I was recently invited to join FP&A-Trends’ Artificial Intelligence/Machine Learning (AI/ML) Committee by Larysa Melnychuk, managing...

I was recently invited to join the Artificial Intelligence and Machine Learning (AI/ML) Committee. The AI/ML Committee is comprised of finance practitioners and data-management/science experts.

I was recently invited to join the Artificial Intelligence and Machine Learning (AI/ML) Committee. The AI/ML Committee is comprised of finance practitioners and data-management/science experts.

The Committee focuses on identifying and sharing the practical application of AI/ML-enabled technologies in Financial Planning & Analysis (FP&A).

This article is based on the committee’s first two meetings in 2018.

The use of AI/ML in finance is not yet widespread; however, there’s every indication that more data-science-enabled analytics will migrate from their “traditional” home in marketing to the finance function.

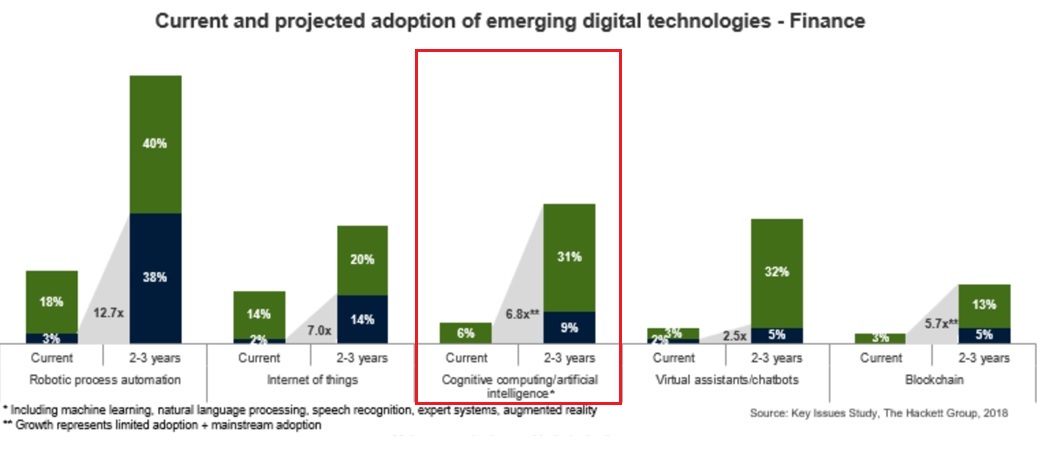

The Hackett Group’s 2018 Key Issue study shows a projected 6.8X increase in their use in finance organization (see chart below) over the next two to three years. According to one committee member, “AI/ML are critical for staying competitive and maintaining margins, in finance and elsewhere.”

Three Lessons Learned

The conversation among committee members introduced three main considerations with regard to the adoption of AI/ML for finance organizations:

1. Getting your homework done

The application of AI and ML in finance comes with some prerequisites:

- The technologies must be able to access usable data. That means the data needs to be aggregated and cleaned. This critical step can consume large resources in terms of cost and effort.

- The organization must have people with the right skill-set to leverage the AI-enabled application. Professionals’ skills in interpreting the outcomes of the analyses is the key to transforming information into action.

- Finance must have the right tools. Today, most of the AI applications are open source and can be harnessed and customized. There are also some vendors that are beginning to offer off-the-shelf, AI-enabled functionalities.

2. Identifying key drivers

There’s clearly potential for the application of AI/ML to enhance driver-based modeling for budgeting, forecasting and analysis. To gauge business performance, leading FP&A teams identify critical business drivers of financial performance and use them to build models that can predict the effects of any changes on financial performance. The trick is to figure out what are the key drivers to plug into the model. AI and ML can help FP&A find out by sifting through massive amounts of data to identify what truly moves the needle on performance.

3. Changing the mindset

Finally, to ensure the introduction of AI-enabled technologies transforms the planning process, finance executives must take a comprehensive change management approach. They need to work with stakeholders, communicate effectively and offer the necessary training.

The introduction of AI/ML into finance may cause staff unease about interacting with “machines,” as well as concerns about being replaced. It’s important everyone understands the purpose of the implementation. To help build trust, finance professionals must be acquainted with the algorithms that drive the technology’s actions, so the machines are not just black boxes.

AI/ML hold the potential for improving sales/revenue forecasting, cost analysis, account-to-report processes and collaborative planning, among other areas in finance. However, they are yet to have the potential to completely replace human interpretation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.