In this article, the author outlines why the transition towards Integrated FP&A is necessary for organisations...

Most organisations strive for successful Integrated FP&A. But are companies prepared to embrace this shift? What does it take to move from working in silos to being fully integrated? How can companies cultivate a supportive culture that combines skilled people, well-defined processes, and the right technological platforms?

These questions were explored at the recent webinar hosted by FP&A Trends Group, “The Winning Formula of Integrated FP&A”.

This article provides an overview of the topics and case studies presented and discussed by the expert panellists, shedding light on the journey towards achieving Integrated FP&A.

Are Our Company Cultures Ready for Successful Integrated FP&A?

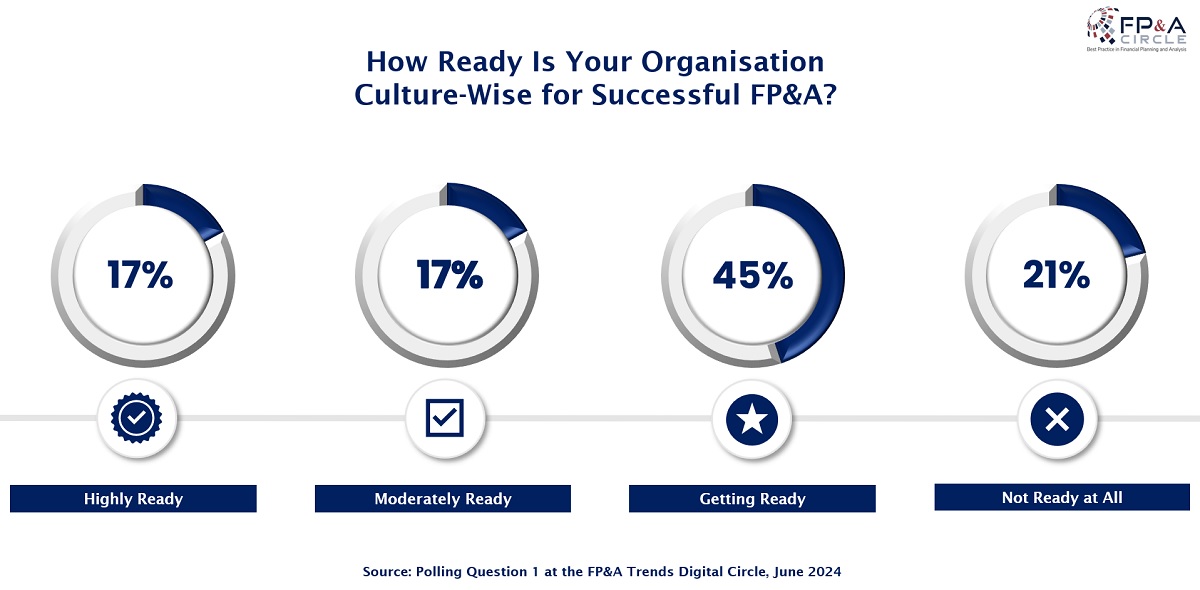

In the first interactive polling question, most of the webinar audience (45%) stated that they are “getting ready” culture-wise for Integrated FP&A implementation. 21% believe that they are “not ready at all,” while the options “highly ready” and “moderately ready” each gained 17% of the votes.

Figure 1

Purpose-Driven FP&A

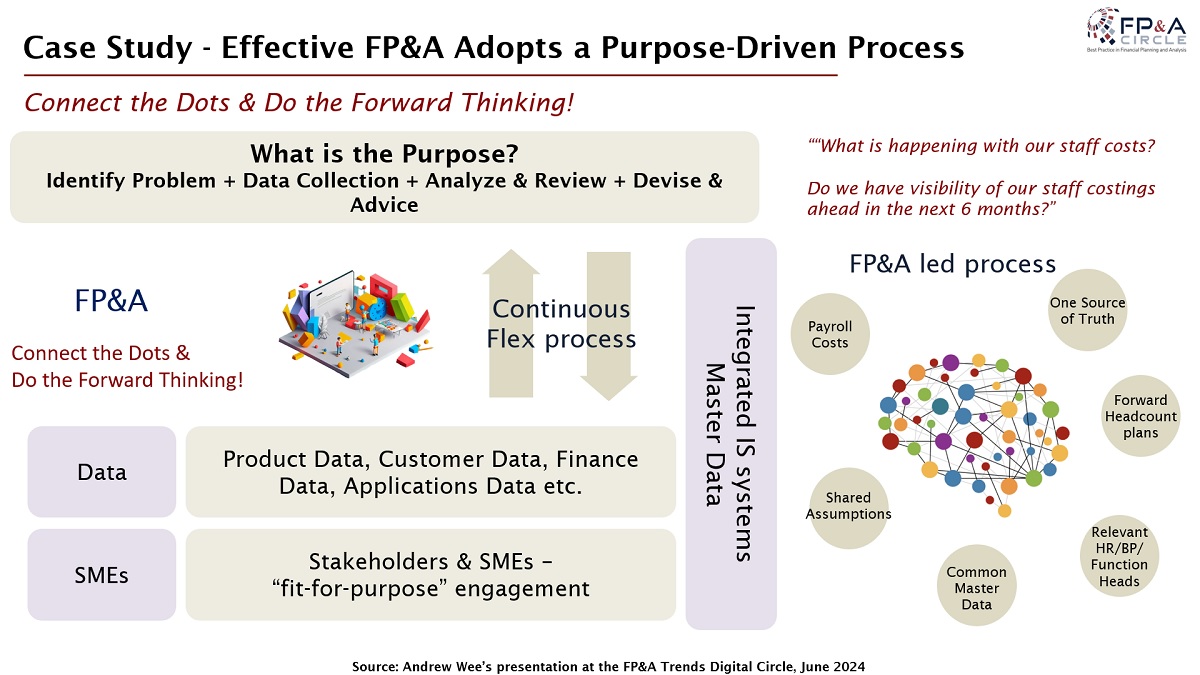

In the webinar, Andrew Wee, Chief Financial Officer at GOOD BARDS, emphasised two key aspects of FP&A: collaboration with non-finance departments and translating financial data into actionable business insights.

Andrew highlighted recent studies by Deloitte and EY indicating subpar performance within finance departments themselves, revealing a need for improvement acknowledged by finance leaders.

Andrew criticised the traditional, siloed, and rigid FP&A processes that hinder effective decision-making, especially in dynamic business environments. He shared an example of how integrating staff costs and payroll reporting was challenging due to these siloed processes.

Figure 2

To address these issues, Andrew advocated for a purpose-driven approach, urging FP&A professionals to become proactive problem solvers. He stressed the importance of adopting integrated systems and fostering a collaborative culture within businesses. By leading data analysis and engaging with subject matter experts, FP&A can shift from being task-driven operators to results-focused partners. Andrew concluded by emphasising the significance of standardised data definitions, collaborative systems, and personal engagement with colleagues for successful FP&A.

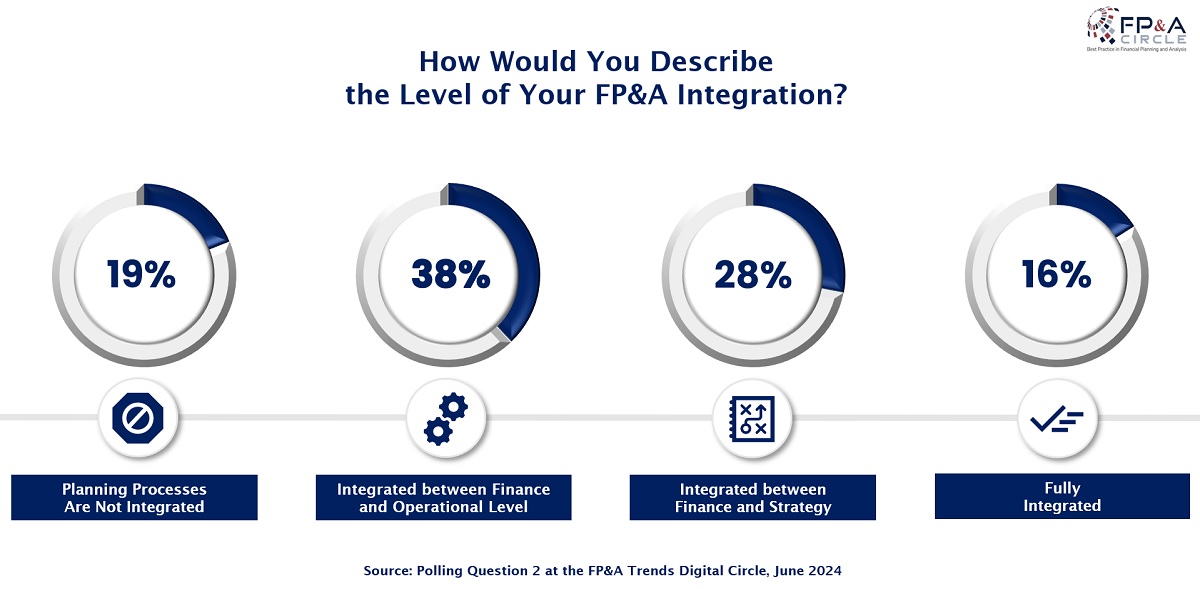

How High Is the Level of Our FP&A Integration?

38% of the webinar audience have achieved integration between finance and operations, while only 28% managed to do it between finance and strategy. 19% of the attendees admit that their processes are not integrated at all, while 16% are proud of having fully integrated FP&A.

Figure 3

FP&A Skill Set of the Future

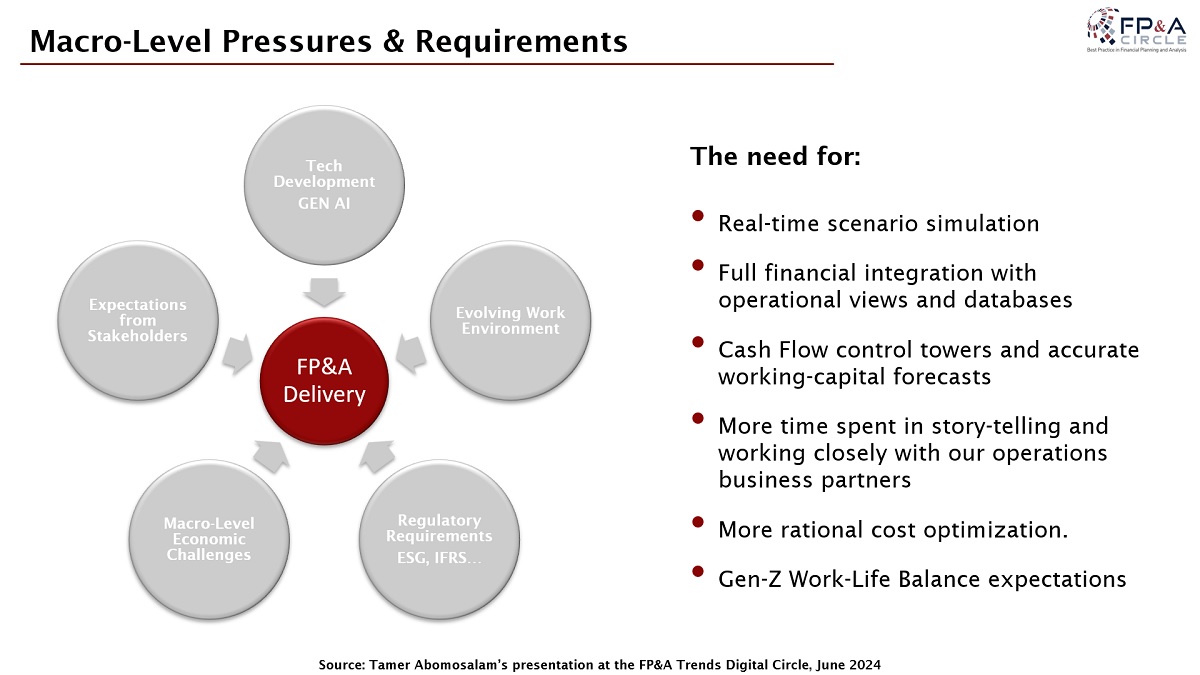

Tamer Abomosalam, Group Chief Financial Officer at emaratech, speaking from his global finance perspective, emphasised the universal pressures finance professionals face. He highlighted the increasing necessity for Integrated FP&A in the post-pandemic era, driven by the need for real-time data and operational insights. Tamer noted that while technology acts as a catalyst, it is not a standalone solution. Finance professionals must develop their skills to utilise these tools effectively.

Figure 4

During the pandemic, we were introduced to concepts like cash flow control towers and global inventory forecasting, which underscored the evolving demands on finance teams. Tamer stressed the importance of transparency, collaboration, and storytelling in finance roles, moving beyond traditional tasks to provide clear and actionable insights.

He also pointed out that achieving a single source of truth, such as a data lake, is crucial for accurate financial reporting and operational alignment. He shared an anecdote about the significant impact of understanding data valuation, illustrating the necessity of finance professionals being conversant in IT and data science to avoid costly errors.

Concluding his speech, Tamer emphasised that upskilling finance teams is key to leveraging technology. By fostering a culture of continuous learning and equipping team members with advanced tools like Power Query, Power Pivot, and data analytics, finance leaders can ensure their teams are prepared for the challenges of modern finance and can enhance the organisation's overall efficiency and accuracy.

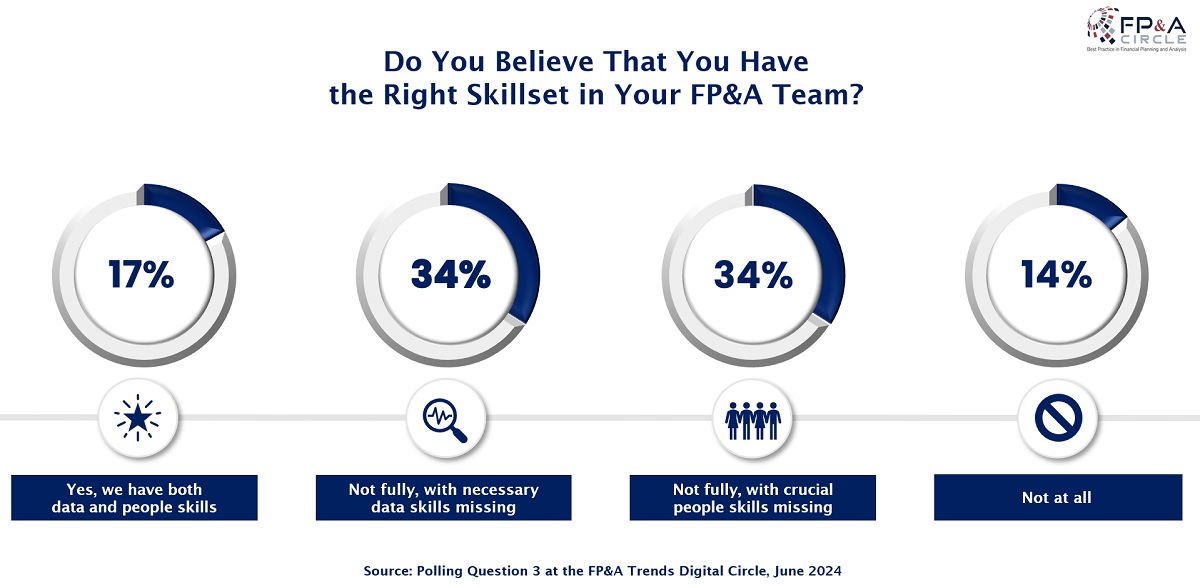

Do Our FP&A Teams Have the Right Skill Sets for Integrated FP&A?

This interactive poll showed two leading answers, which gained 34% each. One-third of the audience believes they have data-related skills but lack the necessary people skills. Another third has it the other way around. The last third was almost equally split between “we have both people and data skills in our FP&A team” and “we have none of those skills.”

Figure 5

Technology’s Role in Enhancing FP&A

In his presentation, Vince Randall, Regional Vice President at Workday Adaptive Planning, emphasised the critical role of FP&A in modern businesses, particularly in facilitating faster decision-making amid economic uncertainty. He highlighted the increased pressure on FP&A to incorporate more data analysis and deliver frequent, accurate forecasts. Vince noted the common challenge of fragmented planning processes across departments, leading to duplicated efforts and disconnected data silos.

He stressed the importance of adopting flexible, agile, modern tools to bridge this gap. According to Vince, many companies operate with the illusion of having an integrated planning environment when, in reality, they run multiple disconnected planning processes. This results in incomplete data and missed opportunities for meaningful company-wide assumptions and collaboration.

Figure 6

Vince underscored the benefits of modern planning tools, such as ease of use, built-in analytics, and real-time insights. These tools enable users across departments to self-serve, fostering collaboration and enhancing decision-making. He advocated for company-wide planning, facilitated by user-friendly tools that cater to different departmental needs, and the incorporation of Artificial Intelligence (AI) to assist employees.

In conclusion, Vince championed the idea that modern planning tools and Machine Learning (ML) can transform FP&A into a strategic powerhouse, significantly boosting productivity and impacting business decisions. He believes these advancements position FP&A to become a crucial strategic advisor, driving better, faster decisions across the company.

Conclusions

Achieving Integrated FP&A requires a harmonious blend of skilled people, well-defined processes, and the right technological platforms.

However, these elements alone are insufficient without a culture that embraces collaboration and innovation, supported by strong leadership. As underscored by the insights from Andrew, Tamer, and Vince, the future of FP&A lies in becoming proactive problem solvers who leverage modern tools and cultivate a continuous learning environment.

By fostering a culture ready for change and empowering finance teams with the necessary skills and tools, organisations can transform their FP&A functions into strategic, integrated powerhouses that drive superior business outcomes.

To watch the full webinar recording, please check out this link.

This Digital FP&A Circle was proudly sponsored by Workday.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.