FP&A establishes the foundation for thinking and learning about how processes affect outcomes. These actions can...

Introduction

In the dynamic world of Financial Planning & Analysis (FP&A), professionals are often tasked with communicating complex financial data and strategic plans to stakeholders. A structured approach is essential to ensure clarity and effectiveness in these communications. One such approach is the SCQA framework, which can significantly enhance the quality of business communication and decision-making processes in FP&A.

The SCQA framework originated in management consulting, where it was used to structure problem-solving and communication processes. It was popularised by Barbara Minto, a former McKinsey consultant, in her book "The Pyramid Principle." The framework is based on the idea that every business communication should start with a situation, followed by a complication that creates a question and then an answer to that question. This structure helps to capture the audience's attention and guide them through the thought process logically and coherently.

In the context of FP&A, the SCQA framework can be used to structure financial reports, guide decision-making processes, and communicate strategic plans. It is particularly relevant in today's business environment, where FP&A professionals are expected to play a strategic role in guiding business decisions.

Concept of SCQA as a Problem-Solving Framework

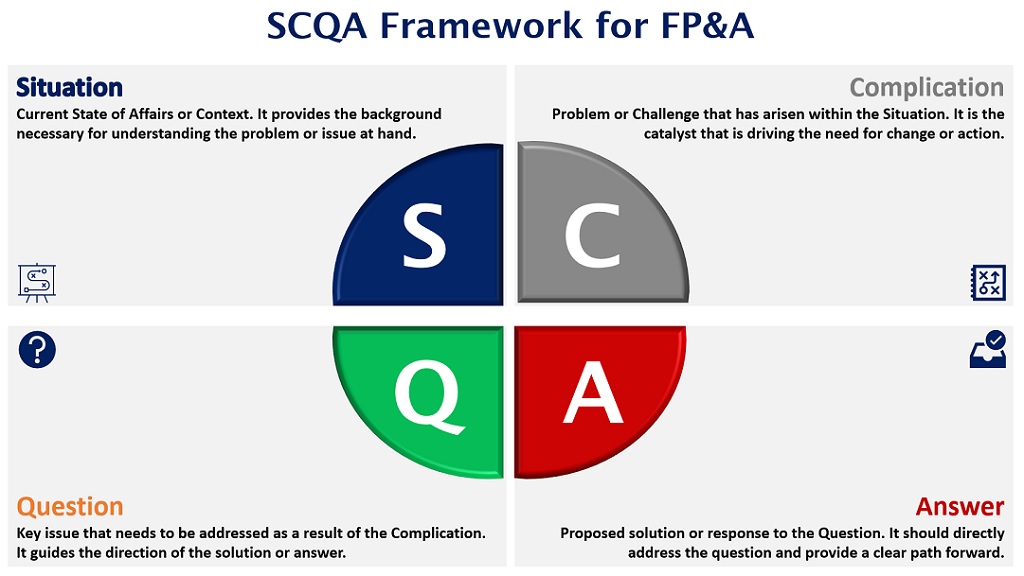

SCQA stands for Situation, Complication, Question, and Answer. This framework provides a logical structure for presenting information, making it easier for the audience to understand and engage with the content.

Figure 1

In the SCQA framework, the "Question" component is critical. It serves as the bridge between the problem (Complication) and the solution (Answer), guiding the direction of the analysis and decision-making process. A well-framed question can help FP&A professionals focus their efforts, identify the most relevant data, and develop effective solutions.

Sample Case Study of SCQA for FP&A

- Situation

A leading US-based company has been enjoying steady growth and customer acquisition over the past few years. However, recent data analysis reveals an unexpected uptick in the customer churn rate over the last two quarters.

- Complication

The rising churn rate, unevenly distributed across geographies, customer segments, and product offerings, threatens the company's recurring revenue and growth projections. External factors like increased competition and macroeconomic trends add to the complexity. If unchecked, this trend could significantly impact profitability and necessitate a reevaluation of financial forecasts and strategic plans.

- Question

The key question arising from this complication is: How can the company address and reverse the increasing churn rate to protect its recurring revenue and ensure sustainable growth? This overarching question can be broken down into several sub-questions:

- What are the primary drivers of the increased churn rate across different geographies, customer segments, product offerings, and platforms?

- How does the churn rate vary by entry price point? Are customers at certain price points more likely to churn?

- How does our churn rate compare to industry benchmarks and competitors? Are there industry-wide trends or macroeconomic factors contributing to the increased churn rate?

- What are the potential impacts of recent technology breakthroughs or changes in the competitive landscape on our churn rate?

- What strategies can be implemented to improve customer retention, and what would be the cost implications of these strategies?

- How can we measure the effectiveness of the implemented strategies in reducing the churn rate?

- Answer

The FP&A professional proposes a data-driven approach to address this issue. This includes:

- Conducting a deeper financial analysis to understand the impact of churn rate across different geographies, customer segments, product offerings, and platforms. It would involve segmenting the churn rate data and identifying high-risk segments.

- Analysing the profitability of different customer segments and product offerings to determine if there are specific areas where the company should focus its customer retention efforts.

- Collaborating with the sales and marketing teams to understand the competitive landscape and industry benchmarks. This could help identify external factors contributing to the churn rate and inform the company's strategic response.

- Developing financial models to assess the cost-effectiveness of various customer retention strategies. It could involve forecasting the potential impact of these strategies on the churn rate and the company's bottom line.

- Tracking and reporting on the churn rate key metrics regularly to measure the effectiveness of the implemented strategies and make necessary adjustments.

Benefits of SCQA Framework for FP&A

1. Clear Communication

FP&A professionals often need to communicate complex financial information to stakeholders who may not have a financial background. The SCQA framework can help structure this information clearly and logically, making it easier for others to understand.

2. Strategic Planning & Decision-Making

The SCQA framework can guide decision-making processes as it helps identify and potentially address key business issues. It provides a structure for considering the current situation, identifying potential complications, formulating key questions, and developing strategic answers.

3. Problem-Solving

The SCQA framework is excellent for problem-solving. FP&A professionals can focus on finding the most effective answer or solution by defining the situation, complication, and question clearly.

4. Efficiency

By providing a clear process to follow, the SCQA framework can help FP&A professionals work more efficiently. This can save time and ensure that all important aspects of a problem or situation are considered.

5. Presentations and Reports

The SCQA framework can provide a clear structure when creating financial reports or presentations. This can make the information more digestible for the audience, whether it's a team meeting, a board presentation, or a report for investors.

Practical Challenges in Leveraging SCQA Framework

1. Asking the Right Question

One of the first challenges that FP&A professionals might grapple with when employing the SCQA framework is determining the central question that anchors the entire analysis. Complex issues often present many questions, which, while all relevant, can detract from a focused analysis. In such scenarios, zeroing in on the most pertinent question can be challenging.

2. Overuse or Misapplication of the Framework

SCQA framework is a powerful framework when applied to the right problems. However, a common pitfall is trying to fit every situation into the SCQA mould, even when it's not warranted. Not all business scenarios require this level of structured analysis. For straightforward issues or those not directly tied to a complication requiring a strategic solution, the SCQA framework might lead to over-complication or unnecessary use of time & resources. Discerning when to use the SCQA framework and when a simpler or different approach is needed can be a significant challenge.

3. Overcoming the Hurdle of Habit

Introducing the SCQA framework might encounter resistance to change, especially in established working culture. Ensuring all stakeholders are on board and see the value in this framework can feel like an uphill battle.

Conclusion

The SCQA framework is a powerful tool that can enhance the effectiveness of FP&A professionals. By providing a structured approach to communication and problem-solving, it can help FP&A professionals communicate more effectively, make strategic decisions, and solve complex financial problems. As the role of FP&A continues to evolve, tools like the SCQA framework will become increasingly important in helping professionals navigate the complexities of the business environment.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.