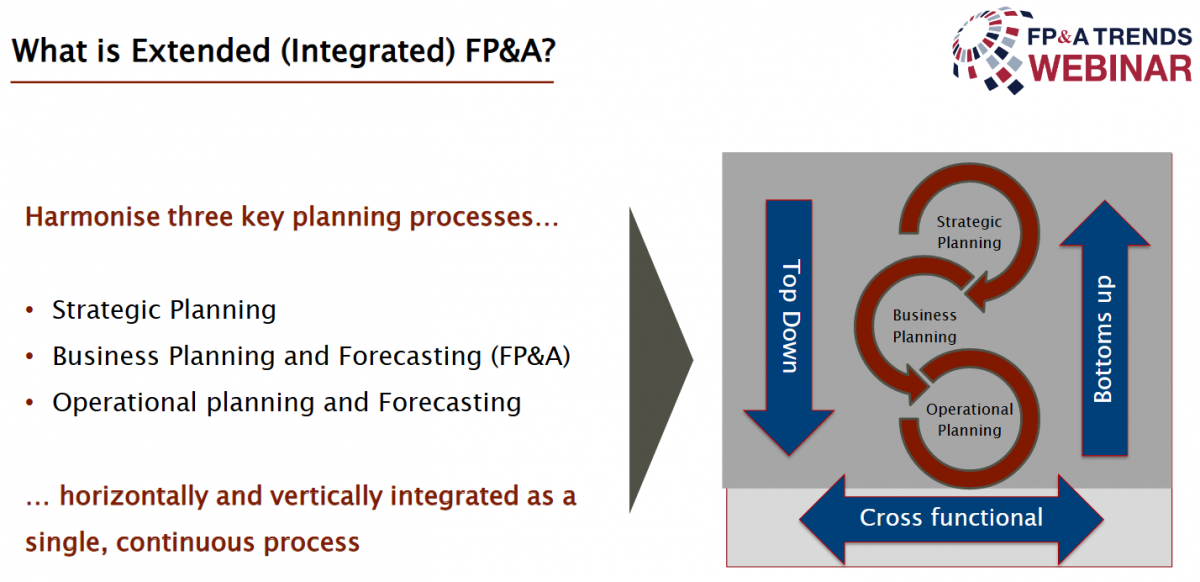

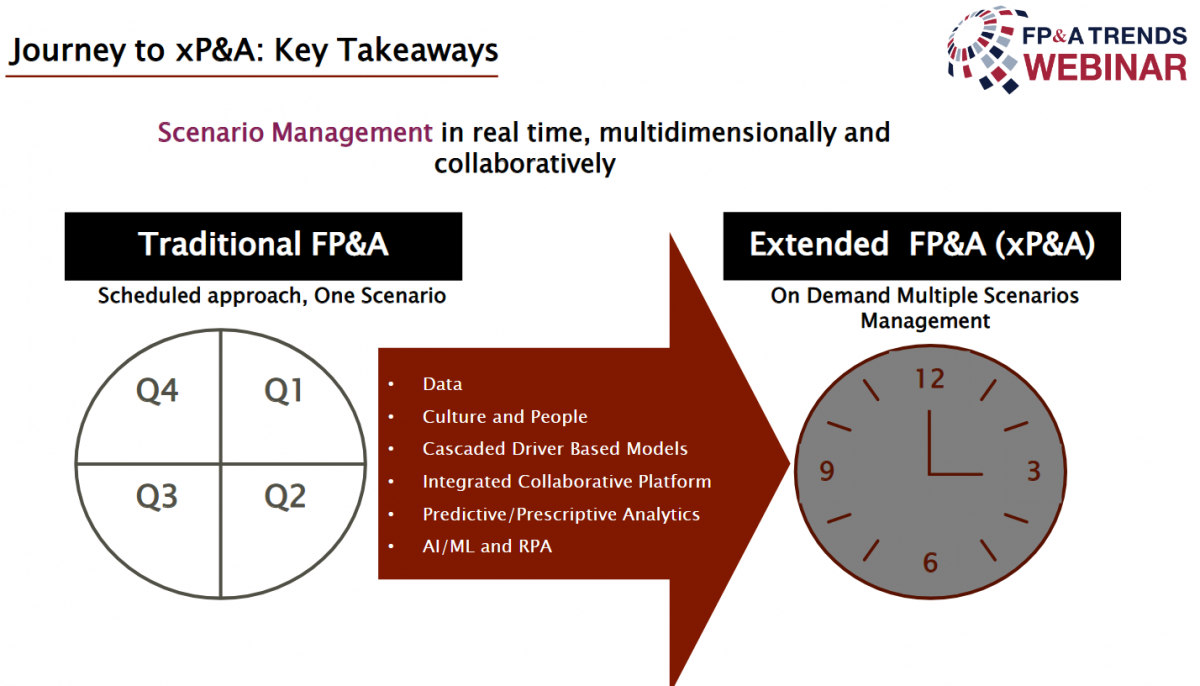

xP&A is not a new term in finance. Usually, it is called integrated FP&A or collaborative planning. It is based on the idea that finance professionals have to run scenarios in real-time co-operatively, multi-dimensionally and at different levels of the organization.

By embracing xP&A, organizations will see greater performance improvements compared with traditional FP&A processes. This is enabled through combining strategic planning, FP&A and operational planning and forecasting. It is also about top-down and bottom-up and cross-functional integration.

According to Dr Liran Edelist, President at Jedox, xP&A can be used as a roadmap to illustrate the evolution of the FP&A profession. Most of the finance professionals are thinking about what is the next appropriate step or how will profession change in the future. xP&A concept is the roadmap that can help answer these questions. This is why Gartner replaced “F” with “X” to show that we are talking about extended, cross-functional planning and analysis.

What are the steps to move to xP&A?

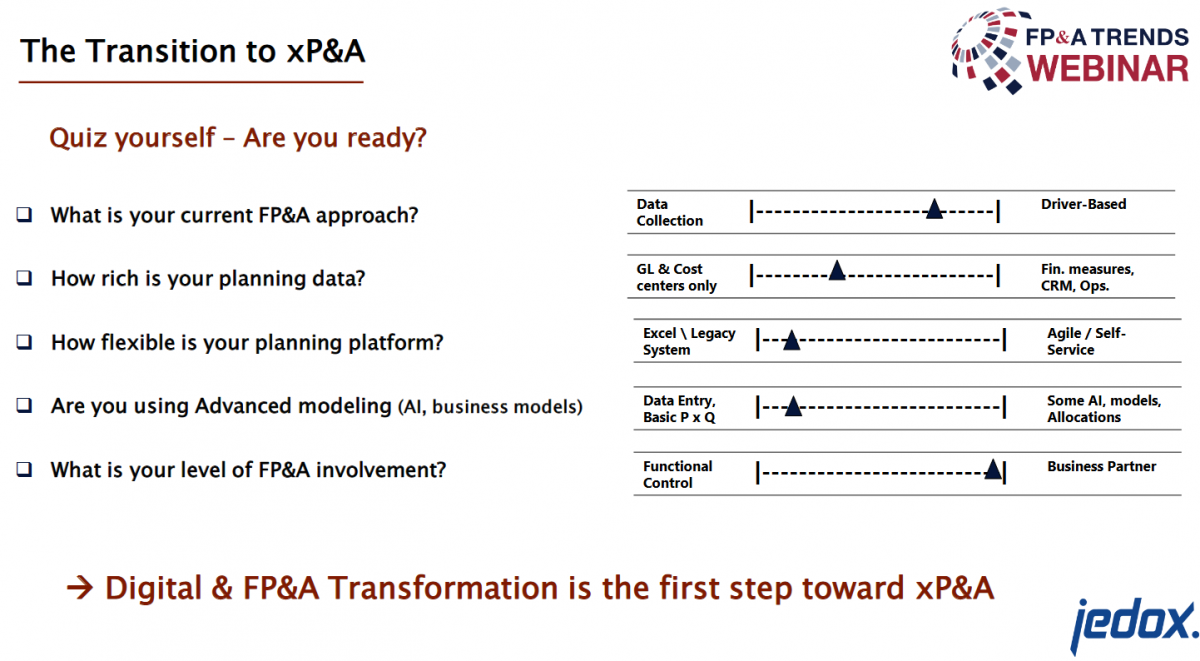

The digital transformation will be the first point to start with. The mindset of digital transformation is always tools, technology, processes, systems and so on.

The next point is creating a centre for excellence. It should also be about utilizing a holistic approach, and not just the finance one. Therefore, it is important to avoid creating silos in the organization.

Sometimes organizations are not ready for this transformation and have to identify their weak spots. There is a 5-question framework that can help decide whether your department is ready to embrace this change:

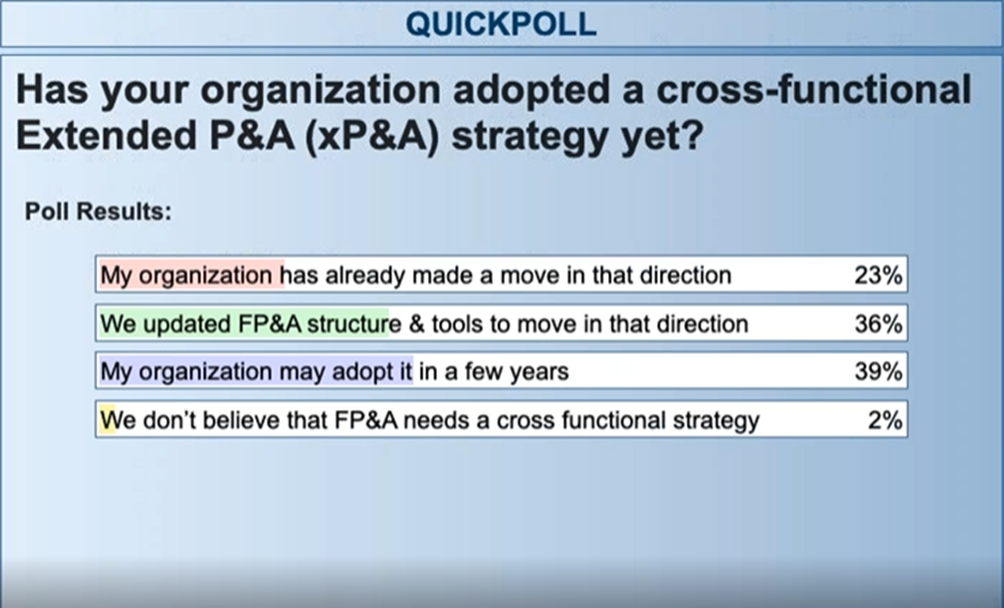

At the webinar, we also conducted a quick poll to see how many organizations have already adopted a cross-functional xP&A strategy. A quarter of the participants are already on that journey. Despite the current challenges, organizations are moving forward, taking the right steps, and are thinking about the business value that can come out of extended P&A.

xP&A Journeys by Microsoft and Deutsche Bahn

In the last couple of years, the advancement of technology in driving digital transformation has been the key for Microsoft. They call this the Modern Finance era which is about using the tools and seeing how they can be improved. Emre Gungoren, Group Finance Manager - Surface at Microsoft, demonstrated how Modern Finance era looks like in Microsoft.

Their team create the planning details for one product. They have target metrics for a specific product depending on the drivers. By using the dynamic driver-based modelling, the teams will be able to understand what revenue they are expecting from the existing customer.

Microsoft had this process at a high level and then cascaded the drivers down to the subsidiary level relatively fast. They were able to do this by leveraging their own technologies. Having very detailed models, at a very granular level, helped them collaborate much better.

Microsoft is also using one of xP&A platforms, namely Machine Learning. They have created a tool called Commercial Predict. This tool combines the traditional methods like looking at and understanding the past information and also machine learning techniques that are used to produce predictions based on what happened in the past.

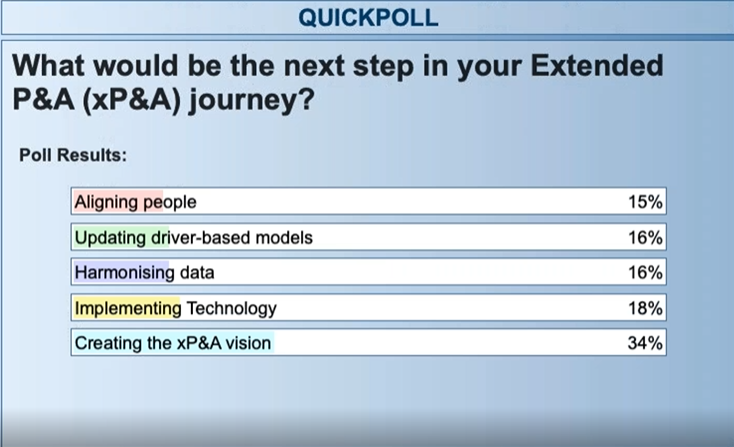

With the next polling question, FP&A Trends Group wanted to understand what the next step in the xP&A journey would be. The answers were mostly balanced with the majority (34%) focusing on creating the xP&A vision. As mentioned by Emre Gungoren, vision is crucial. It is important to have a plan and then being able to go to the next steps.

At the webinar, Tanja Schlesinger, VP Business Intelligence OneSource at Deutsche Bahn Regio AG, introduced the use case for machine learning at her company.

No matter how well your planning process is, a solid prediction is only possible when the key value drivers are fully understood. In her presentation, Tanja focused on energy costs to illustrate the machine learning journey because in Deutsche Bahn (DB) electricity and diesel are two large cost positions to look at. First of all, the DB finance department looked at these costs from environmental point of view and from the financial impact of diesel consumption.

Their challenge was that there was no metric system implemented in the fleet of diesel trains to monitor its specific consumption. The team wanted to predict and plan future consumption. The task in front of them was to generate a metric system. They started by installing a telemetric box in a vehicle to retrieve diagnosis data. Then they streamed this data, plus the vehicles’ GPS position, to cloud-based server. As the result, they developed tailor-made algorithms. The team aimed at better analysis and better planning for the diesel consumption and explored key value drivers.

All that the team learned along the transformation journey was mostly about the impact of the driver’s behaviour on the outcome. The transformation process would not be successful as long as planning and analysis were not extended to the operational unit.

At the end of this journey, the FP&A was fully transferred to the operational unit. However, FP&A could still use the same tools, share the results, look at the same data. The company also hired data engineers to work on the algorithms. After some time, it was decided to add more factors to the developed model such as weather conditionals or delayed trains. With this transformation, DB reached xP&A. It would not have been possible without a modern data architecture and tools because they allow very consistent access to data across the whole organization.

The effect DB Regio AG generated within the first half-year was energy savings that led to a noticeable financial impact. At the same time, they largely reduced the CO2 emissions.

Conclusion

The journey towards extending planning and analysis can be a long one but it is a rewarding experience. Nevertheless, team leaders should not focus only on technology and tools but also pay attention to the human factor. For example, like with any other processes, employees might be resistant to changes.

We are very grateful to our sponsor, Jedox, for their great support with this webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.