Fortunately, an increasing number of organisations have come to embrace what IFP&A can offer. These people...

Learning Lessons on the Go

In my day-to-day job, I interact with many Financial Planning and Analysis (FP&A) organisations implementing predictive planning to improve their budgeting and forecasting processes.

In this article I will share the top five lessons I learned:

- Rome was not built in one day

- It’s about the data, stupid!

- Reimagine your processes

- Usefulness trumps accuracy

- Power to the people!

How Predictive Planning helps Finance organisations

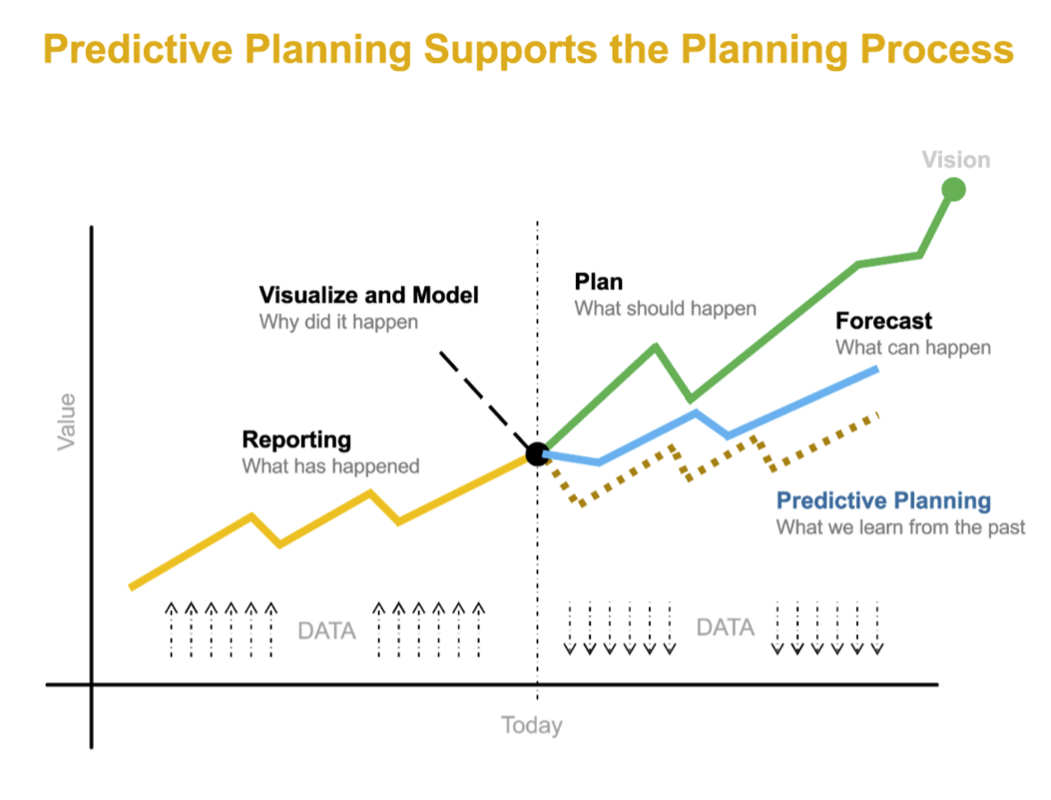

Predictive Planning is the use of time series forecasting techniques to project the evolution of financial Key Performance Indicators (KPIs) in the future, to forecast how sales or expenses are likely to evolve.

Figure 1

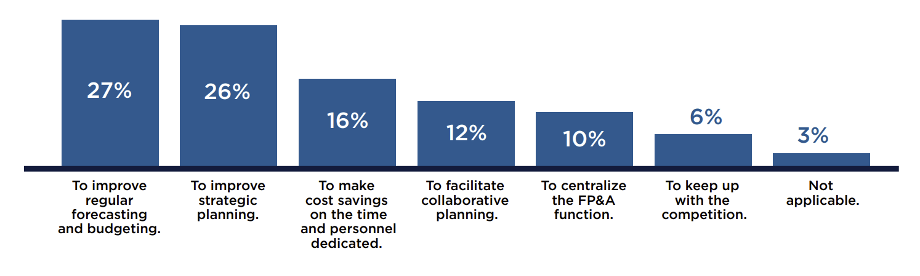

The FP&A Trends 2021 survey “Planning and forecasting in times of high uncertainty” has interesting insights on why predictive planning is important to FP&A organisations nowadays.

Here are three important findings:

- The top investment prioritised by 27% of FP&A organisations is to see improvement in their regular budgeting and forecasting systems.

Finance organisations are looking for innovative ways to improve their budgeting and forecasting processes. For the most advanced organisations, it’s about automating part of these processes.

Figure 2

Prioritisation of investment in FP&A

- 57% of the organisations plan to use Artificial Intelligence for financial planning and analysis in the next years. 11% are using it today.

11% of the organisations are already using Artificial Intelligence techniques to improve their finance processes. Most finance organisations are still in the early days of the journey and face a unique opportunity to improve the way they conduct business.

- 83% of the organisations using Artificial Intelligence for financial planning and analysis consider their forecasts being ‘Great’ or ‘Good’. 53% of average organisations do so.

Early adopters of Artificial Intelligence have proved that the forecasting accuracy gains are real, as 83% of these organisations consider having great or good forecasting processes.

Top Five Lessons

Rome was not built in one day

The pharmaceutical company Roche is the perfect example of a finance organisation that successfully implemented predictive planning. It now takes Roche two hours to generate a US$4.2 billion financial forecast. This is an impressive achievement.

Getting there might feel like having to build Notre-Dame de Paris or the Star Wars Death Star in LEGOs from scratch, without any operating instructions.

Roche summarised their mindset during their predictive planning journey as “Dream big, be agile, don’t be afraid to fail”.

Dreaming big consists in finding a burning use case in your organisation that you want to tackle. Being agile is to start with what you have at hand. As an example, not all data is necessarily ready for use on the first day. Focus where you have ready to use data. This will help you evaluate the value that predictive planning brings to the table.

Don’t be afraid to fail. You will learn during the journey.

Rome was not built in one day. Your predictive planning implementation will need time to reach its full potential.

It’s about the data, stupid!

Although this might sound obvious, the prerequisite for a successful predictive planning implementation is quality data.

Challenges can arise here:

- Is there enough historical data available to forecast the next 12 months with confidence? Some organisations only keep limited data history which reduces the predictive forecasting possibilities. The full potential of predictive planning is achieved when trends, seasonal patterns and regular variations can be detected. A minimum of 4 years' data history at monthly level is ideal to forecast the next 12 months.

- What is the impact of the ongoing COVID-19 pandemic or other black swan events to your business and how to best deal with their impact?

- Beyond one-time data collection, how to industrialise the data collection and data management processes needed to provide a stable foundation to predictive forecasting models? The dream goal for predictive planning is to help automate your planning processes. You will want to automate the predictive planning activities as opposed to being high-touch to refresh the predictions on a regular basis.

Incremental approaches work best here. Find the right areas of use of predictive forecasting. Prove the possible value through initial experimentation. Build on proof-of-concepts, do not build a cathedral.

After completing your initial milestones, you will need to move from experimentation to industrialisation. This will include setting up rock-solid data collection and data management processes.

Reimagine your processes

Ask people what predictive analytics is about – they might mention a crystal ball or sci-fi novels. In practice predictive analytics has nothing to do with black magic or rocket science.

It is a proven and robust technology, based on math, that can bring concrete benefits to finance organisations, when rightly used.

Think about predictive planning projects in two ways.

- On one-side predictive planning is a Finance and IT (Information Technology) project. It requires dedicated and skilled resources from the business and the IT side to be successful.

- On the other side, implementing predictive planning is also a wonderful opportunity to reimagine the existing finance processes. One example is to reallocate the time that will be freed by the forecasting acceleration to high-value activities.

Think how you can industrialise predictive planning as part of your budgeting and forecasting processes. Think about the consequences that the introduction of this technology will have for your organisation.

Usefulness trumps accuracy

The famous quote “All models are wrong, but some are useful” attributed to the statistician George E. P. Box says it all. Predictive models approximate the reality of actuals with more or less accuracy.

The goal is not to be perfect; the goal is to be useful. Finance practitioners will typically value a predictive model more when they can use it, when it helps them and when they can understand it.

This is all about balancing the explain ability of the predictive models and their accuracy:

- A predictive model focused on achieving perfect accuracy might be difficult to make sense of. While these “black box” predictive models might be understandable by data science experts, there is little chance FP&A experts can make sense of them.

- On the other hand, too simple predictive models, while easy to understand, might lack accuracy.

Work in the direction of end-users and select a predictive planning technology that they will trust. Keep in mind that usefulness trumps accuracy.

Power to the people!

Predictive Planning is like cooking – to make a beautiful recipe you need to assemble key ingredients including quality data, proven technology, and a relevant use case.

A key ingredient is the FP&A team members and how they will embrace and use this technology to their advantage. Multiple considerations can come into play:

- How to make finance teams as autonomous as possible with the use of this technology?

- What is the required change management as well as the possible role redefinition, considering less time will be dedicated to low-value, repetitive tasks?

- What is the required process evolution and what this means to the day-to-day tasks and new ways of running the finance activities?

- What is the role of predictive planning? Does it help with decision making but the planners have the final word? Does it help automating part of the recurring planning activities?

Summary

As the well-known quote says: “a journey of a thousand miles begins with a single step.” I wish success to your predictive planning initiatives.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.