This article offers a roadmap for FP&A professionals striving for excellence and improving their Business Partnering...

Leading the Strategic Shift in the Human + AI Era

As humans and Artificial Intelligence (AI) start working more closely, the Financial Planning and Analysis (FP&A) world is experiencing a big shift. FP&A is no longer just about numbers — it is becoming a strategic force where innovative technology and human insight work hand in hand to drive faster, better decisions.

Modern businesses expect FP&A teams to go beyond traditional reporting. They want forward-looking insights, impactful collaboration, and meaningful transformation. In this article, we will explore the evolving capabilities and roles of FP&A teams, the challenges they face, and how they can successfully lead in the Human + AI era.

“AI is the defining technology of our time. The key is not AI alone, but AI in the hands of people.” — Satya Nadella, CEO, Microsoft. [1]

Emerging Capabilities and AI Platforms in FP&A

As AI platforms increasingly automate routine tasks, the traditional FP&A role is rapidly changing. Finance Business Partners (FBPs) must now be value creators and digital thinkers, equipped with a digital-first mindset. Here are five key capabilities every modern FBP must embrace:

1. Data, Analytics & Visualisation Mastery

FBPs need to extract meaning from data, visualise trends using Business Intelligence (BI) tools and communicate insights that drive decisions.

2. AI & Agentic Intelligence Fluency

FBPs don’t need to build AI, but they must understand it. Whether it’s identifying risks, forecasting trends, or augmenting decisions through predictive tools, understanding AI’s application is key.

3. Hyper-automation & Digital Finance Tools

FBPs can save time and reduce errors by automating tasks using Robotic Process Automation (RPA) and smart planning platforms.

4. Integrated Digital Ecosystem Thinking

FBPs must understand how systems like ERP, CRM, and SCM connect, enabling holistic analysis and collaboration.

5. Strategic Digital Leadership

Leading with agility, promoting digital upskilling, and managing change are essential for FBPs navigating transformation.

Four Transformative FP&A Business Partnering Roles

The story doesn’t end with mastering technical skills — FBPs must also align their work with the company’s shared purpose, vision, strategy, and goals. Everyone should be moving in the same direction, and FBPs play a key role in making that happen.

They must collaborate closely with teams across Sales, Marketing, HR, Operations, IT, Legal, and Risk — not just as number crunchers, but as true partners. Whether it’s driving revenue growth, managing costs, planning workforce investments, enabling digital transformation, or ensuring compliance, FBPs help connect the dots. By working across these functions, they align the business, enable smarter decisions, and drive progress with clarity and confidence.

To do this effectively, FP&A Business Partners must embrace four transformative roles.

1. Strategic Advisor

They need to use AI and thoughtful insights to manage uncertainty, guide business decisions, and ensure that money is spent wisely and effectively.

2. Collaborative Influencer

They need to work closely with teams like HR, Sales, Marketing, and Operations for breaking down silos and building strong partnerships to solve business challenges together by using various functional analytics.

3. Insightful Storyteller

They need to use interactive dashboards to turn complicated data into simple, visual stories that help others understand the “why” behind the numbers, because storytelling makes insights more powerful.

4. Value Creator

They need to use data-driven actionable insights to improve profits, manage risks, use resources wisely, and help the business grow faster.

Figure 1 illustrates these roles and how they align with cross-functional business outcomes.

Figure 1

“It is not the strongest of the species that survives, nor the most intelligent, but the one most responsive to change.” — Charles Darwin, naturalist, biologist, and geologist. [2]

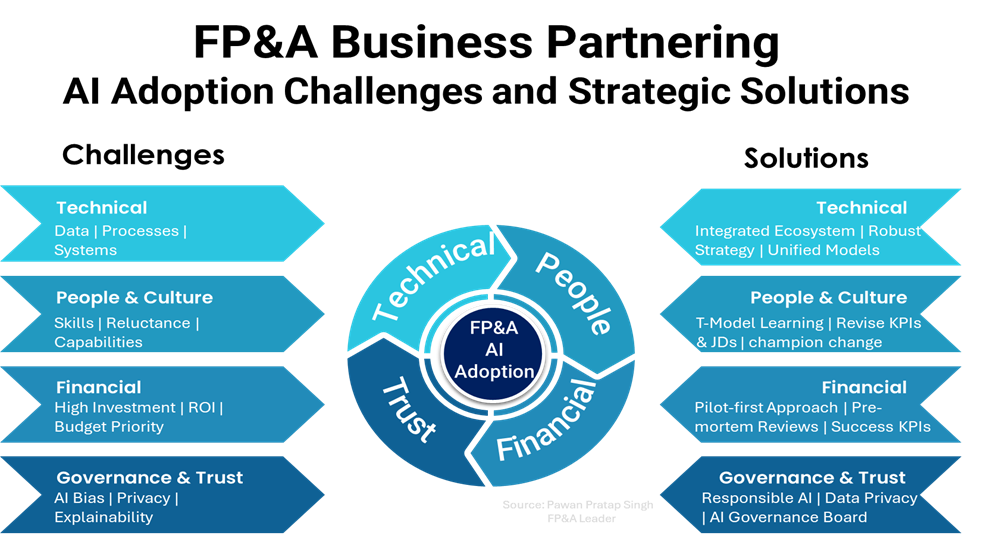

AI Adoption Challenges and Strategic Solutions for Sustainable Transformation

AI is changing how finance teams work and how businesses run. But even with all its potential, using AI isn’t easy. Companies often face messy data, disconnected systems, skill gaps, and a culture that needs to adapt. Plus, new technology brings new risks and ethical questions.

Let’s examine the main challenges companies face with AI and how they can overcome them with innovative, practical solutions for long-term success.

1. Technical

The Challenge:

Legacy systems, siloed data, and poor integration often derail AI initiatives. Without end-to-end digital readiness, organisations struggle to operationalise AI at scale.

Strategic Solution:

AI success demands a strong, integrated ecosystem working on an Integrated Transformation Strategy involving:

- Data Engineering & Architecture

- Digital Transformation Teams

- Process Excellence Groups

- Third-party AI Experts & Platforms

- Functional SMEs and Leadership Champions

2. People & Culture

The Challenge:

Resistance to change, digital illiteracy, and fear of job displacement remain significant roadblocks to AI adoption.

Strategic Solution:

Adopt the T-Model Learning Framework:

- T-Shape Talent = Broad AI fluency + Deep domain expertise

- Drive AI literacy across the organisation — make AI part of everyone’s job

- Revisit KPIs and job descriptions to reflect digital skills and outcomes

- Promote future-ready skills: data storytelling, agile thinking, stakeholder influence

- Model the change from the top: Leaders must demonstrate curiosity, digital openness, and adaptability

3. Financial

The Challenge:

High upfront investment, unclear ROI, and competing priorities can stall AI projects, especially in cost-conscious environments.

Strategic Solution:

- Start with a Pilot-First Approach: Validate feasibility, impact, and adoption before full rollout

- Apply Pre-Mortem Thinking: Identify risks, bottlenecks, and failure points before investing heavily

- Define Success Metrics from the outset: tie each AI initiative to tangible KPIs like forecast accuracy, cost reduction, and time-to-insight

4. Governance, Trust & Ethics

The Challenge:

Bias, explainability gaps, and data misuse concerns can undermine trust and delay AI integration.

Strategic Solution:

- Integrate Responsible AI Principles: Fairness, Transparency, Accountability

- Form a Cross-functional AI Governance Board including legal, risk, tech, and business leaders

- Ensure compliance with data privacy laws (GDPR, etc.) and ethical guidelines

Use explainability tools to make AI decisions transparent and auditable

“The greatest danger in times of turbulence is not the turbulence — it is to act with yesterday’s logic.” — Peter Drucke, management consultant, educator, and author. [3]

Figure 2 shows these AI adoption challenges alongside proposed solutions for each dimension.

Figure 2

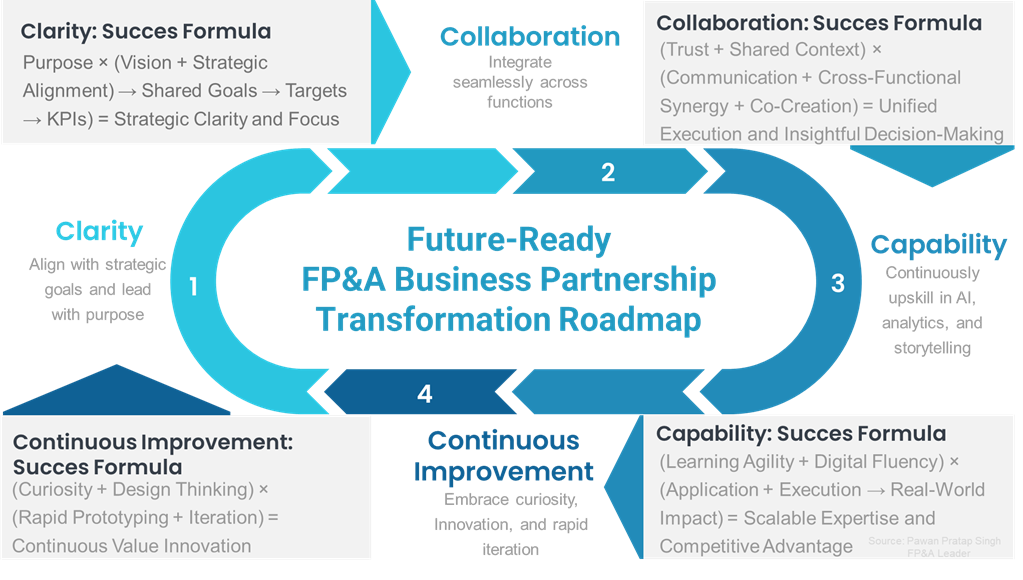

Future-Ready FP&A Business Partnership: Building a Transformation Roadmap

It is quite clear that AI and digital transformation are changing the game in today’s world. Finance business partners can no longer stick to their traditional roles. They must evolve to become transformational leaders. This shift demands more than just tools. It requires a mindset and strategic action plan grounded in four key pillars: Clarity, Collaboration, Capability, and Continuous Improvement.

Figure 3 summarises this transformation framework.

Figure 3

Making It Real: A Practical 10-Steps Formula to Digital & AI-Led Transformation in Finance

It all sounds exciting, but let’s be honest: Most teams get stuck when it comes to where to start and how to make it happen. So, here’s a practical, real-world approach that any finance function can follow to implement AI, automation, and a digital-first mindset.

1. Find the Right Opportunities

Start simple. Walk through your current finance processes and ask:

Where are we spending too much time doing repetitive, manual work?

List all those areas - reporting, reconciliations, forecasting, budgeting, etc. Look for:

- High-effort, low-value tasks

- Bottlenecks in decision-making

- Areas with lots of spreadsheets and version control issues

It is your goldmine. These are places ripe for change.

2. Group Projects by Priority

Now that you’ve listed the possible improvement areas, don’t try to fix everything at once. Sort them into three buckets:

- Top Priority: Big pain points with big returns. These are your transformation candidates.

Example: AI-enabled forecasting that could save 400+ hours/month and improve accuracy.

- Medium Priority: Good-to-fix projects that improve efficiency but don’t need urgent attention.

Example: Automating management dashboards or cost centre reporting.

- Low Priority: Nice-to-have or experimental ideas - park these for now.

Example: Playing with GenAI tools for internal finance tasks.

It helps focus energy where it matters most, especially when resources are tight.

3. Build Your Transformation Squad

It isn’t just a finance thing. Get the right people in the room:

- A few motivated finance folks

- A digital transformation or an IT partner

- A data engineer or analyst (if you have one)

- A business sponsor or leader to back the effort

Keep it lean but cross-functional. You need thinkers, doers, and decision-makers.

4. Pick One Big Bet and Build a Case

Don’t boil the ocean. Choose one top-priority project that’s big enough to matter, small enough to try.

Build a simple business case:

- What problem are we solving?

- How much time/cost does it eat today?

- What benefits will automation/AI bring?

- What does success look like? (e.g., faster forecasting, fewer errors, better insights, end-to-end performance review)

Keep it real. Use rough estimates if needed — just get started.

5. Run a Small Pilot

Before rolling it out across the company, test it in a small, controlled environment. Maybe one region, one business unit, or one cycle.

Focus on:

- Getting a basic version working

- Testing with real users

- Gathering feedback, Iterating quickly

If it works, great, scale it. If not, learn from it and tweak. The idea is to fail small, fail fast, and improve faster.

6. Track Progress & Keep People Accountable

Transformation only sticks if you monitor it. Set up a short, recurring meeting (maybe weekly or fortnightly) with your squad.

Track:

- What’s working

- What’s stuck

- Who’s doing what by when

Create a simple tracker with owners, timelines, blockers, and actions. It doesn’t have to be fancy — it just has to move things forward.

7. Train the Right People

Technology only helps if people are ready for it. So, train the teams who’ll use or support the change:

- Teach tools like Power BI, Python, or the AI platform you’re using

- Build storytelling and digital thinking into everyday work

- Encourage curiosity — let people experiment and explore

This is where culture starts to shift.

8. Set the Tone from the Top

Leaders matter. The tone you set will decide if digital change sticks or stalls.

Make it visible:

- Send a monthly newsletter sharing wins and lessons

- Ask leaders to record short video messages showing support

- Recognise early adopters and celebrate their efforts

It shows that digital isn’t an IT project — it’s everyone’s responsibility.

9. Connect it to Performance & Culture

If this work matters, it should show up in goals and reviews.

Tie project delivery and digital skills to individual KPIs, incentives, or recognition. People need to know this effort is valued, not just “extra work.”

10. Don’t Forget Governance & Trust

Finally, keep it safe and responsible:

- Identify risks and set controls (manual and automated)

- Ensure data privacy and compliance

- Use AI responsibly — make outputs explainable and auditable

- Set up a small AI or digital review board to approve and oversee major projects

Trust is the foundation of any digital success.

This isn’t a one-time push — it’s a continuous evolution. But if you start small, stay focused, and bring your people along the journey, you’ll build a finance function that’s not just future-ready but also future-leading.

Closing Thoughts: The Time to Reimagine is Now

“Change before you have to.” — Jack Welch, business executive and former Chairman and CEO of General Electric (GE). [4]

The future belongs to those who know how to blend technology with humanity. FBPs must do more than just use new technologies — they need to turn them into tools for strategic decision-making, collaboration, and value creation. AI can provide insights, but it’s the FBP who will bring those insights to life, aligning them with business strategy and guiding key decisions.

By embracing change and focusing on transformation, FBPs will remain essential in shaping the future. They will use technology to empower their roles rather than be replaced by it. Their ability to combine AI with human insight will define their success in the future.

Sources:

- Nadella, S. (2023). Microsoft Ignite 2023 Keynote Address. Retrieved from https://news.microsoft.com

- Megginson, L. C. (1963). Lessons from Europe for American Business. Southwestern Social Science Quarterly, 44(1), 3–13. (Quote paraphrasing Darwin’s theory; commonly misattributed directly to Charles Darwin.)

- Drucker, P. F. (1980). Managing in Turbulent Times. New York: Harper & Row.

- Welch, J. (2001). Jack: Straight from the Gut. New York: Warner Books

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.