This article provides an overview of the topics and case studies presented and discussed by the...

FP&A Transformation Over the Last Few Years

FP&A has witnessed a significant transformation in recent years, driven by a growing need for more holistic approaches. This shift has sparked an interest in Integrated FP&A.

Initially, the spotlight was on planning and forecasting processes. However, the focus has since shifted towards deep analytical insights, underlying business drivers and data-informed decisions.

Yet, one might ask - can we truly achieve predictive and prescriptive analytics without first ensuring the synchronisation of planning, forecasting and analytics across the organisation? In other words, is the path to analytical excellence feasible without embracing the principles of Integrated FP&A?

Analytical Excellence

When an organisation achieves an ideal state of analytical excellence, it harnesses the full potential of its data, transforming raw numbers into actionable insights.

For instance, through the lens of analytical excellence, a retail company could accurately forecast consumer demand shifts to optimise inventory levels and reduce waste. Marketing strategies can become more targeted and effective as organisations can focus on desired customer segments and predict marketing campaign impacts.

Integrated FP&A

Analytical excellence is not just about understanding the business and its key drivers. We are talking about ensuring the entire organisation moves in sync, like the precision gears in an analogue watch.

In other words, we are aiming for Integrated FP&A or Extended Planning and Analysis (xP&A), as some may know it. The International FP&A Board developed this concept through hundreds of meetings around the globe and many pieces of research.

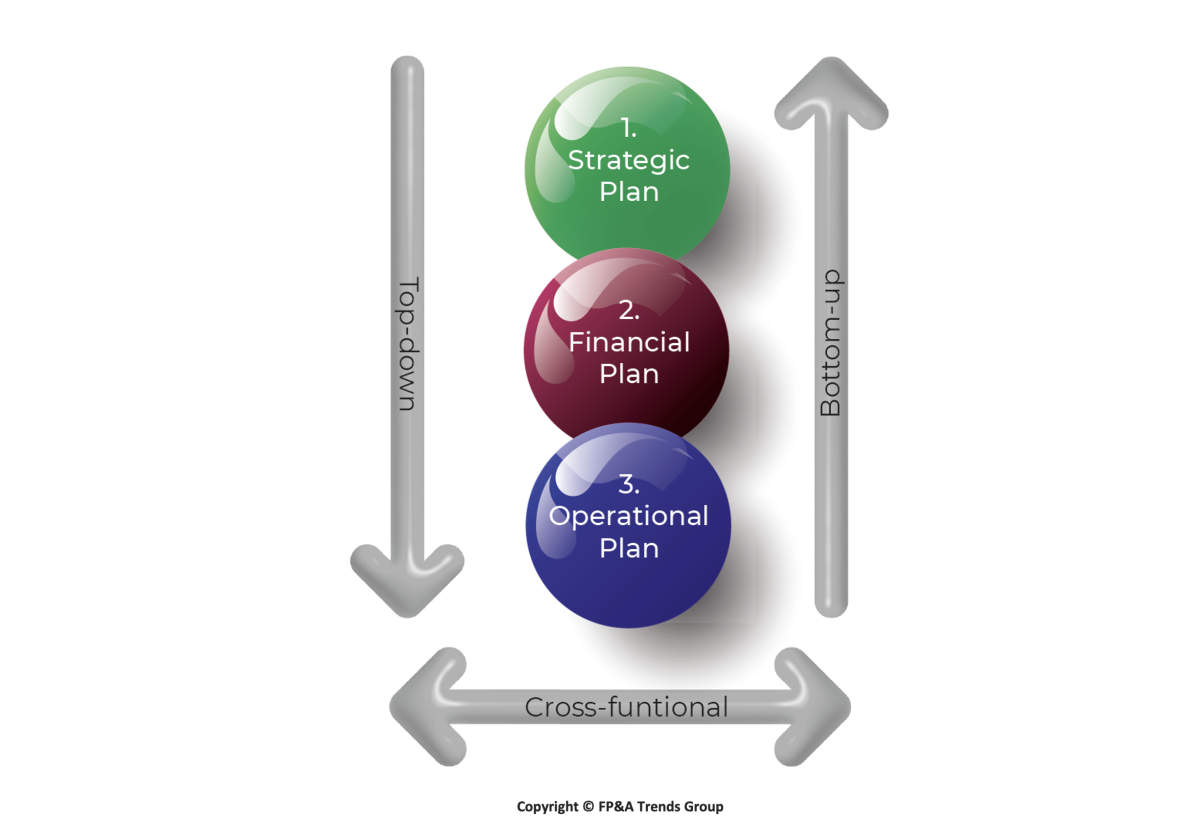

The definition agreed by the FP&A Trends Group is as follows: “Integrated FP&A is a single and continuous framework where plans and forecasts are horizontally and vertically integrated (Figure 1). This concept represents the coordinated departmental activities that lead to developing, assessing and implementing ''the most likely scenarios" to achieve corporate goals. Also, it allows businesses to evaluate and support the impact of multiple futures on demand.” 1

Figure 1: Integrated FP&A

Current Progress in the Adoption of Integrated FP&A

Despite the potential benefits of Integrated FP&A, progress in its adoption remains notably slow. The FP&A Trends Survey 2024 [2] indicated that only 13% of organisations have achieved a fully integrated approach that combines strategic, financial and operational planning into a single cohesive framework. An additional 12% report fully aligned plans, though not fully integrated.

Meanwhile, the remaining organisations either operate with only formally aligned plans, or are hindered by internal political influences and misalignment between central and decentralised units. These underlying structural and cultural barriers continue to slow the broader adoption of Integrated FP&A.

Additionally, Excel is still a predominant tool used by 52% of respondents, while the adoption of modern planning platforms rises slowly. In other words, there's still a significant journey ahead for the full adoption of Integrated FP&A methodologies.

How to Get There?

The International FP&A Board has identified six key elements that are essential for a successful transition to Integrated FP&A based on insights and research gleaned from discussions with leading organisations.

1. Identify Key Business Drivers

It is important to identify and work closely with the most crucial business drivers. According to the Pareto principle, businesses should prioritise the 20% of drivers that account for 80% of the results.

For example, an e-commerce retailer may focus on optimising its website conversion rate, which directly influences revenue. By analysing customer behaviour data and website interactions, the company can identify the most impactful elements, such as page load speed or checkout process efficiency, which might account for 80% of the potential conversion improvements.

2. Set up a Driver-Based Model

A simple driver-based model, even without the added sophistication of Machine Learning (ML), can often outperform analytics, as well as forecasts that are merely based on last year's actuals.

For example, an e-commerce retailer can use a driver-based model that forecasts revenue through the number of active customers, the rate of new registrations and the current industry growth trends rather than simply the previous year’s revenue.

3. Make Sure to Use a Three-Way Model

A robust financial model ought to be a "three-way model," which seamlessly integrates the three core financial statements: the Profit & Loss, Cash Flow and Balance Sheet. While this may seem straightforward, our experience indicates that only around 20% of organisations implement such interconnected models effectively.

4. Integrate Processes

Design a process that integrates strategic, financial and operational decision-making levels and allows smooth cooperation across the organisation.

For example, a retail corporation can set up weekly cross-functional meetings for open communication and swift adaptation to market changes, ensuring that operational practices are aligned with financial goals.

5. Integrate the People

Foster a structural and cultural shift within the organisation. This involves understanding business drivers and encouraging collaboration across all functions.

For example, creating a centralised analytics hub in a manufacturing company can encourage analysts and business unit leaders to co-develop performance metrics and share insights during regular meetings.

6. Implement an Integrated Platform

The transition from isolated planning and analytical systems to a unified, integrated platform approach.

For example, a retail chain in which store managers operate independently in terms of inventory control and sales forecasting can implement a centralised data analytics platform that tracks sales, inventory and customer preferences across all stores.

Figure 3: Key Business Drivers

Dining Industry User Case: Utilising an Integrated Decision-Making Platform

An American dining chain with over 200 restaurants has pioneered the use of an integrated financial planning system by one of the leading software vendors.

The restaurant business above refined its sales forecasting by leveraging detailed analytics on guest counts, average checks and shift-specific sales data. This allowed for a nuanced annual trend analysis that provided a solid foundation for future business planning.

In the area of labour planning, the software offered restaurant managers weekly labour templates that were directly influenced by the sales forecasts. This ensured labour planning and costs were in lockstep with sales volume.

The driver-based models employed imported product ingredient data from third-party platforms, enabling the company to create accurate projections of needed ingredients and ensure the availability of menu items.

Additionally, the platform facilitated financial planning with versatile reporting and analytical tools at a restaurant level.

This case shows how this dining chain aligned its strategy with financial planning and operational activities through an integrated financial planning system.

Act Now

Businesses must act now to remain competitive and agile in a fast-moving world. The journey towards Integrated FP&A needs to begin without delay to ensure that companies are setting the pace rather than simply keeping pace in their respective industries.

If you are unsure where to start your journey, the FP&A Trends Maturity Model can be a perfect first step. This tool allows organisations of any size, industry and geography to identify the stage of their FP&A maturity compared to a leading-stage organisation. It also allows them to create their transformation journey to improve their FP&A operations.

Sources:

- FP&A Trends Research Paper 2023: FP&A Scenario Management: Your Path to Navigating Uncertainty

- FP&A Trends Survey 2024: Empowering Decisions with Data: How FP&A Supports Organisations in Uncertainty

This article was first published on blog.board.com

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.