As the 4th Industrial revolution makes sizeable impacts on our lives through various sectors like taxis/ride...

I was recently invited to join FP&A-Trends’ Artificial Intelligence/Machine Learning (AI/ML) Committee by Larysa Melnychuk, managing director. The committee is comprised of finance practitioners and data-management/science experts and focuses on identifying and sharing the practical application of AI/ML-enabled technologies in Financial Planning & Analysis (FP&A) and controlling. This blog is based on a case study presented at the June 2018 meeting.

I was recently invited to join FP&A-Trends’ Artificial Intelligence/Machine Learning (AI/ML) Committee by Larysa Melnychuk, managing director. The committee is comprised of finance practitioners and data-management/science experts and focuses on identifying and sharing the practical application of AI/ML-enabled technologies in Financial Planning & Analysis (FP&A) and controlling. This blog is based on a case study presented at the June 2018 meeting.

Artificial Intelligence and Machine Learning are on course to become the most revolutionary technologies in enhancing finance’s decision-support role. While automation (even through RPA) has eliminated many repetitive tasks and unnecessary human intervention, the next step for finance is to develop advanced analytics capabilities so it can deliver business value through actionable recommendations.

That’s what drives Swiss rail freight company SBB Cargo to replace its traditional management accounting system with an intelligent business simulation engine that optimizes its shipping operations.

According to CFO Stefan Spiegel, over the past seven years, finance has relied on a traditional management accounting system; the system provided granularity in terms of cost allocation and calculation of contribution margins. But it didn’t offer a clear insight into the specific ways shipment are organized (often trains ship goods from multiple clients). So, it couldn’t help SBB ensure it maximized its capacity based on business data.

The company relied on its ERP to make the complex cost calculations. This was expensive and did not provide visibility of concrete improvement measures. “We had accurate cost allocations, but we didn’t know how financial performance would be affected if we lose or acquire a new customer. We couldn’t say directly what’s happening in the business,” Spiegel said.

Switching Gears

That’s why SBB decided to leverage AI to build multiple models that are customer-made for different business areas. The objective was to simulate the behavior of different operational planning activities and understand their impact on financial performance. “We wanted to know what would happen if we made a business shift. When a customer is added, it cascades through the entire business. The models allow business and finance leaders to dynamically see what’s happening to margins and the cost.”

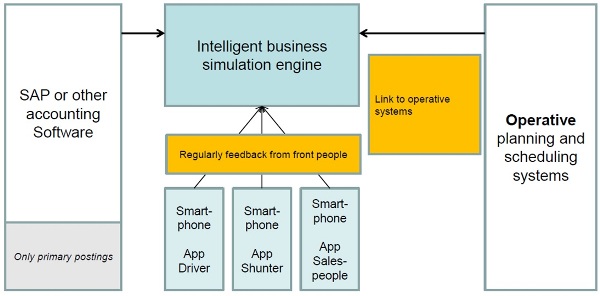

The models make up an intelligence business simulation model that links the accounting/ERP system to the operations’ planning and scheduling applications to identify the impact of business choices on other activities. (See Image Below.)

Comparing Old to New

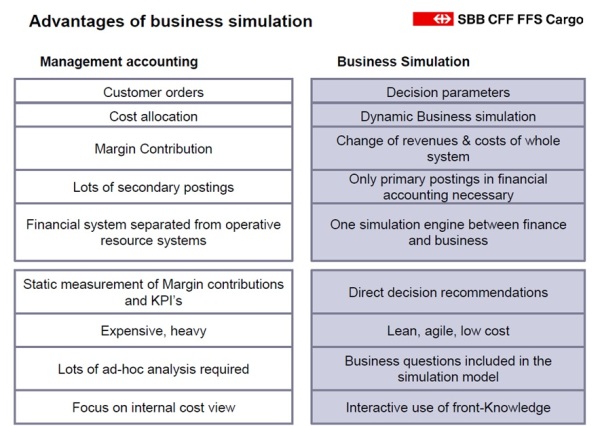

SBB identified multiple benefits based on the difference between traditional management accounting and its new simulation engine (see image below). Overall, the new approach, which is set to replace the preexisting management accounting system, produces direct business recommendations; it’s cheaper than the old ERP model, and offers dynamic interaction with front-end information.

“We found that if we place the shipments in an intelligent way into our logistics network, we can improve asset utilization by more than 30% ,” Spiegel concluded. “Of course, the hardest part is to unlock this potential as all business processes need to be changed. But the way to do it is shown very clearly.”

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.