In this paper, we will explore these different areas to explain what they are, how they...

Defining FP&A Business Partnering

FP&A Business Partners are finance professionals who drive an organisation's value through data analytics and storytelling. They challenge the status quo, transform processes and systems, educate and influence others. With their deep financial and business expertise, they provide valuable insights to optimise business performance.

According to FP&A Trends Group research, most of its community believes that FP&A Business Partnering is distinct from general Finance Business Partnering. One of the key differences is that FP&A Business Partners act as change agents who challenge the status quo.

With their expanding role in becoming strategic leaders, FP&A Business Partners are well-placed to lead organisational change. By challenging the status quo and adopting best-in-class practices, they help drive the organisation towards better performance and success.

FP&A Business Partnering Maturity Model

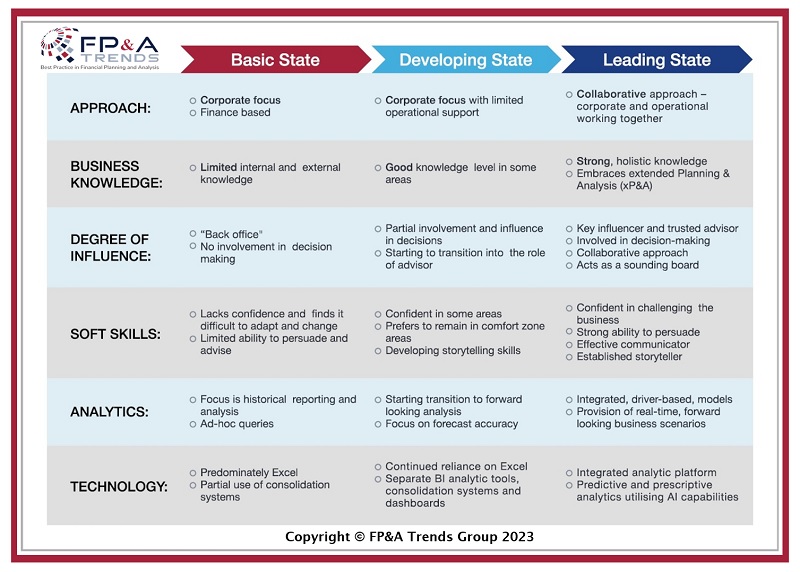

Figure 1: FP&A Business Partnering Maturity Model

The FP&A Business Partnering Maturity Model, developed by the International FP&A Board, evaluates an organisation's maturity in six dimensions of FP&A Business Partnering and enables them to create a transformation plan. By assessing their approach, knowledge, influence, skills, analytics, and technology, organisations can improve their FP&A capabilities and drive strategic decision-making. This framework helps organisations optimise their financial planning and analysis capabilities for success.

Three Maturity Stages

The world of business partnering can be complex, but it can be simplified into three distinct stages:

1. Basic Stage: Data Provider - FP&A provides basic financial data and reports to business units, but there is limited interaction with other business partners. FP&A is viewed as a support function, and there is little collaboration between FP&A and business units.

2. Developing Stage: Information Provider - FP&A provides more detailed financial information to business units and begins to interact more with business partners. FP&A provides analysis and insights to help business units make more informed decisions, but the focus is still on providing information rather than collaborating on business issues.

3. Leading Stage: Strategic Advisor and Change Agent - FP&A is fully integrated into the business and works closely with business partners to identify and solve business issues. FP&A is seen as a trusted advisor and provides strategic insights and analysis to drive business performance. FP&A leads the organisation's overall strategic direction and acts as a change agent, challenging the status quo of planning, forecasting, data handling, technology, and people. They are the storytellers with data and play a crucial role in enhancing the decision-making process in the organisation, especially in times of uncertainty.

In today's dynamic business landscape, the role of the FP&A Business Partner is more important than ever. By understanding the three maturity stages and striving to reach the Leading Stage, organisations can optimise their financial planning and analysis capabilities, drive strategic decision-making, and achieve business success.

Six Dimensions for Evaluating the FP&A Maturity

In order to evaluate the maturity of FP&A Business Partnering in any organisation, it is essential to understand the key dimensions that need to be assessed.

The FP&A Business Partnering Maturity Model comprises six dimensions:

- approach,

- business knowledge,

- degree of influence,

- soft skills,

- analytics,

- and technology.

Let us look at each of them in more detail:

1. Approach: The level of collaboration and alignment with business strategy, from basic financial data collection to strategic collaboration and providing analytical insights to all levels of the organisation.

2. Business Knowledge: The depth and breadth of financial and business knowledge, including industry-specific knowledge, allowing for effective communication with stakeholders and education of the decision-making process.

3. Degree of Influence: The level of involvement in strategic decision-making, from back-office support to decision-maker and trusted advisor, with the use of analytics changing the level of influence.

4. Soft Skills: The ability to build relationships, persuade and tell stories with data adaptable to stakeholders' needs.

5. Analytics: The ability to use data analytics and modelling techniques to provide insights and support decision-making, including the FP&A Data Scientist and FP&A Architect roles.

6. Technology: Using technology and tools to support efficient and effective financial planning and analysis, from basic Excel to best-in-class FP&A ecosystems incorporating self-service technology platforms and predictive planning and forecasting technologies.

By evaluating their maturity in these dimensions, organisations can identify areas for improvement and take actionable steps to improve their FP&A Business Partnering capabilities. This can lead to better strategic decision-making and improved business performance.

Full Description of Each Maturity Stage

1. Basic Stage:

- Approach: FP&A functions traditionally and mainly focuses on providing financial reports and data. There is limited collaboration with business units and little alignment with business strategy.

- Business Knowledge: The FP&A function has a basic understanding of financial and business concepts but lacks industry-specific knowledge.

- Degree of Influence: FP&A has limited involvement in strategic decision-making and mainly provides financial data and reports.

- Soft Skills: Soft skills are not emphasised, as the focus is on providing financial data and reports.

- Analytics: FP&A provides basic financial analysis and reporting without advanced analytics or modelling techniques.

- Technology: Basic technology tools may be used, but access to advanced technologies is limited.

2. Developing Stage:

- Approach: The FP&A function begins collaborating more closely with business units and aligns with business strategy to provide insights and analysis supporting decision-making.

- Business Knowledge: The FP&A function expands its financial and business concepts knowledge and develops industry-specific knowledge.

- Degree of Influence: The FP&A function has a greater influence on business decisions and is involved in budgeting and forecasting.

- Soft Skills: Soft skills become more important as the FP&A function must effectively communicate financial information and analysis to business partners.

- Analytics: The FP&A function provides more advanced analytics and modelling to support decision-making.

- Technology: The FP&A function leverages technology to support financial planning and analysis and to provide insights to business partners.

3. Leading Stage:

- Approach: FP&A is integrated with the business and collaborates closely with business partners to solve business issues. The function is viewed as a strategic partner.

- Business Knowledge: The FP&A function has an in-depth understanding of financial and business concepts and has industry-specific knowledge.

- Degree of Influence: The FP&A function significantly influences business decisions and is involved in strategic decision-making.

- Soft Skills: Soft skills are crucial at this stage, emphasising strong communication and relationship-building skills to collaborate with business partners effectively.

- Analytics: The FP&A function provides sophisticated analytics and modelling to support strategic business decision-making.

- Technology: The FP&A function uses advanced technology tools to support financial planning and analysis and provide valuable insights to business partners.

Next Steps

Our research on five FP&A Team Roles identified the key competencies needed for a best-in-class FP&A department. These competencies form the pillars of the FP&A Business Partnering role, where being a great storyteller must be based on data and important business insights. However, it is almost impossible to drive change in an organisation if analytics and planning are still done in Excel. The trend towards digitised FP&A Business Partnering is significant in today's uncertain business environment.

FP&A Business Partners are agents of change, and becoming a mature FP&A Business Partner is a journey. I welcome you to learn more about the steps required to reach FP&A Business Partnering Maturity and download our comprehensive white paper on this subject. Discover additional information by accessing the related content below, and make sure to follow me on LinkedIn for further insights into the best practices in modern FP&A.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.