Being a business partner will increase your scope and you will be more dependent on others...

Working in FP&A is one of the most dynamic & challenging careers in the finance and business world. It appears that FP&A professionals wear multiple hats, performing tasks of a master of communication, a strategic leader, a resource allocator as well as a positive influencer. However, nowadays, we experience a lack of mature theories and models facilitating FP&A professionals’ development.

Working in FP&A is one of the most dynamic & challenging careers in the finance and business world. It appears that FP&A professionals wear multiple hats, performing tasks of a master of communication, a strategic leader, a resource allocator as well as a positive influencer. However, nowadays, we experience a lack of mature theories and models facilitating FP&A professionals’ development.

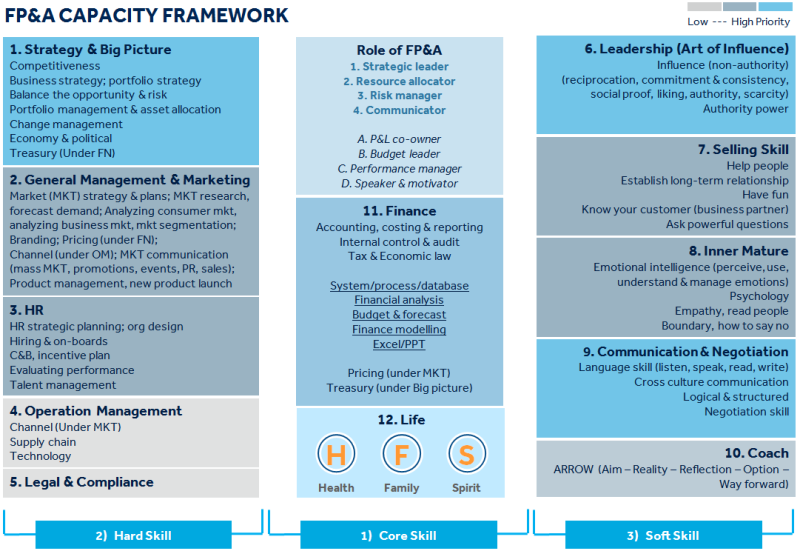

As a result of FP&A practice combined with MBA curriculum, an FP&A capacity framework was developed to facilitate:

- FP&A professionals understanding of the core, hard and soft skills essential for business partnering.

- Identification of the individual knowledge-performance gap and defining the areas of improvement.

- FP&A team development through the application of talent selection criteria.

Capacity Framework

The framework consists of 13 modules that fall into three sectors – core skills, hard skills and soft skills.

Core skills reflect the roles an FP&A professional plays in an organisation. Furthermore, they comprise the critical financial knowledge & skills used in daily practice. Module 12 extends far beyond work, helping us rethink our health, our families and our spiritual growth. It is about finding the life balance for every business partner who, on the one hand, dedicates plenty of time and energy to developing their careers and, on the other hand, securing the foundation of their work.

As everyone knows, the FP&A role is a mixture of hard skills and soft skills. A trust-based relationship helps us fit into the organisation while the quality of our business advice creates values. We summarise hard skills (5 modules) to demonstrate what other knowledge an FP&A professional should master and soft skills (5 modules) to explore what soft skills may contribute to success.

It is clear that these 13 blocks do not have the same priority, we rank the priorities and fill “more important” blocks in blue.

Finance

Financial skills mainly fall into three categories:

- Fundamental skills: including accounting, costing, reporting, internal control, audit, tax, economic laws, etc. Most FP&A professionals take various roles before they join this role, such as audit, controllership, marketing, sales operation, etc.

- FP&A core skills: including the understanding of the system, business process, database; financial analysis; budgeting & forecast; finance modelling; an advanced user of Excel, PPT, etc.

- Other skills: including pricing, treasury and others facilitating business decisions.

Strategy

Hardly anyone would argue that to become a true business partner. One should have strategy & big picture, FP&A most essential capabilities. Senior FP&A professionals constantly immerse widely and deeply in business with a high portion of time allocated for strategic analysis and planning.

HR

Most business decisions should consider both financial and HR impacts. For example, target setting always links with incentive discussion. Future Finance & HR business partners will share more similar capacities & knowledge to build up integrated business solutions mutually.

Leadership (Art of Influence)

The influence level decides the financial business partner level. One good way to gain influence is to take an NGO (like church) leader and influence others positively without power.

Communication & Negotiation

Communication and negotiation are crucial and time-consuming soft skills. Just imagine how time-consuming it is to learn a foreign language and present it in a logical & structured way. If there is a big gap in this section, take action as early as possible.

Coach

Coach has two meanings here. First is finance coach for business & supporting functions. Some FP&A professionals host finance seminars to develop the business team’s finance acumen. This creates the culture of “take finance into every business decision” and at the same time helps these FP&A gain trust quickly. Second, an FP&A always takes the role of a personal coach for their business partners, helping them achieve their potential.

Framework Application

This framework may also be applied as a development tool for FP&A professionals to identify knowledge - performance gap, analyse this gap and define the areas of improvement.

Example:

This example helps you sort out where the main gaps come from and develop an action plan to strengthen your weakness areas and further develop your strong points.

An FP&A development is just a start-up, and the road ahead will be long with no end. Financial organisations of tomorrow will be leaner and business-driven. To achieve this, financial professionals should continuously develop not only in finance & business fields but also master influence skills, strategic thinking as well as work-life balance. Hope this sharing will cast light on your potential and boost your career.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.