Nowadays cash flow is a trending topic and especially in FP&A where we are generally focused...

Cash flow planning is critical to the financial health of a company. Your company can be profitable but still fail due to poor cash management. Recent events have only highlighted the importance of understanding your cash flow drivers, planning ahead to gain the flexibility to respond to unforeseen circumstances.

The Digital London FP&A Circle looked at various aspects of modern cash flow planning and shared practical experiences and tips to master it.

This article provides an overview of the topics and cases presented and discussed by the experts at the webinar “Cash Flow Planning - Why the Traditional Profit-Driven Mindset Needs to Be Rethought”, as well as the results of our polling questions.

Cash is not a King, Cash Flow is

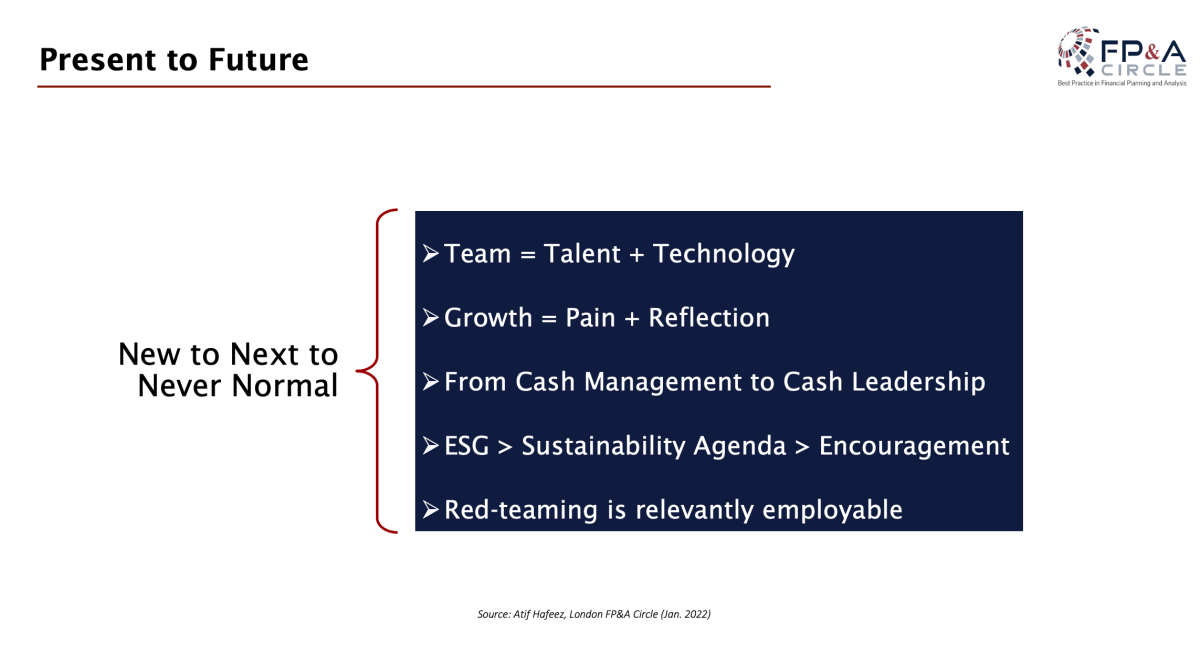

Atif Hafeez, CFO/Corporate Treasurer and Board Member, offered us a view through finance leadership lens of how we have been transitioning from the new normal to next normal to never normal in Cash Flow Planning.

The key elements of these transitions are:

Team = Talent + Technology. The abilities of computers and humans are rapidly improving during and after pandemic and effective teams should include both to understand the business better and plan its future better.

Growth = Pain + Reflection. In the growth environment, it is crucial to be able to synthesise information and transform it into actionable insights.

From Cash Management to Cash Leadership, which is more centre-stage, more frequent and more decision-ready.

ESG > Sustainability Agenda. The primary focus now is to pursue sustainable cash flow to ensure business sustainability regardless of the size of the organisation which you work for.

Adopting Red-teaming principles, which involve rigorous challenging of underlying assumptions to achieve a higher quality of cash flow plans.

Figure 1

So far dealing with the consequences of the COVID-19 pandemic has been a journey from leadership to leader shift. Inclusive leadership combined with situational leadership became a framework to rely on and live up to the expectations that the business has from finance.

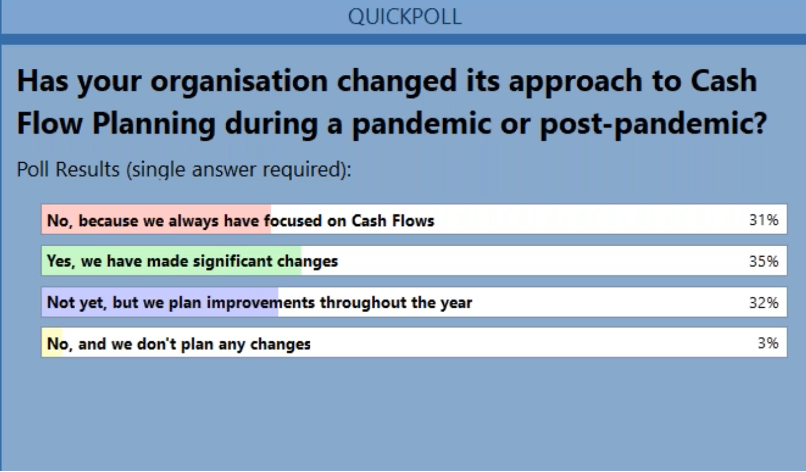

How are we reacting to uncertainty with our approach to Cash Flow Planning

During the webinar, hundreds of attendees from the FP&A industry took part in the poll and stated whether they changed their approach to cash flow planning during or after the pandemic. 31% of organisations should not have done this because they are already cash-flow focused, and another 67% have made changes or plan to do so within the year.

Figure 2

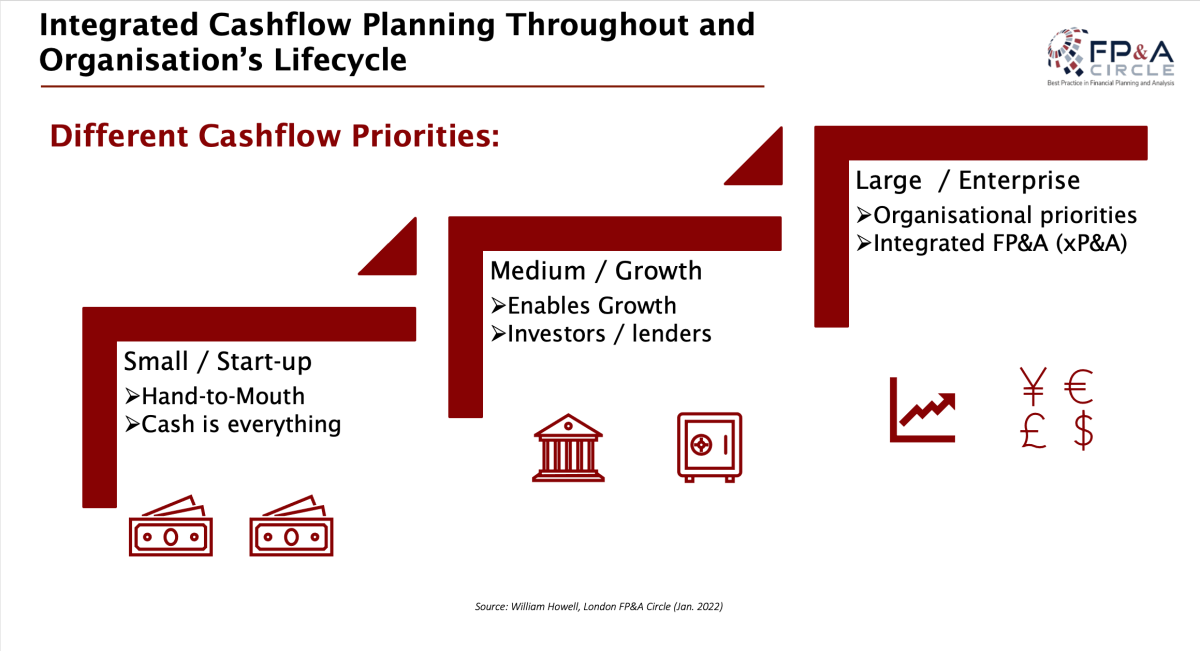

Integrated Cash Flow Planning throughout an Organisation Lifecycle

William Howell, Senior FP&A Manager at Honda of the UK Manufacturing showed how despite different Cash Flow priorities cash flow planning is crucial at every stage of the organisation’s lifecycle.

For small organisations or start-ups, cash is everything, it literally affects, whether they can make payroll or make payments to their key suppliers. Cash forecasting is more important for them than profit forecasting.

In MSE focus might shift a little towards profit, but cash is still required to fuel growth. Thus, cash planning and dialogue with vendors and investors remain high on the agenda.

For large and multinational organisations cash is still important when they seek to return cash to shareholders in the form of dividends paid or share repurchase.

Figure 3

Modern Cash Flow Planning is not achievable without an Extended Planning and Analysis (xP&A), a planning approach that takes the best FP&A capabilities and extends them across the enterprise.

Willian has challenged us with a question ”Can any FP&A team claim to be truly “integrated” or “world-class” if something as important as Cashflow is ignored?”

How to be a Better Business partner in Cash flow planning

“Revenue is Vanity, Profit is Sanity, Cash is Reality”. This quote memorised by many webinar attendees was brought to our attention by Gemma Davie, Associate Director, Performance (FP&A) at comparethemarket.com. In her speech, Gemma has explained why cash should form a solid foundation for every business growth and how to achieve that by being a better business partner.

Top tips from Gemma on how to improve Improve Your Cash Partnering Skills include:

Get to know stakeholders. Build and invest in strong relationships with your key cash stakeholders and make time to have regular checks with them.

Challenge your assumptions. Never just assume. Ask open questions to gain clarity.

Cash KPIs. Introduce Cash KPIs to the business and consider adding them to your compensation plan.

Stress test scenarios. Work with stakeholders to understand your vulnerable areas and the impact they might have on cash.

Retros. Look at what went well, what could have gone better and the actions to be taken.

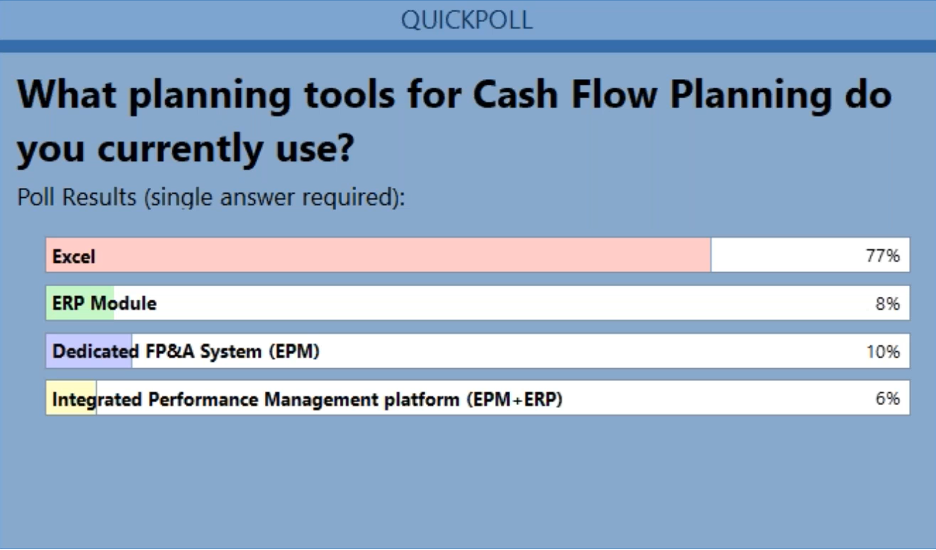

How technology enables modern Cash Flow Planning

77% of webinar attendees admit that they use Excel as a primary tool for cash flow planning and through their questions, they have demonstrated a clear interest to learn more about Integrated Performance Management Platform combining EPM and ERP.

Figure 4

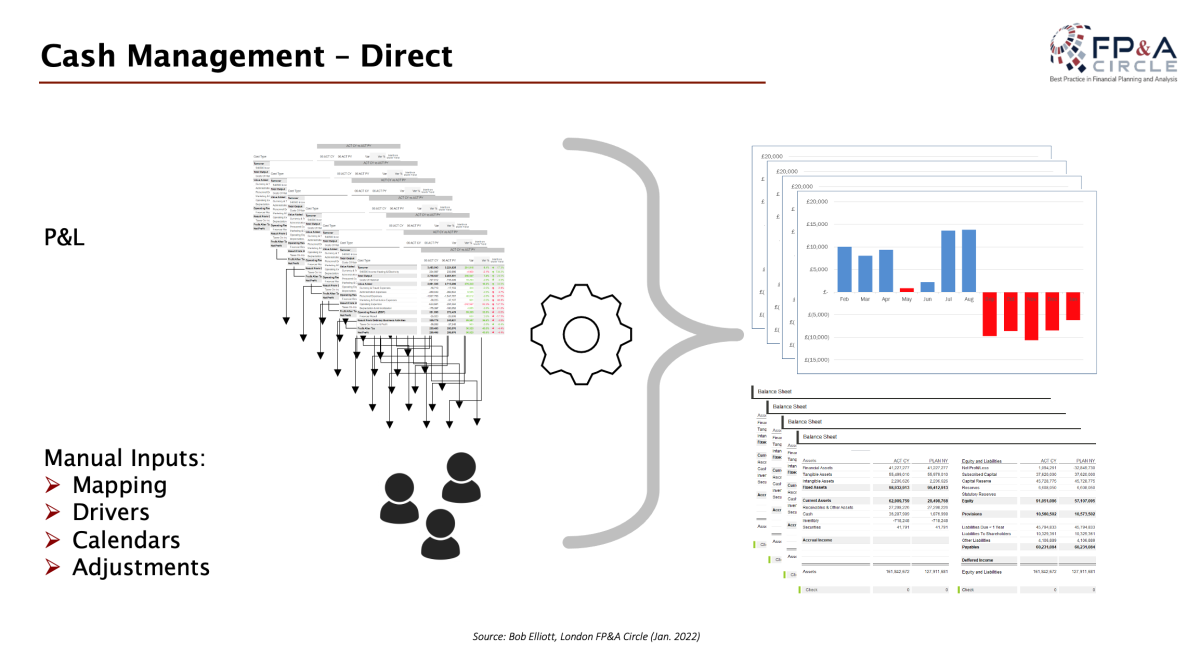

Bob Elliott, Senior Solution Manager at Unit4 FP&A, structured his presentation around these areas:

Short Term Detailed Cash Management

Medium/Long Term Cash Flow

Indirect

Direct

Speaking about a short-term cash flow, Bod has explained how technology platforms now help us to:

Automate data extraction

Leverage standard assumptions for payment runs/delays

Create business models that use the calendars for rentals, leases, dividends, taxes etc.

Facilitate collaborative input of exceptional items/manual overrides

Working with the indirect cash flow it is important to realise that modern technology does support fully integrated business models and enables scenario planning and analysis to drive insight and better business decisions.

But there are limitations to the operational value of such models because the cash outputs are driven from the balance sheet(s) and so, they are highly summarised and have limited analytical scope.

That is why medium to long term direct cash flow remains a “holy grail” of cash flow planning.

The approach that brings a higher level of accuracy to cash flow planning is referred to as the “accrual reversal method”. This kind of model features:

Double-entry financial intelligence that maps the relevant budget lines to the balance sheet

Payment/collection profiles for each mapped line managed at the P&L level

Payment calendars/profiles for periodic payments such as taxes and dividends

This could add an enormous level of complexity and data volume to the business, so this is only really practical when using appropriate technology.

This will drive the evolution of cash awareness within the organisation both from an analytical perspective and from a behavioural perspective as budget holders learn the impact of decisions on cash as well as the P&L.

Figure 5

Conclusions

We still have a long way to go from isolated Excel-based cash flow plans to an integrated process with a strong, skilled team and a solid platform. But we need to start somewhere, as the importance of cash flow planning is paramount these days.

Wherever you start, keep going and never take your eyes off the cash flow.

We would like to thank our global sponsor Unit4 for great support with this Digital FP&A Circle.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.