Organisations are increasingly adopting data-driven approaches to decision-making. This is natural, given the amount of data...

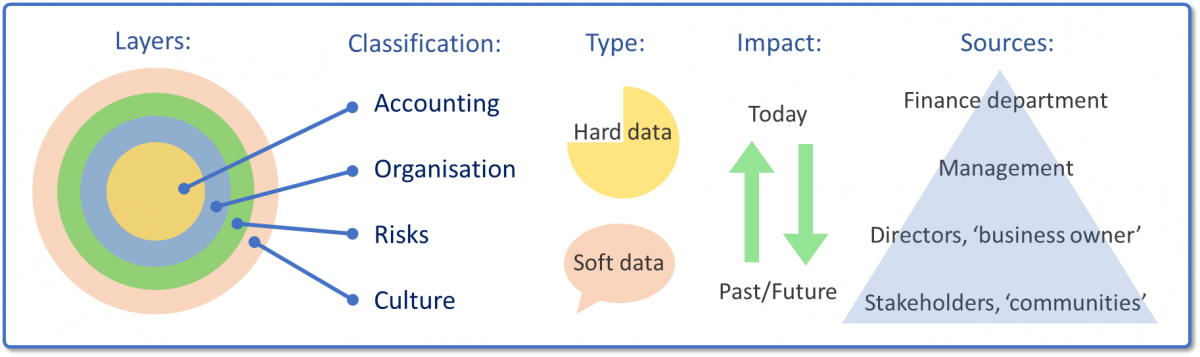

The financial numbers only show one side of the story. When professionals in Financial Planning & Analysis (FP&A) are presenting the complete story behind the numbers, soft data needs to be collected and incorporated. The big question is, what and where is that data? The answer can be found by classifying and layering information that would normally be available for businesses.

The financial numbers only show one side of the story. When professionals in Financial Planning & Analysis (FP&A) are presenting the complete story behind the numbers, soft data needs to be collected and incorporated. The big question is, what and where is that data? The answer can be found by classifying and layering information that would normally be available for businesses.

Hard data and soft data

Financial records provide a lot of data, accounting data. These are facts related to past and future obligations which are called hard data (e.g. 10.000 cars were sold in January). Soft data, on the other hand, is information derived from hard data (e.g. car sales have been steadily growing in the past 5 years). Essentially, soft data is based on the analysis of hard data. It appears through research and is often compiled by experts or key opinion leaders. Company related soft data is often in the hands of internal stakeholders, however, some data can be available in the public domain. For example, on the internet, in research papers or in analyst reports.

The following overview provides directions on where to look for relevant business information, beyond accounting.

Accounting data

The finance department processes all the accounting information from the general ledger to financial statements and financial ratios. They are responsible for the integrity of the data.

The organisation in numbers

This level contains the information necessary to understand the economic efficiency and operational effectiveness of the value chain for each product or market combination. Accounting information is matched with organisational data, like headcount or full-time equivalents (FTEs) for each of the functional departments to analyse efficiency. Assets can also be evaluated by looking at their (residual) value, productivity and time to substitute. Supply chain analysis involves ranking the key clients, points-of-sale and separate distribution channels by volume, quality and frequency.

Short-term and long-term risks

Risks are different for each business; however, the impact is not. This is because FP&A professionals will look at where each risk hits the balance sheet. In general, short-term risks originate from side-agreements, supplier product quality, client complaints, labour laws and production lines. These sources of risks are therefore directors, management, suppliers and clients.

Long-term risks often impact the business indirectly. For example, investment in new technology, loan payments, covenants and credit ratings will impact the future performance of the organisation. Other potential risks are lawsuits, market regulations, tax or budget regulation changes and also environmental issues. In the end, it is the person who owns the risk, in other words, is responsible for the risk, that will have the relevant insight into the inside information or soft data.

Business culture

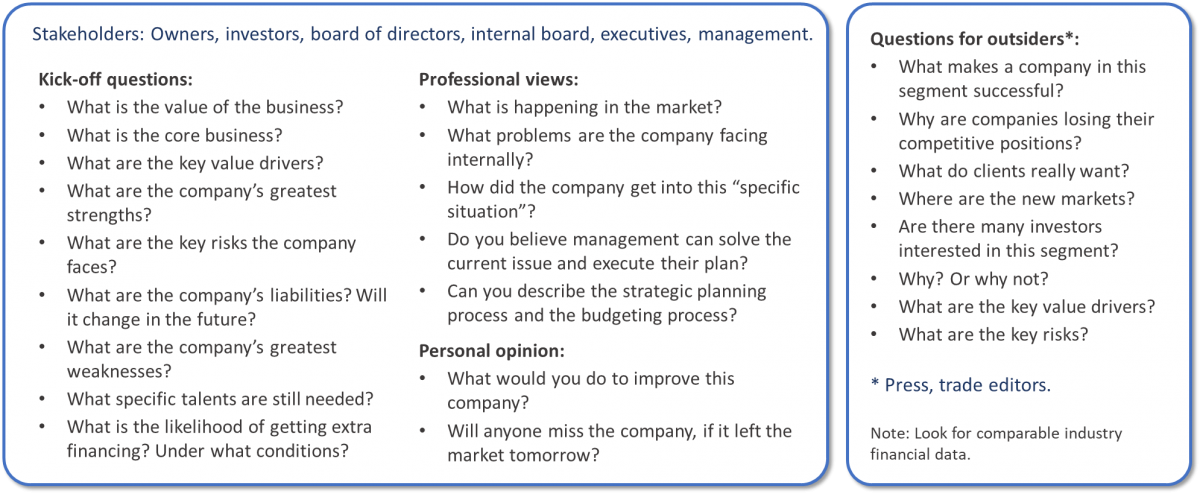

Today, stakeholders group together forming ‘communities’ of mutual support. These can extend to external parties with a broad scope. Each type of stakeholder will hold specific views and information which can potentially redirect the company’s strategy. Here is a list of questions for company stakeholders that will help unravel why certain strategic choices were made.

Case: Forecasting

A country manager was once replaced due to a lack of forecasting skills. No timely action was taken when sales slowed down and the rolling forecast was not adjusted accordingly. Company restructuring was delayed and new markets were left unexplored. The country manager was biased towards the future of the business and sacrificed the financial safety of the organisation as a result of wishful thinking.

Case: Business change

A family business changed its business focus in a period of 3 years, the cancelled the construction of a factory to triple production. The city council had decided that the industrial use of water in their region was to be charged at national rates. Research into the financial benefit experiences in other states that had already experienced this change showed that national production was unviable. Expansion into a new factory was therefore halted and the cash was used to invest in a different form of business before winding down operations completely.

Today, FP&A is often organised around budgeting and forecasting. It starts with hard data and ends with real concerns based on soft data. Advanced forecasting is the method of developing several different scenarios to help the company be prepared for every outcome. Rolling forecasts can even provide insight into the strategic thinking of the executive team. More soft data will lead to better profit predictions. In essence, securing this data shapes the role of a financial business partner and serves as an opportunity for finance to be involved with business strategy.

The article was first published in Unit4 Prevero Blog.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.