Public speaking is a critical skill for today’s finance professionals, and the author of this article...

What makes FP&A Storytelling truly impactful? How can organisations ensure they’re not only gathering data but transforming it into insights that guide and drive decisions? In an age of rapid data growth, understanding the right questions and tools, and having people to answer them is critical to financial storytelling.

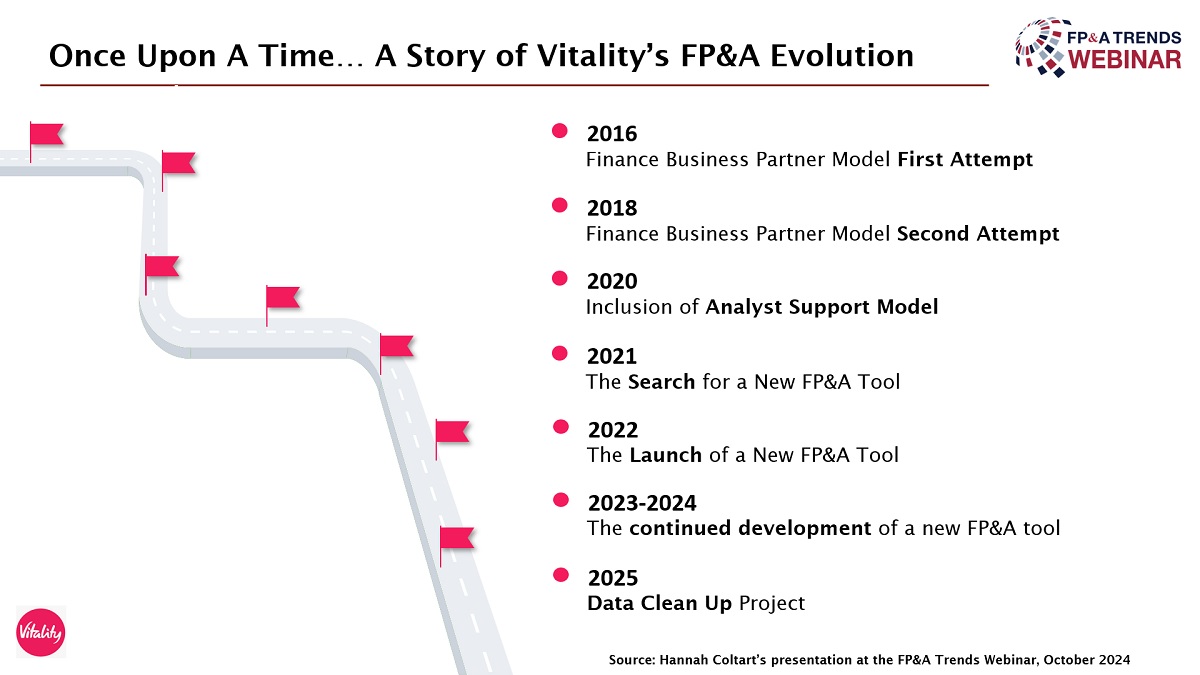

This article dives into Vitality Insurance’s two-decade journey to refine their Financial Planning and Analysis (FP&A) processes, highlighting how they tackled key challenges in data quality, technology integration, and talent development to build a narrative that resonates with stakeholders.

FP&A Storytelling: Vitality Insurance Case Study

During the webinar, Hannah Coltart, Director of Finance at Vitality Insurance, outlined Vitality’s FP&A Storytelling evolution over two decades. She began with Vitality's early days, from its launch as Prue Health in 2004 to becoming a leading UK health insurer, focused on incentivising healthier living. Through growth and acquisitions, Vitality adopted a shared value model, partnering with their ambassadors and sponsoring sports to encourage customer well-being. As this expansion complicated FP&A processes, the team refined its approach over the years.

Figure 1

In 2016, the initial Business Partnering model failed to deliver strategic insights. By 2018, Vitality’s FP&A saw improvements due to involvement of experienced partners. Later, analyst support teams were introduced to focus on data, but Excel’s limits prompted the shift to the one of respected planning software vendors, with an idea of enhancing reporting and insights. Hannah emphasised Vitality’s “people, data, and technology” framework, noting essential data accuracy, effective Business Partnering, and adaptive technology integration as keys to FP&A Storytelling. She highlighted the necessity of clear planning, strong implementation partners, and Change Management for successful transformation. With this foundation, Hannah envisions continued growth and innovation for Vitality’s FP&A.

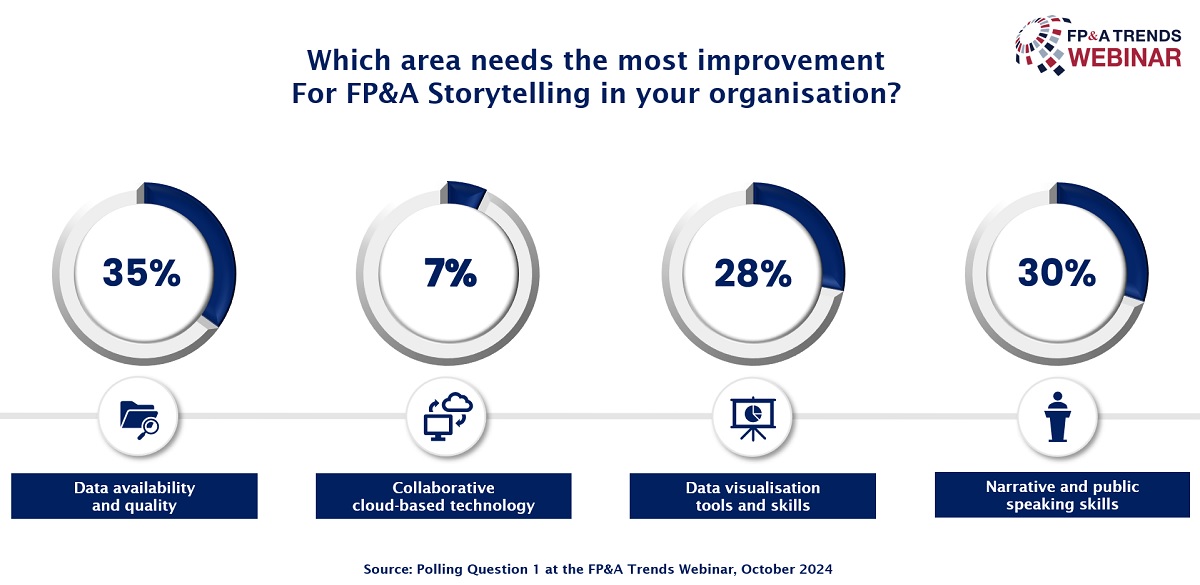

Which Area Needs Improvements in FP&A Storytelling?

The poll results revealed that 35% of respondents identify data availability and quality as the area most in need of improvement for FP&A Storytelling within their organisations. Following closely, 30% pointed to narrative and public speaking skills, while 28% highlighted data visualisation tools and skills. Finally, collaborative cloud-based technology was noted by 7% of participants. These insights provide an interesting snapshot of the priorities in FP&A Storytelling.

Figure 2

Leveraging Technology and Data for FP&A Storytelling

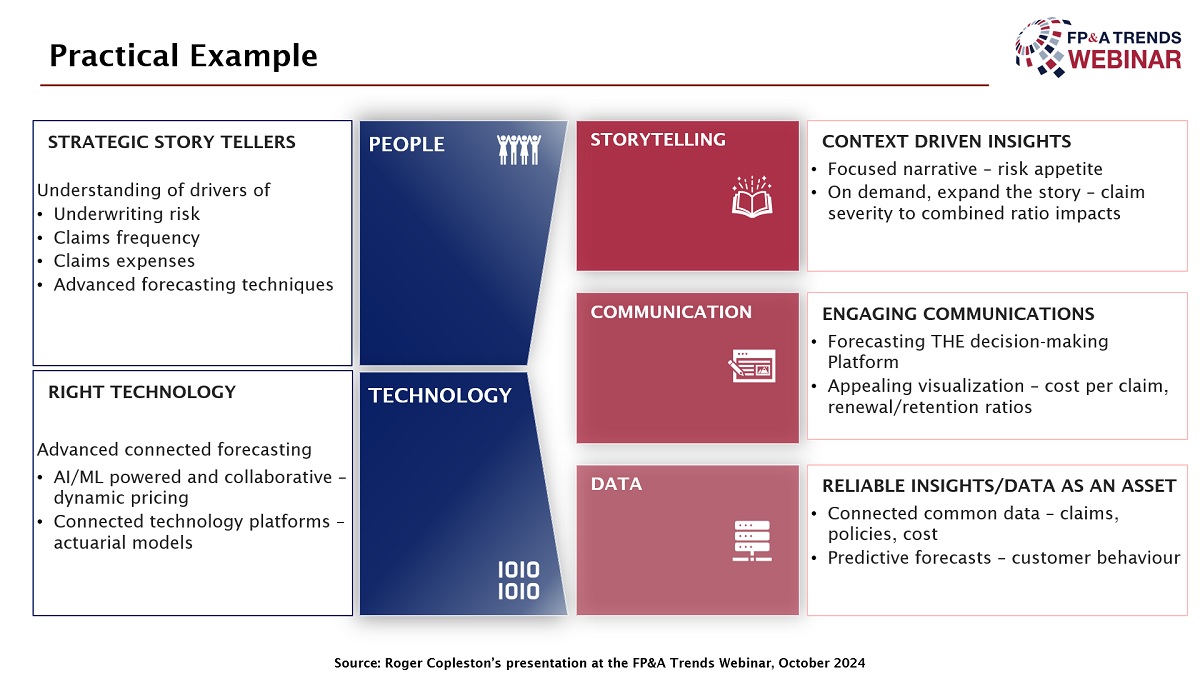

In his compelling presentation, Roger Copleston, Director of Planning Strategy and Transformation at Anaplan, broke down key elements for effective FP&A Storytelling based on clients’ experiences. Unlike traditional models, he introduced a framework focusing on how people, data, and technology intersect to enhance FP&A Storytelling. Roger emphasised that FP&A professionals should be freed from data reformatting tasks, allowing them to focus on high-value discussions with stakeholders. He stressed the importance of choosing technology that supports advanced forecasting, collaboration, and automation through tools like Machine Learning (ML) and Predictive Analytics. Companies can reach the "single source of truth," essential for confident, fact-based storytelling when they have credible, integrated data.

Figure 3

Roger also noted that communication style is crucial. Understanding stakeholders' preferences, whether visual or narrative, creates stronger engagement and transparency. He illustrated how FP&A Storytelling drives insights for industries like insurance, telecom, and banking, shifting decision-making from reactive to proactive. Ultimately, Roger underscored that FP&A Storytelling isn’t just about data or technology; it's about creating compelling narratives that connect with stakeholders’ needs and enhance business outcomes.

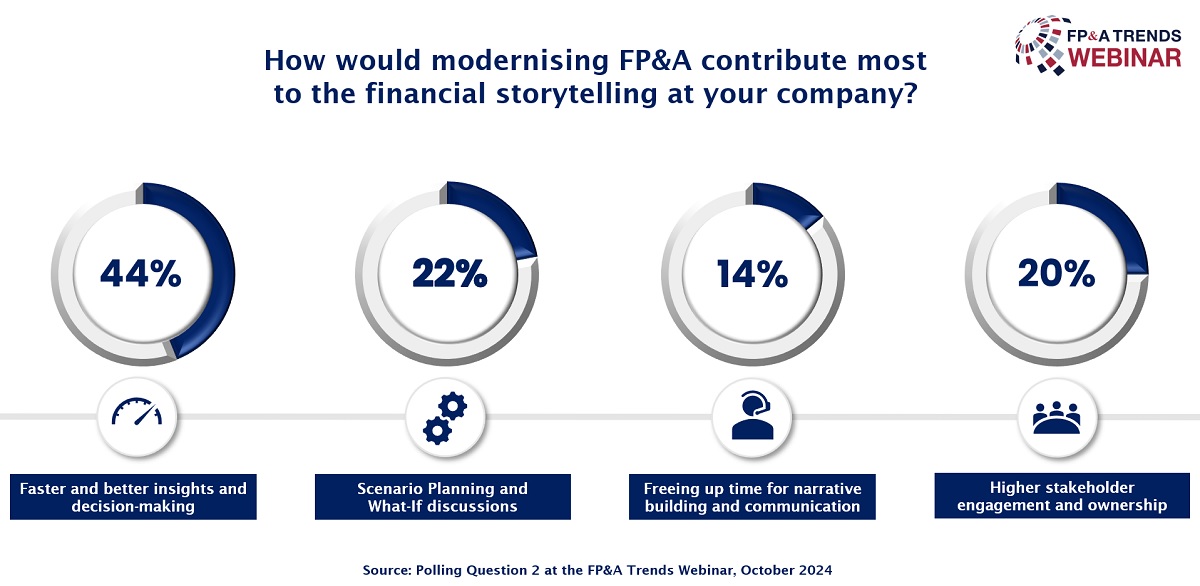

How Can Modernising FP&A Contribute to Financial Storytelling?

The poll results show that 44% respondents believe that modernising FP&A would primarily enhance financial storytelling through faster, better insights and decision-making. In the second place, 22% see Scenario Planning and "what-if" discussions as the key benefit. Meanwhile, 20% identified higher stakeholder engagement and ownership as a top contribution, and 14% noted that modernisation would help free up time for narrative building and communication. These insights highlight the diverse ways modernisation could support impactful FP&A Storytelling.

Figure 4

Conclusions

The case study of Vitality Insurance underscores that effective FP&A Storytelling is built on three foundational components: quality data, advanced tools, and skilled people. Good-quality data serves as the backbone, ensuring insights are trustworthy and decisions are well-informed. Without reliable data, even the most well-thought-out FP&A processes and tools can fall short of delivering robust analysis and clear insights.

Equipped with the right tools, FP&A teams can transform data into visually engaging and easily digestible insights. Yet, it's ultimately the people who bring the story to life: those who interpret the data and build the narrative. Skilled FP&A professionals understand the business context and stakeholder preferences, allowing them to tailor communication that fosters transparency and engagement. Together, these elements create a dynamic FP&A Storytelling framework where technology and data provide structure, and people give meaning, enabling organisations like Vitality to communicate their financial journey effectively and impactfully.

To watch the full webinar recording, please check out this link.

This webinar was proudly sponsored by Anaplan.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.