This paper, based on our interviews with 25 top FP&A practitioners and thought leaders along with...

The London FP&A Board met on 26 January 2023, attended by senior FP&A practitioners from diverse sectors (including representatives of such companies as Walgreen Boots Alliance, Financial Times, Siemens Energy, GSK, Genpact, Dentsu, Anglian Water, Dassault Systemes, and many more), to discuss the five critical roles for building a world-class FP&A team.

The meeting was sponsored by SAP in partnership with International Workplace Group and Michael Page.

Below, you can find the most important takeaways from this think-tank.

FP&A Skills

The participants felt that the most important skills organisations seek from FP&A teams were strong collaborative work within businesses and excellent communication with key stakeholders. High emotional intelligence & EQ, ability to influence and make an impact, being flexible and able to "join the dots" to tell the story were key to delivering these needs.

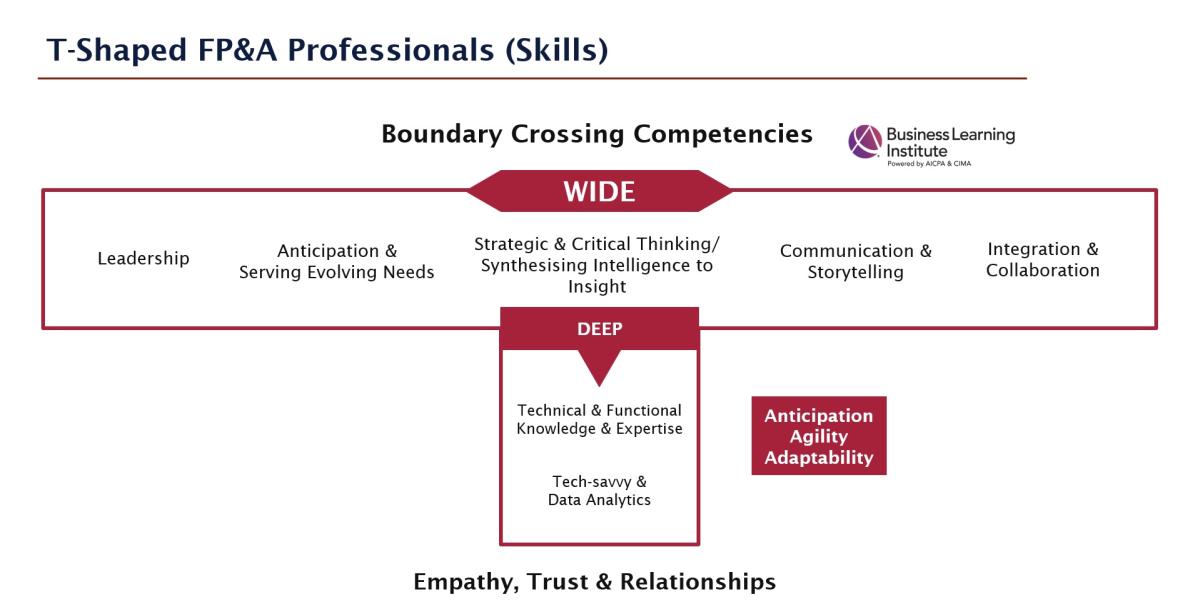

Furthermore, the London FP&A Board attendees agreed that the five most important FP&A skills could be classified as technical, business, digital (data analytics), people and leadership. These build and support the competencies required to deliver the functional capabilities of an FP&A team, as shown below:

Figure 1

Top Trends Shaping FP&A Roles in 2023 and Beyond

The members of the London FP&A Board discussed the current trends impacting our profession. As per the forum, in rapidly changing times, the following were considered to be the top 7 trends that are shaping the FP&A roles in 2023 and the foreseeable future:

- Scenario Management

- Integrated FP&A (xP&A)

- Inside Analytics 2.0

- FP&A Technology – AI & ML

- Value and values

- T-shaped FP&A professionals

- ESG for FP&A (Sustainability)

Challenges for FP&A Functions

Businesses are increasingly needing FP&A teams to be valuable business partners. We can achieve it only if the FP&A function moves away from the low value-add activities, such as data & information generation to value-adding activities, such as insightful storytelling to support decision-making and strategy setting. This transition continues to be a challenge for many FP&A teams.

The group felt that ways to reduce the non-value add activities included:

- Challenging existing activities and not systemise them in new systems

- Developing new skills and capabilities

- Focusing on delivering only important activities

- Improving data quality

- Benchmarking against peers

- Creating centres of excellence to remove duplication of work and align processes

- Outsource non-value-adding activities

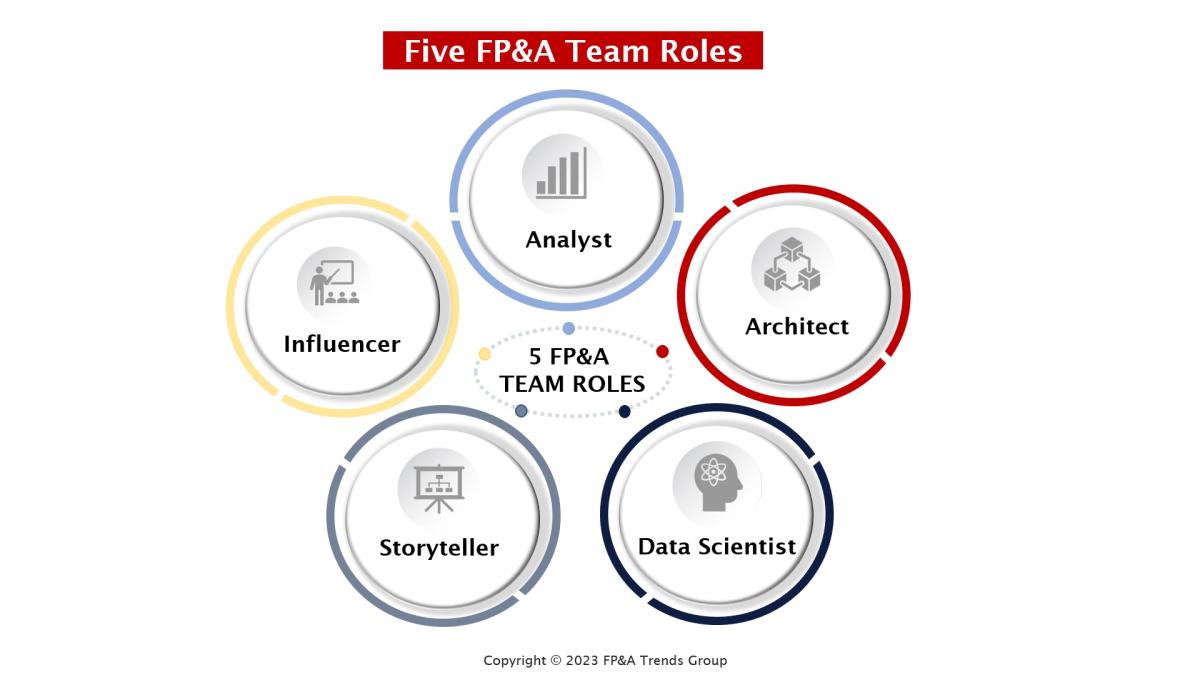

The Growing Importance of Five FP&A Team Roles

The main focus of the discussion was on the five FP&A Team roles. With the increased complexity and competitiveness in the business world and operating in unprecedented turbulent economic times, many businesses have struggled to stay afloat. Many companies are undergoing a major transformation, including digital transformation, in response to these challenges. FP&A teams have a great role in supporting businesses through these turbulent times by modernising in turn.

The traditional FP&A roles of Influencer, Storyteller and Analyst are no longer sufficient. There has been a move to bring in digital capability within FP&A teams through the recruitment of Systems Architect and Data Scientist roles. The latter has emerged from an increasing need for IT and Finance to work together. It acts as a bridge to bring a greater understanding of the business and shape data generation, interrogation and analysis capabilities. A trend in recruiting Python programmers and financial modellers into FP&A reflects this. However, these roles require business and technical IT skills and are difficult to recruit for.

Figure 2

Now, the structure of a modern FP&A team looks like this:

Traditional roles

- Influencer

- Storyteller

- Analyst

New roles

- Systems architect – development of data warehouses, systems and architecture

- Data scientist

More importantly, businesses now should have compelling storytellers to explain complex concepts engagingly. A recent New York FP&A Board note states, "Storytelling with data would be a skill differentiator for the FP&A professional of the future".

The attendees deep-dived into the responsibilities of each role, paying attention to the emergence of the FP&A Connector and FP&A Interpreter. These roles, in essence, provide the ability to interpret and communicate what is going on in the business to different audiences.

The discussion was also centred on the T-shaped FP&A department (generalist & specialist roles) comprising the seven roles and building synergistic FP&A teams.

FP&A Roles in Practice

Gemma Davie, Head of Finance Business Partnering at Anglian Water Services, presented her experience of how FP&A roles have evolved from traditional scorekeeping to business partnering to a critical friend. It has required a greater demand and emphasis on soft skills. The Architect, Analyst, Storyteller and Influencer roles were seen as key in her organisation, and their key capabilities were discussed during the London FP&A Board. A strategy is required for developing soft skills depending on the urgency and its importance to the organisation. Doing a capabilities gap analysis and developing a plan to get to where you want to be should be done.

She also explained what she has done to attract, develop and retain good FP&A talent. This included:

- use of social media to attract the right talent;

- keeping up to speed with relevant management reading, tools and tips ("Surrounded by Idiots" by Thomas Erikson is a great read);

- developing staff through PDRs, and 90-day plans, providing constructive feedback, and listening to the team by giving them your time.

Figure 3: The presentation by Gemma Davie

Practical Steps in Building a Modern FP&A Team

There was a group exercise to consider practical steps in building a modern FP&A team from leadership, functional skills and business partnering perspectives. Here you can find some of the key takeaways from group work.

Leadership

- Provide finance leadership in the business with a mindset to lead rather than follow what you are asked to do

- Get the buy-in of the CEO & CFO and convince them how you can support them credibly and with authority

- Gain experience by shadowing senior managers in both internal & external meetings

- Challenge the status quo – analyse what activities are adding value and which ones are not, and remove the latter as far as possible

- Be curious - try to understand the business and its dynamics and tell the story by connecting the dots

Figure 4: Small group work

Functional Roles

- Work as one team even if there are five separate roles

- Work effectively in a matrix structure and build a strong business acumen

- Work through ambiguity

- Manage your stakeholders well – get to a consensual view

- Develop strong communications and networking, formal & informal, to increase influencing and building credibility

- Listen well and bring the intelligence gathered into FP&A activities.

Business partnering

- Build credibility – earn a seat at the table

- Ask and understand well what the business is looking for and try to deliver that

- Embed within operations and functions to be close to the business and understand their issues, pain points, and challenges

- Ask probing questions and be impactful in steering decision making

To prepare for building the best-in-class FP&A Departments, the FP&A team should assess where it stands on the FP&A Maturity Model and how it can move to the leading state.

Figure 5: London FP&A Board members

Senior finance practitioners from different industries concluded the meeting with a lively discussion during a fruitful networking session.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.