At the recent FP&A Trends webinar hosted on December 13, 2023, we focused on how FP&A...

The FP&A Trends webinars continue to shed light on the evolving landscape of Financial Planning and Analysis (FP&A), drawing on the expertise of leading industry professionals to navigate the complexities of modern FP&A roles. The recent webinar, "The Power of Five: Essential Roles for FP&A Team Success," not only explored the integral roles within an FP&A team but also delved into the challenges and opportunities that come with building a multidisciplinary team. This article aims to provide a comprehensive overview of the discussions at this webinar and offers valuable tips for achieving FP&A team success in today's dynamic business environment.

FP&A Team – Finding the Right Mix

In a recent webinar, Connagh Hopkins, Head of Business Planning and Reporting at Western Power, offered insightful reflections on navigating organisational change amidst the dynamic landscape of the utilities sector in Australia. Connagh emphasised the criticality of adaptability in the face of the industry's ongoing transformations, particularly those driven by decarbonisation and the integration of renewable energy sources.

Western Power, which plays a pivotal role in transmitting and distributing electricity around Perth, has witnessed significant growth, expanding its workforce from 3200 to 3500 employees within a year. This growth underscores the pressing need for strategic adjustments within the company, especially in aligning its functions with the evolving industry demands.

Connagh detailed the proactive measures taken to reassess the FP&A's ability and capacity to support the organisation and revisit its purpose through group workshops. A key outcome from these sessions was the recognition of the need for a more agile, future-focused finance and leveraging technology such as Machine Learning (ML) and predictive forecasting to enhance business foresight.

The process revealed a gap in how FP&A’s team efforts were perceived externally, highlighting the necessity for improved storytelling and influence to communicate the company's value and insights effectively. This led to a thoughtful reconsideration of the delivery model to better cater to stakeholder needs.

Connagh shared insights on assembling the right mix of skills within teams, advocating for a model that values specialisation over a “one-size-fits-all” approach to competencies. This involves grouping employees based on expertise to foster synergies and enhance collective output. The initiative has also focused on bolstering tech and digital capabilities alongside storytelling and influence skills, which are crucial for operational success and strategic impact.

Figure 1

Concluding her presentation, Connagh underscored the importance of revisiting FP&A's purpose, aligning it with stakeholder needs, and investing in technological and digital capabilities. Flexibility and readiness for continuous improvement were highlighted as essential attributes for finance professionals aiming to navigate and thrive amidst the sector's rapid changes.

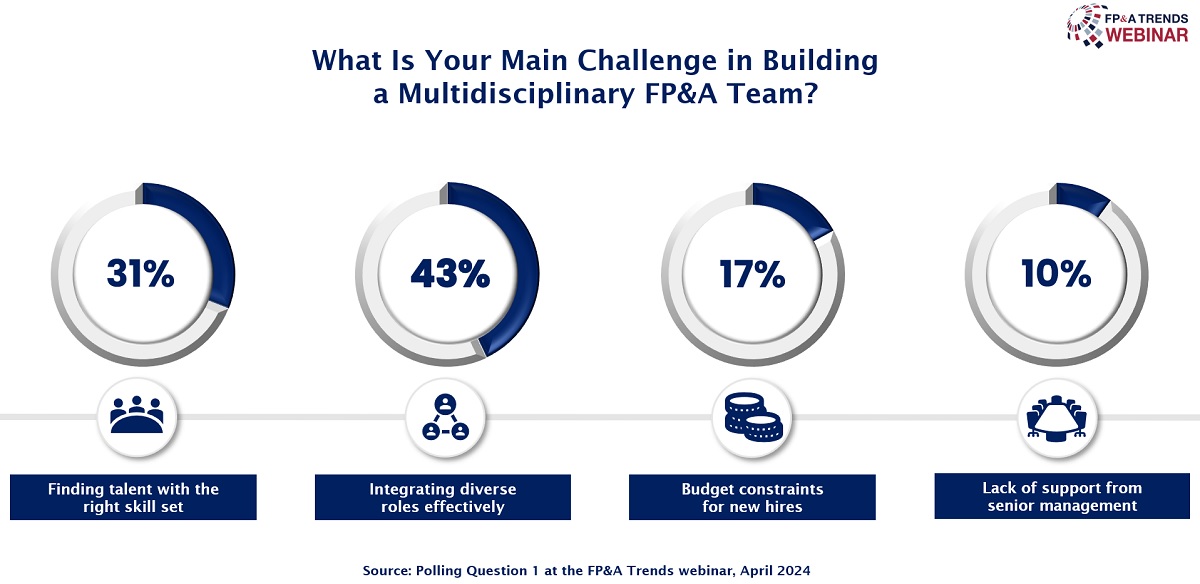

What Is Our Main Challenge in Building a Multidisciplinary FP&A Team?

43% of the webinar audience sees integrating diverse roles effectively as a main challenge. While another large portion of the attendees (31%) believes that finding talent with the right skill set is not easy. 17% and 10% of the audience selected budget constraints for new hires and lack of support from senior management as their answer, respectively.

Figure 2

FP&A: Reinventing Ourselves

In his compelling presentation, Amarnath Kamath, CFO, Malaysia, Indonesia and Philippines, AXA Group Operations, shared the transformative journey of his organisation, employing a unique analogy of food and cooking to illustrate the complex process of financial transformation. He underscored the profound impact such transformations have not just on processes and products but significantly on the people involved.

The essence of Amarnath's narrative was the need for finance departments to evolve swiftly to match the pace of business digitisation and market changes. He highlighted common critiques of finance functions, such as being out of touch with market realities, providing data lacking actionable insights, and merely acting as scorekeepers rather than proactive Business Partners. These challenges caused a strategic overhaul within his organisation to stay relevant and supportive of business objectives.

Figure 3

Key to this overhaul was restructuring the finance function into three distinct roles:

- routine accounting tasks were centralised into a shared services centre, enabling cost savings and operational efficiencies;

- a central team of specialists was created to focus on areas like tax and pricing;

- and, importantly, Finance Business Partners were positioned to work closely with business units, offering financial insights and solutions directly relevant to business strategies.

Amarnath highlighted the implementation of a job rotation policy to enrich the experience and skills of the finance team, ensuring that individuals do not remain siloed in specific tasks.

Technological innovation played a pivotal role in this transformation. The organisation streamlined its systems to a single source of truth, automated and standardised reports, and introduced online dashboards for real-time financial monitoring. This shift to a more agile and responsive finance function was complemented by the adoption of Rolling Forecasts and a “management-by-exception” approach, which significantly reduced the routine reporting burden and freed up finance professionals to engage in more strategic activities.

Amarnath also touched on the critical aspect of presentation or storytelling, emphasising the importance of connecting financial insights with a corporate strategy. This approach aims to empower decision-makers with factual insights while aligning financial reporting with broader organisational goals.

Concluding with a quote from Warren Buffet, Amarnath reiterated the unpredictable nature of the future but affirmed the responsibility of finance leaders to prepare their companies for any eventuality, ensuring resilience and readiness for change.

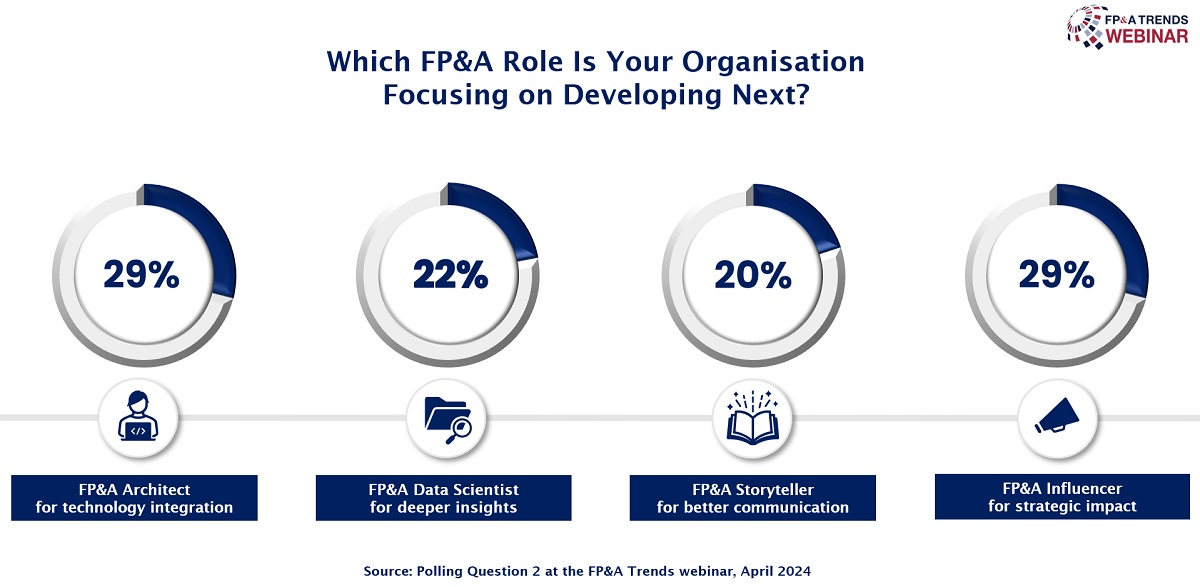

Which FP&A Role Is Your Organisation Focusing on Developing Next?

Votes have split almost evenly in this poll underlying the importance of all the FP&A roles, both technical and interpersonal.

Figure 4

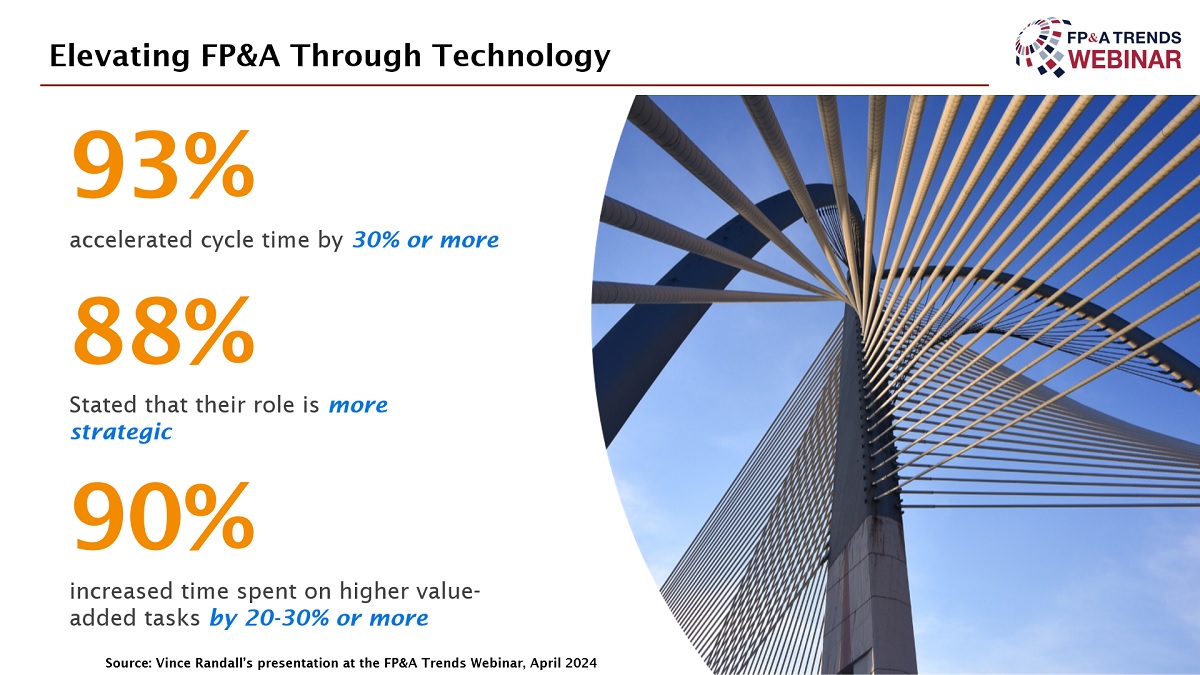

Elevating FP&A Through Technology

During his recent presentation, Vince Randall, Regional Vice President at Workday Adaptive Planning, shared intriguing insights about the current landscape of financial decision-making and the pivotal role of modern FP&A systems in navigating through change. He began by highlighting a revealing statistic: 50% of CFOs rely on gut instinct for decision-making. This point set the stage for discussing the dynamic and ever-changing business environment, especially in the post-pandemic era, where rapid decision-making is crucial for growth and survival.

Vince articulated the challenges faced by businesses due to disconnected data silos across various departments, including finance, which arise from multiple systems and processes running in isolation. This disconnection leads to data duplication, inconsistent planning assumptions, and a general lack of collaboration, ultimately hampering the organisation's ability to act swiftly and efficiently.

To address these challenges, Vince proposed a shift towards a modern FP&A experience. It is characterised by ease of use with no coding or scripting needed, built-in analytics for active dashboard reflections, flexibility through unlimited dimensions for real-time data analysis, quick deployment, scalability, and high performance. He emphasised the importance of Machine Learning (ML) integration for enhancing planning processes and achieving a single source of truth across the company.

Vince further elaborated on the potential of Artificial Intelligence (AI)/ML to revolutionise FP&A by enabling systems to learn and identify patterns, thus facilitating anomaly detection, outlier reporting, and predictive forecasting. He shared practical applications of AI/ML, such as a major retailer in North America leveraging ML for customer footfall predictions and inventory management, showcasing the tangible benefits of technology in planning and decision-making.

Figure 5

Concluding his presentation, Vince reiterated the critical need for organisations to adopt modern planning systems to not only attract but also retain talent by transforming roles into more strategic Business Partnering positions. This shift, he stated, is essential for enabling faster, more accurate decision-making and ensuring agility in a constantly changing business environment.

Conclusions

The crux of our exploration into FP&A team roles is that the future of Financial Planning and Analysis is not reliant on a single role or skill set but a symphony of them, each playing its part in the organisation's success. The FP&A Architect is instrumental in integrating technology to streamline processes, while the FP&A Data Scientist delves deep into the available data, extracting meaningful insights that can propel the company forward. The FP&A Storyteller then weaves these insights into a compelling narrative, effectively communicating complex information across the business. Meanwhile, the FP&A Influencer leverages this information to shape strategic decisions, ensuring that the FP&A function has a tangible impact on the company's direction.

Yet, it is the harmonious integration of these roles that truly elevates an FP&A team from good to exceptional. This integration challenges the conventional notion of departmental silos, advocating for a multidisciplinary approach where the sum is greater than its parts.

To watch the full webinar recording, please check out this link.

This webinar was proudly sponsored by Workday.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.