This article offers food for thought on transforming a team towards Advanced FP&A using the FP&A...

The Finance Business Partnering Challenge

Reconciling spreadsheets, sending Excel files back and forth, iterating endlessly with stakeholders, fixing errors, doing resubmissions, waiting because of slow systems, and working late hours… In my 25-year career in different finance areas of multinational CPG companies, there was always a challenge when finance leaders did not spend enough time on true finance Business Partnering. Business and finance are used to working in silos and are too backwards-focused instead of working on forward-looking analytics, insufficiently supporting the organisation in their financial decision-making. I see three main reasons for this.

First, to make a career as a finance leader, you will have to deliver on the finance governance cycle. Second, you need to support the business with their “financial requests” and deliver what they need. However, in many cases, the business doesn’t even know what they want or if they really need it. Third, systems are often designed and built in a sub-optimal way with an extended focus on transactional processes and external financial reporting requirements. Consequently, these systems don’t usually meet business needs such as profitability insights by customers and products.

In this article, I will explain how to address these challenging situations and the underlying root causes. My purpose is to trigger your thinking about demystifying FP&A and the value it may bring by making clear what it is and what it can do for you and your organisation. While FP&A remains an appealing career choice, it depends on the organisation how much time is actually spent on true finance Business Partnering to allow for real value creation.

Understanding Business Requirements and Drivers

Around 15 years ago, I changed my role outside the finance governance cycle to address this finance Business Partnering challenge. This step allowed me to spend sufficient time with commerce and supply chain functions to understand what they need. We were able to identify and capture high-value potential through improved financial decision-making. This was around 2010 when I had some trouble defining the name of the role. Finally, it was transformed into “Finance Business Development Manager”, where my key remit was to get the finance organisation closer to the business.

Nevertheless, it is not about the naming of the role. It is about the fact that finance professionals need to be better aligned with the business requirements, go beyond financial figures to understand the relevant internal and external drivers behind their numbers and be able to challenge the business. I realised that the finance function had to innovate, especially in the FP&A area. In 2020, I got the opportunity to drive such an FP&A transformation journey in a big global CPG company, being responsible for finance leaders in operations, shared service centres, and regional and global and international offices.

Demystifying FP&A as if It Is a Transactional Process

As a starting point, an organisation should understand what FP&A is. Currently, we perceive FP&A as the activity and business control as the function performing this activity in our company. My aim is to demystify the activity and treat FP&A as if it is a transactional process. By treating it as a transactional process, the organisation is enabled to write down the detailed process steps. While it’s crucial, it is not sufficient to fully understand what FP&A is or should do.

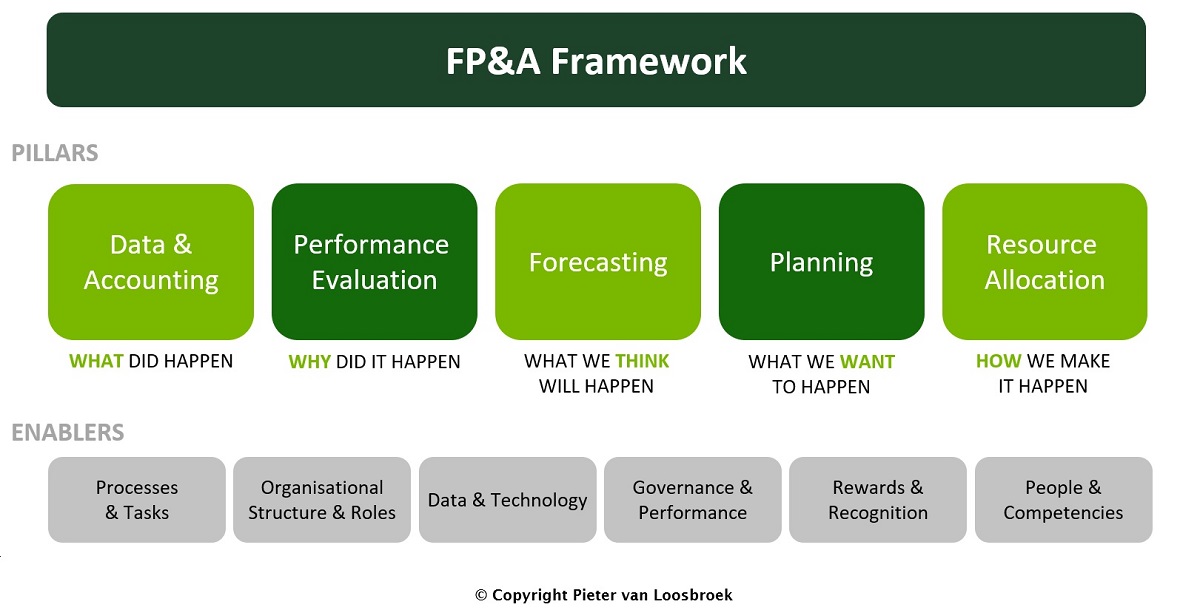

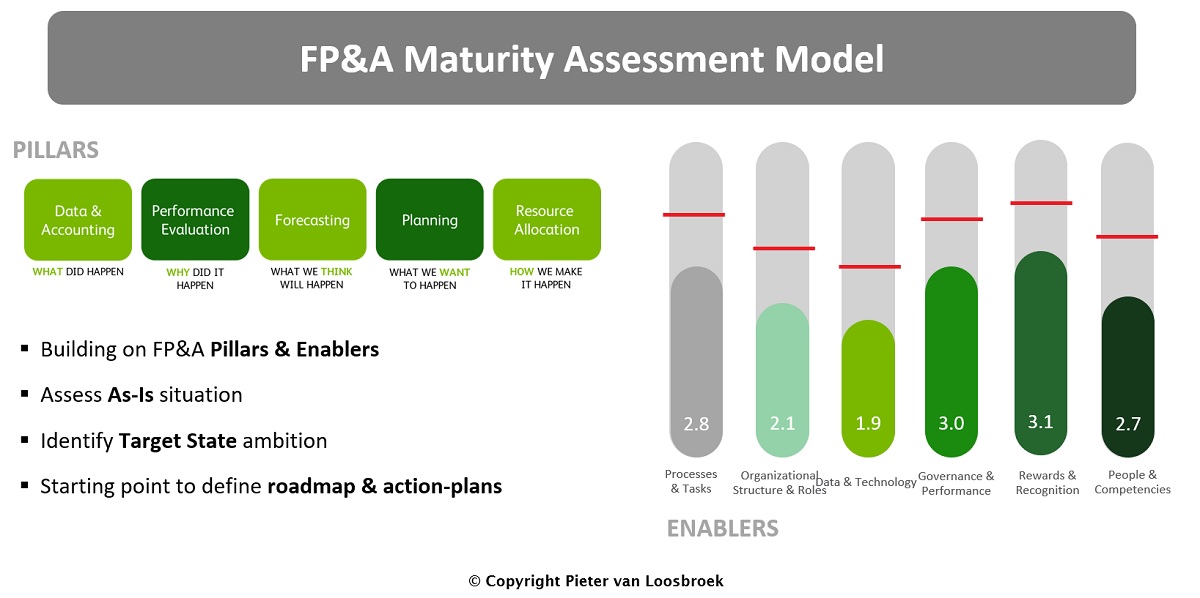

For transactional processes such as Purchase to Pay and Order to Cash, the purpose and requirements are clearer. For FP&A, this is not as straightforward since it can be done in many ways, and, therefore, it is highly dependent on the finance leadership guidance in each organisation. Describing the relevant decision-making situations in 5 Pillars, as shown in Figure 1, with a clear purpose, requirements and guidance from both commerce and supply chain perspectives makes sense.

Figure 1: The framework is providing a structured approach to demystify FP&A

It helps to use a “persona approach” of the finance leaders and their business counterparts at all organisational levels, from operations to regional and global offices. Outline the pillars with playbooks to guide how FP&A needs to be performed. Ask the relevant “happen” questions for each of the pillars to stay connected to different purposes. This purpose separation is inspired by the Beyond Budgeting principles derived from “This Is Beyond Budgeting” by Bjarte Bogsnes. Deliberately, planning is not called target setting to make it more applicable for organisations that still have their traditional strategic and annual planning processes in place to set their targets.

Here are some examples for each of these five pillars:

- Data and Accounting: Postings and allocations by customers and products

- Performance Evaluation: Revenue variance and driver analysis

- Forecasting: Driver-based scenario modelling

- Planning: Ambition and target setting

- Resource Allocation: Commercial spend productivity

To perform FP&A most effectively and efficiently, “enablers” are required to develop standardisation, centralisation and automation: standardised processes, organisational structure, data and technology, process governance and performance, rewards and recognition, and people development. It is important to consistently balance and improve all pillars and enablers in a structured manner, following the FP&A Framework shown in Figure 1.

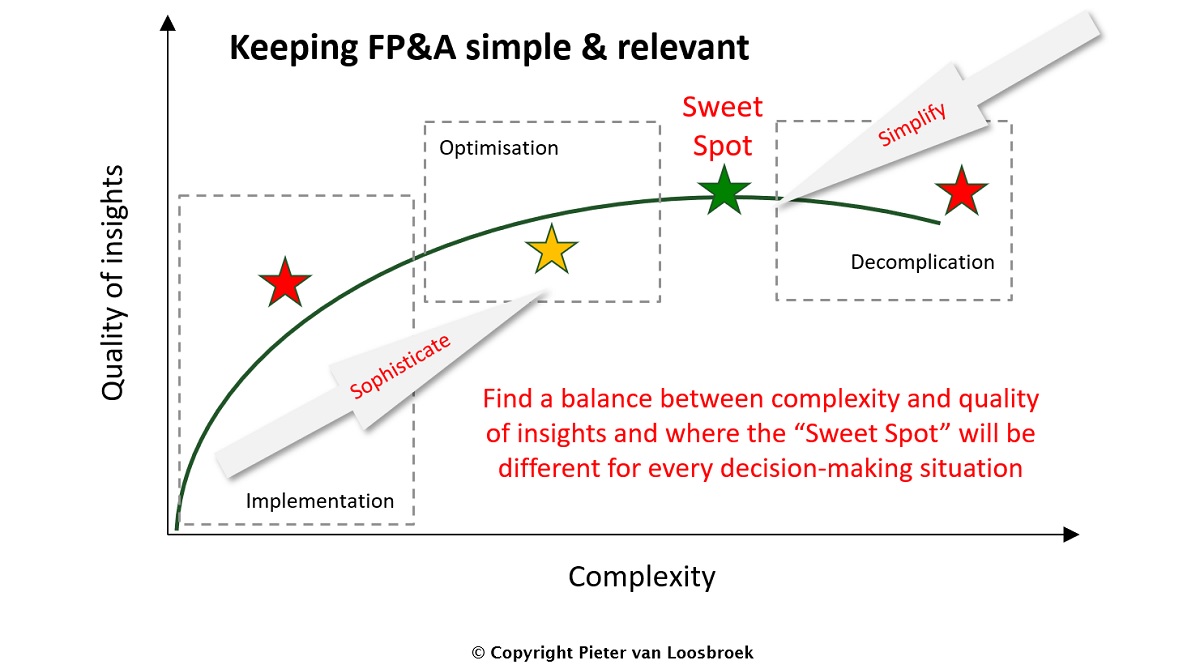

Find Balance between Complexity and Quality of Insights

Demystifying FP&A is a continuous journey, and it is critical to keep FP&A simple, relevant, and attractive. The better the understanding of the different business decision-making situations and requirements, as addressed in the “pillars”, the better the knowledge of what is exactly needed from the “enablers”. It is a balancing act that may require sophistication and simplification sometimes, as shown in Figure 2. I see FP&A more as an art, and when it’s done properly, there are clear benefits which unlock value for the organisation:

- Increased understanding and ownership by the business of their financials and better guidance about what analysis they need and what they don’t need;

- Better and faster systems and tooling design, which can be developed with less costs; optimal business usage and more effective and efficient delivery on the finance governance cycle;

- More time for finance Business Partnering and improved decision-making based on practical and actionable insights;

- More attractive for prospective talents to make a career in the FP&A domain.

Figure 2: Staying close to the Sweet Spot is a continuous balancing act

To improve FP&A capability and become a better finance Business Partner equipped with the right hard and soft skills, we need to stay close to the “Sweet Spot”. It is important to spend sufficient time identifying emerging business requirements and regularly assessing your FP&A maturity to check if it is still connected to the business needs. The FP&A Framework provides a clear structure for a maturity assessment of all elements. We can assess them as-is, identify the target state and define action plans to get there, as shown in Figure 3. To design, implement and optimise a maturity assessment model, it is highly recommended to explore and leverage the FP&A Trends Maturity Model, which is based on extensive research and the latest FP&A developments.

For some organisations, it makes sense to have a dedicated team outside the finance governance cycle to develop and optimise their FP&A Framework, drive and run the maturity assessment and manage transformational change. It depends on the size of the organisation; as for smaller companies, it is more logical to do this within the team, which is also responsible for the finance governance cycle itself.

Figure 3: Building on the framework and leveraging the FP&A Trends Maturity Model

Conclusion – Demystify and Innovate FP&A, Where Technology Is Just One of the Enablers

As FP&A is not a transactional process, it can be done in many ways. We have to demystify what it really is and how it can and should create business value. When FP&A is done properly, the biggest benefits are not the process efficiency gains achieved due to standardisation, centralisation and automation like those in transactional processes. They also matter but will never be as substantial as the value creation of improved financial business decision-making.

Today, we see a strong focus on the latest developments in the data and technology area, such as planning solutions and the use of Artificial Intelligence (AI)/Machine Learning (ML). Companies are exploring these capabilities. Some bigger organisations are hiring data scientists to see how technology innovations can be applied to the business. I fully agree that we need to stay on top of these developments, but let’s do this in the right sequence, where business requirements and processes are a critical prerequisite and need to come first. Only then will technology solutions be designed, built and utilised correctly.

Next to that, technology is just one of the enablers. There should be a healthy balance between it and the other enablers, such as processes. Strangely enough, we don’t see a lot of innovation in our management and FP&A processes, specifically within the finance governance cycle. For example, only limited companies have stopped dealing with a cumbersome traditional annual planning process and moved towards Beyond Budgeting. Ask what the FP&A activities in your organisation are, the purpose of each, how you can mature, and how you can leverage technology optimally.

To conclude, I recommend and invite you to demystify and innovate FP&A with the following steps to transform your FP&A team into an enterprise capability and unlock value for your organisation:

- Standardise and describe the process as if it is a transactional process

- Develop your FP&A Framework and outline how to do FP&A in your organisation

- Set up your organisational structure and centralise it where possible

- Design, build and implement technology by following the business requirements

- Track your FP&A process performance as if it is a transactional process

- Set incentives on required data availability and quality and forecast accuracy

- Develop a capability program, as people and competencies are critical for FP&A

- Implement a maturity assessment using and leverage the FP&A Trends Maturity Model to identify targets and set action plans

To watch the webinar with Pieter's presentation, please follow this link.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.