This paper explores the What, Why, and How of Intelligent Transformation, emphasising three interpersonal...

Introduction

With accelerating technological advancements, such as AI-driven automation in areas like law, finance, medicine and others that traditionally demanded a high level of expertise, it becomes clear that moving to Advanced Financial Planning and Analysis (FP&A) is not a choice anymore. It has turned into a necessity. It means that a significant chunk of employment across businesses may face transformation due to automation in the coming years.

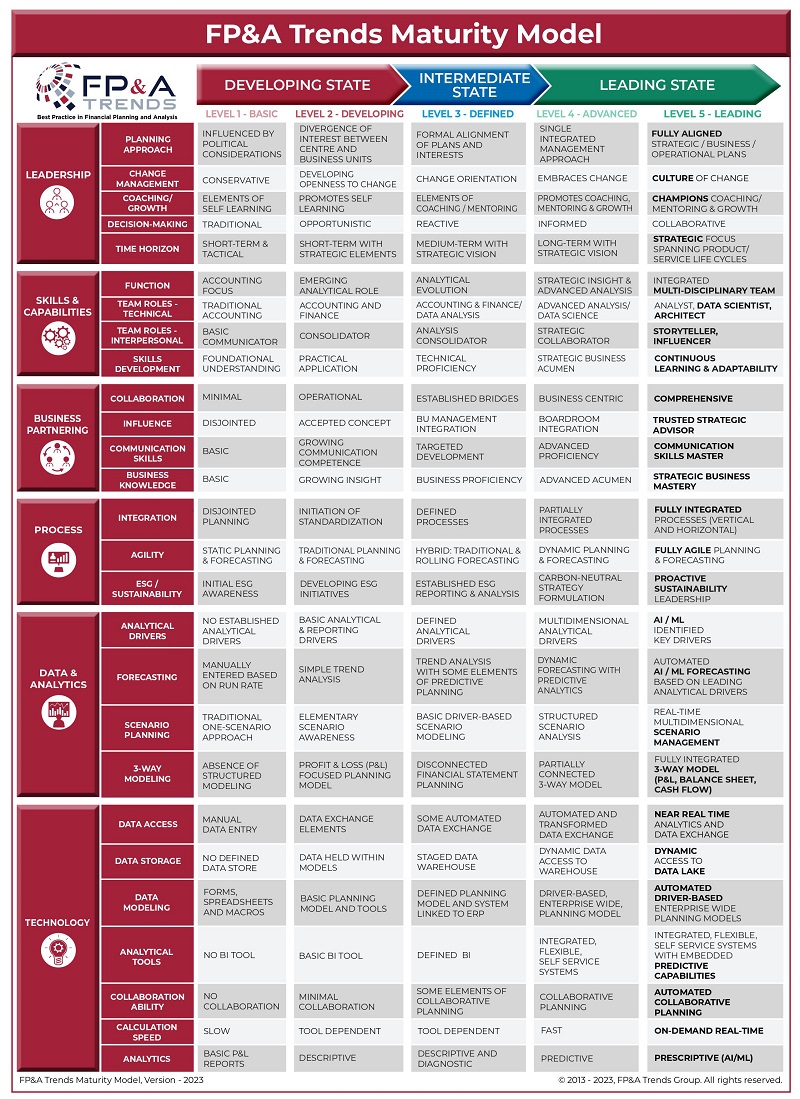

As the FP&A Trends Maturity Model clearly shows, moving to Advanced FP&A is more than just a technological change.

Figure 1: The FP&A Trends Maturity Model

This article offers food for thought on transforming a team towards Advanced FP&A using examples derived from a €1 billion+ revenue company. The company specialises in leasing and renting road freight and intermodal transport equipment, as well as related services such as maintenance, repairs, and sales. We provide services to transportation and logistics customers from 140 locations over 17 countries in Europe. The company has tripled in size in the last 10 years.

This article will address the following aspects of this transformation journey:

- Companies in transition

- Traditional FP&A becomes more data-driven

- From Excel to cloud solution: a solid technological base

- Dedicated roles – upskilling the team

- FP&A integration within the company

Companies in Transition

Many companies operating in industries like transportation and logistics are trying to move to a more data-driven decision-making model. The biggest challenge is not the technology to be implemented but rather the transition that companies have to undergo.

Challenges may arise in the following areas:

- Enterprise-wide data governance is lacking or suboptimal

- Operational planning is not entirely done in dedicated systems, often only in Excel

- Business leaders’ positive/optimistic bias, which can be hindering acceptance of fact-based analysis

- Data loads and usage of API in development or limited in use

- Remote working makes interaction between people more difficult

So, how can we move to Advanced FP&A in this environment? This article will glimpse how we tried to make it work.

Traditional FP&A Becomes More Data-Driven

While the company is in transition, FP&A is also in transition, as it needs to be operating in a more data-driven environment.

Four years ago, with the support of an external consultant, we determined a target operating model for FP&A in our company. The model showed us a path to Advanced FP&A. This meant optimising the tools used and the skill set of the FP&A team while improving the understanding of the different operational, planning, forecasting, and analytical processes within the company.

We strongly emphasised standardisation and enhanced data governance as input for planning and forecasting. Since the company has a strong acquisition agenda, this is challenging as acquired companies are not integrated from day one.

We are using the best practices shared by the International FP&A Board members and the FP&A Trends Maturity Model to validate and refine our approach on our journey to Advanced FP&A.

From Excel to Cloud Solution: a Solid Technological Base

As the areas of attention are clear, the first focus should be on the IT landscape in which to operate. Importantly, it must be cloud-based. Remote working has become standard and demanded by employees.

The company has matured over the last four years due to moving more data into a single data lake with a reporting tool overlayed. Both are from a leading software supplier. In 2021, we implemented a cloud-based planning tool, which was selected out of 10 tools that were qualified by Gartner as leading in the market.

The planning tool, the reporting tool and the data lake are parts of an overall enhancement of the company-wide ERP environment.

Dedicated Roles – Upskilling the Team

After the implementation of the cloud solution, we started to identify people who could take the lead in moving to a Data and Analytics focus within our team. Utilising input from our cloud solution implementation partner on the business readiness of the team and input from our BI department, we identified areas of improvement within the skill sets of each individual.

Observations on the team’s performance during the implementation of the planning tool and their attitude towards utilising the reporting tool gave us a clearer picture of the maturity of each individual.

We also emphasised the importance of communication. During the implementation of the planning tool, communication of the changes in the planning process and a shift to a cloud-based solution instead of Excel with regional and functional finance teams was crucial. So was promoting the usage of the reporting tool as a source for analysis for them.

To make the transition more visible, we changed job titles and included terminology such as “Data and Analytics”.

During this process, we used the roles identified by the International FP&A Board (i.e. FP&A Influencer, Storyteller, Analyst, Data Scientist and Architect) to help the team understand where we were going.

Besides that, people became more experienced with the tools and data-driven thinking. We used the opportunities when our employees moved to other roles within or outside the company to bring in people with a more advanced Data and Analytics level from outside. This has become a natural process that eliminates concerns about job security, supports further training on the job, and helps us articulate existing gaps better.

FP&A Integration within the Company

Migrating to a cloud-based environment is not limited to FP&A. Other departments in finance and back-office functions in the company are migrating IT applications to a cloud-based environment, too. It helps us to increase flexibility and rapidly deploy these applications as we grow. At the same time, investments are made at the front end of the business to drive productivity and efficiency with lean process engineers across all functions and to leverage Business Intelligence for the customer within our platform. Further investments were focused on implementing a parts inventory application to position our business to take advantage of the Internet of Things (IoT) and predictive maintenance for equipment in the future, including Artificial Intelligence (AI). The company is evolving rapidly due to accelerated growth. New ideas come from people joining us from other industries, because of the retirement of key employees, changes of shareholders, and diversification of funders.

The FP&A team tries to keep up with these developments by making individuals leads for regions, functions, processes or specific subjects. They become a direct point of contact for the rest of the business, participating in sync calls with the BI team, helping to ensure that we use standardisation initiatives across the business optimally, and pushing for alignment across departments wherever possible.

Furthermore, the FP&A Influencer plays a key role in bringing people across the company in contact with each other and keeping the team up to date on the latest developments within the business. The influencer tactically changes course in an uncertain environment and tries to link Strategic Planning to maturing operational planning if necessary. It has been achieved by fully leveraging extensive years of business experience.

Final Thoughts

This article pictured a potential path to Advanced FP&A. This path may differ for each team and/or company, but there will be some similarities.

Here are some points that you might consider on this journey:

- Do not underestimate Change Management. Moving at the right speed is critical

- Understand the level of technical skills in the team and the maturity of the tools

- Level of detail depends on the maturity of data governance in the company

- Incremental improvements versus having it right at the start

- Prepare documentation and provide ongoing training to users

- Dedicated resources to support users of the tools

- Continuous improvements based on the customers’ voice

- Validate by using inputs from external or internal sources

- Continuous communication to ensure a motivated team

Experiences during this journey helped influence others in the company and enabled FP&A to articulate better how to support the company's growth.

As professionals, we must be proactive in adapting to this new reality. Lifelong learning, upskilling, and embracing the collaborative potential of humans and AI are essential steps towards thriving in the AI-driven workplace of the future.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.