This article provides an overview of the topics and cases presented and discussed by the expert...

In today's dynamic business environment, transforming FP&A departments from mere data providers to strategic Business Partners is imperative for organisational success. This topic was discussed at the recent FP&A Trends webinar “Digitised FP&A Business Partnering: The Formula for Success”, featuring insights from industry leaders like Frédéric Labey, Harsh Amarasuriya, and Ben Page.

This article delves into their perspectives and practical advice, offering a roadmap for FP&A professionals striving for excellence in an evolving business environment.

Turn-Around FP&A Teams and Perspectives

In the webinar, Frédéric Labey, Group CFO – France at dentsu International, shared insights from his diverse industry experiences, emphasising the common initial immaturity in FP&A departments he encountered.

Often, these departments operated in silos, struggled with outdated Key Performance Indicators (KPIs) and lacked business acumen, primarily staffed by accountants. FP&A was more of a data provider than a strategic advisor, leading to low influence and exclusion from key business forums.

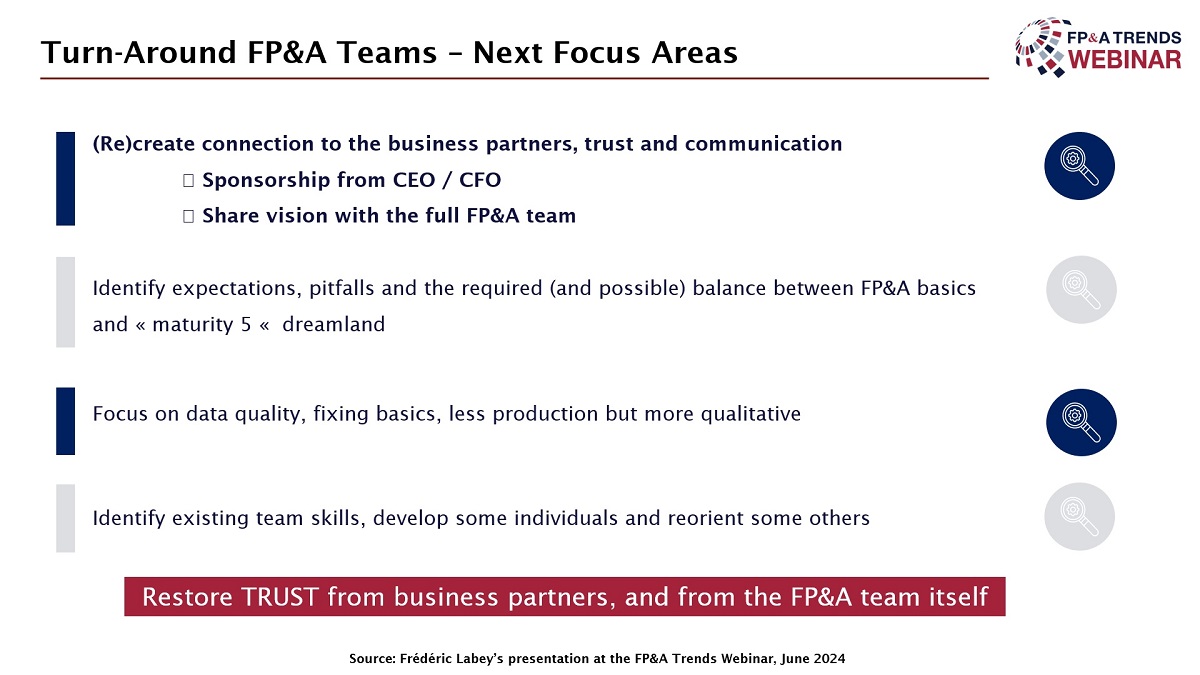

Frédéric highlighted the necessity of building trust and communication with CEOs, CFOs, and business leaders to turn around FP&A functions. His approach focuses on connecting FP&A with Business Partners, ensuring quality data, and fixing basics before aiming for advanced maturity. He stresses the importance of clearly defining responsibilities within finance, creating strong relationships between FP&A members and their Business Partners, and embracing system automation for efficiency.

Figure 1

Frédéric also advocated for finance training for non-finance staff to build a foundational understanding and foster trust. He underscored the need for diverse skill sets within FP&A teams, including analytical, IT, and Business Partnership skills, to evolve with technological advancements like Artificial Intelligence (AI).

Overall, his strategy revolved around building a robust infrastructure and network within the organisation for effective FP&A operations.

Which Maturity Angle Should Be a Priority When Addressing Turn-Around FP&A?

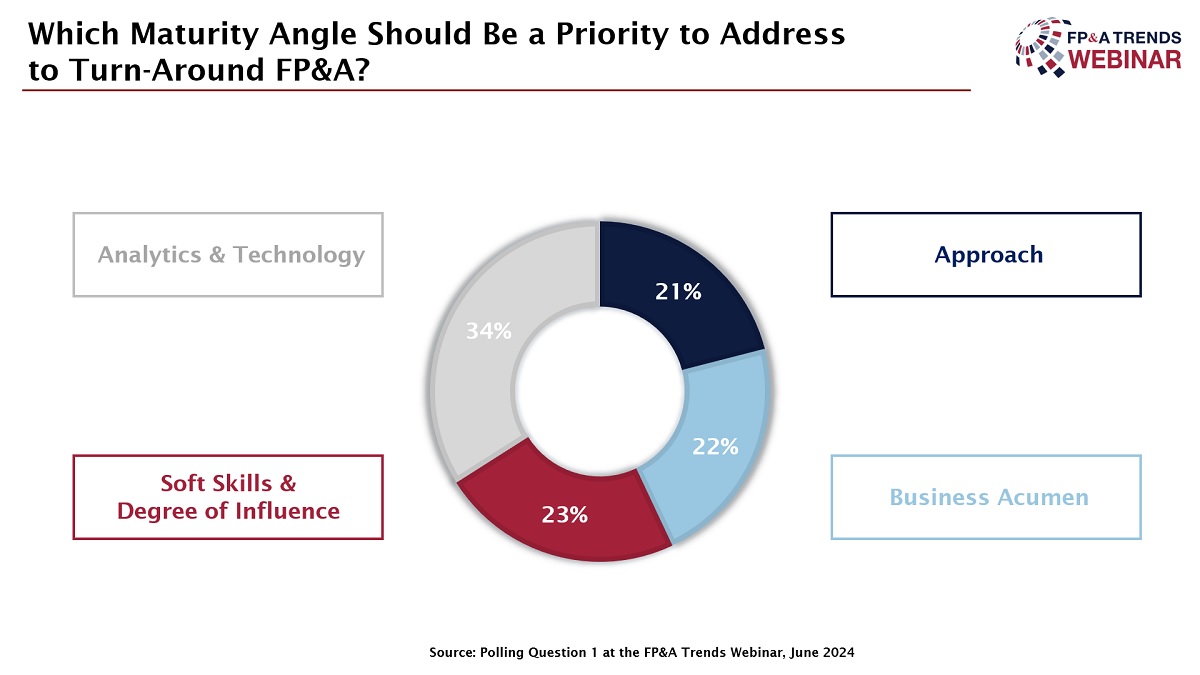

Most of the webinar audience (34%) sees analytics and technology as a main priority. In comparison, soft skills and degree of influence, business acumen and approach have gained 23%, 22% and 21% respectively.

Figure 2

Are Non-Financial Indicators More Important than Pure Financial Performance?

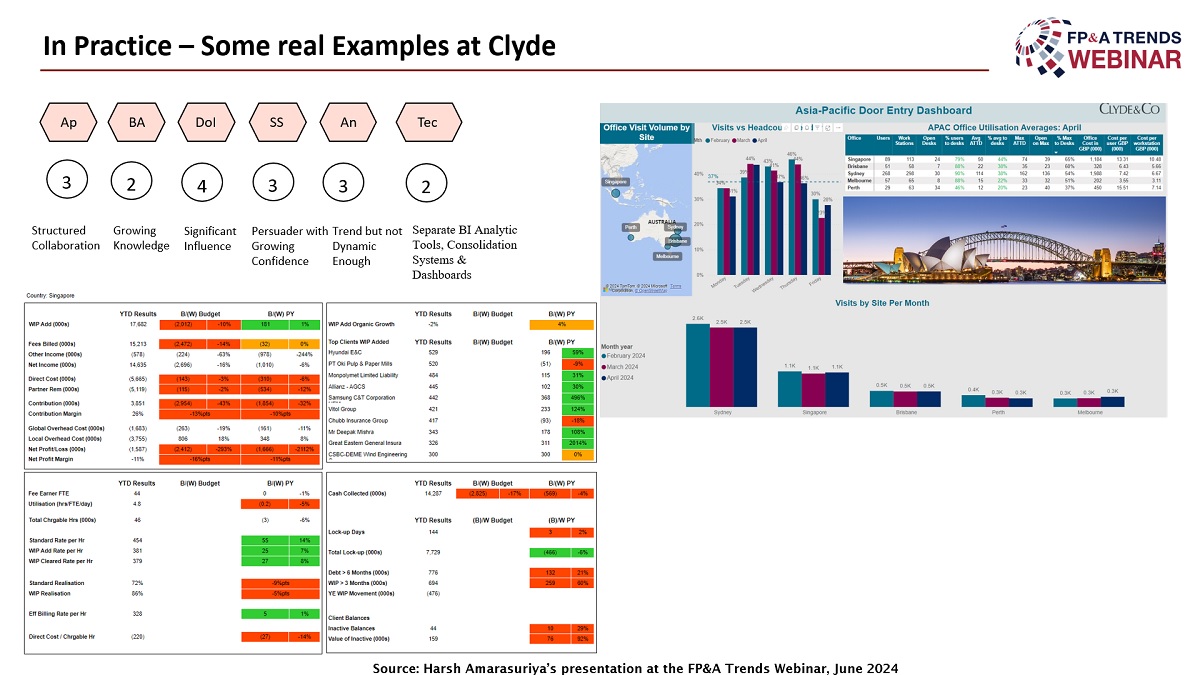

In his compelling presentation, Harsh Amarasuriya, Global Head of FP&A at Clyde & Co, emphasised the importance of a holistic approach to metrics and dashboards, grounded in the balanced scorecard concept introduced by Harvard professors in 1992. This approach encourages cross-functional decision-making by focusing on multiple business facets. At Clyde, Harsh applies this concept using four fundamental perspectives: financial, customer, internal business processes, and learning and growth.

Financial metrics, such as revenue and margin, are well-understood and widely used. However, integrating customer metrics like satisfaction and Service Legal Agreement (SLA) compliance introduces a broader perspective. Harsh differentiates between lead indicators, such as the number of new projects, and lag indicators, like customer satisfaction, to predict and analyse financial performance.

He stressed the significance of people metrics in professional services, monitoring aspects like turnover and morale, which are crucial but complex to measure. Post-COVID, Clyde uses technology to visualise data, such as office utilisation, linking it to productivity and morale.

Figure 3

Harsh illustrated how FP&A can paint a comprehensive picture for non-financial stakeholders, aligning metrics with business objectives. By mapping Clyde's progress on a maturity curve, he highlighted areas for improvement and underscored the evolving role of FP&A in driving strategic value.

How Strong Is the FP&A Team's Understanding of the Organisation and Business Environment?

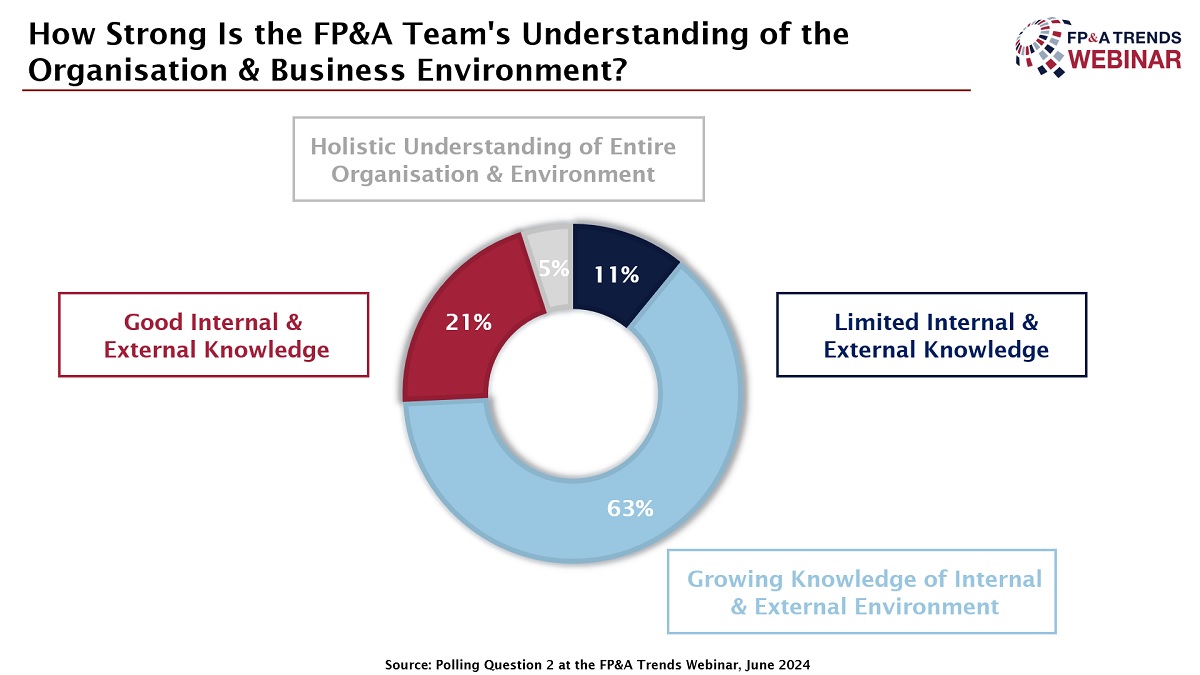

Most of the audience (64%) describes their level of knowledge as “growing,” while another 21% characterises their level of knowledge as “good.” 11% admit that their FP&A team has limited internal and external knowledge, and only 5% believe their knowledge level is “holistic.”

Figure 4

Technology’s Role in Enhancing FP&A

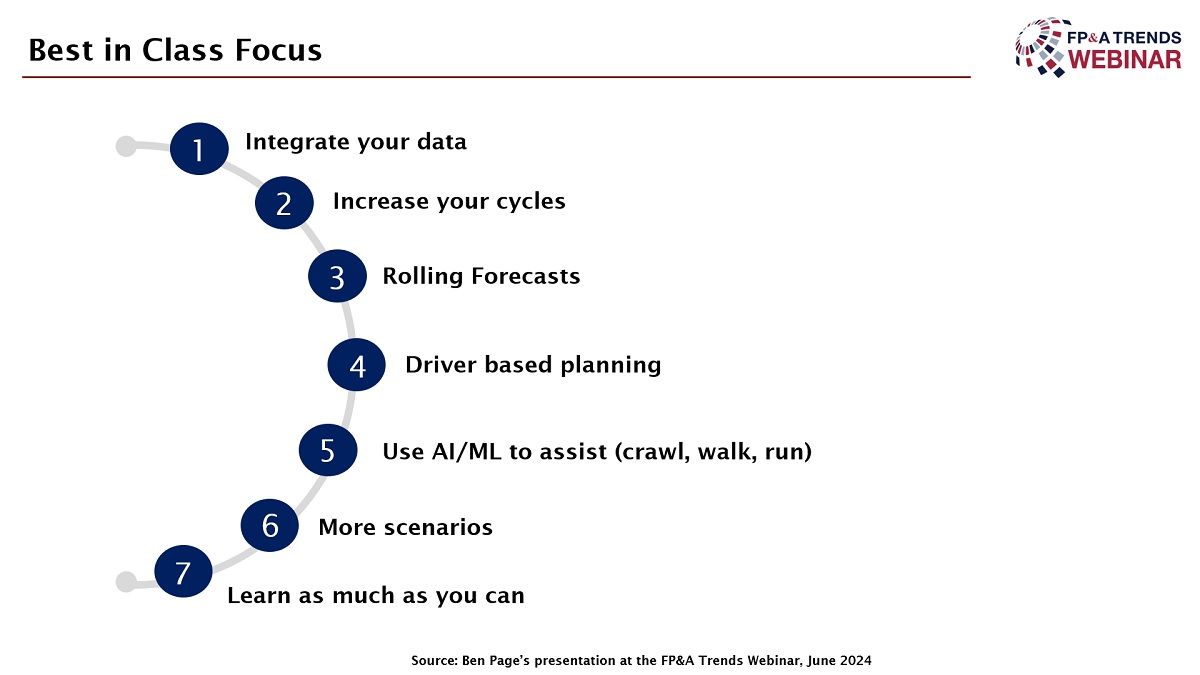

Ben Page, VP Solutions, Consulting at Planful, began his presentation by discussing the current landscape of FP&A, highlighting the prevalent use of spreadsheets and the friction and inefficiency they cause. He emphasised the need for FP&A to be a collaborative effort, integrating knowledge from various departments. Ben underscored the growing role of AI and software as a service (SaaS) in transforming finance operations, reducing the reliance on outdated systems and enabling continuous updates and improvements.

He argued that technology enhances efficiency and security, crucial for protecting sensitive data amid rising cyber threats. New functionalities provided by SaaS can streamline operations and integrate AI and Machine Learning (ML) to identify anomalies and make forward projections, thus mitigating risk and enhancing decision-making.

The benefits of technology include the ability to handle large data sets, perform Scenario Planning, and conduct Rolling Forecasts. Ben highlighted the importance of integrating operational data with financial data for comprehensive analysis and better business outcomes. There is a necessity for constant learning and adapting to new technologies, particularly for young professionals who can bring fresh, tech-savvy perspectives.

Figure 5

Ultimately, Ben sees technology as a means to support a changing business environment, improve efficiency, foster better Business Partnerships, retain talent, and increase the overall financial IQ of an organisation, preparing it for future challenges and opportunities.

Conclusions

Advancing along the FP&A Business Partnering maturity curve is a multifaceted journey requiring steadfast management support, stakeholder trust, streamlined processes, and effective communication. This progression hinges on the integration of data analytics, the development of influencing and storytelling skills, and the adoption of modern technology tools.

As the insights from Frédéric, Harsh, and Ben underscore, transforming FP&A functions into strategic partners demands a holistic approach. By building robust infrastructures, fostering cross-functional collaboration, and embracing technological advancements, organisations can not only enhance their decision-making capabilities but also position themselves to adeptly navigate the complexities of an evolving business landscape.

This gradual transformation requires dedication, continuous learning, and an unwavering commitment to innovation.

To watch the full webinar recording, please check out this link.

The webinar was sponsored by Planful.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.