In this paper, we will explore these different areas to explain what they are, how they...

As the field of Financial Planning and Analysis (FP&A) continues to evolve, organisations are increasingly turning to digitised FP&A Business Partnering to enhance their financial decision-making processes. However, this transformation comes with its own set of challenges.

As the field of Financial Planning and Analysis (FP&A) continues to evolve, organisations are increasingly turning to digitised FP&A Business Partnering to enhance their financial decision-making processes. However, this transformation comes with its own set of challenges.

How to overcome those challenges and shift the FP&A function to new heights of effectiveness and value?

The FP&A Trends webinar has attempted to answer key questions about Digitised FP&A Business Partnering.

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the webinar "Digitised FP&A Business Partnering: How Technology Can Support It".

Challenges in Digitised FP&A Business Partnering Implementation

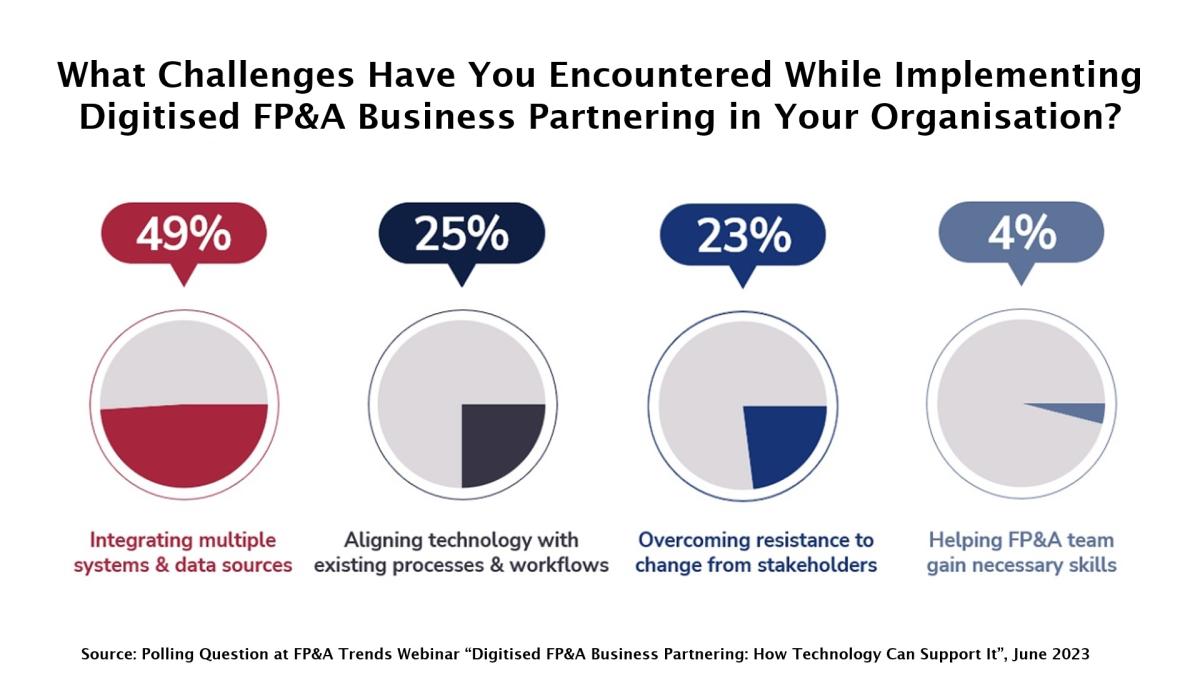

In a poll conducted during the webinar, participants were asked about the challenges they encountered while implementing this approach in their organisations. The results revealed that integrating multiple systems and data sources was the most prevalent challenge, with 49% of respondents citing it as a hurdle. Aligning technology with existing processes and workflows emerged as a notable challenge for 25% of the participants. Overcoming resistance to change from stakeholders was identified as a significant challenge by 23% of participants. Helping the FP&A team gain the necessary skills was mentioned by only 4% of respondents, indicating a relatively lower concern in this area. These poll results shed light on the key obstacles organisations face when implementing digitised FP&A Business Partnering.

Figure 1

Case Study: Where Do We Stand in Terms of Digitised FP&A

Shady Nassour, Regional Finance Director MEA, EU, & CIS at IDP Education Ltd, in his presentation on digitised Financial Planning and Analysis (FP&A), highlighted three main objectives for the digitalisation process.

- The first objective is maximising value, which involves providing the FP&A team with the right tools to enhance cost efficiency and maximise return on investment (ROI).

- The second objective is gaining leadership by improving the quality of leads received, thereby increasing conversion and finalisation rates.

- The final objective is enhancing Business Partnering by cultivating a personalised 1-to-1 customer experience and utilising robust ideas to deliver real-time plans.

Figure 2

Shady also discussed the challenges faced in the FP&A world. One of the primary challenges is managing a vast and unreliable database with varying data quality. This results in time-consuming processes and redundant tasks, which do not add value to the overall operation. Furthermore, the involvement of different stakeholders and the need for data validation often hinder the timely delivery of accurate reports to internal and external customers.

To address these challenges, Nassour emphasised the need to adopt Artificial Intelligence (AI). By implementing advanced algorithms, AI can effectively filter and categorise leads based on demographics, consumer behaviour, preferences, and time spent on research. Thus, AI application significantly improves volume forecasting and enhances efficiency across various aspects, such as time, energy, system utilisation, and overall cost. Consequently, the accuracy of volume forecasts reaches up to 90%, enabling better decision-making and resource allocation.

In summary, Nassour's presentation underlines the importance of digitalisation in FP&A and the three key objectives for maximising value, gaining leadership and enhancing Business Partnering. With the adoption of AI, FP&A teams can overcome challenges related to data management and achieve improved forecast accuracy, higher conversion rates, and resource optimisation.

Case Study: Small Team Enabling Self-Service

Julian Manche, Head of Finance and IT, RSPCA NSW, addressed the challenges faced by small teams in not-for-profit organisations regarding data management and reporting. In his presentation, he emphasised the dangers of relying on complex, error-prone spreadsheets that contain critical data, which can compromise data and reporting quality and professional reputations.

Julian highlighted the importance of Corporate Performance Management (CPM) solutions in addressing these challenges. These solutions utilise industrial-sized databases to capture and integrate financial and operational data, improving teams' efficiency and ensuring data accuracy. With the exponential growth of data volumes driven by digitalisation and the proliferation of devices, the need for robust master data management becomes crucial. CPM platforms facilitate structuring data for reporting and enable analysis and insights across different parts of the business.

Furthermore, Julian emphasised the significance of data security in an increasingly data-driven world. Protecting sensitive information and ensuring that access is limited to authorised personnel should be a top priority. He also stressed the importance of leveraging tools and technologies to maintain a healthy work-life balance, avoiding being overwhelmed by data manipulation and report generation.

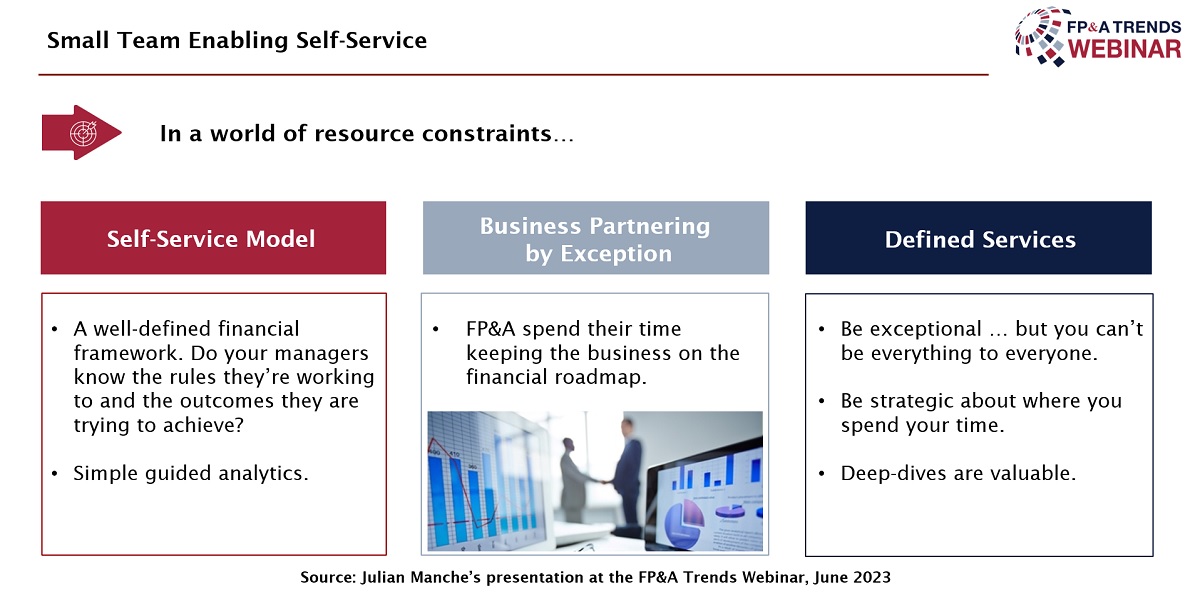

In resource-constrained environments, Julian suggested implementing a self-service model, where users can access timely reports and relevant information through a portal. Establishing a well-defined financial framework, communicating rules and training users on variance analysis allows for effective decision-making. Business Partnering should focus on exceptions and strategic issues, maximising the value of FP&A efforts.

Figure 3

Julian Manche's insights underscore the significance of CPM solutions in enhancing data management, reporting accuracy, and strategic decision-making for small teams operating in not-for-profit organisations. Companies can overcome resource constraints and achieve greater efficiency and effectiveness in their FP&A processes by adopting these solutions and implementing best practices.

Maintaining Trust Through Change

Paul Cavanagh-Downs, Head of Professional Services APAC at Insightsoftware, emphasised the importance of trust in Financial Planning and Analysis (FP&A) in his presentation on the role of trust in enabling change. Paul highlighted how trust plays a crucial role in the face of a changing landscape for FP&A professionals.

He acknowledged that the current business environment is characterised by challenges such as high inflation, disrupted supply chains, evolving work models, and high staff turnover. These factors contribute to the need for faster visibility and better control in an uncertain future. Paul referred to a recent survey that revealed making timely and flexible decisions as a significant challenge, along with balancing growth and profitability.

According to Paul Cavanagh-Downs, technology can address these challenges by providing tools that support flexibility, scenario modelling, and timely operational and financial metrics visibility. He emphasised the importance of trustworthy technology and highlighted the need for good people who can champion change and work collaboratively to achieve success. Trust among team members and their ability to deliver change while respecting each other's roles are essential.

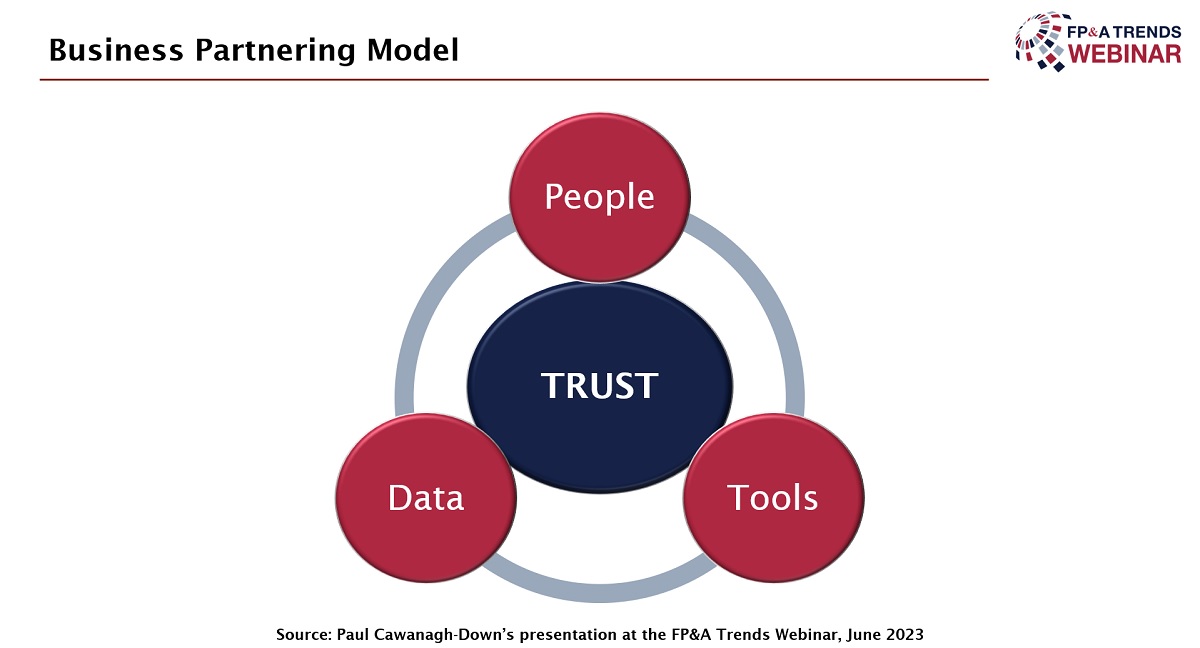

Figure 4

Paul shared an example of a successful implementation of integrated planning for a specialised distribution company. The implemented model allowed for top-down and bottom-up data entry, providing flexibility and efficiency. To address potential challenges stemming from human error, the solution included full traceability and rollback capabilities, ensuring accuracy and data integrity.

In conclusion, Paul emphasised the need to recognise and plan for the arising challenges during change initiatives to maintain trust. He advocated for creating an environment where individuals can contribute their unique value to the process and see tangible results. Trust in people, data, and tools throughout the process are crucial for achieving rapid and successful outcomes in FP&A.

Overall, Paul Cavanagh-Downs highlighted the significance of trust in Financial Planning and Analysis. He also urged professionals to break down changes into achievable chunks and continually build upon them, always considering the level of trust within the organisation.

Conclusions

The adoption of digitised FP&A Business Partnering is a growing trend in the Financial Planning and Analysis field, offering organisations the opportunity to enhance their decision-making processes. However, this transformation is not without its challenges. Integrating multiple systems and data sources, aligning technology with existing workflows, and overcoming resistance to change from stakeholders are among the key hurdles organisations face.

The expert panellists in the FP&A Trends webinar provided valuable insights and case studies to address these challenges. Shady Nassour emphasised the importance of maximising value, gaining leadership, and enhancing Business Partnering through digitalisation and the adoption of Artificial Intelligence (AI). Julian Manche highlighted the significance of CPM solutions in improving data management and reporting for small teams in not-for-profit organisations. Paul Cavanagh-Downs emphasised the role of trust in enabling change and advocated for trustworthy technology and collaborative teamwork.

By leveraging these insights and strategies, organisations can overcome challenges and unlock the full potential of digitised FP&A Business Partnering, achieving higher accuracy, efficiency, and strategic decision-making.

We are grateful to insightsoftware for sponsoring this webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.