CEOs that are more strategically oriented and less numbers-oriented tend to want to partner with a...

Our business environment is changing dramatically. Smart devices, smart offices, and autonomous vehicles are boosting and creating avalanches of data every day. Big data will benefit a business. It enables businesses with greater insights and new opportunities, but only if you are able to manage it well.

Our business environment is changing dramatically. Smart devices, smart offices, and autonomous vehicles are boosting and creating avalanches of data every day. Big data will benefit a business. It enables businesses with greater insights and new opportunities, but only if you are able to manage it well.

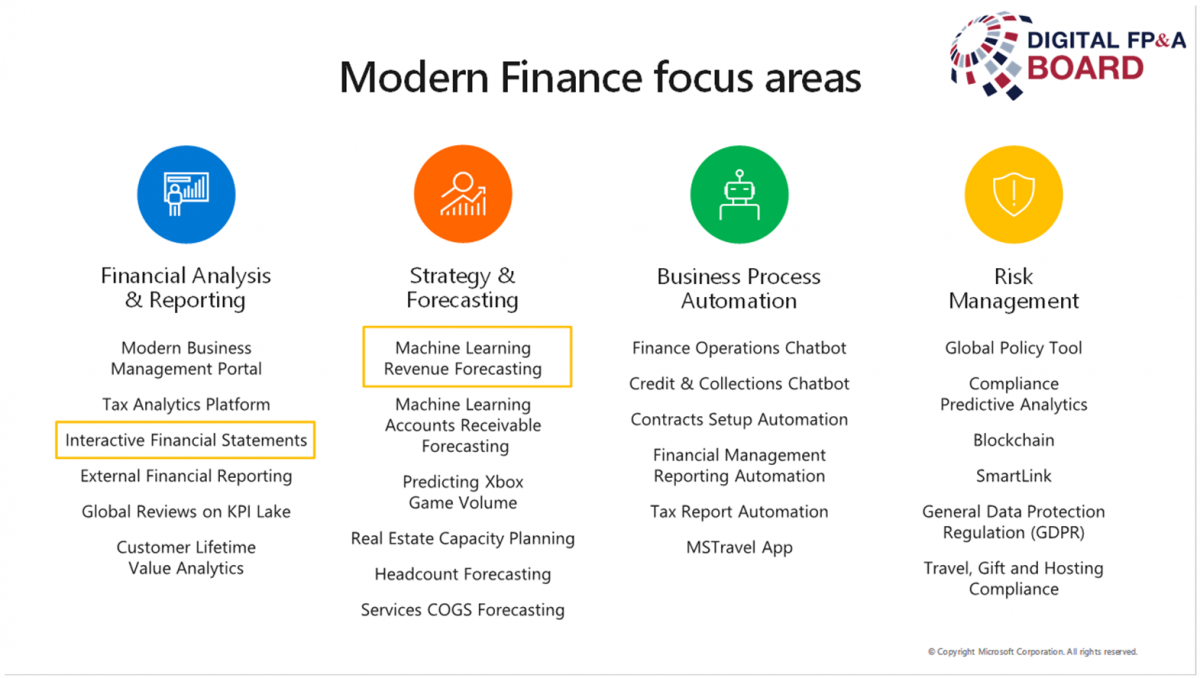

Modern Finance: Main challenges and four focus areas

Today we face challenges such as surging data, legacy systems, inadequate tools to anticipate growing business complexity, manual work which will eventually lead to error-prone processes, generate even bigger problems, risks and threats.

To overcome these difficulties, these are examples of the modern technologies which we leverage at Microsoft.

There are 4 categories.

The “Financial analysis and reporting” section is about creating data consistencies and how we leverage business intelligence (BI) tool and automate reporting to be more agile in the business decision-making process. Moving away from manual excel work.

The “Strategy and forecasting” section is primarily about artificial intelligence (AI) and machine learning (ML), where we leverage it for forecasting, prediction and capacity planning and what not.

In the “Business process automation”, one example is to leverage chatbot for basic Q&As to improve agility and efficiency.

In the “Risk Management” section, taking "compliance predictive analytics" as an example, this is where AI captures unusual transactions automatically, flag them, and inform finance controllers what they need to do, to follow up. We are now in the stage where machines can provide recommendations and tell you what to do.

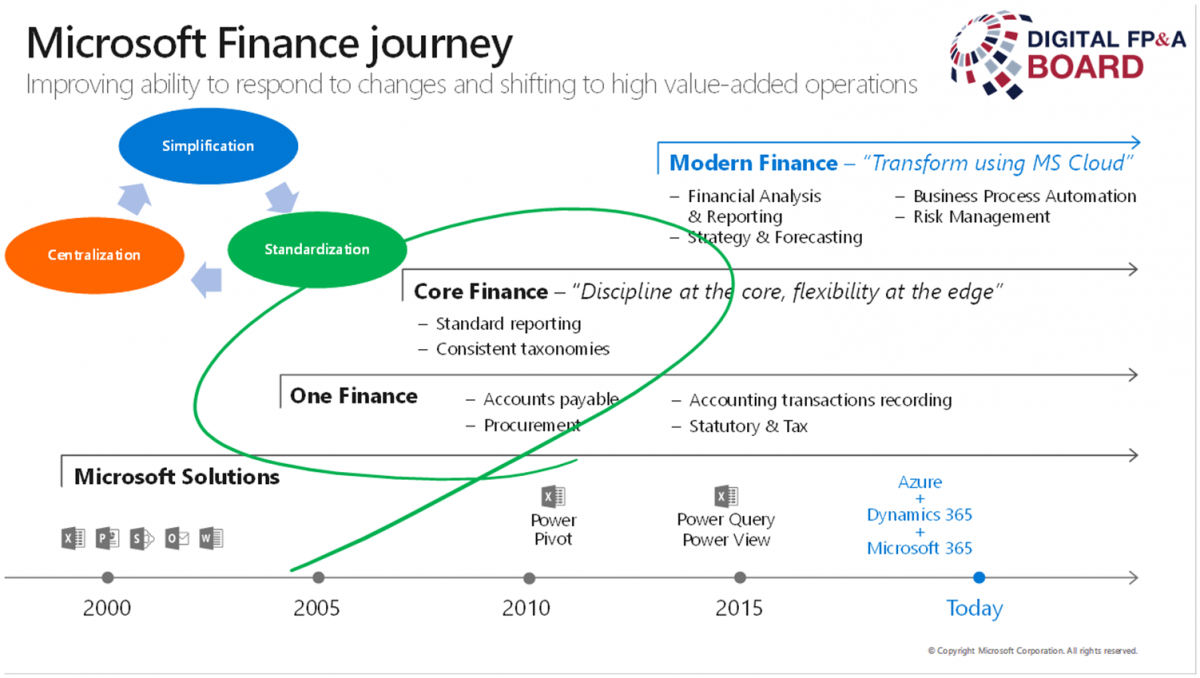

Microsoft Finance journey: Four stages towards automation

Of course, these changes did not happen in one day. Before we moved to Modern Finance where we leverage technology, we spent a huge amount of time to cleanse the data. Unless the data is clean, we cannot put the data and run an AI or ML model.

This journey started from the shared services centre (SSC) around the year 2000, where we consolidated our global routine task to three central hubs – in America, Europe and Asia.

Next comes the business process outsourcing (BPO) project, we call these stages "One finance" and "Core finance". At this stages, the main goal was to simplify, standardise and centralise the report and data that existed worldwide. During this BPO journey, the definition and taxonomies of the data are streamlined and standardised, and much cleaner at a worldwide level. This enabled the company to consolidate the data and review the data holistically across countries and vertically by-products and segments.

To accelerate centralisation and standardisation across the company, we discouraged each country to create their own local reports and encouraged them to use the one that is "centralised", or use the BI report that HQ centrally created. For example, at our quarterly business review, the data and metrics in the deck are based on the reports from BI created by HQ. We are not allowed to add any locally created metrics in the deck. It was a journey of trial and error and took time, but it enabled us to drive automation and, thus, move on to the next step we started around 2014 to the stage which we call “Modern Finance”.

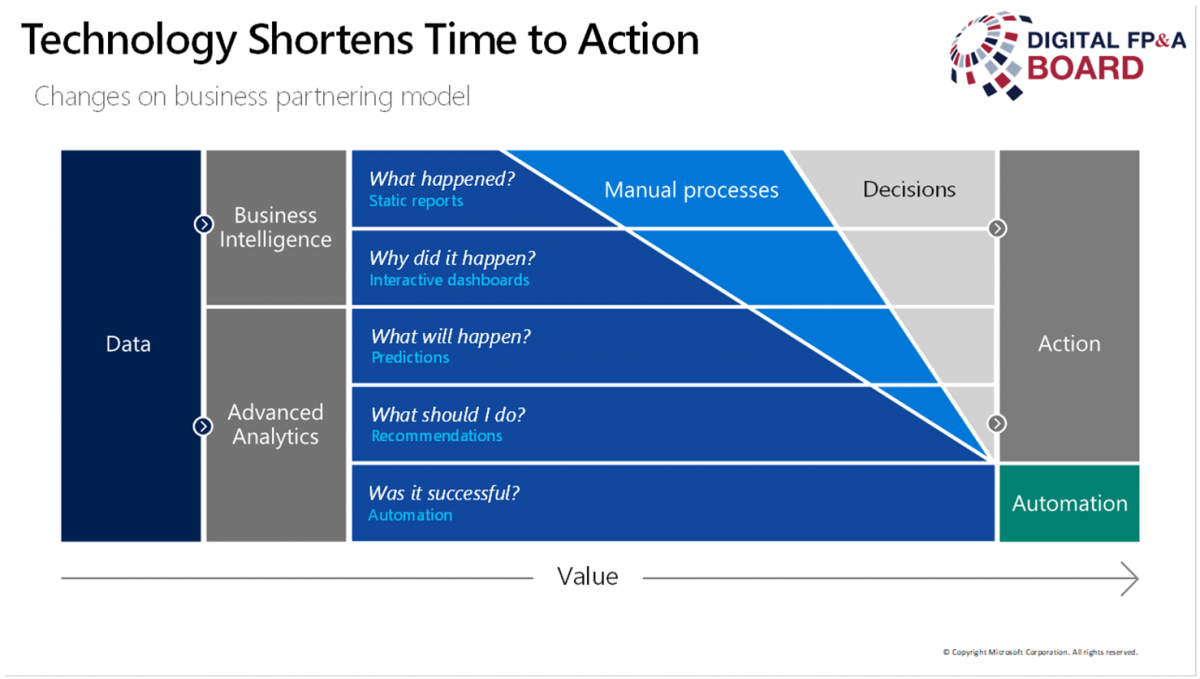

Practical recommendations: turning data into actions

Step 1: Prepare your data

At first, you need to clean up the data and create a single source of truth. Many companies are still in this data cleansing phase. Once data is clean and easily available, the company can start utilising business intelligence (BI) and advanced analytics.

Step 2: Utilise business intelligence tools

Excel is about static reports that could only tell what happened. They do not allow the drill-down capability and do not produce insights for the Business. Furthermore, the amount of manual process and work that the finance team has to put together to build these reports and then produce insights is huge and time-consuming.

On the contrary, Power BI is an interactive report. It makes meetings much more dynamic and helps understand why it happened on the spot and reduces the amount of manual processes in the daily reporting and analytics. In Japan, the Microsoft finance team follows the motto: "Don't bring back any homework". The BI tools help the team solve the problems within the meeting. In the past, if we were reviewing numbers from Segment A and the management asked about the same numbers in Segment B and Segment C, we did not have the data right away and needed to take time to prepare it in a couple of days. This delayed the decision-making process. The BI tool helped us immediately respond to such ad-hoc requests and drive business discussion with agility.

Step 3: Explore capabilities of advanced analytics

Although we achieved a lot of efficiency improvements with BI tools, we still could only look at the past and were not able to predict the future. Therefore, our next step was to leverage technologies and start looking at the future with advanced analytics:

Machine learning (ML) enabled us to learn from the past to predict the future. We can know what will happen. The distance between data and action is shorter, the amount of manual processes and human errors is lower. If you are interested to learn more about the use of ML in Microsoft, check out one of the FP&A Trends videos.

Machine learning combined with bots helped us understand what to do and move really fast from data to decision. For example, in compliance predictive analytics, AI/ML flags the unusual sales transaction and notifies the finance controller to check the detailed information on these transactions.

The below chart summarises the Microsoft transformation journey. The key message here is “Clean your data and turn it into action”. Being a modern finance professionals means adding value to the business in the fastest and most relevant way.

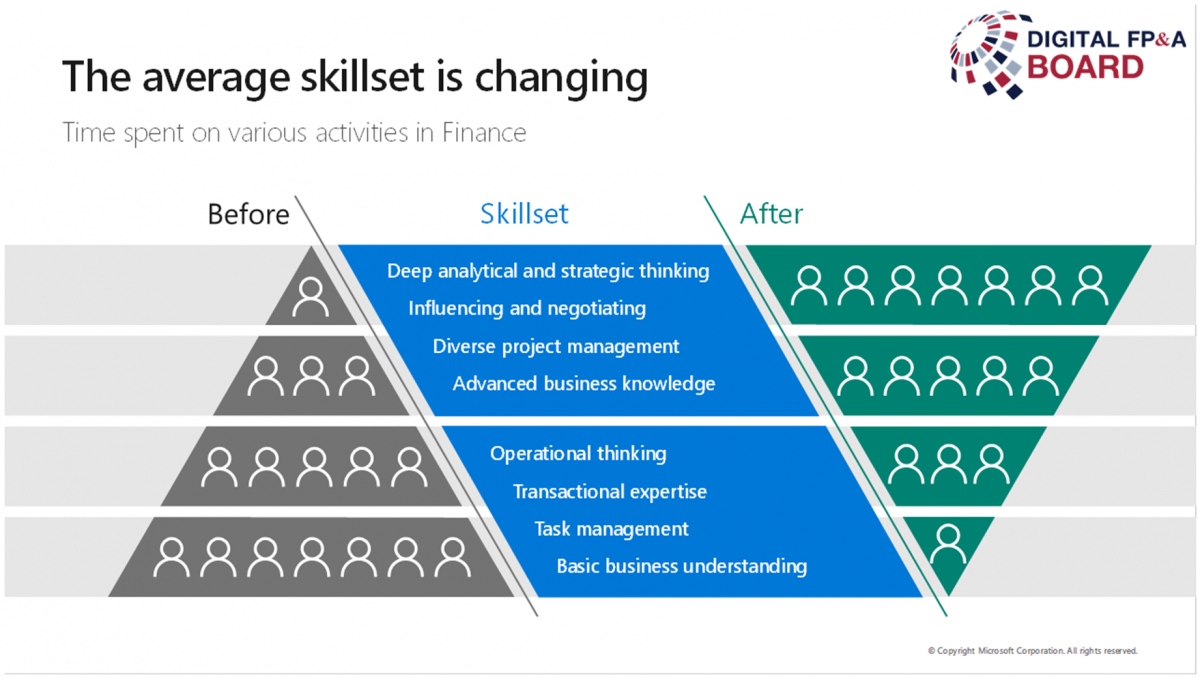

Step 4: Ensure that your team has the right skillset

Technology can automate things and accelerate your decision-making process, but you need a strong leader to drive this change, a process to run it and a team to make this change. The way we do business at Microsoft and how we interact with business partners is changing, so is the average skillset. Technology has freed up our time, but we now need to use this time wisely.

In the past, requirements for finance professionals were about operational thinking, expertise in handling transaction and task management. Now modern technologies have automated these tasks for you. Today’s skillset is about having deep analytical and strategic thinking, ability to influence business and negotiate. Finance professionals are expected to spend time on higher ROI tasks, provide a greater impact and, thus, drive business.

In summary

With modern technology, imagine just how big of role finance can play in business discussions and driving business with actionable insights. I am really excited about all the great changes coming for finance professionals.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.