The survey found that the rapidly changing landscape has forced change at the C-suite in FP&A. To be successful and keep up with the rate of change, they need their FP&A teams to step out of the data collection and validation and play a larger more strategic, customer facing role.

This is the conclusion of the recent FP&A Empowerment Survey (Nov 2017). I’m honored to have been part of this watershed in-depth research project conducted by some of the current thought leaders in FP&A. The team included Ernie Humphrey and Larysa Melnychuk. The survey gained insight into why FP&A teams are struggling to make a real business impact. The solution requires reassignment and a refocus to strategic vs. being overloaded with data and outdated tools.

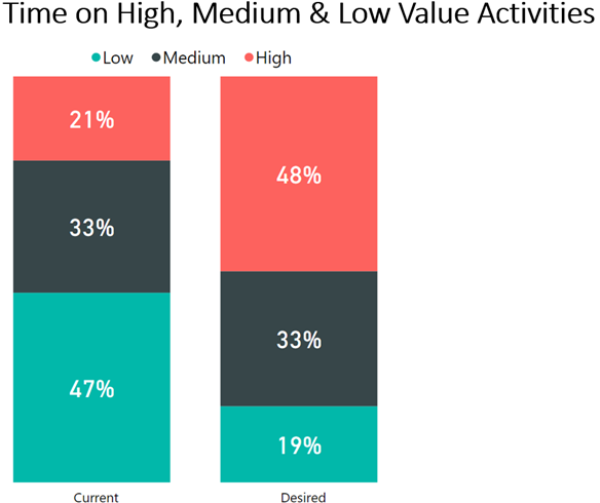

Fact Confirmed: FP&A teams are not optimized as they are spending too much time on low-value activities.

Fact Confirmed: FP&A as a function is underinvested in technology and repetitive processes are not automated.

Discovery: The value of FP&A is not fully understood by many Top Executives making the investment in solutions difficult.

We had an overwhelming response to our survey and had a total of 311 respondents with a good mix across geographical, company size and position segments. What was interesting is that these discoveries hold true across all of these dimensions

1. FP&A Teams Aspire to spend more time on strategic activities

On average FP&A professional spend 21% of their time on high-value activities. We defined high-value activities as: Business partnering; strategic support; customer-facing activities and driving actions. For me this is in line with what I expected – the number one frustration of FP&A professions is by the time they’ve pulled the data together, there is never enough time to provide insight. What was a surprise is how far away we are from where we think we should be: the answer back is we should be spending 48% (Fig 1) of our time on high-value activities. In other words, we need to be spending more than double the amount of time on high-value activities and in the case of more senior roles, this was almost triple the amount of time.

FP&A in my mind should be seen as a consulting function – a function that should be helping the business with data driven decision making. So what is the solution to reducing low-value activities and freeing up the time to be more strategic?

Fig 1:

2. The need for Technology investment

Seventy-nine percent (79%) of companies report an upgrade in FP&A technology would empower FP&A to deliver better results.

From my experience this does not come as a surprise – The solution is very simple: free up time by replacing repetitive tasks of data collection and validation (which together account for 51.5% of analytics time) by technology that can automate all of this. In practice this is never that simple - business and data in finance is a little bit more complicated. Before investing blindly in technology, you will also need to look at the problem more holistically – what is the problem that needs to be solved and what are the impacts on People, Process and Technology. This is why investment in FP&A costs so much – there needs to be a lot of upfront work in not only bringing in the right technology solutions, but also investment in time to improve the process and manage the change. This is why you often hear of ERP implementations failing, the promise is they will halve your workload, but by the end you find its doubled.

So investment in FP&A is expensive, so how do we get the support we need to make these investments?

Fig 2. Driving transformation required investment in Technology, Process and People

3. The value of FP&A is not clearly perceived or understood by top executives

The value of FP&A is not clearly perceived or understood by top executives

A staggering twenty-seven percent (27%) of respondents conveyed that their companies do not view FP&A as an area of strategic investment. Even more surprising was fifty-six percent (56%) of respondents conveyed that their companies don’t think that FP&A has an impact to the bottom line

So to frame the problem: To free up time for FP&A to be more Strategic, we need investment in Technology, People and Processes, but if the perception of FP&A is low then investment will be difficult to come by.

When asked what is the biggest barrier to investment thirty-eight percent (38%) of companies reported it was difficult to justify the ROI of investing in FP&A against shorter-term investments in sales or marketing.

Conclusion

To be successful, the C-suite needs to commit to reform, investment and respect for FP&A. The information age is forcing the office of the CFO into a more data driven, strategic role away from the back-office accounting role of the past. For CFO’s to be successful, they need their FP&A teams to step out of the data collection and validation and play a larger more strategic, customer facing role. To enable this transition there needs to be the investment in tools and solution, but more importantly there CFO’s and FP&A teams as a whole need to be able to sell the value they are generating!

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

James Myers is the founder and CEO of FP&A Strategy Consulting, helping to accelerate finance transformation resulting in smarter organizations that focus their talent on issues that matter.

James Myers is the founder and CEO of FP&A Strategy Consulting, helping to accelerate finance transformation resulting in smarter organizations that focus their talent on issues that matter.