Last week we discussed how to build a partnership covering one part of the equation of...

The digital revolution is not only shaking company business models but also has a direct impact on the finance function. The world is now evolving at a faster pace, and now more than ever before, there is a need to question regularly the long-term strategy. Also, Business Partners need daily support to work on new ideas and to create robust business cases.

The digital revolution is not only shaking company business models but also has a direct impact on the finance function. The world is now evolving at a faster pace, and now more than ever before, there is a need to question regularly the long-term strategy. Also, Business Partners need daily support to work on new ideas and to create robust business cases.

The finance role has to evolve from traditional management accounting roles, heavily impacted by month-end close, to something else. Moreover, the digital revolution also had an impact on how we forecast / budget. Technology can make financial modelling more flexible, more accurate and faster.

I will describe the journey we undertook at The Economist and then highlight the roles that are required in building a finance team 2.0

Beyond the management accountant role

Historically, the finance team at The Economist was built around management accountants that will be tied up in the month-end close. The support required by the business was increasing as the rise of the digital was (and still is) at the same time risk and a great opportunity. The role of management accountant had to evolve to adapt to the business needs.

Therefore we split the management accountant role between financial controlling and commercial finance roles.

The finance controlling team will look at what happened and, therefore, will be focused on the Actuals/ past.

The commercial finance team will work on what is coming next, provide business scenarios and work on the forecast, budget, five years plan.

A new role…

Another big challenge was financial modelling. We had issues in forecasting accurately the subscription volume and revenue for our over 1 million customers.

The tool that was used at the time was designed for a static product offering and was not providing the flexibility with the business required. It was also often described as a black box where it was challenging to understand the performance drivers.

The commercial finance role helped a lot in building the understanding of the drivers and provided simplified tools to explain the trends to the business better.

However, there was a need for more sophisticated tools to provide the level of accuracy that the business expected. It was clear that the commercial finance role would have neither the bandwidth to do the modelling work nor the skills.

The task required a close working relationship with the Business Intelligence team (BI) and strong project management experience. It also requires expertise in data to ensure quality input are used for the financial model. Also, time should be dedicated to exploring the new tools, new software available in the market that will help us make a step-change in our forecasting capability.

Thus, we created the FP&A Architect team to work alongside the commercial finance team to develop new generations of reports and models.

How to build a team?

It is essential to think about the different components of the finance functions as a single team. All the roles within the finance team need to work toward a shared objective which is delivering the best value to the business.

It is, in fact, very similar to a team sport. In all competitive sport, you have an aspiration for excellence. The objective, which is gaining games / trophies, is shared by the team. The successes should be celebrated, and then it is critical to quickly go back to work to further improve in order to remain at the top. The best teams are often driven by a strong group mentality; they rarely have the best players. For example, in football, Portugal and Argentina are often disappointing as they play for one individual rather than for the team. In order to have a world-class finance team, we should avoid silos, and the business value should be at the heart of every single decision made.

What else could we learn from the way teams are structured in sport? We should have well-defined team structures but need to recognise and develop the interdependence between them.

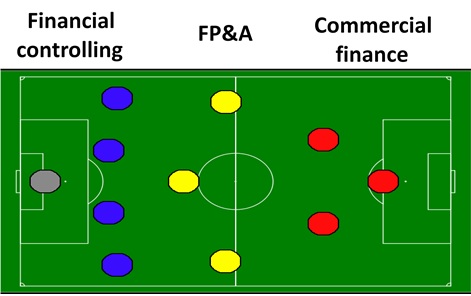

The defence and the goalkeeper (= the finance controlling roles) will ensure that we comply with accounting standards, ensuring that we have controls in place to safeguard the company assets. They will also manage the relationships with the auditors. Their main focus is to avoid their own goal.

In midfield, the FP&A Architect will cover some grounds by providing standard reports to the business and providing modelling capability for forecast / budget / 5 years planning. They also have a crucial role in providing creative ideas to improve the financial processes.

The forwards / strikers are the commercial finance roles. They are working alongside the business to provide new insights and analyses that will inform business cases and help quantify the risks and opportunities. They will score a goal when their work help delivers additional profitability or by working with the business on mitigation plans to deliver on the financial targets. The goal is then celebrated with all the players on the field, including the financial controlling and FP&A Architect.

Figure 1: Comparing Finance to Football

I’m convinced that an essential step toward a world-class finance team can be achieved by structuring the work between Financial Controlling, FP&A Architecture and Commercial Finance. Then it is critical to develop talents within each function (defence, midfield and forward), but it is only part of the journey.

Equally important, the interdependence between the function should be identified, and tactics should be elaborated to encourage team interactions and support between them. Processes/structures that create frustrations and individualistic behaviours should be addressed.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.