On 7 November 2023, the Geneva FP&A Board had its 15th meeting, which attracted 40...

Let’s imagine your Business Partner has given you a task to perform a deep dive into their portfolio's profitability, or you have been assigned a project to evaluate growth opportunities for your business.

You have vigorously jumped on the task, spent hours and hours analysing numbers, reading articles, going through history, talking to other people around you, and consolidated it into a report… The only thing you got from your Business Partners was something like “I don’t understand what you are saying” or “What’s the key takeaway?”. I know it’s disheartening and disappointing as you start thinking, “How come they did not understand it? I have spent endless hours analysing, preparing, and giving my recommendations. What was there not to understand?”. We all experienced something similar at some point in our careers, as most probably very few people were born with natural storytelling and data/business analytics skills simultaneously.

Why Is Storytelling So Important?

Why is it one of the critical traits of a successful Finance Business Partner?

We can all agree that we don’t remember too much from childhood, but we do remember fairy tales. Why? Because they were told as a story, and you remembered the key components: “Good defeated evil”; “Prince has defeated the dragon and married a Princess, and they lived happily ever after.” You probably have already got the gist of it. Storytelling has an easily understandable start/entry, mid-part (which can encompass issues, business case and performance), and memorable ending (e.g., key takeaway, suggestions, conclusions, call to action). One wise person said:

“No one ever made a decision because of a number. They need a story.”

What does this mean in the context of being a finance professional? Being a data analyst, having all the technical skills only gets you up to a certain level, as there will always be a request to “interpret” the numbers into “Business Partner’s language” so that even leaders with non-financial backgrounds can understand it. I feel that one sub-set of this skill is essential for any finance person, especially those who work in Financial Planning and Analysis (FP&A). And that is to put numbers into CONTEXT = BIG PICTURE = WIDER STORY.

Here is a simple example. Let’s imagine you own a performance of Product A, which has generated specific revenue for the current quarter. Your task is to compare it to a set annual plan for that quarter, which was done six months ago.

Figure 1: Revenue Performance of a Product A

The usual pattern or behaviour that we tend to see from the business analyst is as follows:

“Product A has achieved 102% of the plan. We have done very well and exceeded our plan, which is an awesome result! Let’s move on to another Key Performance Indicator (KPI), which is already checked as “GREAT”.

But where is the CONTEXT?

There are a few things we need to ask ourselves prior to answering this question:

- What is the internal performance?

- What is the internal relative performance?

- What is the external relative performance?

Based on the example above, we should be at least considering the following to wrap a story in the appropriate context:

What Is the INTERNAL Performance?

How can it be compared to the official plan:

- yes, we did OK, and we were at 102%, but:

- 2% is usually a rounding/coincidence range, which indicates Product A ended up close around the plan. If so, it could result from coincidence or proper planning or…

- Or we could have easily ended up 2% below the plan. What would be the language then? How would we describe the 98% performance? Something like “almost on the plan,”; “flat to plan,” or “slightly below plan”? Humans naturally like good stories instead of raising problems!

- We may compare it to a “special” plan, something like an internal team’s stretch plan, which was done later than the annual plan. This “special” plan may resemble more of an “ambition” of what the team can achieve.

What Is the INTERNAL RELATIVE Performance?

Internal-relative performance presupposes comparing this 102% to your business performance in other periods. We can also compare it to the existing internal competition.

- Comparison versus Prior Year, usually referred to as Y/Y, YY or YoY, helps to understand the growth of the business while taking into account seasonality. In terms of seasonality, we understand achieving the results in the same period mainly under the same external conditions, such as school holidays, Christmas, the government's last budget quarter, the same weather, etc.

- Comparison versus Prior Quarter, usually referred to as Q/Q, QQ or represents the direction of the performance. It is primarily used in “recovery” times, when we want to see if the business is picking up from the bad season, unprofitability, revenue decline, etc.

- Comparison versus other internal sections of the company, such as the same region or Route to Market for similar Products, categories with a comparable structure, audience, competition, market, customer base, and more. Putting things into context reveals the actual performance vs. internal “competition.”

What Is the EXTERNAL RELATIVE Performance?

Traditionally, it is a comparison between “your” market and competition. The insights on the external relative performance can be published by official agencies such as IDC, Gartner, GFK, Context, and others. However, there are multiple other sources for different industries. If you grow your business premium to the market, you certainly grow your market share. But if you grow your business with a gap in the market, you may lose share to your competition.

Another comparison could be made to your competitors' financial statements, which can be obtained via the investor relations websites of respective companies, provided they trade publicly. You can compare the financial statements and other disclosures across multiple companies and draw a complete picture of the performance of your business.

So, How to Wrap a Story in the Context?

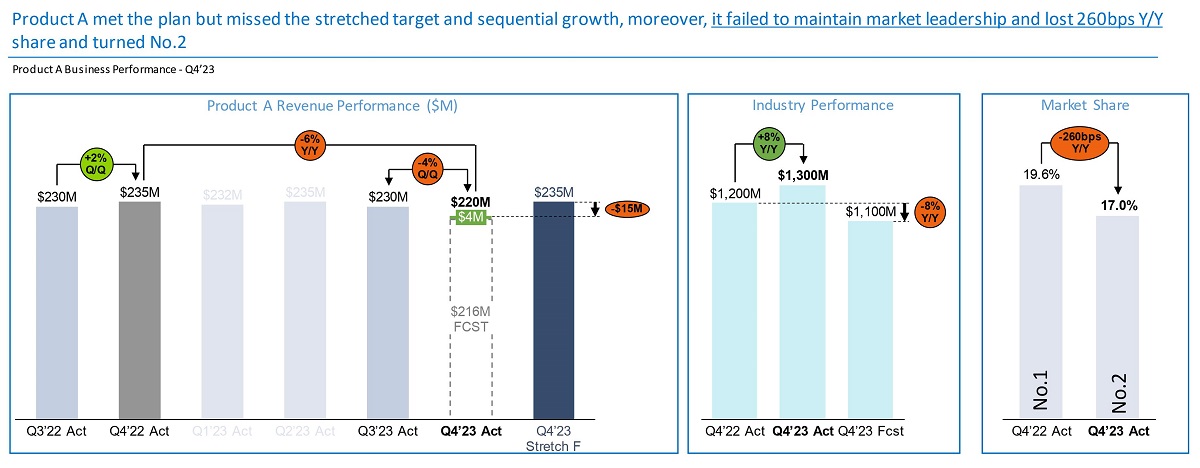

Let’s consider an example of how your story should look when you are going to describe the performance, as indicated in Figure 1. The sample provided in Figure 2 is not exhaustive and only indicative.

Figure 2: A Figurative Example of Performance Storytelling

Start/Entry

- Product A revenue finished the current quarter at $220M, which is down 6% Y/Y and 2% above the annual plan for the current quarter.

Plot

However, there are a few key observations I would like to point out to complete the overall picture of Product A performance:

- Stretch Plan: we did not achieve our internal stretched target of $235M, as we knew the market conditions had improved since our original plan.

- Sequential growth: Seasonally, we were able to grow from Q3 to Q4, but this year, we did not manage sequential growth, and we declined 4% Q/Q.

- Market: The original projection of market performance predicted a decline of 8% Y/Y. It was in line with our revenue forecast decline of 8% Y/Y as we assumed to keep our share flat on the same period basis. However, the market turned out to be much better. We should not have been surprised as we set our Internal Stretch Target already higher based on that assumption, and the market grew 8% Y/Y. Bad news: it means we lost ~260bps share Y/Y and became №2 in the market. Yikes, that hurts!

Call to Action

Overall, we beat our annual plan, but the market dynamics improved, and we were unprepared to react to those changes fast enough. As a result, we lost our №1 position to the competition. We need to review our processes, such as faster reaction to the pricing changes of our competition, improve our distributors' sell-out, align with our supply chain for more agile inventory management, and many more. That’s it! You have a story with a meaningful impact and actionable takeaways.

Conclusion

The HBR Research1 shows that storytelling can help us captivate people’s attention and inspire them to act. It is one of the essential human traits. The harder the situation, the more essential an action is. The French philosopher Blaise Pascal once apologised for writing a long letter, explaining that he didn’t have time to write a short one. The ability to tell a concise story to your Business Partner will make you stand out among your peers and showcase that you can take on a more advanced role in the future!

References:

1 – FREI, Frances X., MORRISS, Anne. "Storytelling That Drives Bold Change: How to Craft a Narrative That Matters." Harvard Business Review. November–December 2023, from the Magazine. https://hbr.org/2023/11/storytelling-that-drives-bold-change

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.