There has never been greater uncertainty and a faster pace of change than over the past...

“Plans are worthless, but planning is everything.”

This saying is about the importance of the planning process rather than the plan itself. The same can be said about your budgeting and forecasting processes. The act of creating it is far more valuable than the result.

Such processes provide a reason to interact with other functions, build finance acumen, and understand how the business fits together. This is where the opportunity lies!

Working towards and implementing Rolling Forecasts allows FP&A teams to demonstrate strategic and operational leadership and improve their capabilities. It will help them focus on developing the attributes required to a shift towards “leading state“ FP&A practitioners.

If you are wondering where to start with your finance transformation and not sure whether the focus should be on data, systems or Business Partnering, consider implementing Rolling Forecasts. Why? It will help you shift towards more mature FP&A practices and contribute to achieving “Intelligent Transformation”.

The FP&A Trends Research Paper defines and helps us understand what the “Intelligent transformation” is:

“Intelligent Transformation is more than just the application of technology: it redefines how stakeholders collaborate, the organisation’s approach to analysis, and how management processes are conducted throughout the enterprise.”

Why Should We Initiate a Transition to Rolling Forecasts?

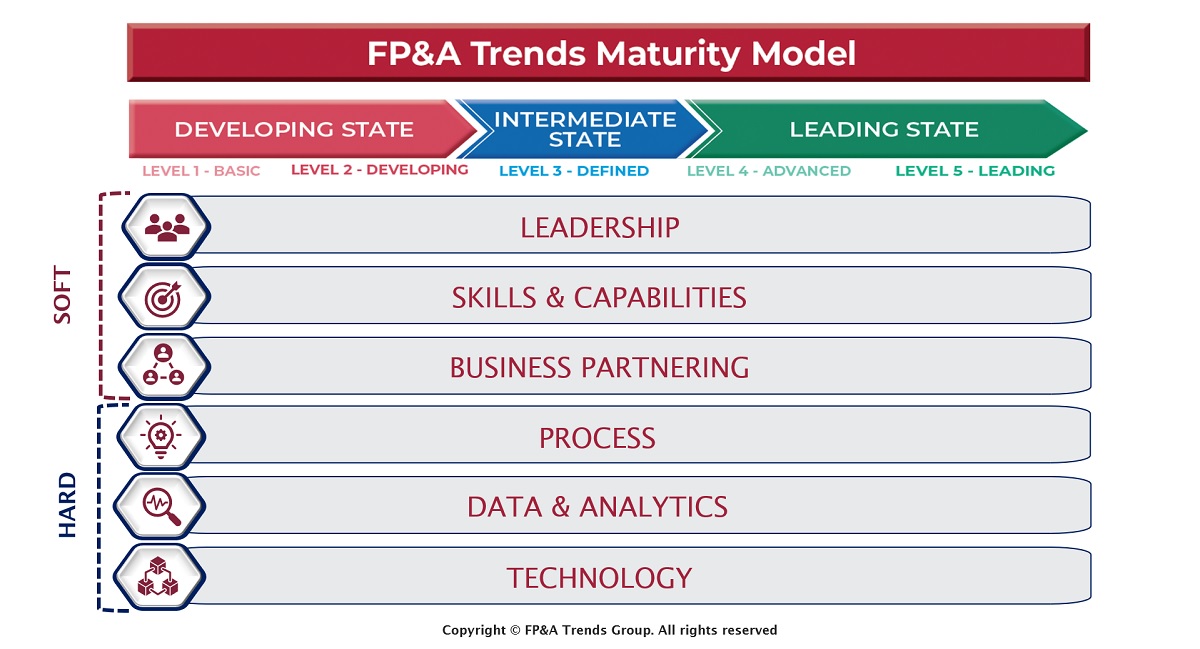

Transitioning to Rolling Forecasts will address all the dimensions of the FP&A Trends Maturity Model and shift your team closer to the leading state of maturity.

Let’s consider some of the key attributes of mature FP&A and transformation.

Mature FP&A practices include the following:

- Integrated and dynamic planning processes (Strategic, Financial and Operational planning)

- Scenario Management

- Driver-Based Planning

- Predictive Analytics

- A real-time collaborative platform

- Business Partnering in the role of trusted advisors who can influence decisions

- Integrated and multi-disciplined team with a future-oriented mindset.

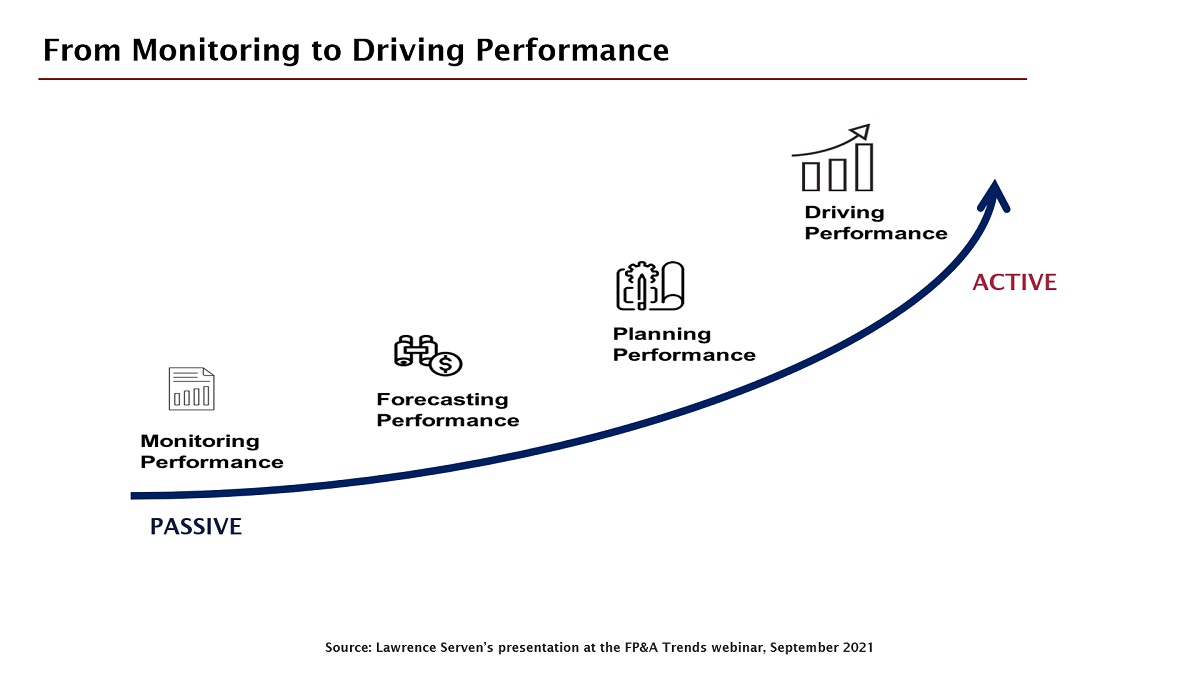

A Rolling Forecast process can incorporate any or all of the above and can be implemented iteratively. This is how we can shift our teams from a passive to an active mindset and related outputs.

We should focus on driving performance instead of monitoring it!

Figure 1

For many of us, a radical change is required to address obstacles and close the capability gaps to achieve this maturity. Understanding which aspect of change to focus on first may be challenging.

According to the International FP&A Board members, obstacles to this shift from monitoring to driving performance are often cited as:

- data cleanliness

- data quality

- misalignment of strategic and operational plans

- mindsets (in FP&A and the wider business)

- lack of prioritisation and leadership support

- insufficient technology

- lack of soft skills.

These obstacles will be reduced or removed by implementing Rolling Forecasts or adopting this approach in stages.

How To Initiate Rolling Forecasts?

Below are a handful of steps required when adopting the Rolling Forecast approach. Also, there is a non-exhaustive list of benefits that will follow:

- Determine forecast drivers and grain

- Identify sources of forecast data (systems and processes) and the data owners

- The integration of those sources to a data warehouse, working with IT to manage data provisioning and governance

- Determine the frequency of updates – daily, weekly, monthly, quarterly or annually. How often revenue and cost drivers need to be updated will depend on your industry.

- Decide the timeframe: Rolling Forecasts for 12, 18 or 24 months. The more the horizon is, the better insights into strategic performance.

- Determine accountability gaps. Do all forecast inputs have a business owner? This may be where finance may initially input a revenue stream or cost ‘buffer’ because they know it will occur.

Benefits of Rolling Forecasts

Helps prioritise the processes and business areas to work on first

Some drivers will be less sensitive to change and won’t need to be monitored and updated frequently. If you are struggling to find the data sources, park them and start with the ones you can.

Relationship building

Your staff will need to discuss business processes with their colleagues and understand how data is collected and stored, and this is a great way to build trusted relationships.

Documentation of processes

This often leads to standardisation. You will find duplications and inefficiencies when identifying data sources and associated business processes. It also improves understanding of how information flows from one department to another (or doesn’t flow!), which leads to more streamlined processes. It works even if it is as basic as finding the alternative to cutting and pasting information received from another department into preferred templates.

Automation

Standardisation and simplification of processes can help with automation implementation or, ironically, take away the need for automation.

Builds trust with business colleagues

By discussing the challenges with processes and issues, you take a ‘walk in their shoes’ approach, which is a great way to build empathy. Plus, the finance team usually knows how to solve their problems, particularly if it relates to spreadsheets.

Business process architecture and end-to-end value chain knowledge

This can be very powerful because finance functions are often the first to see the financial impact of issues in the operational delivery chain. They can quickly point management in the right direction to address it.

Bridge the strategic and operational gap

Frequent updates of profitability indices (PIs), operational key results, and future performance projections can help management make better resourcing or incentive decisions.

Intelligent reporting and insights

The Rolling Forecast can be updated during the month-end close and incorporated into the reporting process. This improves performance, as we provide more timely insights about actual results to plans, and it can help us check if the updated forecasts remain strategically aligned.

Improved financial accountability

The finance department should not ‘own’ any operationally controllable drivers. Identifying business owners and more regular forecasts will reduce the need for finance to make adjustments and ‘plugs’.

The encouraging thing is that even if you only do the first step, you will see benefits emerge. Other positive changes will continue to occur.

How Will This Help Elevate FP&A Maturity?

Figure 2: The Dimensions of the FP&A Trends Maturity Model

Leadership

It shows that finance is taking the lead in improving information transparency and strategic performance.

Skills and capabilities

The act of investigating data sources, how the value chain works and how it is impacted by processes increases operational business understanding.

Business Partnering

The initial concerns of your FP&A staff related to the necessity of delivering forecasts monthly can be quickly resolved. Explain to them that they will experience a positive change in the types of interactions they are having with their business colleagues.

Process

Finance has a huge opportunity to help other areas improve their activities, particularly if we need to integrate output from their processes to create financial forecasts.

Data & Analytics

Integrating multiple data sources into one platform or warehouse leads to more consistent data, less time spent on data assembly and more timely performance monitoring and insights. Some data may still be ‘dirty’, but making it visible is the first step.

Technology

Standardising processes and data will provide the platform for introducing predictive forecasts and Artificial Intelligence (AI) and Machine Learning (ML).

Conclusions

Treat it as an iterative and continuous improvement path to take.

Do you agree that this is an effective way to approach finance transformation?

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.