The digital revolution is not only shaking company business models but also has a direct impact...

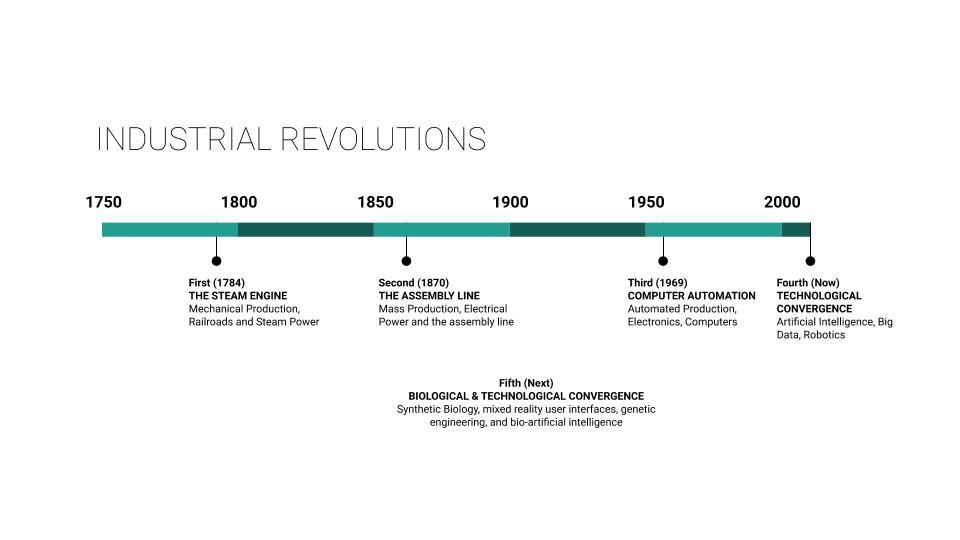

We are in the 4th wave of the Industrial revolution.

My aim in this article is to proffer suggestions for assembling members of an FP&A team. This is the team that will ensure an enterprise is resilient enough to navigate competitive threats, technology disruptions, regulatory effects, and can adapt to broad market dynamics in this 4th wave of the industrial revolution.

It is common for me to receive questions from people wondering -

- What makes the ideal background for an FP&A professional?

- What skillsets will make a person successful as an FP&A professional?

My retort most times is indefatigable curiosity.

Curiosity is the underlying attribute that delineates successful FP&A practitioners from each other. Since FP&A is both an art and science, there are no specific rules or methods that can be applied to FP&A work, in contrast to accounting and its international financial reporting standards.

In FP&A, someone who is intellectually curious will be able to ask the right questions to internal clients, be it executive or senior management. Furthermore, such an individual will be scrupulous when unearthing levers that drive business performance; analyze the root causes of performance trends, and recommend robust prescriptive and predictive insights that give rise to revenue growth and optimal allocation of finite resources.

Building an Effective FP&A Team

It is my opinion that a best-in-class FP&A team should comprise members from different disciplines. These disciplines could include Accounting, Corporate Finance, Physics, Mathematics, Social Sciences, Engineering, Biology, and Chemistry.

This might come as a surprise to some because, traditionally, most FP&A teams are comprised of individuals with backgrounds in accounting. In the last 5 years, the Office Of Finance has been charged with playing an integral role in the strategy execution process. What excites me about the Office of Finance today is the remit that has been given to the FP&A arm. FP&A is charged with providing recommendations that serve to:

- Increase the enterprise value of an organization

- Uncover new market opportunities, for example, a new vertical or geographic market

- Allocate staffing and capital resources to accelerate growth trajectories

- Own and refine the business model or revenue model

- Recommend levers for executives to pull that cause the achievement of short term and long term objectives

- Proffer methods to increase an organization’s share of its customer’s wallet

The above-listed remit which comprises of areas that were previously reserved for marketing departments, strategy teams and even consulting firms are, now, in the purview of FP&A teams. As a result, to tackle unsolved enterprise growth/profitability problems, a best-in-class FP&A team has to be interdisciplinary.

The above-listed remit which comprises of areas that were previously reserved for marketing departments, strategy teams and even consulting firms are, now, in the purview of FP&A teams. As a result, to tackle unsolved enterprise growth/profitability problems, a best-in-class FP&A team has to be interdisciplinary.

The Composition of an Effective FP&A Team

Listed below are traditional and unconventional backgrounds and skillsets that an effective FP&A team should comprise of:

- Accounting. This is a traditional background for many FP&A practitioners. An accounting designation, public accounting experience in a specific industry (e.g. financial services, consumer products, healthcare, etc.) are table stakes for these professionals. Furthermore, these team members possess well-honed skills in accounting research, tax, performance measurement and management, budgeting, financial reporting, risk management and internal controls.

- Corporate Finance. This comprises of finance professionals from corporate finance, treasury, management consulting, investment banking, and private equity backgrounds. Often armed with an MBA in finance or strategy, these individuals possess extensive experience in building financial models and providing recommendations on seismic events that impact a company’s growth trajectory – for example, an initial public offering (I.P.O.), sale of a portfolio company, or even the acquisition of a competitor.

These individuals are well-versed with understanding business models, strategy, revenue models, competitive threats, performance benchmarking, economic factors and broader market dynamics that face an enterprise.

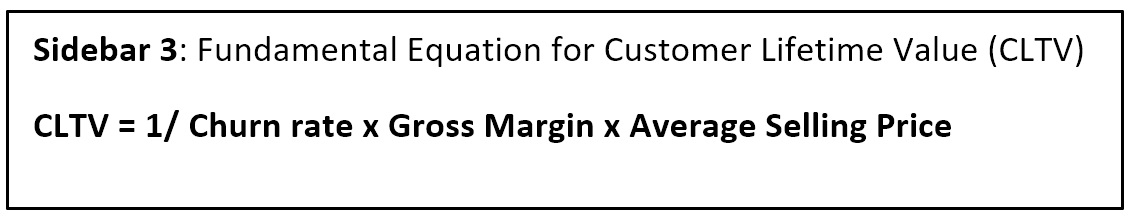

For example, an important part of an enterprise’s business model is the cost of acquiring a new customer. It is typically costlier for an organization to acquire a new customer than to retain an existing one. As a result, an FP&A team, for example, in a Software-as-a-service (SaaS) environment could be charged with optimizing Customer Lifetime Value (CLTV) from a customer segment.

For example, an important part of an enterprise’s business model is the cost of acquiring a new customer. It is typically costlier for an organization to acquire a new customer than to retain an existing one. As a result, an FP&A team, for example, in a Software-as-a-service (SaaS) environment could be charged with optimizing Customer Lifetime Value (CLTV) from a customer segment.

CLTV represents the total revenue derived from a customer over the life of the relationship. There are various methods for calculating customer lifetime value, however, in sidebar #3, I have identified the fundamental calculation for CLTV.

The understanding of an enterprise’s business model also aids in the effective design of management reports. The layout of a management profit and loss statement, for example, for internal reporting purposes across an enterprise can be designed by the FP&A team based on organization’s business model. This determines the order and arrangement of revenue streams, expense line items and the selection of key performance indicators. Furthermore, as a result of developing countless proposals and presentations for executives, these professionals possess well-honed skills at presenting financial/non-financial information to meet the needs of various end-users. The ability to present financial/non-financial information to executives (CXOs), business unit leaders, and non-finance departments is an art that facilitates decision making at the strategic, operational and tactical levels.

- Marketing Strategist. Marketing strategists are usually well-versed in the commercial side of an enterprise; typically, they come from the Office Of The Chief Marketing Officer (CMO). If these marketing strategists add skills such as model building and an analytics mindset, you have FP&A team members who can accurately define the impact of a company’s product or service roadmap in relation to its go-to-market (GTM) strategy, digital marketing strategy, sales funnel optimization, search engine marketing, and brand management. Such team members can partner with marketing and sales teams to unearth insights related to optimal customer acquisition costs (CAC).

For example, in a SaaS enterprise, team members with marketing strategy backgrounds can possibly unearth insights from customer cohort analysis related to customer data multidimensionally by analyzing: customer trends by marketing campaign; churn trends by customer segment; customer trends by sales representative; customer trends by customer success representative to inform decision making on the optimal ratio of customer acquisition cost to customer lifetime value. The end result is better decisions on pricing model changes; product redesign; customer churn reduction; redesign of how external customers are serviced; and savvy decisions on partnerships and strategic alliances.

- Natural Sciences. Physics, Biology, and Chemistry seek to describe the nature of the physical world and involve the study of atoms, molecules, chemical reactions and components of the universe. Natural sciences such as Physics demystify impalpable areas in the universe. In a sense, Physics is a general approach to problem-solving, but at its core, it provides a handful of basic mathematical principles that can be leveraged for a lot of situations.

Branches in physics, such as statistical mechanics, can be leveraged by FP&A professionals that are well-versed in it for algorithm development and deployment, statistical modeling, and the underlying processes for leveraging machine learning (ML) models when forecasting revenues and expenses. Due to what is commonly termed, today, as The Fourth Industrial Revolution - the convergence of big data, artificial intelligence, ubiquitous computing power, smart factories, and robotics - the big data load for FP&A teams to leverage is multitudinous. FP&A teams that are able to design effective techniques for the governance, exploration, processing and analysis of the vast troves of data at their disposal to engender improved financial outcomes will be lauded by executives for creating value and driving competitive advantage. FP&A teams that leverage natural science principles for advanced analytics can assist executives identify the levers to pull for revenue growth, cost optimization, cash flow improvement and margin expansion.

Other disciplines that serve as suitable backgrounds for FP&A that were not expatiated upon in this article include Social Sciences, Engineering, Mathematics, and Computer Science.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.