Watch this video from Garrett Dennie to learn how process and integration can pay valuable dividends.

When I enrolled in University, my Major was titled ‘Management Economics, in Industry and Finance’. As an economics major, I had several different academic strengths. Math, of course, was one of them, and understanding accounting and basic economic principles were another. One course I didn’t have as much an appreciation for but was required to take was Psychology.

When I enrolled in University, my Major was titled ‘Management Economics, in Industry and Finance’. As an economics major, I had several different academic strengths. Math, of course, was one of them, and understanding accounting and basic economic principles were another. One course I didn’t have as much an appreciation for but was required to take was Psychology.

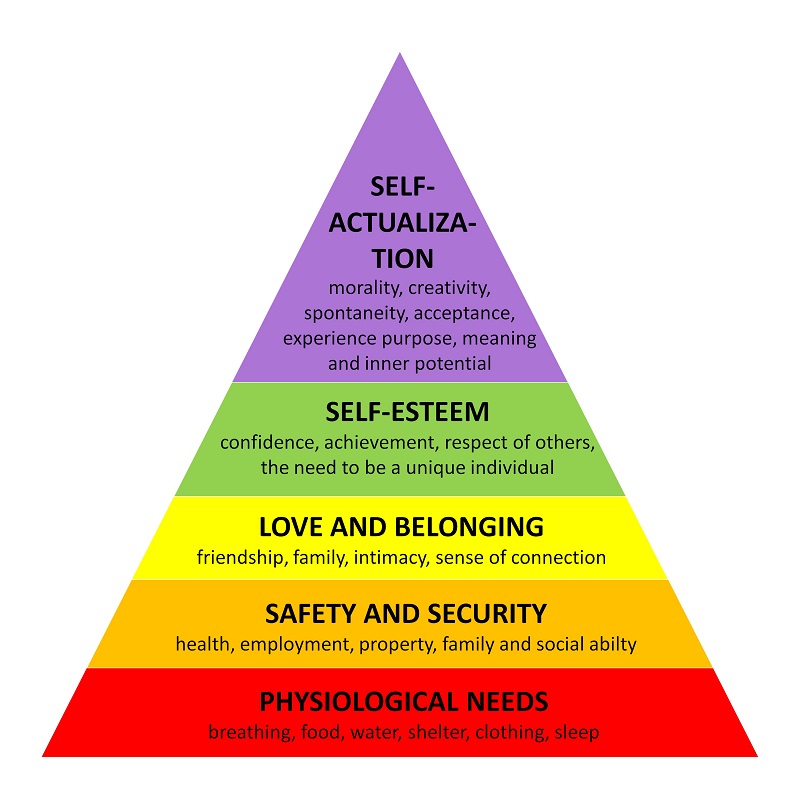

Why would I, an economics major, need Psychology? There were no numbers; there was nothing about supply or demand, inflation, or free trade. Regardless of my confusion, it was a mandatory course, and I was on a mission to obtain my degree - so I went to my Psychology lectures. While attending these sessions, one of the most fundamental principles has stuck with me for the past 25 years. As I have gone through my career, I have found that the framework of the idea has many relevant applications in business and management. The idea I am referring to is Maslow’s Hierarchy of Needs.

How Maslow's Hierarchy of Needs Can Be Applied to FP&A

Maslow’s Hierarchy of needs is a framework usually presented in the form of a pyramid, describing the need development of a human being in stages. Each need stage can only be attained if the subsequent steps have been satisfied. The lesson is that there are no shortcuts to becoming a well-adjusted person. You must work on satisfying every need sustainably to become the most you can be.

Companies have been looking for the possibility of assigning their finance divisions some control, whether it be financial regulatory control or even profit control.

The regulatory side of that need has a rigid training and qualification standard to which accountants must enrol, complete, and adhere. With that, training comes very prescribed processes and methods to ensure and comply with the standard.

Financial Planning & Analysis (FP&A) has emerged in recent years as the latter end control mentioned above. The way to enhance and control profit. In contrast with more regulatory skill sets, there are many ways companies and finance departments approach this control or enhancement of profit. FP&A as a practice is still developing; as such, there are varying applications to processes employed across the business landscape.

Many companies will see some of the flashier outputs from different FP&A processes, tools, or techniques and think they can easily replicate them.

What is not appreciated in most organisations is that for any flashy outputs to be effective or even accurate, much preparation is required to have the correct data and processes to feed adequately into that final output.

Many companies build strategic or operational plans, in complete silos, at high levels with little to no viable connection to each other.

Financial Budgets and Plans are formulated in the waning months of a financial year, for the next year, without much thought as to what needs to be prepared and executed to get to the targets inputted into these plans. These are done only to realise in the first few months of their new year that they had no chance to achieve the goals or targets they dreamt up only a few short months prior.

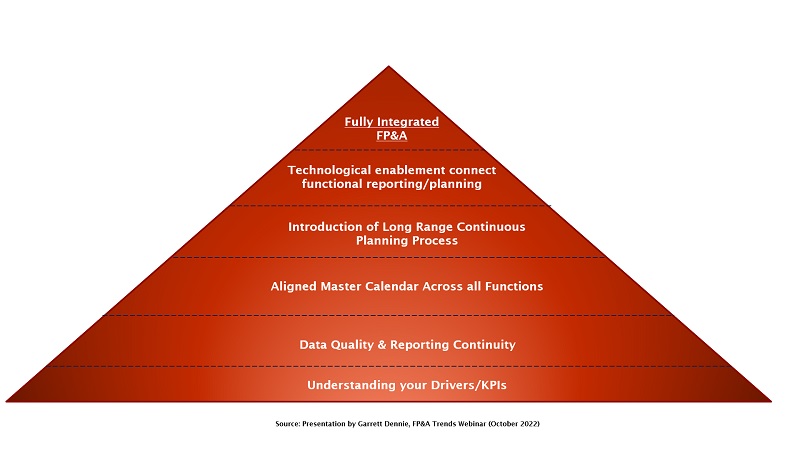

True, best-in-class FP&A is built over time, brick by brick. So, when we think of those ‘bricks’, we must think of all the necessary preparation steps needed to ensure the inputs into your FP&A ecosystem are of good quality and relevance. Let’s take the concept of Maslow’s Hierarchy of Needs and how one can achieve self-actualisation. We can apply it similarly to achieving Integrated FP&A, with various stages of preparedness needed to reach that end goal eventually. Some of those input stages are listed below.

Understanding of Output Drivers and KPIs

Several companies I have seen and been a part of often miss what drives their sales or costs. This requires a company to sit back and understand what is driving their sales – is it a particular product, price, marketing/market impression? Are macro-environmental forces influencing their sales, or is it all driven by their actions?

What are the activities that drive their costs? One exercise to drive this understanding could be ‘Zero Based Budgeting’ or ‘Activity based costing’.

Without a good understanding of these drivers, an organisation won’t know the correct KPIs to track and will never get to forecast or understand their financial outputs adequately.

Data Quality – Consistent Reporting

Once you understand what drives the sales and costs in your business, you are now ready to create KPI reporting. Many organisations encounter an issue in that the integrity of their data is often relatively weak. Missing data, inconsistent account definitions across systems or functions, inconsistent data labels, and poor attribution processes all lead to fragmented data outputs that can adversely affect the validity of what a report or KPI is telling its managers.

Without good data quality, there always remains doubt as to whether the actual picture is being depicted in the performance reporting, which leads to varying versions of what an organisation’s ‘Truth’ might be. This has critical downstream effects when integrating FP&A across different functions and plans. Without consistent data, it only causes chaos in fully integrating planning or analysis.

Aligned Master Calendar

When we think of Planning vs Budgeting, many organisations think of these concepts synonymously. But the fact is that they are two distinct processes. Planning – is the act of developing plans or initiatives to achieve results, whereas Budgeting is more about taking those plans and fleshing them out financially. To achieve cross-functional planning, you must understand the following:

- a) lead times of each function need to be able to execute upon the plan adequately;

- b) the driver inputs that would drive sales or costs in each function, i.e., planned sales in a retail organisation, will drive the costs and operations that need to be planned in logistics and stores.

If you have already done the work to understand drivers, you must work to understand and align your planning that fits with the lead times needed by each function. For example, a retail organisation that buys their goods overseas usually needs about six months lead time from the time they place their buy to getting it in their store. To plan that buy, they probably need 2 or 3 months, so a retail organisation’s planning cycle should begin about 9-10 months before expecting results from that planning. Not to mention all the cross-functional lead times within those 9-10 months for marketing, operations, and logistics.

So, aligning all those cross-functional calendars and honouring the lead times each function needs becomes of great importance. Otherwise, all the work you would have done up to the planning stage becomes un-executable if not done on a consistent, integrated calendar.

Long Range Planning

If aligning a master calendar is the first step in integrating operational plans with the financial plans, Long Range Planning becomes the next step in integrating the operational and financial plans with the strategic plans. Many organisations have multi-year strategic plans but forget to work backwards through them and connect them with the financial and operational plans. In not doing so, the work needed to be done in the interim of the realisation of the Strategy plan. However, other processes are usually not kept up to pace with the timing expected in the strategy.

A good Long Range Planning process that connects timing and financials with the financial and operational plans ensures the understanding of resources and timing needed to realise those plans.

Technological Tool Enablement

While we are living in an evermore digital world, and there are a lot of great tools out there, they cannot fix incomplete or inconsistent data. Neither can they correct your KPIs if you don’t understand the drivers of your business yet, or cure execution gaps in incompatible timelines.

There are a lot of great tools out there. They make people’s work easier, faster, more accurate and even optimised. A genuinely efficient FP&A team can maximise productivity and output using the world’s best tools.

But if you don’t have good data, if you don’t have aligned timelines, if you don’t understand what drives your business, the tools are not going to be able to make up for that, or at least not entirely.

Many organisations I have seen bringing in the newest fanciest tools – end up disappointed and usually blame it on the device not living up to its billing. The reality is that it is usually not the tool’s fault; it is because the tool has been placed on top of a weak base of data and processes.

Fully Integrated FP&A

So, there you have it. Like Maslow’s Hierarchy of Needs, the FP&A Hierarchy requires proper diligence at each stage before you can practically tackle the next.

Aligning data and processes and then complimenting them with best-in-class tools is the only path to genuinely Integrated FP&A.

Several teams or organisations will try to cut corners and add the best tool or introduce Long Range Planning without the requisite preparation of data quality alignment and/or the calendar/process alignment. In almost all cases, those teams don’t get the result they intended with those efforts and abandon their pursuit or realise they need to start over at the ‘bottom of the pyramid’. They have wasted time and valuable resources only to discover the quickest and cheapest way would have just to do it right.

Lucky for me, I have already been through those futile efforts before, and I understand the concept laid out in Maslow’s Hierarchy. Now I know why they had me study Psychology as an economics major…

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.