Despite the current circumstances of the COVID-19 epidemic, many FP&A teams have been able to adapt...

To provide relevant business insights, FP&A need to act fast, adopt a business partnering mindset and leverage digital analytics. Five key pillars enable FP&A teams to shift from being gatekeepers to enablers.

1. Mindset

The shift in the FP&A mindset starts by positioning FP&A as a value creator (profit centre), not just a value protector (cost centre). It should be about curiosity about what exists behind numbers and the ingenuity to build business relationships. FP&A professionals need to have the courage to coach stakeholders by asking them the right questions in order to validate business assumptions and get a sense of the numbers. This is an example of a forward-looking mindset that encourages questions like “so what?” and “what if?”. Modern FP&A professionals should strive to provide decision-makers with options, scenarios and predictions, not only historical data analysis.

Another important shift in mindset is to move from communicating behind the screen towards hosting face-to-face meetings with stakeholders. This helps foster a productive conversation, builds rapport and helps avoid misunderstandings and misinterpretations arising through emails. FP&A can achieve simplicity and build trust by thinking from a stakeholder’s perspective and presenting complex financials in simple, clear messages. Moving away from technical finance terminologies will help FP&A deliver messages with impact.

2. Skillset

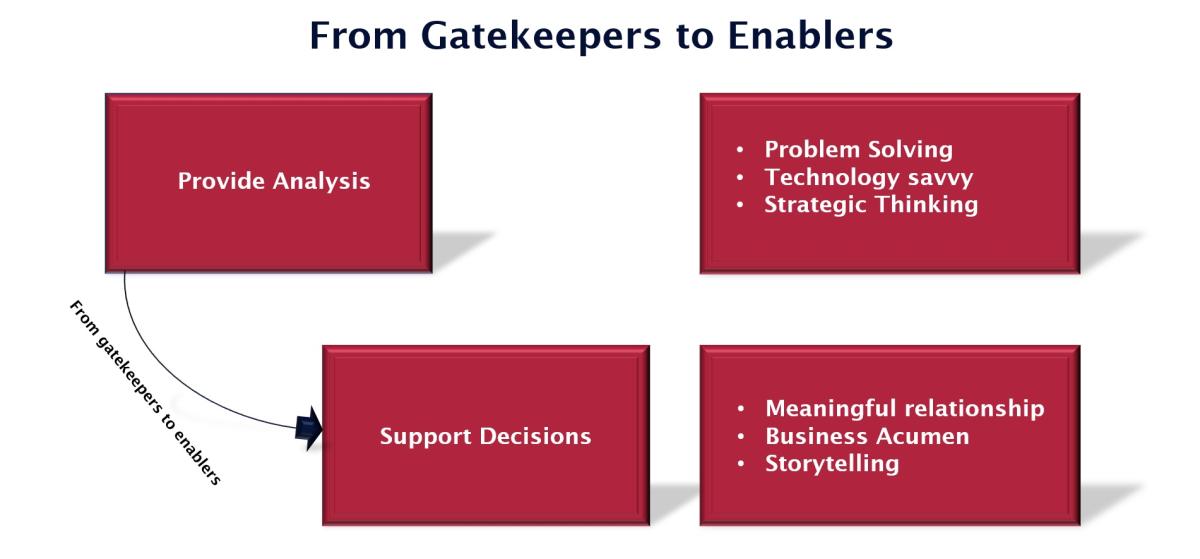

FP&A teams need to develop certain soft and hard skills to succeed as credible and trusted business partners. These skills can be grouped into two broad categories: analysis and decision support.

Figure 1

To provide solutions to stakeholders and solve their business problems, FP&A needs to have sufficient problem-solving skills. In addition, in a data-driven world, teams need to be tech-savvy and be able to simplify, automate, integrate and quickly analyse data. This helps especially in organisations that have adopted predictive planning and other innovations. To provide the business with strategic direction, FP&A need to work on their strategic thinking and try to understand the complexity, volatility and ambiguity of both the internal and external environments.

The skills required to gain buy-in from stakeholders and secure influence are the ability to build meaningful relationships and learn business acumen. If FP&A can understand what stands behind the numbers, they can deliver insights directly to stakeholders and support their decisions.

Owing and reporting numbers are not enough. FP&A must be able to explain the numbers to the business in a way they will understand. To transform numbers into narratives and inspire action through a story, FP&A need to work on their storytelling skills. FP&A’s career path should not stop at analysis or problem-solving. FP&A can become a set of valued and trusted advisors to the business by providing clear, precise, transparent messages and turning complex analytics into simple and impactful messages.

3. Digitalisation

Finance digitalisation entails the integration of multiple technologies and strategies that enable the finance function to deliver value in the digital age. FP&A need to leverage digitalisation through multiple areas in order to succeed as a business enabler. Some examples include:

- Automation is required for greater efficiency and saving time to create more strategic value for the business. For example, adopt robotics process automation (RPA).

- Cloud. Adopt user-friendly enterprise performance management (EPM) cloud solutions to provide stakeholders with self-service access to data and insights. This helps decision-makers make fast decisions no matter where they are.

- Digital visualisation tools can create customised real-time reports to suit stakeholders’ needs. They turn complex numbers into simple messages through effective visualisation tools.

- Machine Learning (ML) and Artificial Intelligence (AI) can be used on data sets to apply advanced predictive and prescriptive analytics and support strategic decision-making.

4. Capacity

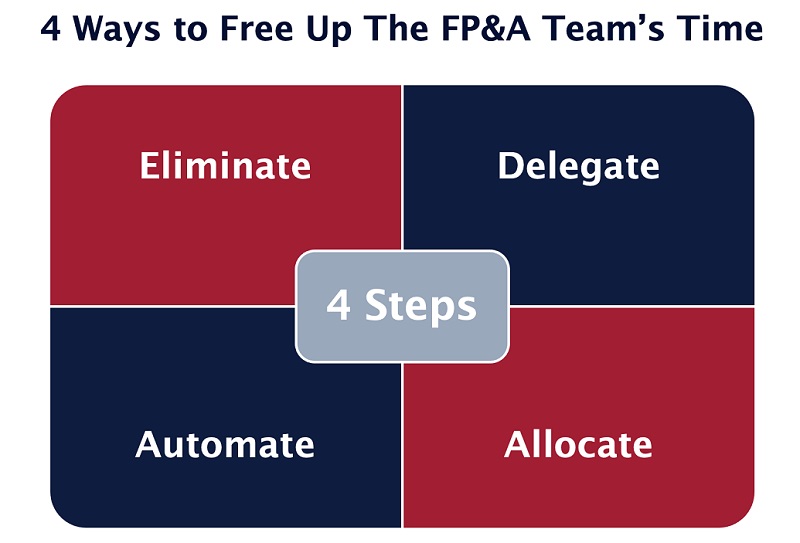

If you hired the best talents in the market and implemented the best technology ever, FP&A would not be able to add value to the business until you freed up their time to interact effectively and at length with all the other functions. There are four ways to help FP&A free up their time.

Figure 2

- Eliminate: Review the full task list of the FP&A team and eliminate all unnecessary reports and low-value-adding tasks.

- Automate: Automate all possible repetitive, high-volume, and low-value-adding activities from the FP&A task list.

- Delegate: Assign low-value adding activities to a third party or shared service team.

- Allocate: Align with the business on key business priorities and strategic objectives in order to reallocate the FP&A team’s time most effectively.

5. Culture

One key pillar enabling FP&A success is implementing the right culture in the organisation. Three types of cultures should be considered: ethics and compliance, collaboration and diversity.

The most important one is the ethics and compliance culture. It entails integrity, trust, due care and respect. These are a must in any organisation. The second one is collaboration culture. By encouraging cross-functional teamwork, organisations can ensure that all functions add value while not working in silos. Finally, the diversity culture is built by establishing a diversified FP&A team with different personalities, backgrounds, experiences and skills.

Conclusion

The five pillars for building winning FP&A teams include:

- Adopting a business partner mindset.

- Developing skills to influence decision-making.

- Implementing technology to empower the team and maintaining a healthy work environment and culture for the FP&A team to succeed.

This article was first published on the Unit4/Prevero blog.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.