Our business environment is changing dramatically. Smart devices, smart offices, autonomous vehicles are boosting and creating...

The "Modern Finance" journey at Microsoft underscores the transformative impact of technologies and Artificial Intelligence (AI) on finance operations. This transformation involves understanding rapid market changes and leveraging technology to handle increasing business complexity. The goal is to move away from outdated, manual, and inefficient tools, and utilise advanced technologies to reduce human errors, improve efficiency and drive agility from data to actions.

This shift enables finance professionals to focus more on strategic and value-adding tasks, thereby driving business resiliency and value through deep analytical and strategic thinking.

Modern Finance Focus Areas

Figure 1

In the rapidly evolving business environment, several challenges arise, including surging data, legacy systems and inadequate tools to deal with growing business complexity. These challenges can lead to error-prone processes and governance risks, causing businesses to spend excessive time on non-value-adding manual tasks.

To address these challenges, Microsoft leverages various digital technologies categorised into five main sections as outlined in Figure 1:

- Financial Analysis and Reporting: For instance, The Modern Business Management Portal aims to consolidate all finance-related reports into a single, up-to-date platform, eliminating the need for multiple Microsoft Excel reports scattered across various folders. The Interactive Financial Statements leverages Business Intelligence (BI) tools to automate reporting, enhancing the agility of business decision-making by enabling real-time data analysis and reducing reliance on manual Excel-based tasks.

- Strategy and Forecasting: This involves incorporating AI and Machine Learning (ML) for forecasting, prediction and capacity planning. These technologies enable finance professionals to produce unbiased forecasts, assess the business’s bottom-up ground-up forecast, improve forecast accuracy and simplify and streamline processes, allowing more time for value-adding tasks.

- Business Process Automation: Implementing Virtual Agents for basic questions and answers (Q&A) to improve agility and efficiency.

- Risk Management: Utilising compliance Predictive Analytics to flag unusual transactions for follow-up actions and provide machine-generated recommendations. For instance, flagging a large-sized deal from a customer who has never made any transactions before or the sudden appearance of a deep discount for a specific customer deal during the quarter-end may indicate the need for a deeper investigation to understand the context. This approach allows the system to guide finance professionals on the next steps to take.

- Workforce Productivity: The finance team has been utilizing Microsoft 365 Copilot for Finance to streamline their variance analysis and reconciliation processes. By leveraging the Financial Reconciliation Agent, the team quickly identifies outliers and discrepancies in their financial data, significantly reducing the time spent on manual data compilation and analysis. This not only improved efficiency but also enhanced the accuracy of their financial reports. This agent significantly reduced the internal time required for account reconciliation.

These technologies help manage data effectively, reduce manual work and enhance overall business efficiency.

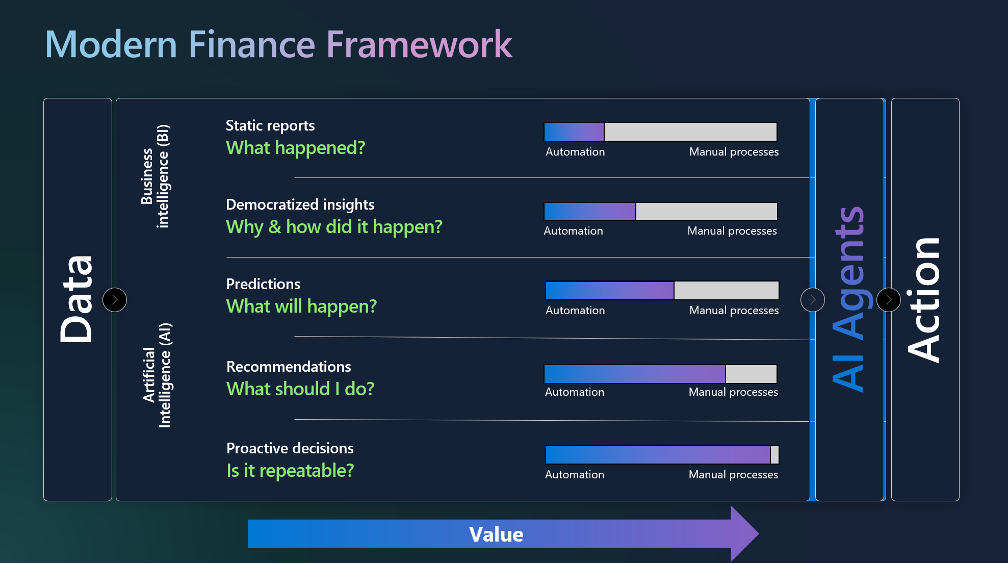

Modern Finance Framework

Figure 2

The key purpose of “Modern Finance” at Microsoft is "turning data into actions" as quickly as possible (as shown in Figure 2). This begins with establishing a "single source of truth" for data, which involves consistent definitions, taxonomies and migrating data to the cloud. Once the data is ready and available, it can be utilised to produce Business Intelligence. The transformation flow includes:

Business Intelligence:

- Static Reports: Excel provides static reports that only indicate what happened, without drill-down capabilities or insights, and involves a lot of manual processes.

- Democratised Insights: BI tools offer interactive reports that make meetings more dynamic, helping understand why something happened on the spot, reducing manual processes and enabling immediate responses to ad hoc requests.

Advanced Analytics:

- Prediction: Machine Learning helps predict the future by learning from the past, shortening the distance between data and action, and reducing manual processes and human errors.

Recommendations:

- Automated Decision-Making: Combining ML to automate decision-making processes help us move quickly from data to decision. For example, compliance Predictive Analytics uses AI/ML to flag unusual transactions and notify finance employees for follow-up actions.

AI Copilot:

- Enhanced Productivity: Due to the introduction of AI, the speed of transformation is expedited, significantly enhancing productivity across solution areas.

In summary, the focus is on transforming data into actionable insights and adding value to the business in the fastest and most relevant way. Additionally, it aims to encourage finance professionals to dedicate more time to value-adding tasks by utilising the time curved out and saved through technology-driven efficiencies. This journey involves continuous improvement and leveraging automation to shift focus to higher ROI tasks.

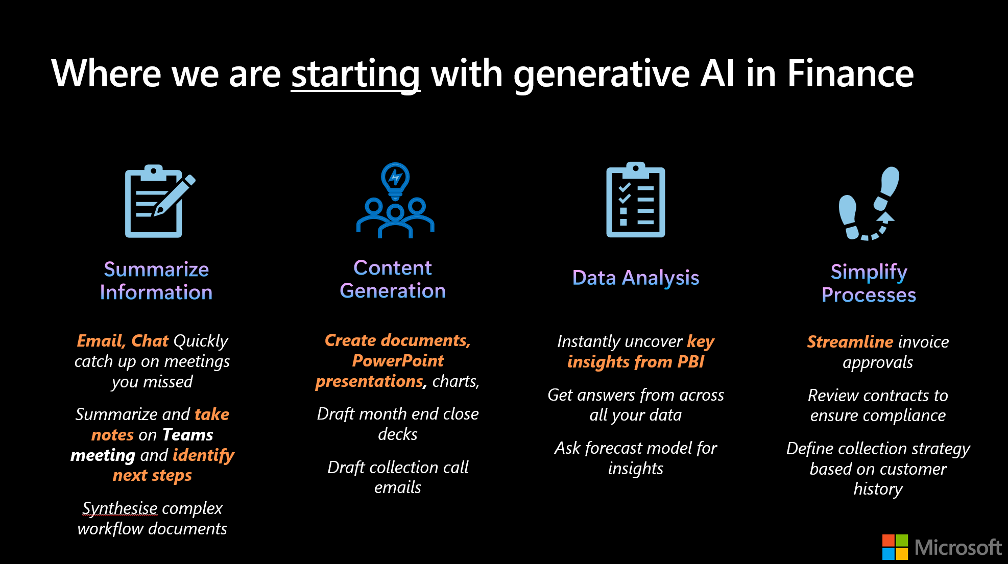

Where Is Microsoft Using AI?

Figure 3

As we are entering the new era of AI, we have observed that AI can significantly enhance productivity in our daily tasks. It can summarise information from emails, chats and Microsoft Teams meetings, identify the next steps and allow us to focus on decision-making and taking action, as illustrated in Figure 3. Additionally, AI can generate content and presentation slides, analyse BI reports, and simplify processes. By leveraging AI, we can ask it to summarise meeting notes and follow-up actions, saving time and enabling participants to concentrate on discussions.

To conduct the transformation successfully, we have to factor in cultural changes. It is about embracing new technologies, fostering a learning mindset, and adapting to the rapidly changing business environment. This transformation is essential for driving efficiency, reducing manual processes and enabling finance professionals to focus on more strategic tasks.

Conclusions

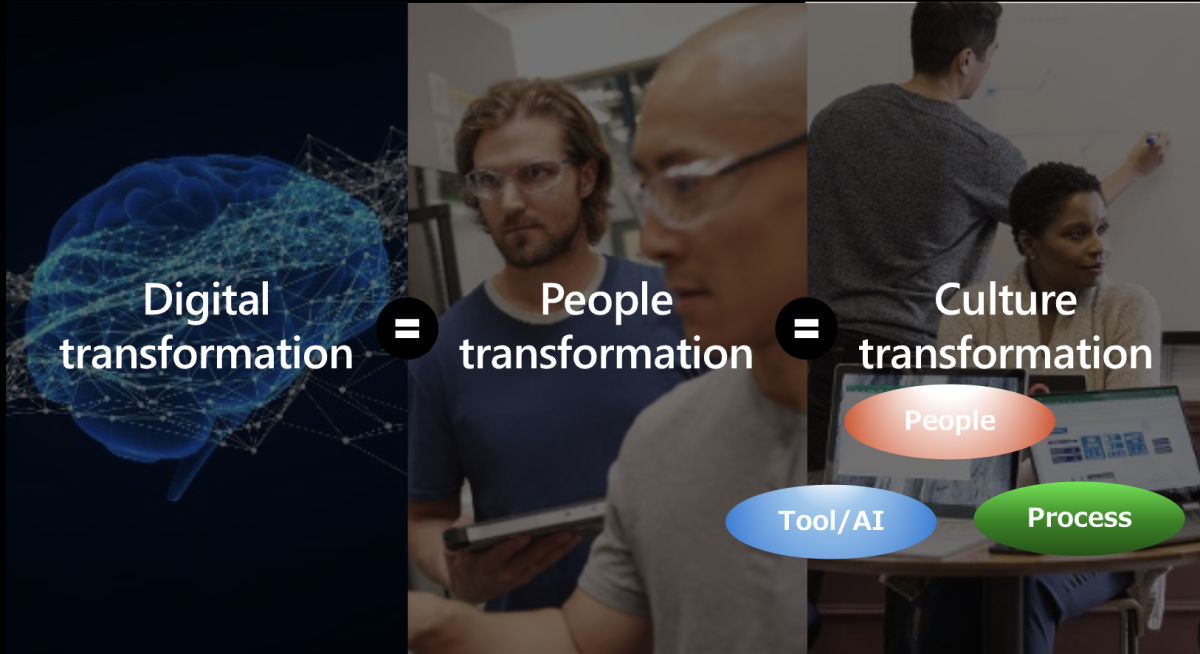

Figure 4

While technologies enable automation, strong leadership and effective processes are crucial for driving change. The most important aspect is how we transform ourselves to drive business impact (Figure 4). Embracing Generative AI is about more than just new tech; it's about being willing to learn new things and adapt to new ways of working. This transformation is essential for driving efficiency, reducing manual processes and enabling finance professionals to focus on more strategic tasks.

The leadership team plays a pivotal role in driving this cultural transformation, ensuring that employees continuously learn and improve their skills.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.